Goldman Expects A 60% Drop In Q2 EPS, Much Worse Than Consensus

Tyler Durden

Sun, 07/12/2020 – 19:30

While Morgan Stanley continues to cheerlead some imaginary V-shaped recovery that is increasingly just in the heads of its research analysts who are running out of time to convince the bank’s clients to buy everything the bank’s prop desks have to sell (while pointing to the market’s surge as if central bank manipulation in the form of trillions of money printed is somehow equivalent to discounting the future, something which the market used to do before central banks took over “price discovery”), Goldman has increasingly become the bearish foil to Stanley’s mind-numbing cheerleading, and in his latest note, Goldman’s chief equity strategist David Kostin looks at Q2 earnings, writing that “investors seek answers about the size of the downturn and the scope for recovery”, and warns that the earnings reality about to be revealed will be far uglier than even the pessimists expect.

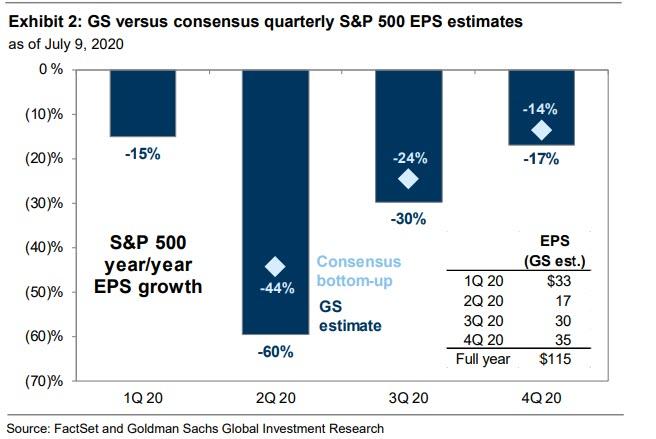

Which is why, unlike consensus which expects an already catastrophic 44% drop in Q2 EPS Y/Y, Goldman is even more downbeat with Kostin predicting that “earnings will fall by 60% in the quarter“, the worst print since the financial crisis.

As was the case in Q1, when historical earnings reports were largely ignored, investors will be looking below the surface of aggregate results to better understand the earnings impact of shutdowns and how quickly earnings can recover as the world reopens. Given the recent resurgence of COVID-19 cases in the US, we expect management commentary will prove more important to gauging the forward path of earnings than actual 2Q results. That is, assuming that companies will not eliminated guidance for the second quarter in a row.

We’ll find out as soon as Tuesday, when the largest US Banks, including C, JPM, WFC, and BAC, report second quarter results, with 66% of S&P 500 companies set to report earnings during the two-week period between July 20 and July 31.

Here are some more details from Goldman on why an already dismal consensus will likely end up being overly optimistic:

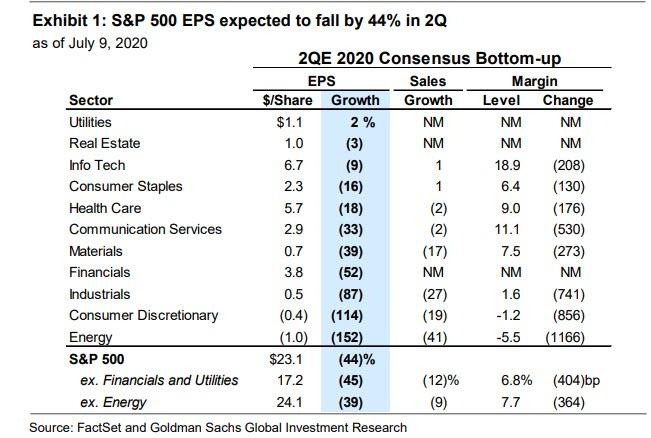

Consensus expects S&P 500 earnings will decline by 44% in 2Q, but aggregate results will mask wide dispersion by sector. Equity analysts forecast S&P 500 sales will decline by 12% and net profit margins will contract by 400 bp to 6.8%. If realized, 2Q 2020 EPS growth would be the weakest since 4Q 2009 (-65%).

Energy and Consumer Discretionary are expected to post outright losses in the quarter due to the sharp decline in oil prices and direct impact from coronavirus shutdowns. Financials results will also be weak as Banks build additional reserves ahead of an expected surge in bankruptcies and nonperforming loans. Goldman’s Banks team expects earnings to decline by 69%.

At the other end of the distribution, analysts expect Info Tech EPS to decline by just 9%. The defensive Utilities is the only sector expected to grow EPS in 2Q (+2%).

