Key Events In THe Coming Holiday-Shortened Week

Tyler Durden

Mon, 06/29/2020 – 09:40

As the mid-summer sun rises, we see a shortened trading week with Friday a US holiday in lieu of Independence Day on Saturday, and as DB’s Jim Reid predicts, Thursday will likely see activity wind down early and rapidly ahead of the weekend.

That said, the last major act of the week will be the all-important payrolls report brought forward to Thursday, where DB’s economists are looking for a further +2m gain in non-farm payrolls, following last month’s unexpected +2.509m increase, along with a further reduction in the unemployment rate to 12.6% (unclear if this assume the BLS will continue making the same admitted mistake it has been doing for the past two months). This improved labor market performance chimes with what we’ve seen in other indicators, such as the weekly initial jobless claims that have fallen for 12 consecutive weeks now. That said, it’s worth remembering that given the US shed over 22m jobs in March and April, even another +2m reading would still mean that payrolls have recovered less than a quarter of their total losses, suggesting there’s still a long way to go before the labor market returns to normality again.

The other main data highlight will be the final June PMI releases from around the world. The manufacturing numbers are out on Wednesday before the services and composite PMIs come out on Friday for the most part (ex US), while there’ll also be the ISM manufacturing index too from the US (on Wednesday). For the countries where we already have a flash PMI reading, they generally surprised to the upside, even as many remained below the 50-mark. It’ll also be worth keeping an eye on the numbers for China, given they’re some way ahead in the reopening process relative to the US and Europe.

In politics, a key highlight this week will be a meeting between Chancellor Merkel and President Macron taking place today, where both the EU budget and the recovery fund will be on the agenda. That comes ahead of another summit of EU leaders scheduled for the 17-18th July, where the 27 leaders will meet in person in Brussels for further discussions on the recovery fund. Meanwhile, the start of July on Wednesday formally sees Germany take over the rotating EU presidency, which they’ll hold for the next six months.

Staying with politics, Reid points out that Brexit negotiations between the UK and the EU on their future relationship will return once again. This will be the first set of intensified talks that are taking place every week over the next five weeks, as the two sides look to come to an agreement following fairly slow progress in the talks thus far. Since the last round of negotiations, a high-level meeting took place between Prime Minister Johnson and the Presidents of the European Commission, Council and Parliament, where the two sides agreed in their statement that “new momentum was required” in the discussions. There does seem a bit more positivity now than there was a month ago but much work still needs to be done.

Elsewhere we have the release of the FOMC minutes for the June meeting on Wednesday, along with an appearance by Fed Chair Powell and Treasury Secretary Mnuchin tomorrow before the House Financial Services Committee. Otherwise, speakers next week include the BoE’s Governor Bailey and Deputy Governor Cunliffe, along with the ECB’s Schnabel and New York Fed President Williams.

