Bank of America Slides On Surge In Credit Loss Provisions Despite 35% Trading Revenue Jump

Tyler Durden

Thu, 07/16/2020 – 08:08

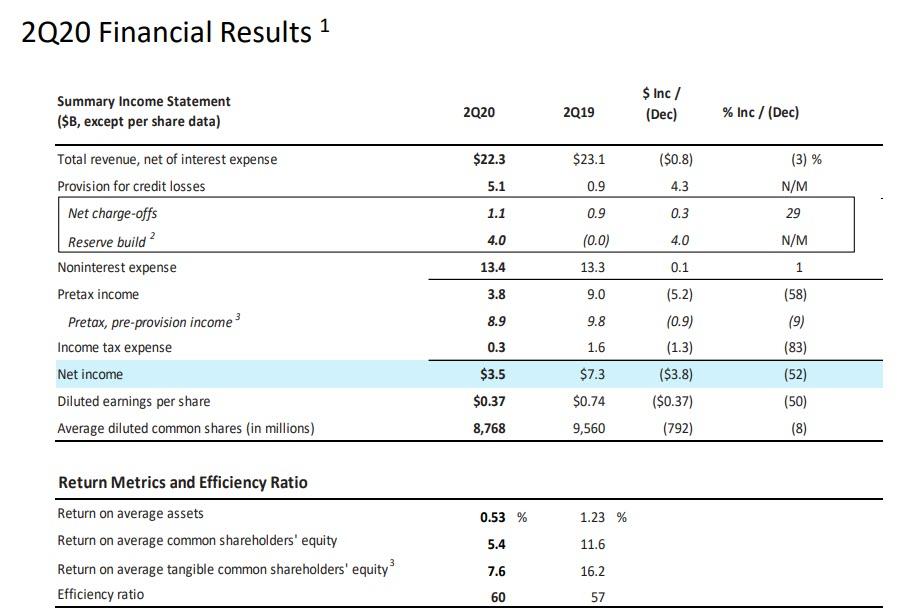

Concluding the reporting by the big US money center banks, Bank of America this morning published Q2 earnings which were more of the same observed earlier in the week: strong trading results offset by a deteriorating balance sheet and surging credit loss provisions.

Specifically, the bank reported total Q2 revenue of $22.3BN, slightly better than the $22.01BN expected but down 3.3% Y/Y. This resulted in Net Income of $3.5BN, down 52% Y/Y, and EPS of $0.37, down exactly half from the $0.74 a year ago.