Looking at the big picture, Goldman believes Q2 earnings results will be worse than consensus currently forecasts. With economic growth the primary driver of S&P 500 EPS growth; 65% of the variation in quarterly year/year EPS growth can be explained by US economic activity in the quarter. Goldman’s US Current Activity Indicator averaged -12% in 2Q, improving from -25% in April to -1.4% in June. The bank forecasts S&P 500 EPS will decline by 60% year/year.

The S&P 500 comprises large, profitable firms and should be insulated from the economic damage relative to smaller firms. Analyst estimates show Russell 2000 EPS falling by 120% in the second quarter.

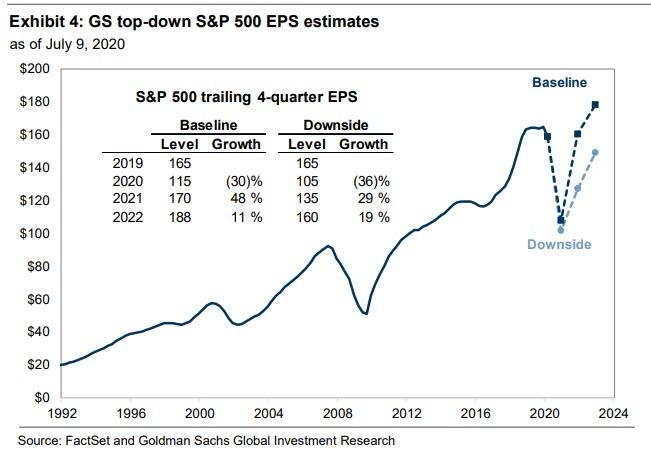

Investors continue to look through 2020 EPS and focus on the earnings outlook for 2021 and 2022. Many investors expect the coronavirus-induced collapse in profits will be concentrated in 2020.

In order to shift attention even further away from the current collapse in profits, Goldman believes FY+2 earnings and valuation multiples “more accurately reflect the investing environment” and the bank “adjusts our baseline forecast for S&P 500 2020 EPS to $115 (-30%) from $110, maintain our 2021 EPS estimate of $170 (+48%), and introduce a 2022 EPS estimate of $188 (+11%).”

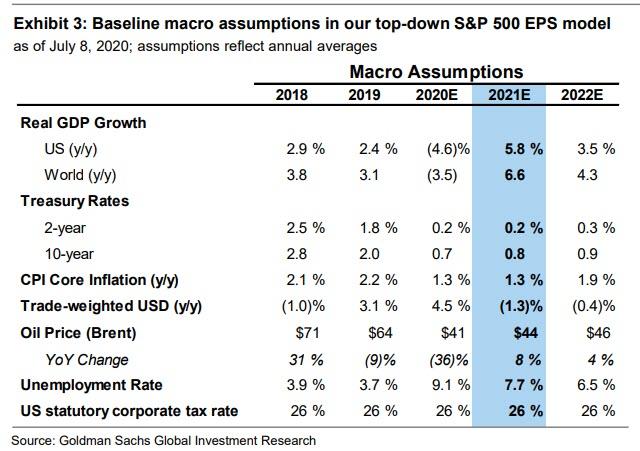

Goldman’s 2021 EPS forecast is 4% above realized 2019 EPS, while in 2020, Goldman assumes average annual US GDP growth of -4.6%, average Brent crude oil price of $41/bbl (-35% year/year), and a 5% stronger trade-weighted US dollar relative to 2019.

The bank’s 2021 and 2022 forecasts incorporate expectations of modestly higher oil prices, a weaker USD, and US real economic growth that averages +5.8% in 2021 and +3.5% in 2022. The bank’s economists also expect slack to persist in the labor market through 2022, providing additional flexibility for corporate profit margins.

According to Kostin, “more of the 2020 decline in earnings is driven by margin contraction than by a drop in sales” as many companies have adjusted their revenue models (e.g., online, curbside) but are experiencing increased costs to reopen safely. Excluding Financials and Utilities, Goldman forecasts S&P 500 sales growth of -8% in 2020, +13% in 2021, and +7% in 2022, and net profit margins of 8.6% (-205 bp) in 2020, 11.1% (+250 bp) in 2021, and 11.5% (+40 bp) in 2022.

While Goldman is especially downbeat on Q2 earnings, it is far more optimistic looking at the year ahead, and its estimates for 2021 and 2022 remain above bottom-up consensus and most buy-side estimates. Consensus continues to look for a rebound in earnings through 2022 following a 24% decline in 2020. However, revisions have been steadily negative in the past month. Consensus now expects 2021 EPS of $162 (+30%) and 2022 EPS of $187 (+15%), both below Goldman’s top-down estimates.

