Gold Gains As Investors Dump Dollars, Bonds, & Stocks

Tyler Durden

Thu, 06/04/2020 – 16:01

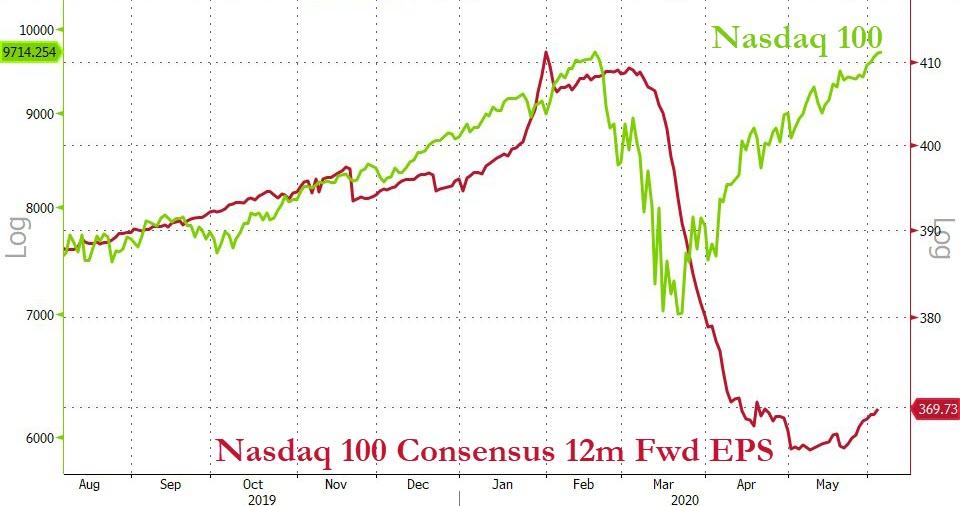

The Nasdaq 100 reached a new all-time record high today… because, fun-durr-mentals…

Source: Bloomberg

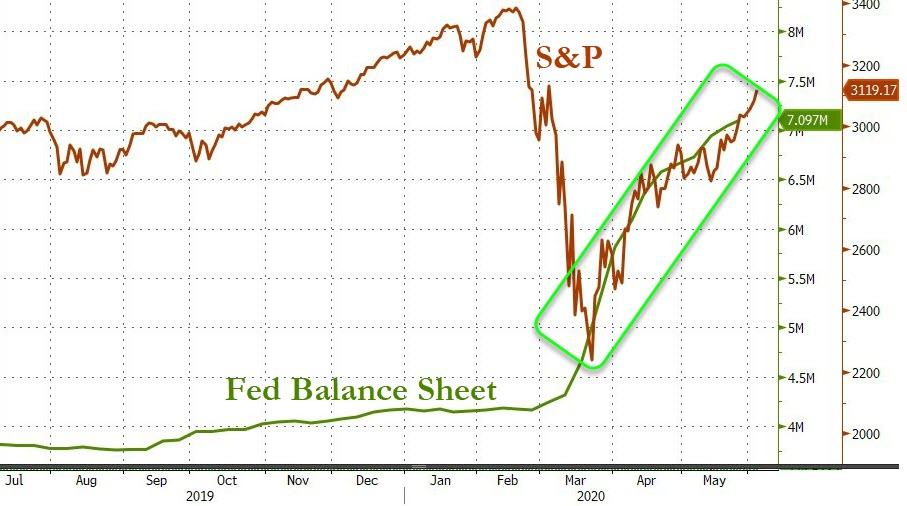

This is Madness…

…No, This is The Fed!!