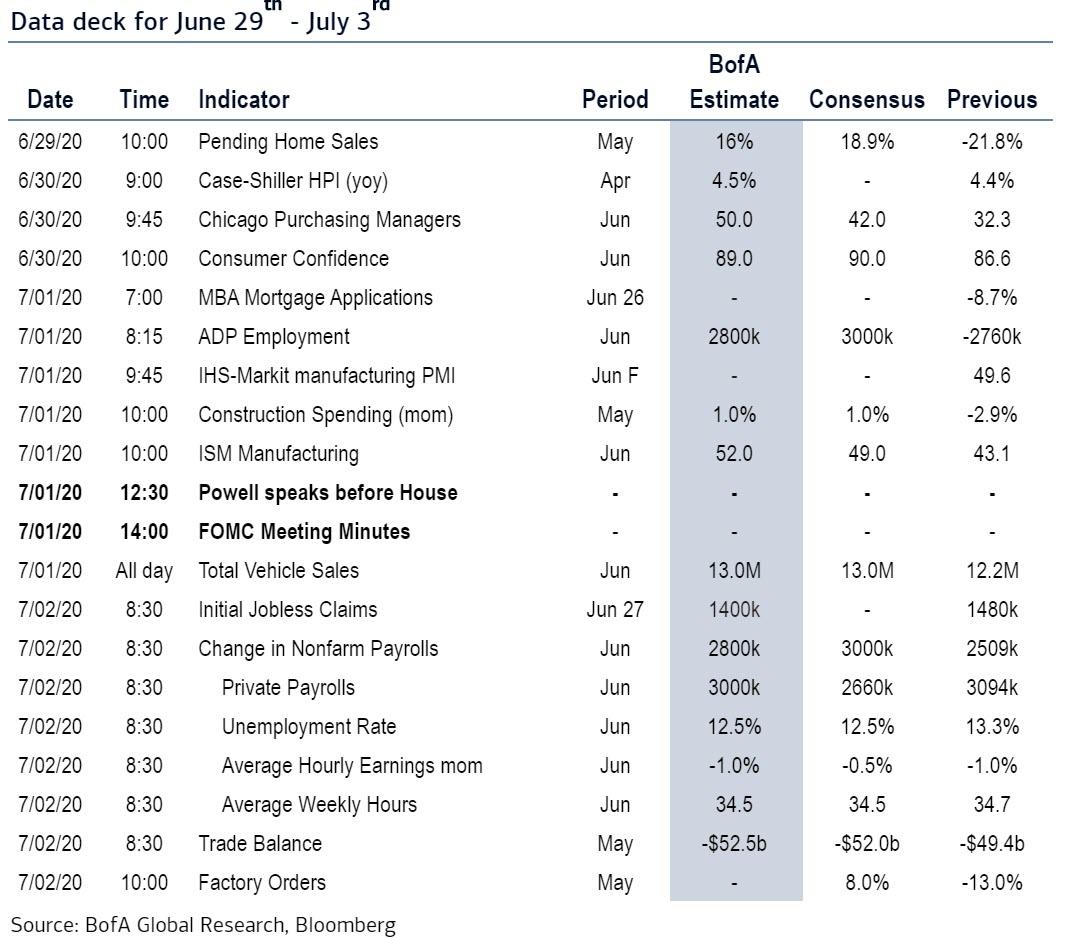

Courtesy of Deutsche Bank, here is a day-by-day calendar of events:

Monday

- Data: Japan May retail sales; Spain preliminary June CPI; UK May consumer credit, mortgage approvals, M4 money supply; Euro area June economic, industrial, services and consumer confidence; Germany preliminary June CPI; US May pending home sales and June Dallas Fed manufacturing activity index.

- Central Banks: BoE’s Bailey, Breeden and Vlieghe speeches; Fed’s Daly and Williams speeches; IMF’s Georgieva speech.

- Politics: German and French leaders meet to discuss clinching a deal on the EU recovery fund.

- Others: EU Brexit chief negotiator Michel Barnier meets UK counterpart David Frost for further talks on a trade deal.

Tuesday

- Data: Japan preliminary May industrial production; China June official PMIs; UK final June GfK consumer confidence, June Lloyds business barometer, final 1Q GDP, private consumption, government spending, gross fixed capital formation, exports, business investments, current account balance, imports; France preliminary June CPI, May PPI and consumer spending; Spain final 1Q GDP; Italy preliminary June CPI and May PPI; Euro area preliminary June CPI and Core CPI; US April S&P CoreLogic house price index, June Chicago Fed PMI, Conference board consumer confidence, expectations and present situation index.

- Central Banks: ECB Schnabel speech; BoE Cunliffe and Haldane speeches; Fed Williams speech; Colombia rate decision.

- Others: Fed’s Powell and US Treasury Secretary Mnuchin testify before the House Finance Panel.

- Politics: European Council President Charles Michel and European Commission President Ursula von der Leyen meet with South Korean President Moon Jae-in in a virtual summit, NATO Secretary General Jens Stoltenberg speaks on the geopolitical implications of Covid-19.

