Here Comes Yield Curve Control: The Fed Is About To Unleash A Mindblowing Stock Rally

Tyler Durden

Mon, 06/22/2020 – 13:50

With consensus growing that the Fed will unveil Yield Curve Control for the rates market, where it pins the short end somewhere just above 0% to avoid a spike in yields, some time around the September FOMC meeting if not sooner, it is worth recalling that this won’t be the first time the US has implemented a monetary policy that was enacted by both Japan four years ago and most recently Australia.

We first discussed the original YCC episode back in 2012, reminding readers that the US first underwent a period of Yield Curve Control lasting 9 years between March 1942 and March 1951 to allow the US to keep rates low during WWII and its immediate aftermath, and which concluded with the Fed-Treasury Accord.

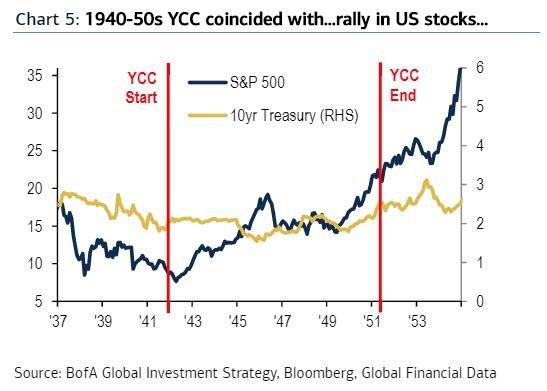

What is remarkable about this first YCC period – when the Fed capped yields at 2.5% to allow Treasury to fund cheap debt in WWII – is that as BofA’s Michael Hartnett points out it coincided with start of a huge rally in US stocks…

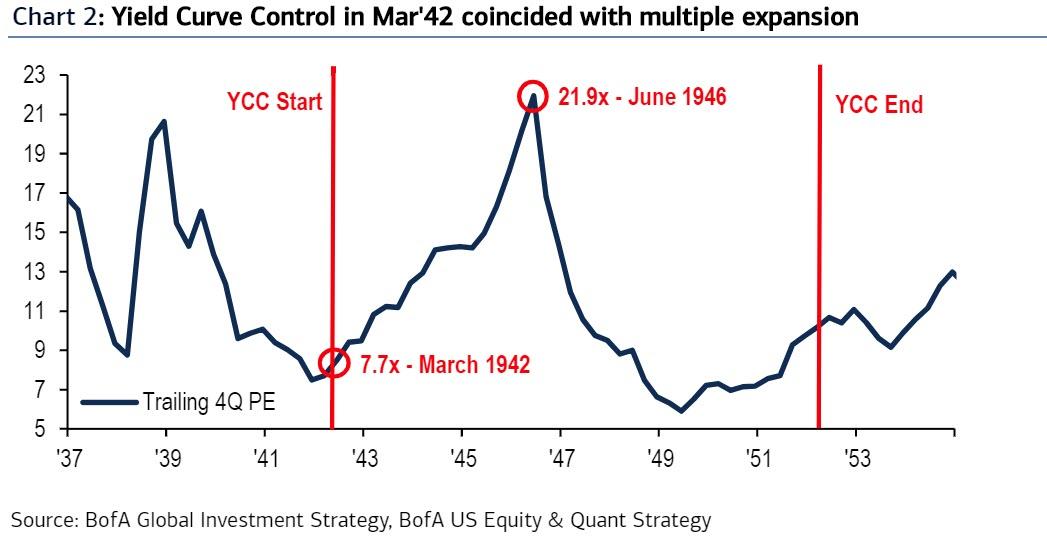

… multiple expansion as PEs soared from 7.7x in March 1942 to 22x in 2 years, nearly tripling over a very short period of time…

… and a sharp upward inflection point up in US home prices.

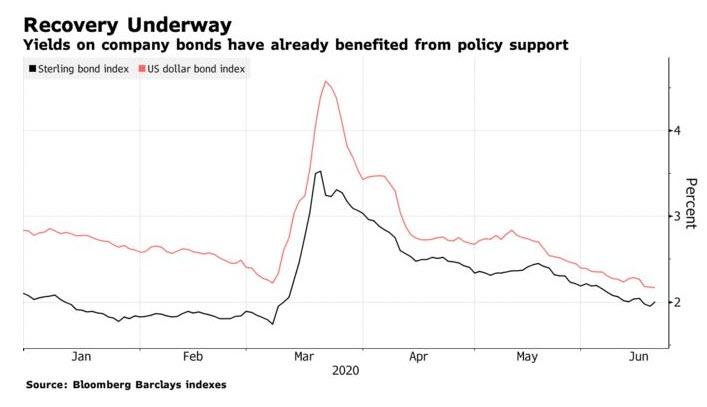

BofA is not the only one to hint that the coming YCC could result in a massive rally for risk assets: Bloomberg does too, writing overnight that “should yield curve control go global, it would cement markets’ perception of central banks as the buyers of last resort, boosting risk appetite, lowering volatility and intensifying a broader hunt for yield.”