Source: Bloomberg

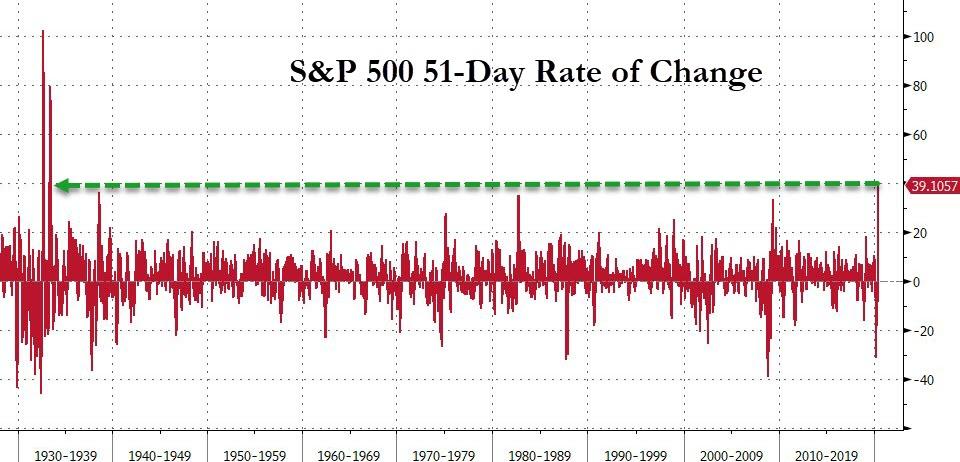

This is the greatest 51-day surge in stocks since June 1933…

Source: Bloomberg

1. What is driving the swift recovery of equities?

a) Fed – 73%

b) Earnings Optimism – 0%

c) Labor market recovery – 6%

d) Further fiscal stimulus – 5%

…

But, after the Nasdaq 100 tagged all-time record highs, sellers were quick to appear…

…but as the afternoon rolled around, dip-buyers were back lifting The Dow to unchanged, but another wave of selling hit in the afternoon…only to be rescued by another 1550ET apnic-bid pushing The Dow marginally green…

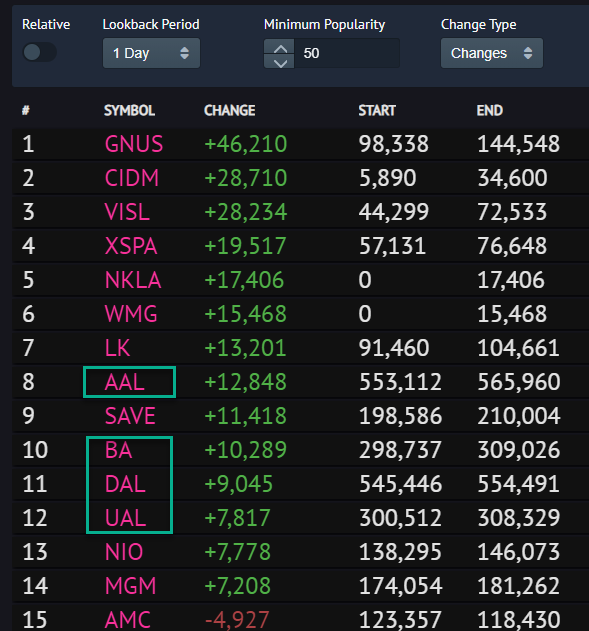

Airlines exploded higher today – seriously, come on!!!

Source: Bloomberg

Here’s why! Because they are the 4th and 5th most widely held stocks on Robinhood…

Here’s what JPMorgan’s Baker said: “investors appear to be confused on AAL today.”