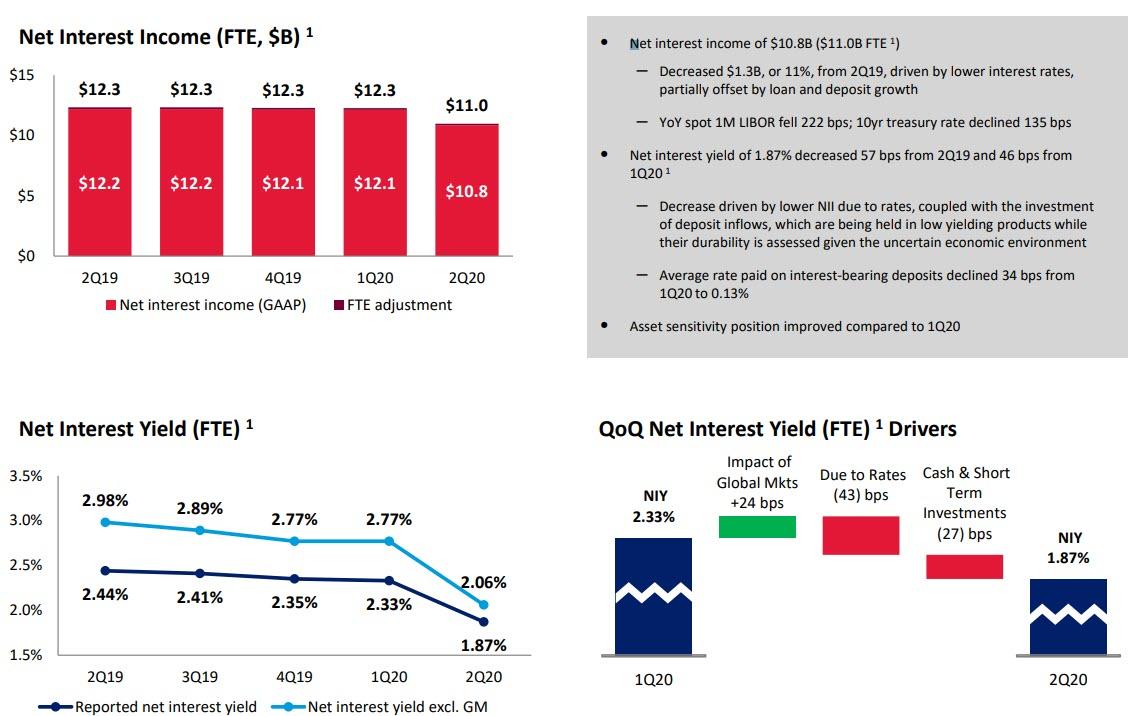

Looking closer at revenue, Net Interest Income tumbled to $10.8BN, missing the $11.1BN expectation and down 11% from $12.3BN a year ago, driven by lower interest rates, partially offset by loan and deposit growth (YoY spot 1M LIBOR fell 222 bps; 10yr treasury rate declined 135 bps). The bank was hit especially hard by the plunge in the net interest yield which slumped to an all time low of 1.87%, a record 46 bps drop from 2.33 in Q1. The decrease driven was by lower NII “due to rates, coupled with the investment of deposit inflows, which are being held in low yielding products while their durability is assessed given the uncertain economic environment.” On the other end, the average rate paid on interest-bearing deposits by BofA declined 34 bps from 1Q20 to 0.13%.

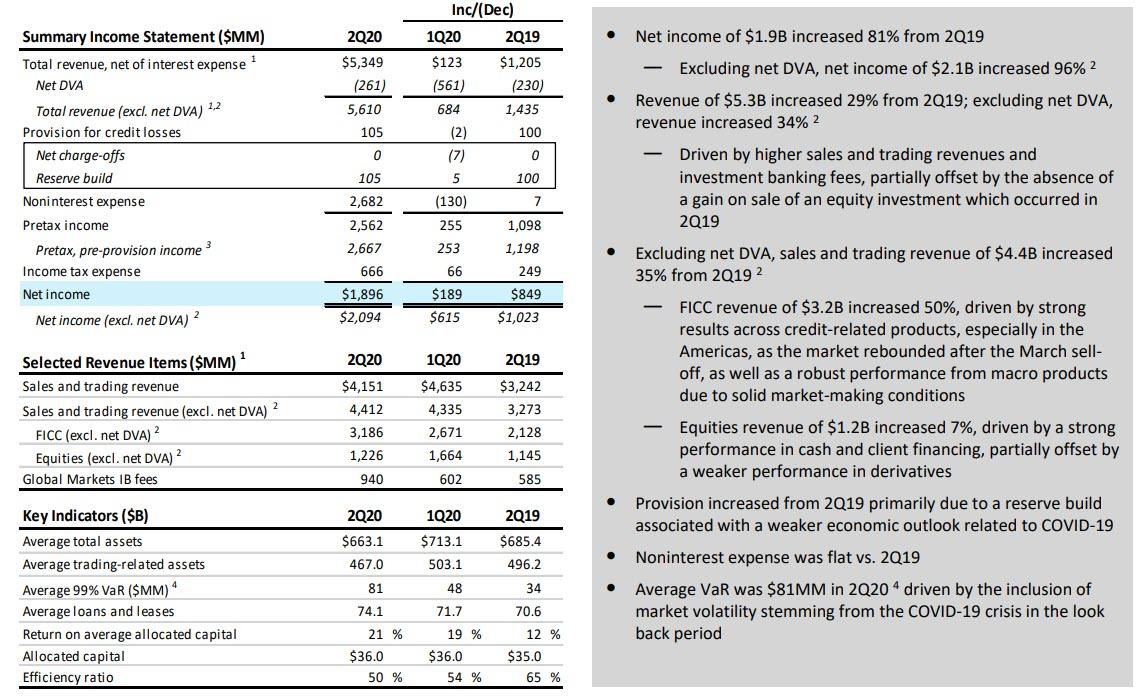

The collapse in Net Interest Income was partially offset by a surge in Trading Revenue, which jumped to $4.41BN, up 35% from Q2 2019, and smashing consensus expectations of $3.83BN. Looking at the breakdown:

- Equity revenue: $1.226BN, +7% from $1.145BN (exp. 1.25BN), driven by a strong performance in cash and client financing, partially offset by a weaker performance in derivatives.

