Wirecard Shares Plummet 80% After Company Files For Insolvency Proceedings

Tyler Durden

Thu, 06/25/2020 – 05:56

German payments company Wirecard filed for insolvency proceedings on Thursday, one week after auditors refused to sign off on accounts due to a $2.1 billion financial hole, reported Reuters.

A statement from the company warned about over-indebtedness as the primary reason behind applying for insolvency in Munich, Germany. There’s also a consideration by Wirecard management to apply insolvency proceedings to its subsidiaries.

- MANAGEMENT BOARD OF WIRECARD AG HAS DECIDED TODAY TO FILE AN APPLICATION FOR OPENING OF INSOLVENCY PROCEEDINGS FOR WIRECARD AG WITH COMPETENT DISTRICT COURT OF MUNICH (AMTSGERICHT MÜNCHEN) DUE TO IMPENDING INSOLVENCY AND OVER-INDEBTEDNESS.

- WIRECARD AG – IT IS CURRENTLY EVALUATED WHETHER INSOLVENCY APPLICATIONS HAVE TO BE FILED FOR SUBSIDIARIES OF WIRECARD GROUP.

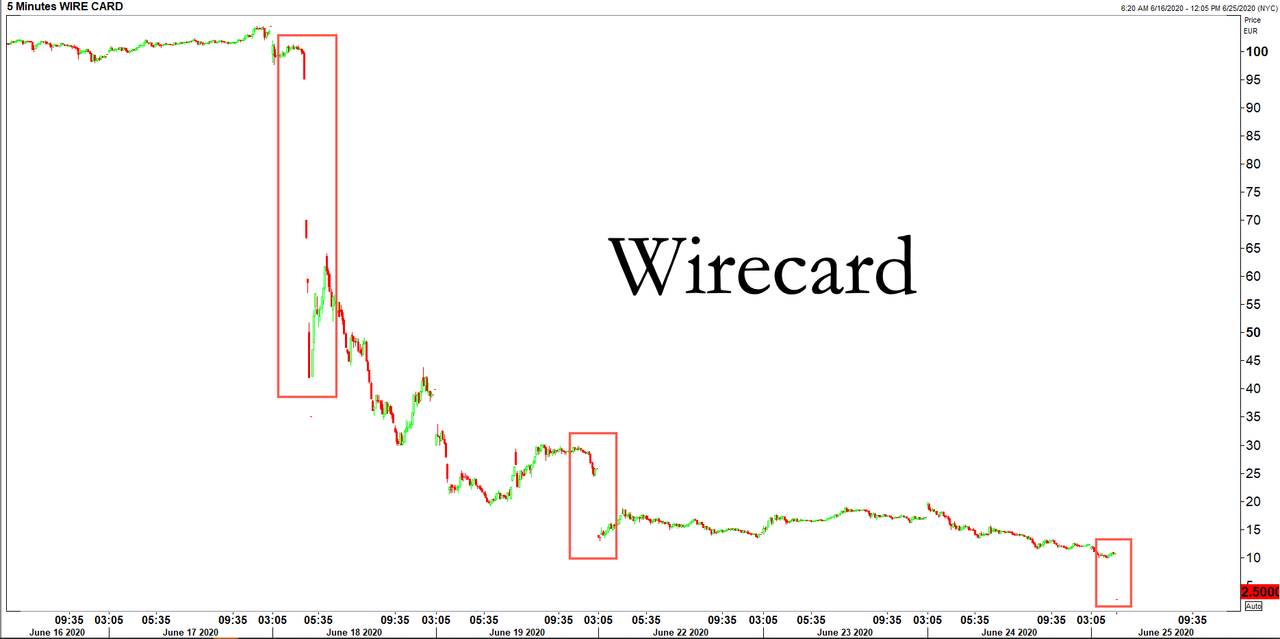

Wirecard shares trading on the Frankfurt Stock Exchange plunged by more than 80% Thursday morning. They have lost more than 96% on a year-to-date basis. Most of the losses began last week when Ernst & Young refused to sign off on 2019 accounts, which then resulted in the resignation and arrest of CEO Markus Braun.

The quick death of Wirecard

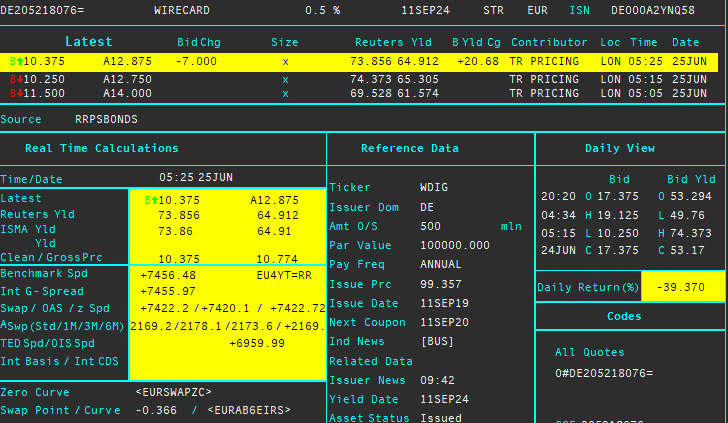

With shares suspended in Frankfurt – 500 million euros of bonds due 2024 fell to a record low of around 10-12 cents.

The German-based payments company collapsed about two years after it joined Germany’s DAX blue-chip index. Before whistleblowers exposed the company for fraud in early 2019 – the company had a peak value of $28 billion.

My prediction Tuesday that Wirecard could become the first CDS credit event in Europe this year now looking pretty good!

(um, not that this one took any particular impressive foresight… )https://t.co/IgXBrNxGkx pic.twitter.com/hOBKIyQx0Y

— Robert Smith (@BondHack) June 25, 2020

The collapse of Wirecard is an embarrassment for Germany and regulators who failed to investigate what appears to be one of the country’s worst-ever accounting scandals.

“The Wirecard scandal did not come out of the blue,” said Florian Toncar, a member of parliament for the business-friendly FDP. “It’s a mystery to me why the finance minister and BaFin did not shed light on the matter much earlier.”

The Munich prosecutor’s office said: “We will now look at all possible criminal offenses” for Braun.

The next big question for Wirecard is that if it can retain licenses with Visa, Mastercard, and JCB International, through which the company’s banking segment issues credit cards. If the $2.1 billion is not found – credit card companies could revoke the company’s licenses.

via ZeroHedge News https://ift.tt/3fUs2ID Tyler Durden