Bank stocks continued to surge this week

Source: Bloomberg

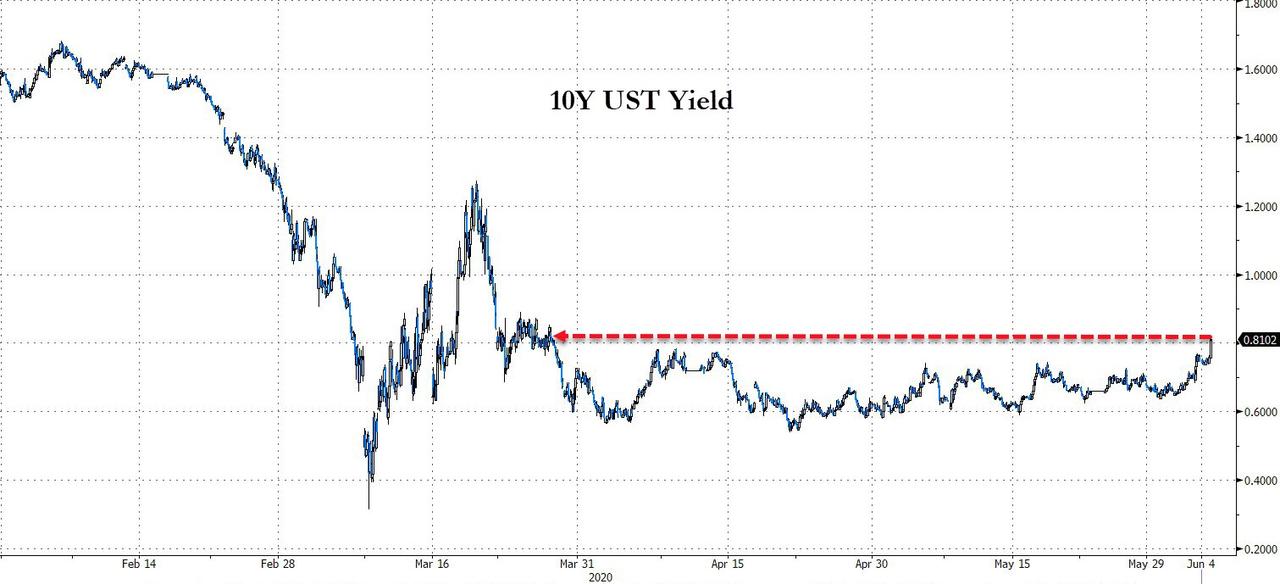

While stocks slipped, Bonds were also dumped with a significant steepening intraday…

Source: Bloomberg

With the 10Y back above 80bps…

Source: Bloomberg

Driving 10Y yields up out of their 3-month range…

Source: Bloomberg

Notably, equity momentum is significantly underperforming value, reverting back to yields…

Source: Bloomberg

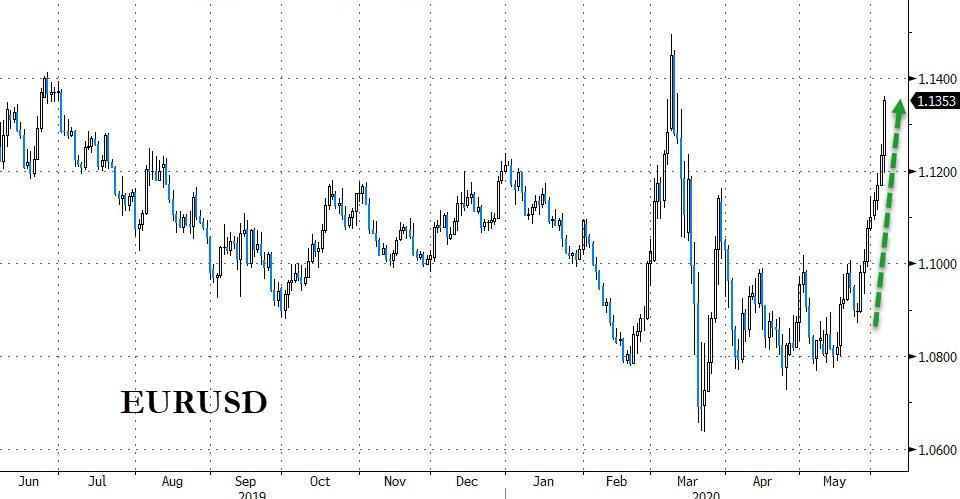

The dollar was dumped yet again today (after some gains overnight)…

Source: Bloomberg

This is the biggest 14-day drop in the dollar since Oct 2011 as the EUR explodes higher for the 8th straight day (on higher than expected ECB QE…?) This is the longest streak of gains for euro since 2011

