Moody’s Reignites Feud With SoftBank By Revising Ratings Outlook To “Negative”

Tyler Durden

Fri, 06/26/2020 – 20:45

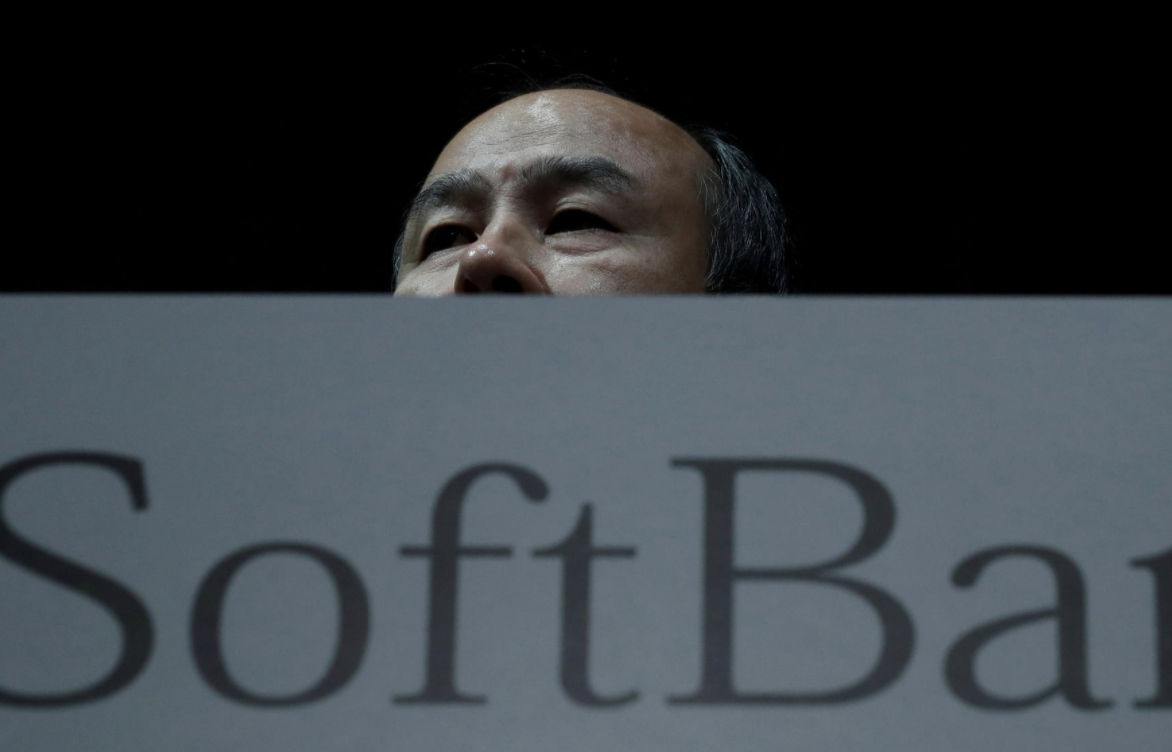

Weighing in for the third time this year, Moody’s just reignited its feud with SoftBank by reaffirming the company’s junk credit rating while moving its outlook to “negative”, from “ratings under review” on Friday as the collapse of Wirecard (once a major SoftBank holding though the company dumped its stake last year) creates yet another blemish on Masa Son’s reputation one day after the SoftBank Chairman quit the board of Alibaba.

Back in March, the ratings agency downgraded SoftBank’s credit rating to Ba3 and warned that it could soon fall further into “speculative” (ie “junk”) territory. That sparked a feud between SoftBank and Moody’s as the company took the “unusual step” of asking for the rating to be withdrawn.

In response to Moody’s “doubling-down”, as Reuters put it, SoftBank shot back that it hadn’t delivered any new information to Moody’s since the ratings agency’s last update. SoftBank says it has “provided no information to Moody’s”…and it’s…”unclear what Moody’s intention is”…or…”what information it uses” to make these determinations.

Unfortunately, SoftBank’s recent investing track record – and that of its $100 billion “Vision Fund”, which managed to lose money on stakes in Uber, WeWork and many other less-notable companies, speaks for itself. Though, just yesterday, the company announced it had raised $35 billion by selling some of its Alibaba stake back to Alibaba, which it plans to buy back more shares and pay down debt in an attempt to satisfy certain activist investors who have taken an interest in the Japanese disgraced national champion.

Not only are buybacks extremely politically sensitive right now, but both Moody’s and S&P Global Ratings have taken issue with SoftBank’s share-buyback plan for financial reasons.

“Major asset sales have been announced but given the structured nature of the transactions, cash proceeds may not all yet have been received or applied towards debt reduction,” Moody’s said.

SoftBank’s preference for complex financial transactions like collateralised margin loans “signals a heightened tolerance for risk and financial complexity,” Moody’s continued.

The concerns follow peer S&P Global Ratings which earlier this month said SoftBank’s 2.5 trillion yen ($24 billion) buyback plan – launched to stabilise the firm’s stock price after its tech investments faltered – raised doubts about “financial soundness and creditworthiness”.

Of course, none of that matters to SoftBank, since it’s goal with the buybacks is to boost its lagging share price, satisfy the activists nipping at its heels, and alleviate some of the pressure on Masa Son, whose personal wealth is now in play as his SoftBank shares have been used to guarantee loans.

We suspect this won’t be the last we hear from Moody’s or S&P, as the ratings agencies have apparently vowed to make an example of SoftBank – not that the company doesn’t deserve it.

via ZeroHedge News https://ift.tt/2ZaPhY8 Tyler Durden