Wednesday

- Data: Japan 2Q Tankan survey results, June consumer confidence and final June manufacturing PMI; China June Caixin manufacturing PMI; Spain June manufacturing PMI; Italy June manufacturing PMI; France final June manufacturing PMI; Germany final June manufacturing PMI, June unemployment claims rate and unemployment change; Euro area final June manufacturing PMI; UK final June manufacturing PMI; US latest weekly MBA mortgage applications, June Challenger job cuts and ADP employment change, final June manufacturing PMI, May construction spending, June ISM manufacturing, new orders, prices paid and employment, June FOMC meeting minutes, June Wards total vehicles sales.

- Central Banks: Sweden rate decision, BoE Haskel speech; Fed Evans speech.

- Politics: Russia holds the final day of voting on changes to the nation’s constitution.

- Others: The head of Germany’s BaFin financial regulator testifies before the German parliament on the accounting scandal at payment-processing firm Wirecard AG; the U.S.-Mexico-Canada Agreement is due to take effect.

Thursday

- Data: Euro area May PPI and unemployment rate; US May trade balance, June nonfarm payrolls, unemployment rate and average hourly earnings, latest weekly initial and continuing claims, May factory orders, final May durable goods and capital goods orders.

- Others: SIFMA has recommended an early close (14:00 EDT) for the fixed-income market before the U.S. Independence Day holiday

Friday

- Data: Final June services and composite PMIs for Japan, China (Caixin), Spain, Italy, France, Germany, Euro area and UK; France May YtD budget balance; UK June official reserve changes.

- Central Banks: ECB Knot speech.

- Others: US Independence Day holiday

* * *

Finally, courtesy of Goldman, here is a preview of events in the US, where as Jan Hatzius notes, key events this week are the ISM manufacturing index on Wednesday and the employment report on Thursday. The minutes of the June FOMC meeting will be released on Wednesday.

Monday, June 29

- 10:00 AM Pending home sales, May (GS +33.0%, consensus +18.0%, last -21.8%): We estimate that pending home sales rebounded by 33.0% in May based on regional home sales data, following a 21.8% drop in April. We have found pending home sales to be a useful leading indicator of existing home sales with a one-to-two-month lag.

- 10:30 AM Dallas Fed manufacturing index, June (consensus -22.0, last -49.2)

- 11:00 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will speak on a panel discussion on higher education. Prepared text is not expected. Audience and media Q&A are expected.

- 3:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will moderate a discussion with IMF Managing Director Georgieva.

Tuesday, June 30

- 09:00 AM S&P/Case-Shiller 20-city home price index, April (GS +0.7%, consensus +0.5%, last +0.47%); We estimate the S&P/Case-Shiller 20-city home price index increased by 0.7% in April, following a 0.47% increase in March.

- 09:45 AM Chicago PMI, June (GS 46.0, consensus 44.0, last 32.3); We estimate that the Chicago PMI rebounded by 13.7pt to 46.0 in June—following a 3.1pt decline in May—reflecting improved June readings for other manufacturing surveys.

- 10:00 AM Conference Board consumer confidence, June (GS 94.0, consensus 90.5, last 86.6): We estimate that the Conference Board consumer confidence index increased to 94.0 in June from 86.6 in May.

- 11:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give a speech via webinar on central banking during the pandemic. Prepared text and moderator Q&A are expected.

- 12:30 PM Fed Chair Powell (FOMC voter) speaks: Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin will testify before the House Financial Services Committee. Prepared text is TBD and questions from Members are expected.

- 02:00 PM: Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a virtual panel discussion on race and social justice in economics. Prepared text is not expected. Audience Q&A is expected.

Wednesday, July 1

- 08:15 AM ADP employment report, June (GS +2,500k, consensus +2,950k, last -2,760k); We expect a 2,500k gain in ADP payroll employment, reflecting a boost from falling jobless claims and higher oil prices. We expect the “active” employment input to understate actual job gains in the ADP model.