Source: Bloomberg

Cryptos managed gains on the day…

Source: Bloomberg

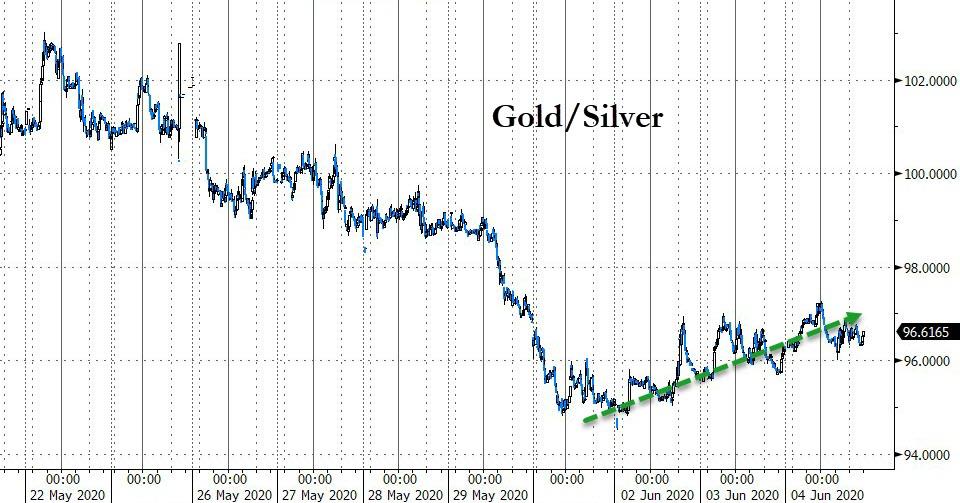

As the dollar slid, gold rallied back above $1700…

Silver also gained ground, back above $18…

With gold/silver rising for the 3rd day in a row…

Source: Bloomberg

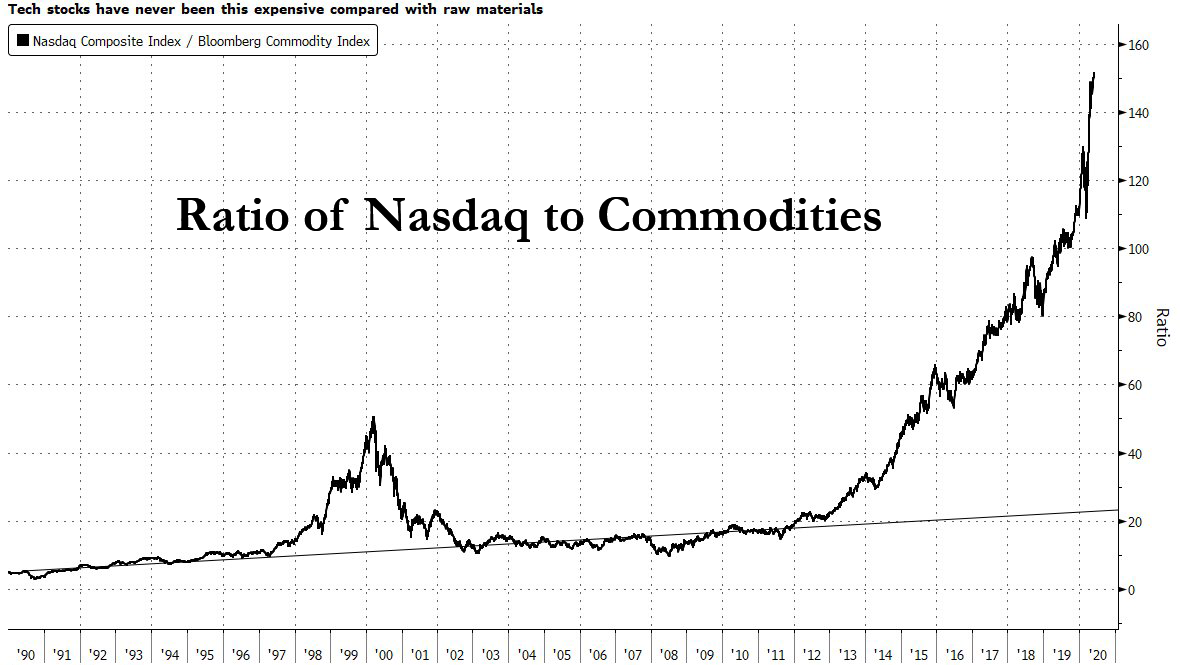

Finally, Bloomberg’s Eddie van der Walt points out that raw material and equity prices have become severely disconnected. A correction will probably entail both lower stocks and higher commodity prices.