- FICC revenue: $3.186BN, +50% from $2.128BN (exp. $2.57BN), driven by strong results across credit-related products as the market rebounded after the March selloff, as well as a robust performance from macro products due to solid market-making conditions.

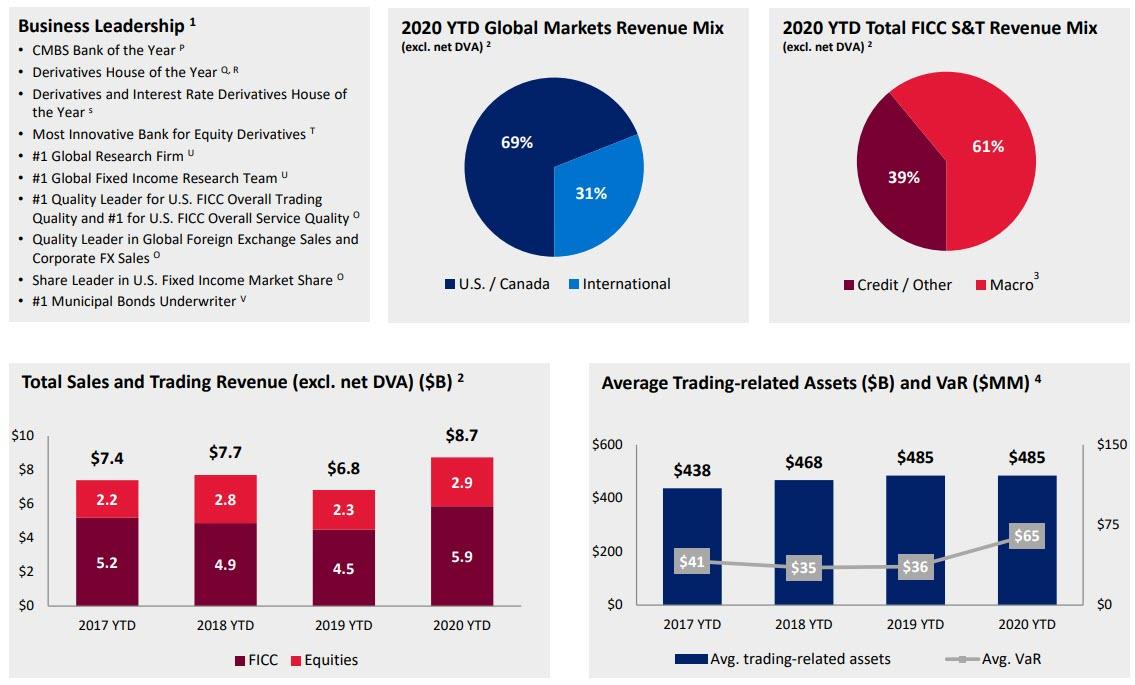

Also notable, if not nearly as high as JPM’s, BofA’s average VaR jumped to $81MM in 2Q (from $34MM a year ago) driven by the inclusion of market volatility stemming from the COVID-19 crisis in the lookback period.

Visually, the breakdown is as follows:

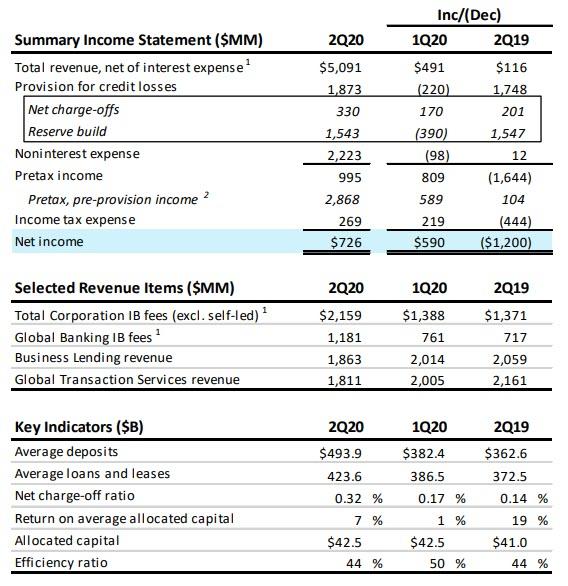

Investment banking revenues also crushed expectations of $1.6BN, rising 57% to $2.2BN in Q2 from $1.37BN a year ago, driven by increases in debt and equity underwriting fees which again is all thanks to the Fed whose nationalization of the bond market sent issuance volumes to all time highs. Some more details:

- Average deposits of $494B increased 36% from 2Q19, reflecting client flight to safety, government stimulus and placement of credit draws

- Average loans and leases of $424B increased 14% from 2Q19, driven by revolver draws at the end of 1Q20 which were partially paid down throughout 2Q20

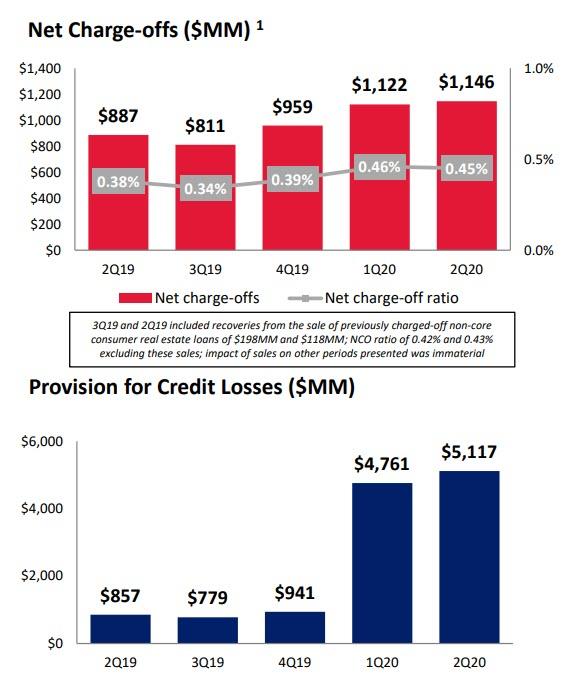

As with the other banks, stellar trading results – which are unlikely to repeat unless we have another crisis and the Fed pumps another $3 trillion in the market 0 was the good news. The not so good news: the surge in credit loss provisions, which after jumping to $4.8BN in Q1, rose another $5.117BN in Q2 which included a reserve build of $4.0B, primarily due to the weaker economic outlook related to COVID-19.

