Is The Treasury About To Flood The US With $700 Billion Over The Next Three Weeks

Tyler Durden

Mon, 06/08/2020 – 14:15

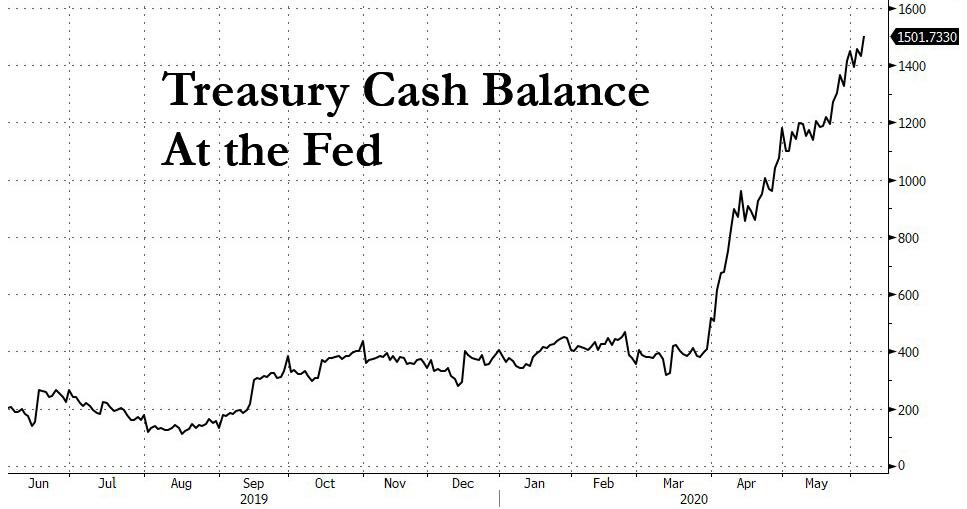

As a direct result of a flood of Bill issuance in the past two months, the Treasury’s cash balance which it will use to fund various stimulus programs and other fiscal initiatives, has exploded since the onset of the coronavirus crisis, hitting a record $1.5 trillion on Friday.

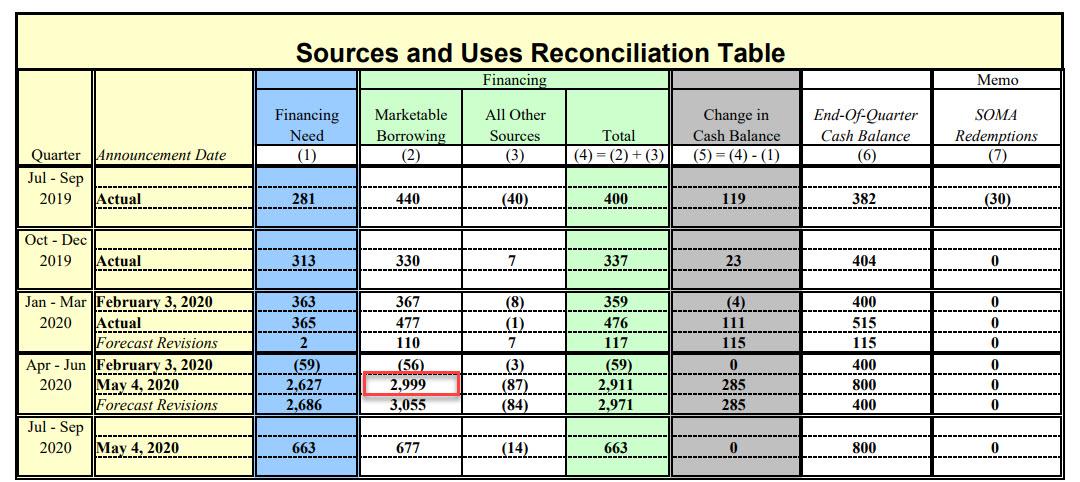

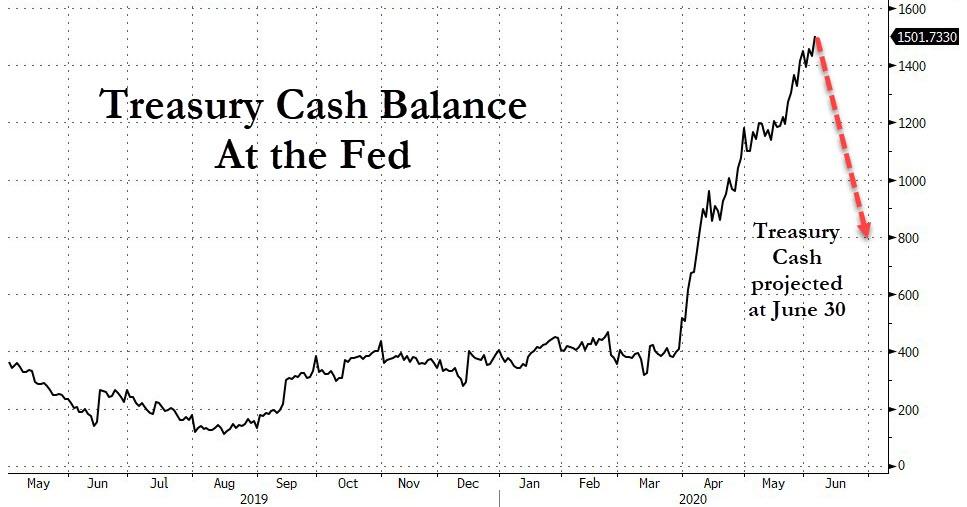

This is notable because in the Treasury’s latest quarterly borrowing needs forecast which projected a funding need of $3 trillion for the current quarter, the Treasury also projected that the cash balance at the end of the quarter would be $800 billion.

This also means that if indeed the Treasury’s forecast is accurate, then over the next three weeks, the Treasury’s cash balance has to drop by a record $700 billion to hit the $800 billion target!

Commenting on this surprising eventuality, Nordea writes that “it seems as if administrations around the globe have “overestimated” the issuance need by now as e.g. the USTs cash account at Fed stands at a stunning $1500bn, which is a staggering $700bn above the quarter-end target” and asks if Treasury issuance will be taken (substantially) down into H2-2020 since the Dollars reserved for aid-packages struggle to leave the Treasury account?”

Alternatively, “if the $700bn actually leave the account at Fed and flow into the real economy before quarter-end, then it is likely a massive boost for risk assets.”

It is not immediately clear just how the Treasury could ram this cash into the real economy: as a reminder, roughly $140BN of the latest iteration of the Paycheck Protection Program remains unused as business demand for what is effectively free money in the form of grants, appears to have peaked. Will the Treasury then proceed with literally paradopping tens of billions in cash on Americans? To be sure, that would be one way to make the daily protests across America a far more festive event.

via ZeroHedge News https://ift.tt/2MCpceG Tyler Durden