Swiss National Bank Ready To Buy Much More Tech Stocks To Weaken The Franc

Tyler Durden

Thu, 05/28/2020 – 06:30

Two weeks ago, with traders and analysts wondering who has been aggressively buying stocks in the past 2 months as markets tumbled – besides retail investors of course – we gave the answer: the money-printing (literally) hedge fund known as the Swiss National Bank.

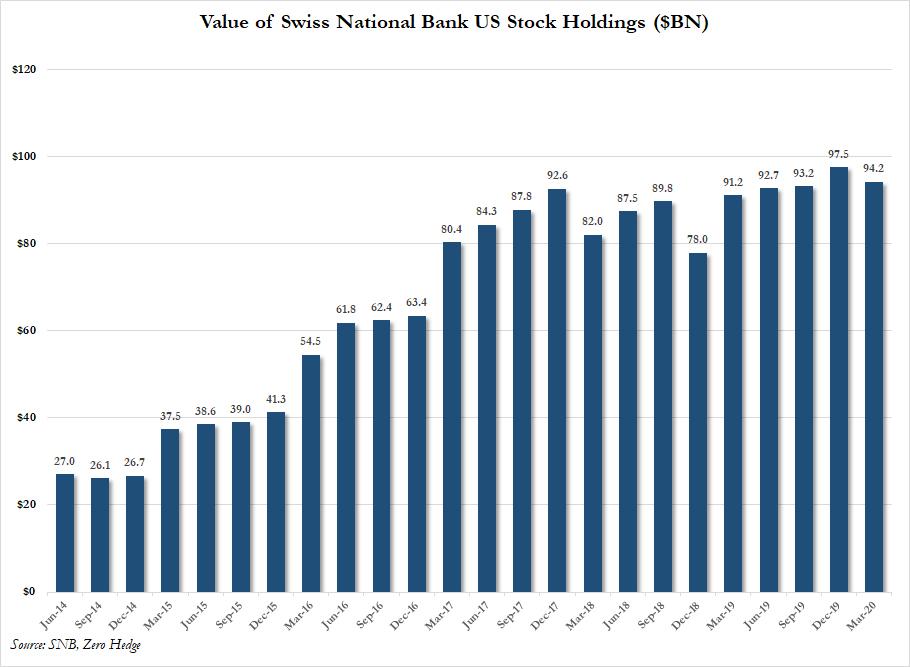

As we explained then, we showed that as the value of the SNB’s US equity holdings increased more than threefold, from $26.7 billion in Dec 2014 to $97.5 billion in Dec 2019….

