A Massive Warning Of Un-Sustainability

Tyler Durden

Fri, 07/10/2020 – 08:20

Authored by Sven Henrich via NorthmanTrader.com,

Raising red flags during a bubble is a thankless job. The crowd gleefully cheers the momentum and as tops are processes anyone voicing contrarian reservations looks to be wrong while the bubble proceeds.

I’m a big boy I can handle it. I was faced with the same issue late last year into Q1 this year as they kept chasing stocks into the high heavens before the 35% crash. Oh but it was Covid, nobody could’ve seen this coming. Nonsense. Covid was the trigger but the technical and excess were long building and now we’re in such phase again, except this one may be worse.

I know, we live in the age where trillions are tossed around candy by central banks and governments and everybody’s eyes just glaze over as the numbers defy context and comprehension.

But let me throw a bit of reality into the mix and it’s absolutely mind boggling.

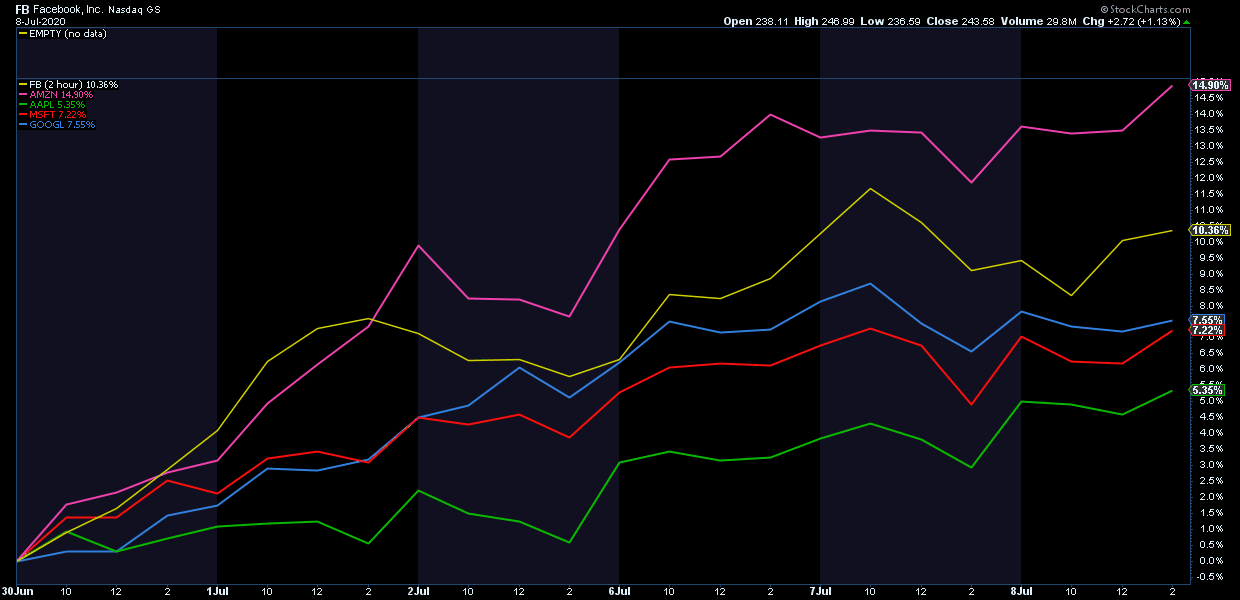

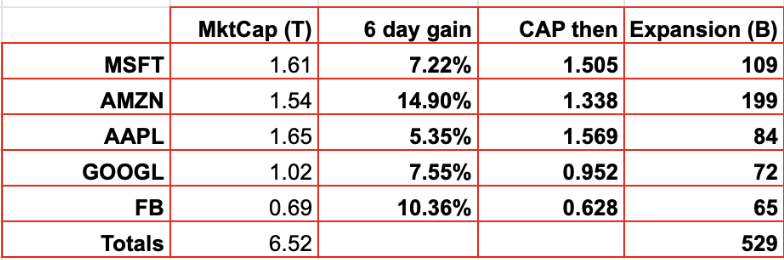

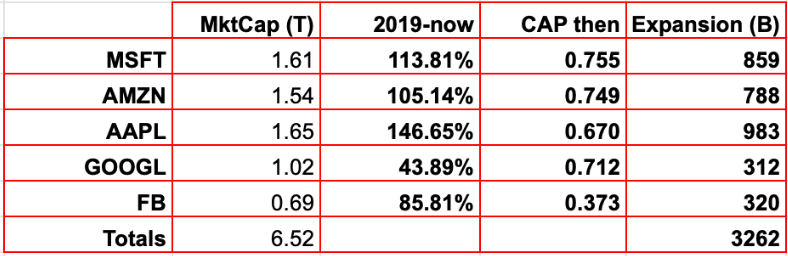

5 stocks have just added over half a trillion in market cap in just 6 days. Six days. Ponder that:

And they’re even higher on the open today.

I ran the numbers:

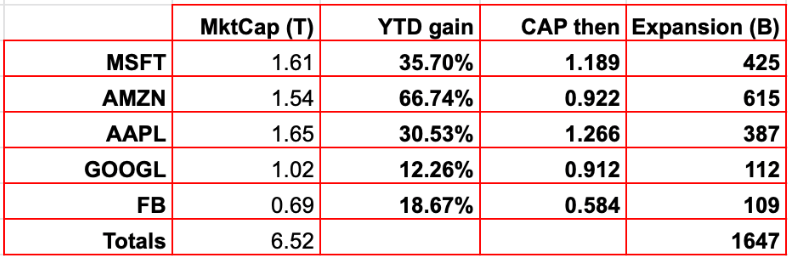

5 stocks now have a combined market cap over $6.5 trillion.

These very same stocks have added over $1.6 trillion in market cap in 2020:

That would be a feat during any bull market during times of great growth, but in a historical recession?

So some of these stocks grabbed some market share during the shutdown, but don’t tell me $AAPL sold more phones during this.

It gets worse. Since 2019 these stocks have added over $3.2 trillion in market cap:

Now, if you can convince yourself to believe that these stocks have earnings growth stories to support market cap expansions anywhere near these figures I suppose you can convince yourself to believe anything.