Source: Bloomberg

The Nasdaq Composite Index is trading at a 152x multiple of the Bloomberg Commodity Index, surpassing even the highs seen during the Dot Com bubble. The average since the end of 2001 is nearer 37. That divergence stems from the Nasdaq approaching record highs set earlier this year while commodities languish near pandemic-crisis lows.

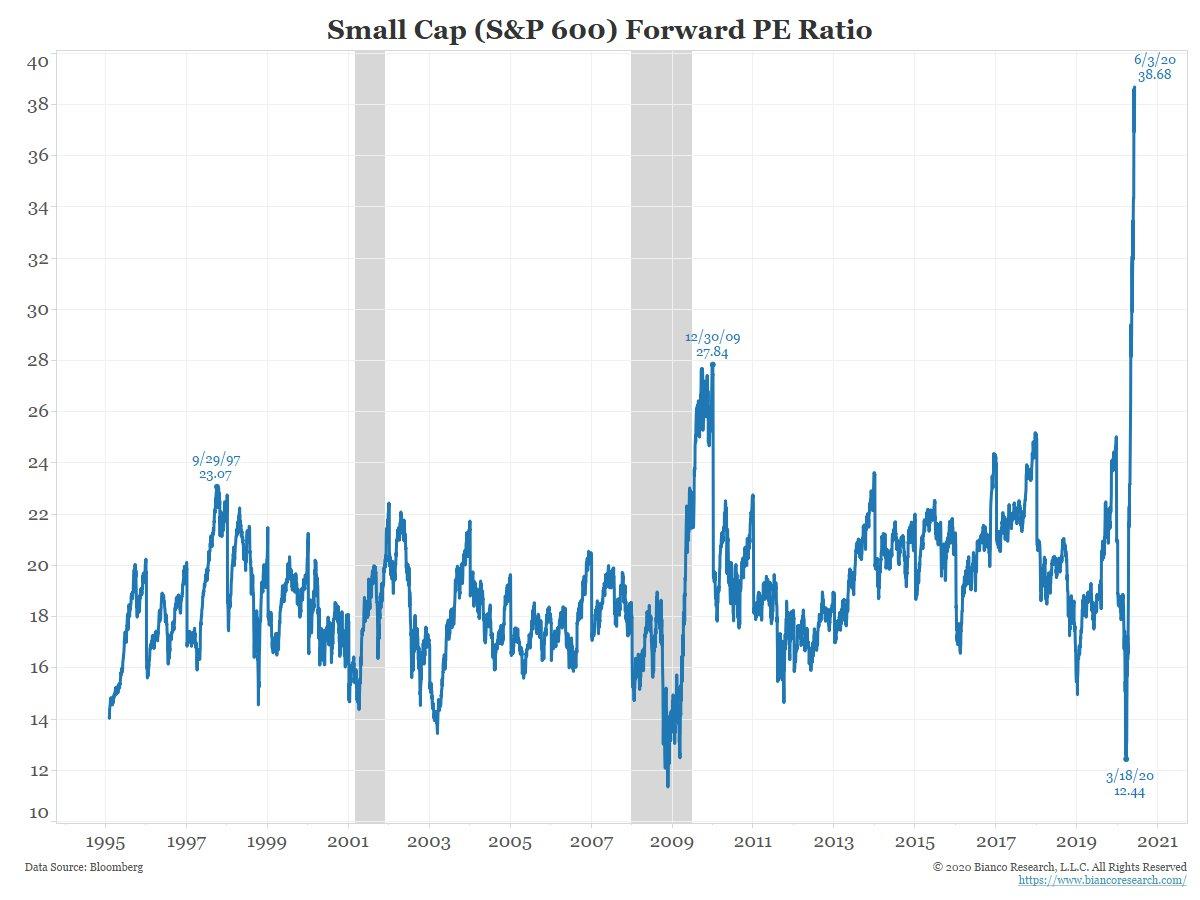

And then there’s this utter bullshit… Small Caps are the most overvalued… ever… by a bloody mile! (h/t @BiancoResearch)

Source: Bloomberg

As a reminder – this is what none other than Jay Powell said in 2012:

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.”

Trade accordingly.

via ZeroHedge News https://ift.tt/3dALHMO Tyler Durden