What if Goldman is – as usual – wrong about everything? Well, in a downside scenario, Kostin expects that S&P 500 EPS would equal just $105 in 2020, $135 in 2021, and $160 in 2022, with the downside estimates implying EPS growth of -36% in 2020, +29% in 2021, and +19% in 2022, meaning 2022 EPS would remain 3% below 2019 levels.

These estimates are broadly consistent with the downside scenario outlined by Goldman’s economists and represent a “check-mark” rather than a “V-shaped” recovery. The bank expects this downside scenario to occur if reopening plans are meaningfully pushed back because the virus is uncontained or if damage to the labor market and businesses becomes more long-lasting in nature. For example, large company bankruptcies have increased sharply in the past few weeks. Based on Goldman’s top-down model, every 100 bp change in US GDP growth equates to $6 of S&P 500 EPS.

On the other hand, if a vaccine were approved and distributed rapidly, it would generate only modest upside to the bank’s optimistic baseline 2021 EPS estimate.

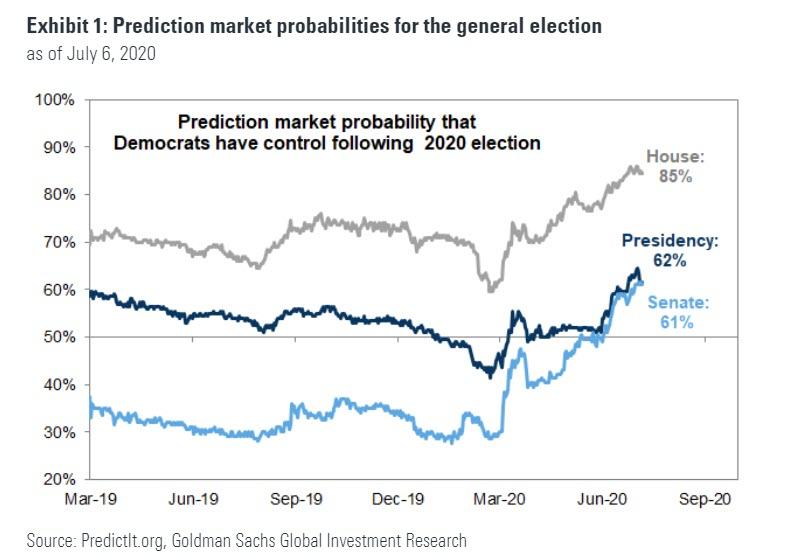

The election wildcard: The 2020 elections add to the earnings uncertainty created by the coronavirus. The odds of a Democratic sweep in November have increased substantially since February and now stand above 50%.

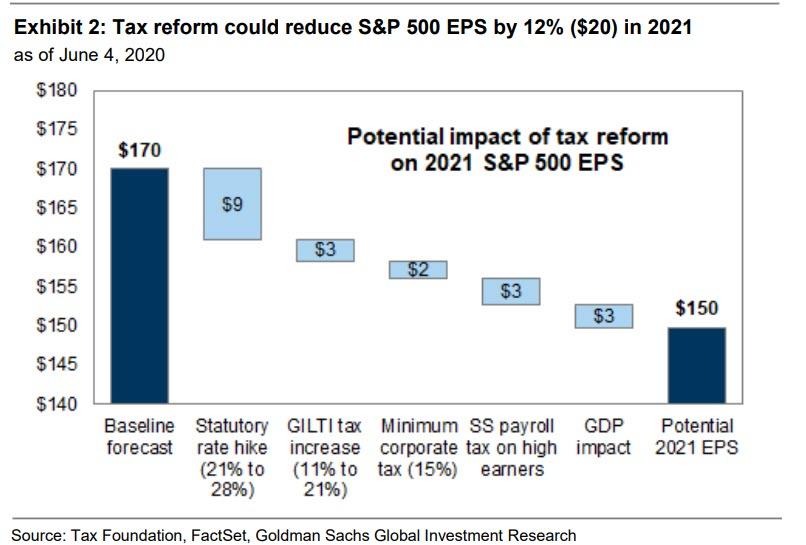

If enacted, the Biden tax plan would reduce our S&P 500 earnings estimate for 2021 by $20 per share, from $170 to $150.

This estimate includes raising the statutory federal tax rate on domestic income from 21% to 28%, doubling the GILTI tax rate on certain foreign income, imposing a minimum tax rate of 15%, adding an additional payroll tax on high earners, and a drag on US GDP of a similar magnitude to the boost the TCJA created in 2018.