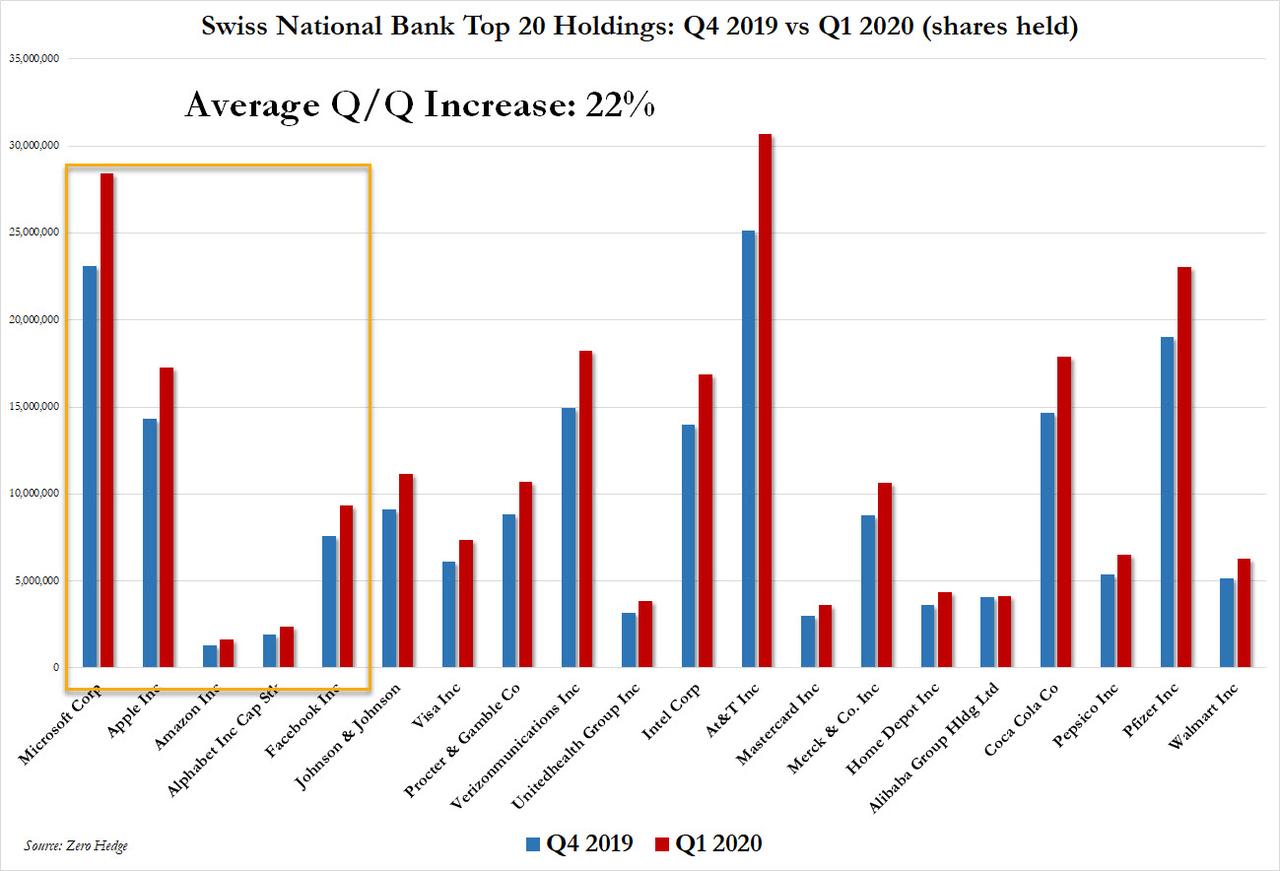

… the SNB had kept its total holdings relatively flat for the past year, conserving its dry powder for just the right occasion, an occasion which materialized in March, and the Swiss National Bank went on a buying spree as markets crashed, adding roughly 22% (on average) to its top positions.

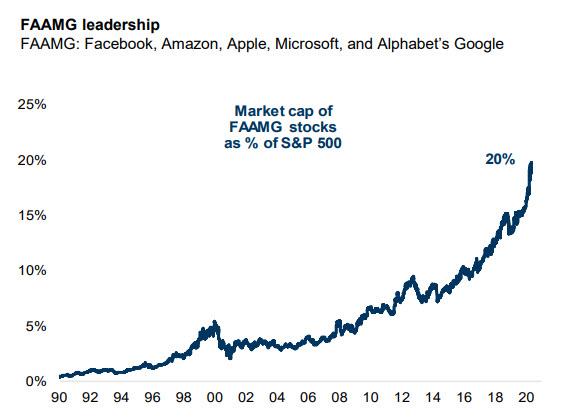

Also according to the SNB’s latest 13F, as of March 31, the central bank owned $4.5 billion in Microsoft shares, $4.4 billion in Apple, $3.2 billion in Amazon, $2.7 billion in Google and $1.6 billion in Facebook, also known as the FAAMG stocks which as everyone knows by now, have become the market leaders, accounting for over 20% of the S&P’s market cap.

And the punchline: the SNB added approximately 22% to its holdings of each of the FAAMGs in Q1 as follows:

- MSFT: +23%

- AAPL: +21%

- AMZN: +23%

- GOOGL: +22%

- FB: +23%

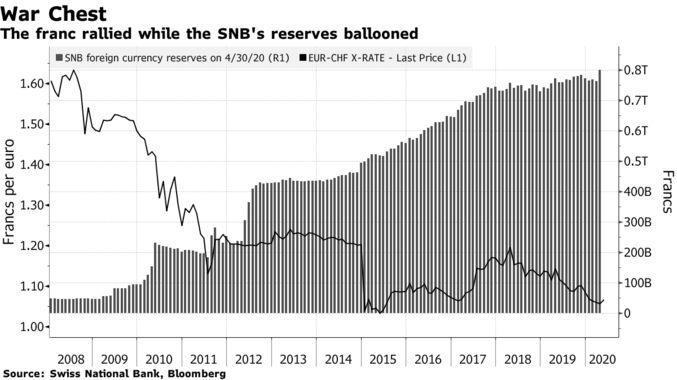

In short, to keep the value of its portfolio of US stocks relatively flat at $100BN, the SNB unleashed a massive buying spree that boosted its FAAMG holdings by over 20%, which in turn sent the bank’s foreign currency reserves – roughly $100BN of which are parked in the US stock market – to an all time high.

As a reminder, the SNB is one of the few central banks – the BOJ being the other – which openly buys equities in order to keep the value of the Swiss franc from rising too rapidly. The fund flow is simple: the SNB prints CHFs, which it then sells for USDollars – in the process depressing the value of one of the world’s most sought after safe haven currencies – and uses the proceeds to buy US stocks of which it owns about $100 billion. In many ways, this is similar to what the Fed does, only instead of buying Tsys, MBS, and now corporate bonds, the SNB is buying equities.

Simple enough.

And now, in order to convinced currency speculators to stay away from the Swiss Franc which, similar to the dollar, has seen an impressive surge in recent months, the Swiss National Bank announced on Wednesday that is intervening more heavily in the foreign exchange market to weaken the franc and can further cut interest rates, if a cost-benefit analysis warrants such a step, SNB President Thomas Jordan said.

“We have room to maneuver for both instruments,” Jordan said at a panel discussion hosted by UBS Group AG. “It’s clear that we have the possibility to cut rates if necessary.”

He may be telling the truth, although some wonder: with the SNB having cut the Swiss deposit rate to a record low -0.75% plus a pledge to wage foreign exchange market interventions to keep the franc in check, some have suggested that it is approaching the reversal rate beyond which any further cuts hurt not help the economy. Yet with pressure on the haven currency rising as a result of the coronavirus pandemic, Bloomberg notes that Swiss central bank officials said they’d picked up the pace of activity, something we already discussed when we noted that in Q1 the SNB unleashed a massive buying spree of US stocks.

Addressing the SNB’s policy dilemma, whereby further rate cuts may now be self-defeating, Jordan said any policy step required a cost-benefit assessment and that the SNB would enlarge its balance sheet via interventions if the pros outweighed the cons. And due to the unique nature of the SNB, what Jordan really meant, is that he is willing to buy even more tech stocks should the franc continue to rise.

We bring this up just in case there is still confusion just who was buying FAAMGs and tech names as everything else crashed.

We also bring it up to bring some clarity to a truly bizarro world: one where, the worse the global economy gets, the more aggressively at least one central bank to buying US tech stocks.

via ZeroHedge News https://ift.tt/2X9EkGH Tyler Durden