And while money managers caution that such an environment could fuel reckless investment already stoked by a flood of fiscal and monetary stimulus – an environment which Jay Powell recently said the Fed would carefully nurture now that the central bank is openly blowing asset price bubbles – “they nonetheless see benefits rippling across credit, equities, gold and emerging markets.”

“It depends on the form and the price but broadly speaking it’s the green light to carry on with the QE trade — buy everything regardless of valuation,” Aberdeen’s James Athey told Bloomberg.

Perhaps the only question is just how powerful the surge in stocks will be once YCC is unveiled: the answer may depend on how much of the curve ends up being “locked out.” Recall that two months ago Credit Suisse repo guru Zoltan Pozsar said that YCC would only be needed for maturities through 3 years. However, Societe Generale sees a case for focusing further out the curve, expecting that 5- and 7-year Treasuries may rally if the Fed looks to go beyond controlling just the front end.

Yet while the question of just where on the curve central banks set their target is key, no matter the details it will likely spark a furious rally way. As Bloomberg notes, a 50-basis-point target on the 10-year Treasury yield would spark a bond rally and flatten the curve alongside a probable rise in equities. However, a full percentage point could see bonds bear steepen and trigger a sell-off in shares, said Aberdeen Standard’s Athey.

The flipside of the coming surge, is that it will once again come as a result of a dash for trash, as the worst of the worst companies, including most corporate zombies, surge.

As if it wasn’t enough that the Fed is now buying corporate debt, the capping of interest rates would also help by ensuring corporate borrowers continue to benefit from attractive financing rates, further detaching their fundamentals from their securities. Lower yields in longer maturities would assist investment-grade companies, which tend to issue longer-dated debt than lower-rated borrowers. Meanwhile, junk borrowers would reap the rewards of the general boost to market sentiment.

Companies with high debt loads such as airlines and energy could get a lift, said Charles Diebel, who manages $2.6 billion at Mediolanum SpA in Dublin. U.K. banks could also gain as lenders will have escaped the crushing effect of negative interest rates.

“It will allow the whole rating spectrum of fixed income credits to borrow at incredibly cheap absolute levels during a time of much uncertainty and would certainly be very bullish,” said Azhar Hussain, head of global credit at Royal London Asset Management.

Meanwhile, the further decline in US yields would – in theory – also weaken the dollar and help riskier currencies like the rand and Mexican peso, while benefiting carry trades involving the Indonesian rupee and the Russian ruble according to Vasileios Gkionakis, head of FX strategy at Banque Lombard Odier & Cie SA in Geneva.

Of course, once the Fed launches YCC, it will only make the asset bubble – which has already resulted in 20-year-old Robinhood traders taking their lives when trades go wrong – even bigger, as assets becoming fully disconnected from underlying fundamentals. Meanwhile, 10-year yields are negative for nine of 25 developed markets tracked by Bloomberg, while the rest stand well below their one-year averages: “It’s a precarious bubble that could eventually burst, should the wall of stimulus spur inflation down the road and eat into investors’ profits” Bloomberg notes.

Regardless of the risks, the notion that central banks are approaching some sort of curve control is here to stay, as is yet another milestone in central banks’ takeover of the bond market, as YCC will further eliminate any information about future inflation the yield curve would otherwise convey, leaving precious metals such as gold the only true inflation hedge. Still, as Bloomberg concludes, the key lesson from the 2008 crisis was that policy makers need to intervene quickly, and investors now expect them to consider any weapon at their disposal.

“Policy makers tightened up the banking system so much that the markets became too big to fail,” said Mark Nash, the head of fixed income at Merian Global Investors in London. “Now they have no choice but to keep them working.”

Indeed, as JPMorgan asked over the weekend, in a world where trillions are created out of thin air every month, why not just own anything? After all, at this point the Fed will never again allow the market to drop and the US central bank will keep doubling down to preserve risk asset prices until finally it loses control over everything.

via ZeroHedge News https://ift.tt/3doM5NJ Tyler Durden