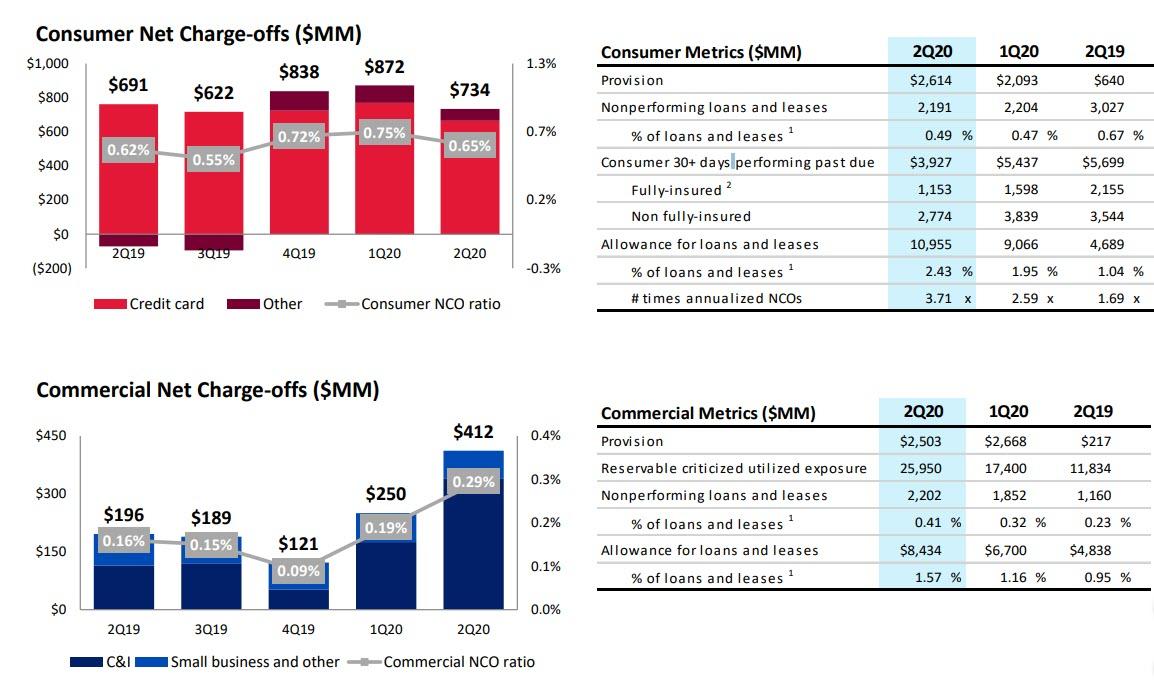

At the same time, total net charge-offs of $1.1B were relatively unchanged from 1Q20 (the net charge-off (NCO) ratio of 45 bps decreased 1 bp from 1Q20 with consumer net charge-offs of $0.7B decreasing $138MM primarily driven by deferrals and government stimulus; Commercial net charge-offs of $0.4B increased $162MM primarily driven by real estate and energy).

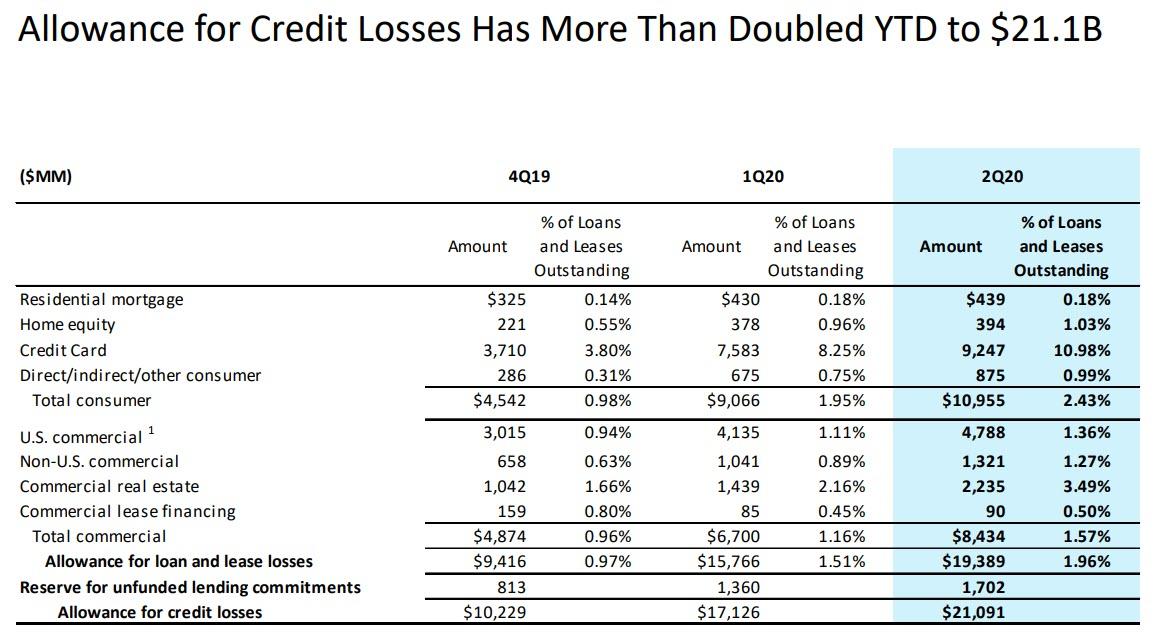

In Q2, the total allowance for loan and lease losses of $19.4B increased $3.6B from 1Q20 and represented 1.96% of total loans and leases. Total allowance of $21.1B includes $1.7B for unfunded commitments.

Putting it all together: trading revenues were strong, but maybe not as strong as they could have been (see Goldman), while the balance sheet was certainly not as ugly as Wells Fargo’s but it could have been better. As a result, BofA stock traded 3% lower on the report, with questions remaining if this was as bad as it would get, or if there would be more pain next quarter.

Full earnings presentation below (pdf link):

via ZeroHedge News https://ift.tt/30fqbrN Tyler Durden