Gold Nears Breakout As Goldman Upgrades Precious Metal On “Debasement Fears”

Tyler Durden

Mon, 06/22/2020 – 13:10

Spot gold prices are rallying this morning, as the dollar dives, pushing to within a tick or two of May’s highs…

A breakout from here would take the price of the barbarous relic to 2012 levels and quickly beyond…

Until the last few days, gold has struggled to find a direction since rebounding in late March on the back of the Fed’s “QE” announcement as it remains torn between a large negative “Wealth” shock to EM consumers and CB demand and a surge in “Fear”-driven DM investment demand.

However, as Goldman argues in their latest Commodities Research note, gold investment demand tends to grow into the early stage of the economic recovery, driven by continued debasement concerns and lower real rates. Simultaneously they see a material comeback from EM consumer demand boosted by easing of lockdowns and a weaker dollar.

As Goldman writes:

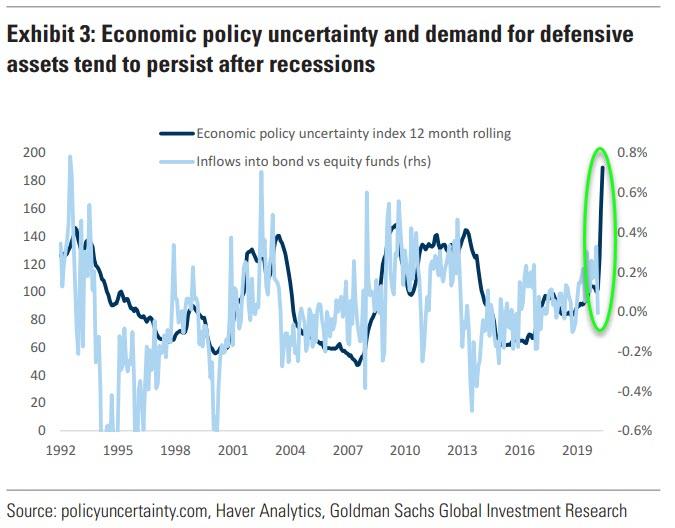

Looking at previous recessions, we note that economic policy uncertainty tends to jump after recessions and remains high for several years (see Exhibit 3). In 2020, the virus has led to unprecedented fiscal and monetary stimulus. It remains unclear how much more stimulus will be deployed by DM governments, how the resulting deficits will translate into higher taxes down the road, and how long monetary policy will remain ultra-loose. Finally, it is unclear whether the crisis leads to second round shocks, such as social unrest, political volatility, or rising international tensions. In such an environment, demand for defensive assets (gold in particular) will continue to expand, in our view.

Policy uncertainty aside, we believe that debasement fears remain the key driver of gold prices in a post-crisis environment such as this. Faced with both an unprecedented shock and an unprecedented policy response, it remains unclear how inflationary the economic recovery will be.

Furthermore, current social unrest increases the uncertainty over how much inflation policymakers will tolerate, and for how long. Although high inflation didn’t follow the 2008 crisis, there are a number of notable differences in today’s economy that may make this time different. Specifically, a much larger fiscal and monetary stimulus, better household balance sheets going into the crisis, no tightening in bank regulation/credit standards and less political will for austerity policies all point to greater inflationary pressure than in 2008.

Specifically, Goldman see gold prices as following a similar path today as they did in 2008-2013:

During the GFC crisis gold had an initial jump as nominal rates fell and QE started in November 2008. It then remained stuck in a range through the first half of 2009 as the policy effect took hold. During these periods there were brief corrections sparked by risk-on mini-rotations out of defensive assets but overall gold price remained directionless for about 6 months. The market finally broke out higher in October 2009 in line with a decline in real rates as inflation rose while policy remained loose.

Allocation to gold continued to increase in line with the share of inflation protected assets in investor portfolio’s for 3 years (see Exhibit 8).

This is consistent with the observation that a high level of economic uncertainty persists for several years following a recession and that investment demand for gold will likely continue to expand into the recovery stage the business cycle. After policy (and economic) uncertainty receded, gold fell.

Goldman believes that a similar case is likely to play out today, with real rates dragged lower by a gradual normalization of inflation expectations while nominal rates remain depressed due to loose central bank policy. This leaves two main drivers sending gold prices higher: lower real rates and higher EM demand.

Our rates strategists expect 5 year rates to end the year at 0.35 and be only 0.45 by end of 2021 – almost the same level they are today. Simultaneously, they see scope for a higher 5 year inflation swap rate, as the market is underestimating inflation beyond 2020. Our economists expect inflation over the next 5 years to average 1.73% vs current market pricing of 1.02%. Therefore, real rates in the US are expected to continue to fall, increasing debasement concerns and putting upward pressure on gold (see Exhibit 9).

At the same time, our FX team expects material dollar downside as US interest rates are back at zero, eroding the positive carry spread it had over other G-10 currencies. A weaker dollar will also help boost the purchasing power of major gold consumers in across Emerging Markets, supporting gold through the “Wealth” effect. Chinese gold demand appears to be rebounding after lockdown in line with the improved Shanghai discount. This suggests EM gold demand will shift from being a drag on gold prices to a tailwind as we move into 2H20 (see Exhibit 10).

On the back of this they have raised their 3/6/12 month gold price forecasts to $1800/1900/2000/toz.

Goldman also revised up their silver forecast from $13.5/14/15 toz to $19/21/22 toz.

The upward revision is driven by two primary factors.

First, coordinated global stimulus will help generate growth in industrial production and global economic activity. Relative to gold, silver demand is more closely tied to industrial production, accounting for 50% of its demand (see Exhibit 16). Therefore, as the economy recovers and “Fear” based demand for gold moderates, we expect silver industrial demand to increase, driving up prices. Silver also stands to benefit from growing investment in solar power.

Secondly, we have argued in the past that silver is the precious metal of second choice after gold. This means that when interest in precious metals is moderate investors may still add to gold but silver often gets overlooked. However, when interest in precious metals is surging (as it is now) a lot of investors historically diversify part of their gold purchases with silver.

In this environment silver can outperform gold because it is a smaller market and moderate relocation into it can lead to a material price spike.

via ZeroHedge News https://ift.tt/3dsGeXE Tyler Durden