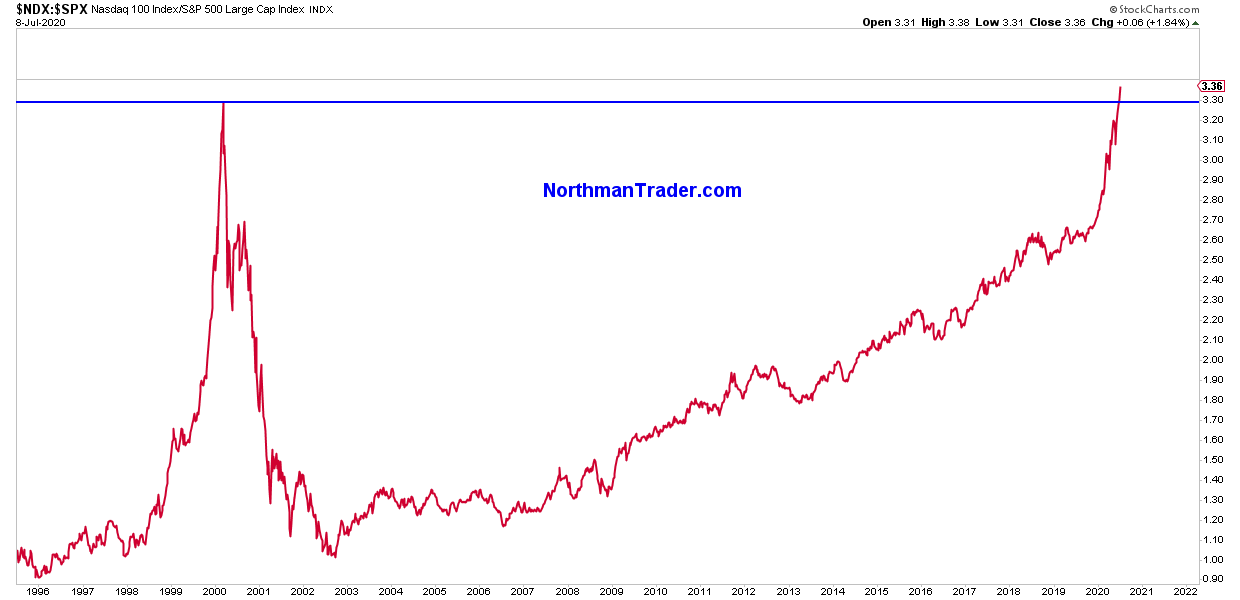

During bubbles people will convince themselves of anything. And this is nothing new. After all people convinced themselves that tech’s valuations versus the rest of the economy were justified before.

How did that work out?

Folks, we’re witnessing the greatest market cap expansion in human history making the year 2000 look like child’s play. The combination of insane liquidity thrown at markets, the mechanics of automatic ETF allocations, retail and FOMO thirsty funds chasing these few stocks all look to contribute to the greatest market cap bubble in history.