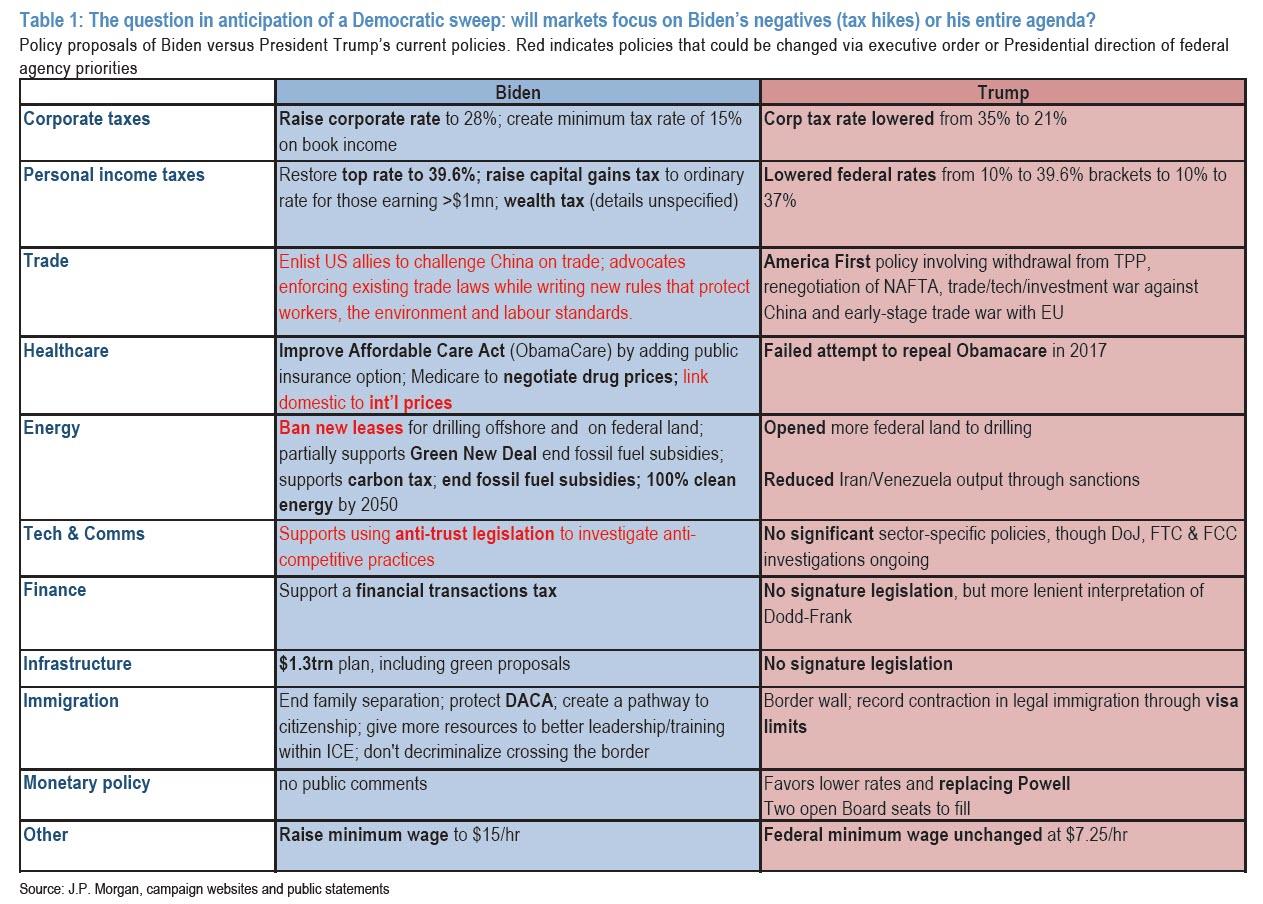

Outside of tax reform, Goldman sees regulation, infrastructure, and trade policy represent potential upside and downside risk to S&P 500 EPS. It’s not just bad news from a Biden beat: Kostin reminds us that this week, Biden outlined a $700 bn economic plan focused on fiscal stimulus. Large fiscal expansion would likely provide a tailwind to economic growth and S&P 500 EPS. Meanwhile, JPMOrgan has published a matrix showing that no matter if Trump or Biden wins, the outcome will be bullish for stocks in either case.

via ZeroHedge News https://ift.tt/302cdcx Tyler Durden