- 10:00 AM ISM manufacturing index, June (GS 49.0, consensus 49.5, last 43.1); We expect the ISM manufacturing index to increase by 5.9pt to 49.0 in June, after rebounding by 1.6pt in May. While we expect the key components – new orders, production, and employment – to improve; faster delivery times will likely weigh on the degree of recovery in the composite index.

- 10:00 AM Construction spending, May (GS +0.8%, consensus +0.9%, last -2.9%): We estimate a 0.8% increase in construction spending in May, with a faster recovery in non-residential than residential construction.

- 10:00 AM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will host a forum on the future of the city of Chicago. Prepared text is not expected, nor is discussion of monetary policy. Audience Q&A is expected.

- 02:00 PM Minutes from the June 9-10 FOMC meeting: At its June meeting, the FOMC left the target range for the policy rate unchanged at 0-0.25%; and in the Summary of Economic Projections, participants expected high unemployment, low inflation, and a flat funds rate through 2022. In the minutes, we will look for further discussion of the economic outlook and the Fed’s toolkit, including the Committee’s discussion of yield curve control.

- 05:00 PM Lightweight motor vehicle sales, May (GS 13.1m, consensus 13.0m, last 12.2m)

Thursday, July 2

- 08:30 AM Nonfarm payroll employment, June (GS +4,250k, consensus +3,000k, last +2,509k); Private payroll employment, June (GS +4000k, consensus +2,519k, last +3,094k); Average hourly earnings (mom), June (GS -1.0%, consensus -0.8%, last -1.0%); Average hourly earnings (yoy), June (GS +5.3%, consensus +5.3%, last +6.7%); Unemployment rate, June (GS 12.7%, consensus 12.4%, last 13.3%): We estimate nonfarm payroll growth accelerated from the +2.5mn record gain in May to +4.25mn in June. With much of the economy reopening, our forecast reflects a rapid albeit partial reversal of temporary layoffs. While jobless claims remain elevated, alternative data suggest unprecedented increases in the number of workers at work sites. We also expect a seasonal bias in education categories to boost job growth by roughly 0.5mn.

- We expect that about half of the 4.9mn excess workers that were employed but not at work for “other reasons” in May will be reclassified as unemployed in the June household survey, applying upward pressure on the unemployment rate. Additionally, we expect the labor force participation rate increased as business reopenings encouraged job searches. Taken altogether, we estimate the unemployment rate as reported will fall by 0.6pp to 12.7% in Thursday’s report. Correcting for misclassification of unemployed workers, we estimate the “true” unemployment rate declined more significantly, but to an even higher level (-2.4pp to 14.0% in June from 16.4% in May).

- We estimate average hourly earnings declined 1.0% month-over-month and 5.3% year-over-year as lower-paid workers are rehired and the associated composition shift unwinds.

- 08:30 AM Trade balance, May (GS -$54.0bn, consensus -$53.0bn, last -$49.4bn): We estimate the trade deficit increased by $4.1bn in May, reflecting a rise in the goods trade deficit.

- 08:30 AM Initial jobless claims, week ended June 27 (GS 1,375k, consensus 1,336k, last 1,480k): Continuing jobless claims, week ended June 20 (consensus 18,904k, last 19,522k); We estimate initial jobless claims declined but remained elevated at 1,375k in the week ended June 27.

- 10:00 AM Factory orders, May (GS +11.1%, consensus +7.9%, last -13.0%); Durable goods orders, May final (last +15.8%); Durable goods orders ex-transportation, May final (last +4.0%); Core capital goods orders, May final (last +2.3%); Core capital goods shipments, May final (last +1.8%)

Friday, July 3

- US Independence Day holiday observed. US equity and bond markets are closed.

Source: DB, BofA

via ZeroHedge News https://ift.tt/3gcbpbI Tyler Durden