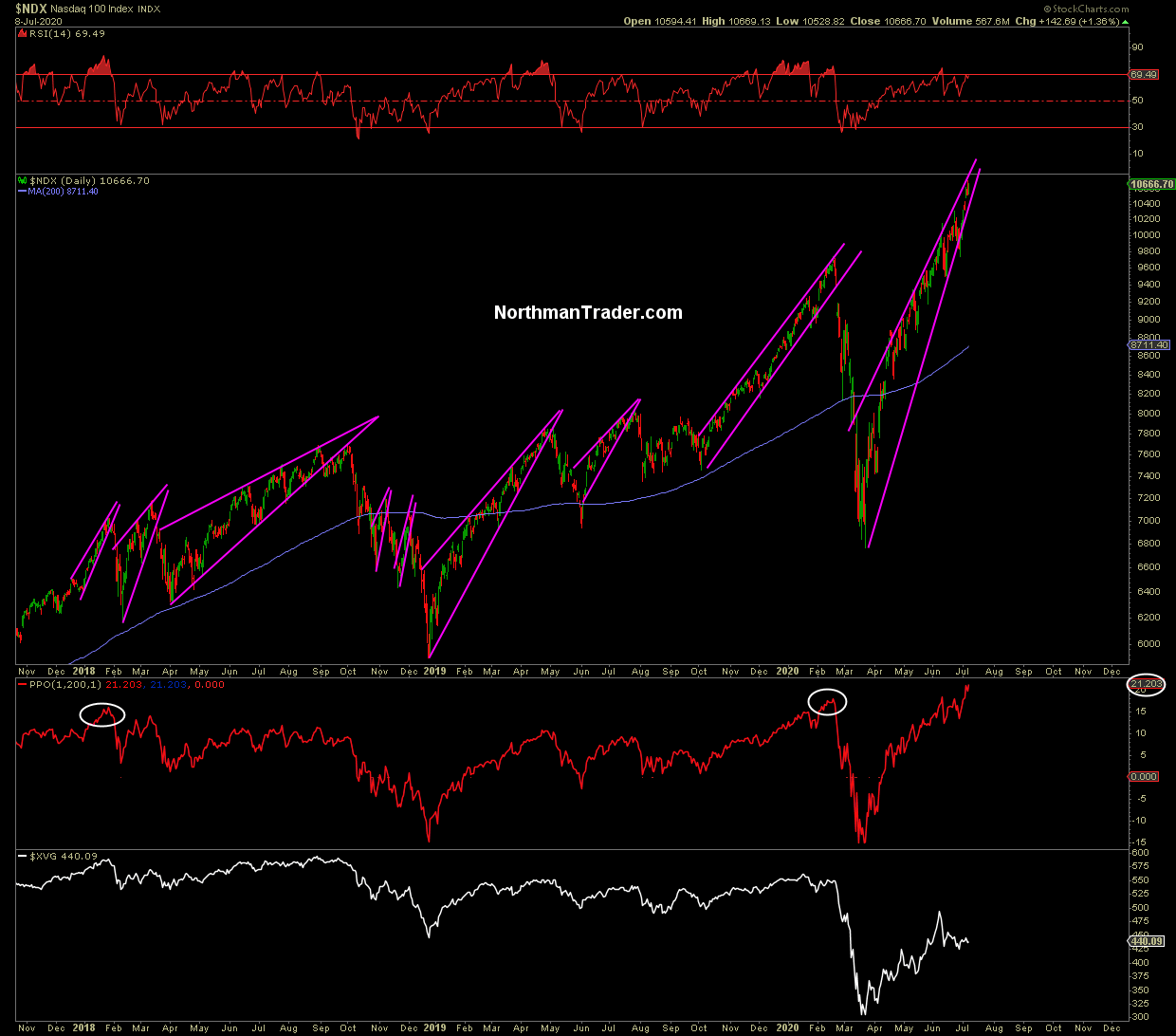

And we continue to stare at the mother of all rising wedges:

The most vertical, most narrowest one way wedge I can recall seeing.

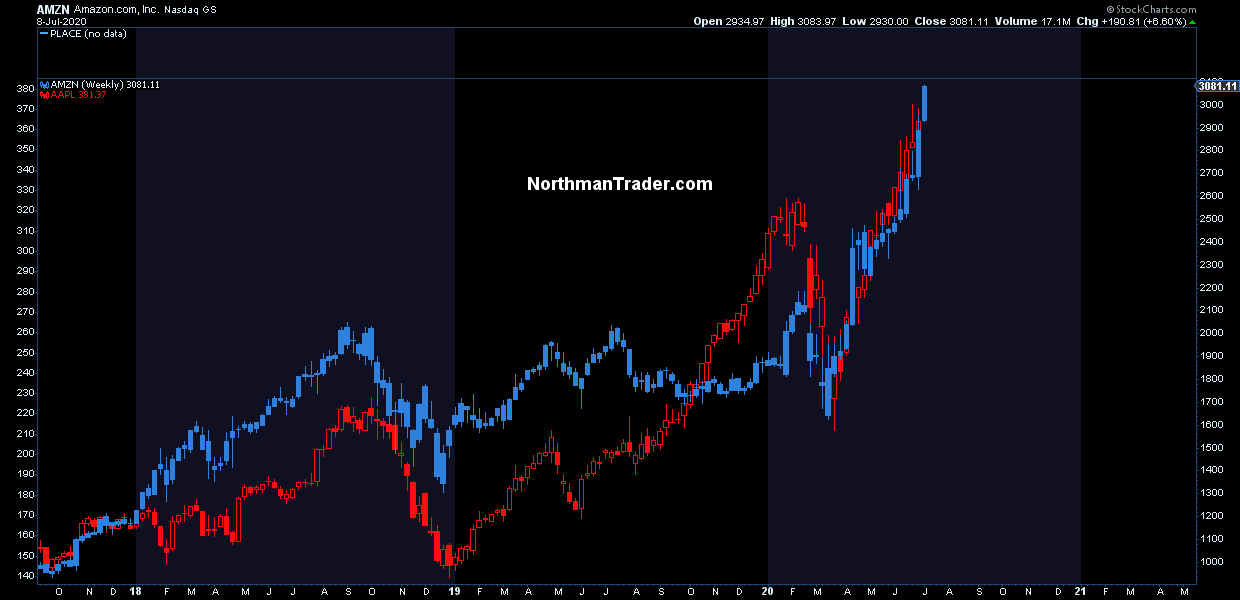

And they keep piling into this valuation expansion like their lives depended on it:

$AAPL has a PEG ratio of 2, $AMZN a PEG ratio of 3 with a combined market cap over $3.2 trillion.

Bubbles will run until they burn themselves out. You know my views on the bifurcation and the bubble (See also DOW Gargoyle and the Bubble).

I’ll let the market cap expansion figures speak for themselves. I consider them to be a massive warning of un-sustainability. Others are free to disagree. That’s what makes markets.

via ZeroHedge News https://ift.tt/2CrmFlB Tyler Durden