Fundamentals & Reality Are Making Their Presence Felt

Tyler Durden

Sat, 06/27/2020 – 18:00

Authored by Sven Henrich via NorthmanTrader.com,

An eventful week in markets and the economy as the month and quarter are coming to a close next week.

The broader market peaked on June 8th on the heels of unprecedented central bank intervention but has since failed to make new highs other than the Nasdaq. Any subsequent efforts by the Fed to stave off any market sell off via the announcement of individual corporate bond buying 2 weeks ago or this week’s announcement to relax the Volcker rule for banks have produced nothing but short lived bounces in markets leading to lower highs and further selling in equities.

Fundamentals and reality are making their presence felt. The reopening of the US economy is hampered by violent spikes in coronavirus infections in some part of the US leading to delayed reopening in some cases raising questions about the veracity of any V shape recovery in the economy as lay off announcements keep mounting globally.

The realization that jobs will not come back to anywhere near February levels may take time to sink in as does perhaps the inconvenient truth that the Fed’s intervention efforts may be hitting a point of diminishing returns.

In this week’s episode of Straight Talk we discuss the market’s technical battle line for control, the state of the banks and their message to markets, the gnawing threats on big cap tech, specifically on Facebook as advertisers are pulling out in droves in the midst of political backlash, the going forward political risk of big cap tech having reached quasi monopoly status in their respective fields, the ongoing threat of the virus resurgence to the V shape recovery narrative, the political risks to markets due the upcoming presidential election and possible impacts of tax policy and much more:

For reference a couple of charts relating to what we discussed in the video above:

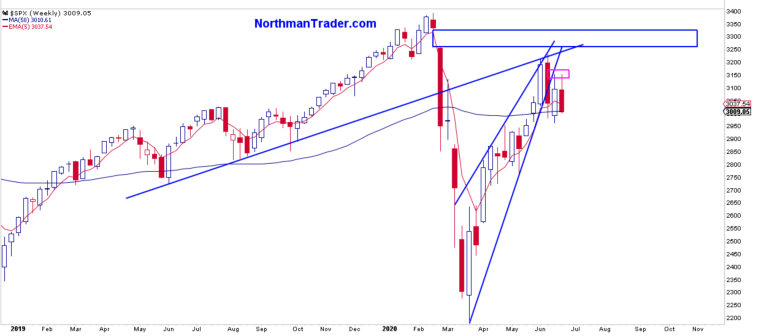

$SPX, following peaking June 8th when it tagged a key trend line has now reversed lower and has closed the week below its weekly 5 EMA for the first time since the March lows following the break of the rally trend earlier in the month:

This could be signaling a trend shift. But also note $SPX closed right at its weekly 50MA and just below its daily 200MA:

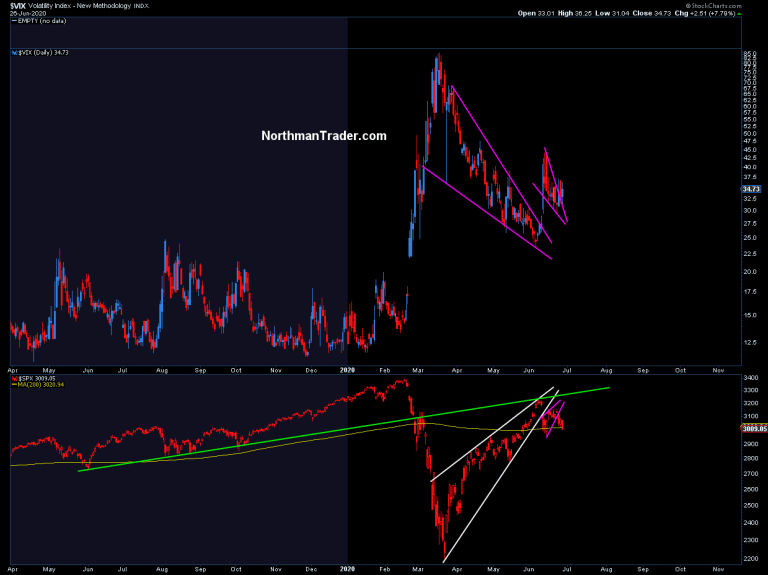

Note also the consecutive breakouts in volatility since the June 8th peak.

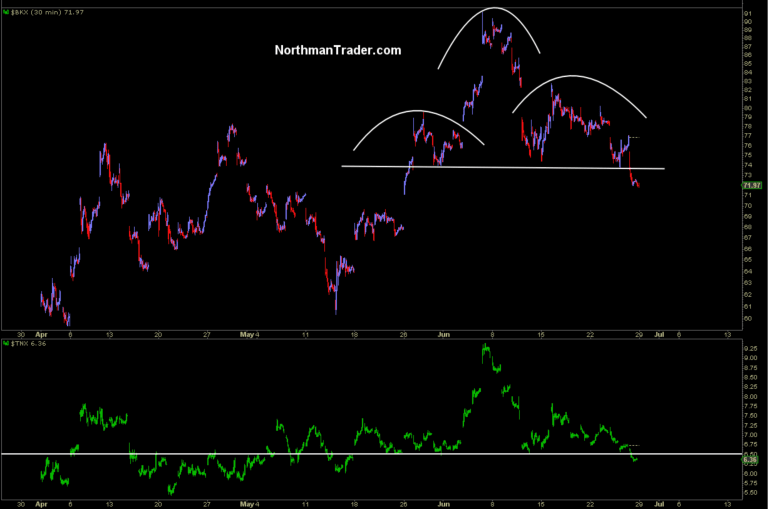

Put in context the horrid action in the banking sector, even this week’s loosening of the Volcker rule lead the resulting bounce to be sold. Worse for banks potentially here is that the chart suggests a potential head and shoulders pattern that could signal much lower prices ahead in context of the 10 year again dropping lower as well:

Since the June peak, $SPX is down 7%, small caps are down over 10% and the banking index is down over 20%. These are sizable moves to the downside and tech is increasingly under threat as well and its strength came on ever weakening internals.

I’ve outlined the reasons why the historic rally may have been still nothing but a bear market rally fueled to extremes by unprecedented liquidity injections and why the Fed looks increasingly busted in trying to defend this market without being able to prevent what the banks and bond market are already signaling: We’re staring at the prospect of a protracted downturn.

Markets are a journey and the day to day back and forth may well distract from the bigger picture, hence it is critically important to keep a close watch on the technical charts and evolving macro data. My primary view: There are plenty opportunities to trade the long and the short side as the battle between artificial liquidity interventions and the fundamental/valuation picture rages on in the months to come. But be clear: In June the broader market made a lower high and the path to a full economic recovery does not look anything like a clear V at all while valuations remain at unprecedented levels during a recession.

* * *

I’ll be posting a separate Market Video focusing on the latest technical implications later today (For those not already signed up for these videos please see link to register). For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2ZkbYJo Tyler Durden