“Nothing Matters Because The Fed Will Buy What I Want To Buy”: El-Erian Slams The “Mindset” Of The Fake Market

Tyler Durden

Tue, 06/02/2020 – 09:30

Pandemic-driven panic, lockdown-enabled economic collapse (record unemployment and crashing earnings expectations), and inequality-sparked social unrest… and markets are pushing higher day after day with no rational recognition of risk.

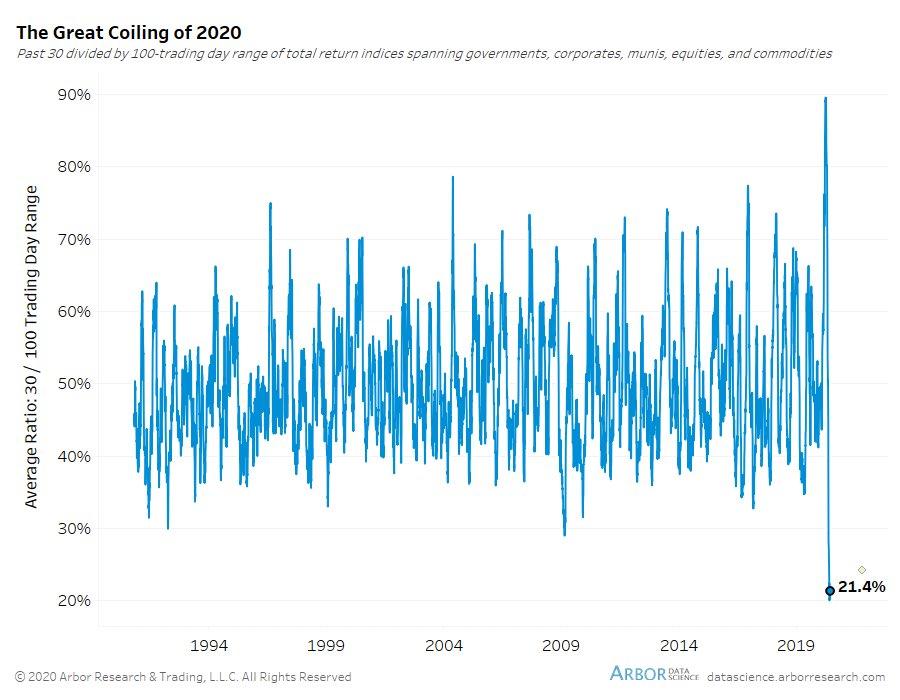

In fact this is the most aggressive compression of risk – across all asset classes – ever…

While many have grown frustrated at the record disconnect between stock prices and perceived reality, Allianz’ chief economic advisor Mohamed El-Erian is now exposing farcical “mindset” of this market for all to see.

Bonds are certainly not buying what stocks are selling about the future…

Reflecting on Jim Cramer’s defense of the idiocy claiming that “the market has no conscience,” El-Erian diplomatically points out that the reality is far different from Cramer’s self-delusional perspective – simply put: nothing matters except The Fed and that can’t last forever!

“I understand people who bet on moral hazard. I understand people who bet on The Fed backstop. I don’t do it. I don’t think that’s a good way to invest… I’d rather invest on the basis of fundamentals”

He continued…

“This notion that it doesn’t matter what happens to fundamentals. It doesn’t matter what happens to corporate earnings. It doesn’t matter what happens to economic growth… because The Fed will buy what I want to buy… that’s the mindset of the market right now.”

And, as El-Erian continues to explain, Central banks are in a “lose-lose-lose” situation.

“You lose if you try to undo what you’ve been doing… you lose if you try to do more (and that’s what markets are pushing for)… and you also lose if you don’t do anything because of the massive disconnect between markets and reality.”

Finally, El-Erian leaves Andrew Ross Sorkin aghast as he questions the omnipotence of central bankers (and the potential consequences of their actions).

“Why has the fed continuously conditioned markets to expect them to step in and repress any volatility… and isn’t it time to stop doing that because you end up not only undermining the system itself but you undermine the credibility of an institution that is critical to the well being of this and future generations.”

Watch the full interview below:

via ZeroHedge News https://ift.tt/2U2rWpE Tyler Durden