Mish Blasts WSJ “Nonsense” On Gold & The Dollar

Tyler Durden

Tue, 07/28/2020 – 10:35

Authored by Mike Shedlock via MishTalk,

Mainstream media is continually wrong about the relationship between gold and the dollar.

Another example came up today in the as the Wall Street Journal discusses the “traditional relationship” between gold and the dollar in Gold Prices Hit Record as Dollar Drops.

The number of errors in the article is staggering.

-

“You’re seeing money slipping out of the stock market or out of other assets and just eking into gold,” said David Govett, head of precious metals at commodities brokerage Marex Spectron.

-

“Gold’s traditional inverse relationship with the dollar had frayed this year, as both assets benefited from haven buying during the pandemic,” said WSJ author Joe Wallace.

-

“So far, a burst of buying by investors has more than offset the dearth of jewelry demand.”

Myth 1: Money Slipping Away

Money does not “slip away”. It is impossible for money to flow out of stocks into gold or bonds or from bonds to stocks or any other combination.

An individual can choose to dump stocks for gold but in aggregate, for every buyer there is a seller so there is no net flow. Rather there are repricing events.

Here’s another example. A “For Sale” sign on one house in a neighborhood can impact the price of every home, even before a sale is made. There is no flow, but the houses were all repriced.

Myth 2: Inverse Relationship

Gold does not have a traditional inverse relationship with the dollar. This subject came up today in a pair of Tweets.

These MSM idiots attributing gold’s move to the dollar’s decline are either stupid or have their head in the sand. Since late 2018 gold has run from $1200 to $1927 – in late 2018 the USD index was at 95, now it’s at 93. The MSM dollar narrative is bullshit…here:

— Dave Kranzler (@InvResDynamics) July 27, 2020

My comment in December

With the US dollar right where it is now, gold has been at $450, $380, $1080, and $1480.https://t.co/BM1HLfq7Id

— Mike “Mish” Shedlock (@MishGEA) July 27, 2020

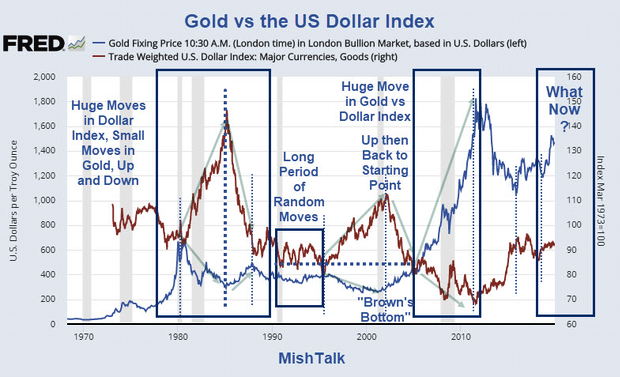

Gold vs US Dollar Index 2019-12-16

Gold’s vs the US Dollar: Correlation Is Not What Most Think

I posted the above chart on December 23, 2019 in Gold’s vs the US Dollar: Correlation Is Not What Most Think.

This was one of my comments at the time

“With the US dollar right where it is now, gold has been at $450, $380, $1080, and $1480.”

Gold vs US Dollar Index July 27, 2020

The lead chart reflects the price of gold vs the US dollar index on July 27.

The horizontal dashed line is the US dollar index at 93.7, When the solid blue line touches the dashed blue line the dollar index at that time is 93.7.

Price of Gold vs Dollar Index at 93.7

-

July 27, 2020: $1931

-

Mid 2016: $750

-

Mid 2003: $370

Repeat after me: The US dollar has little to do with the price of gold.

Myth 3: Jewelry Demand is Important

That comment shows huge ignorance about the true demand for gold as well as the price driver for gold.

What About Jewelry?

According to the World Gold Council, demand for Gold jewelry in 2019 fell 6 percent overall to 2,107 tons. How did the price of gold react?

Gold vs Jewelry Demand

Marginal Utility?

The subject of marginal utility of gold and jewelry came up in a Twitter discussion on May 30.

Jewelry is totally irrelevant to the price of gold.

The supply of gold is nearly every ounce ever mined. Curiously, similar to Bitcoin.

Misunderstanding the Supply of Bitcoin and Gold Leads to Silly Projections – for bothhttps://t.co/4c4t4PBK2B https://t.co/MlFAd5sXs5

— Mike “Mish” Shedlock (@MishGEA) May 30, 2020

Jewelry demand is actually a contrary indicator (people buy more when price is down).

Supply of Gold

Nonsensical analysis of gold demand happens because people do not understand the the supply of gold nor the driver for the demand.

Misunderstanding the Supply of Bitcoin and Gold Leads to Silly Projections

I covered the topic recently in Misunderstanding the Supply of Bitcoin and Gold Leads to Silly Projections

People confuse jewelry buying with the demand for gold and bitcoin mining with supply of Bitcoin.

Contrary to popular myth, the supply Bitcoin goes up every day. This is why halving the mining rate of Bitcoin did nothing for the price.

Similarly, people confuse demand for new gold jewelry as the demand for gold.

Misconceptions About Gold

The best explantionation of the demand for gold comes from Pater Tenebrarum at the Acting Man blog. He was my teacher in Austrian economics.

Tenebrarum wrote Misconceptions about Gold as a guest post on my blog in June of 2007 under the pseudonym Trotsky, a name he regrets. Gold was $650 at the time.

One can further illustrate gold’s unique nature as money with a study of gold prices vs. jewelry demand. If record fabrication demand for gold (jewelry) must be good for the price of gold, then a historic high in jewelry demand should in theory coincide with a high gold price.

However, record high jewelry demand in 1999 – 2000 in actual fact coincided with a 20 year bear market low in the gold price – the exact opposite of what traditional commodity supply/demand analysis would suggest.

We can therefore conclude that there must be a source of gold demand that is of far greater importance than the jewelry and industrial demand components, and that demand constitutes the true driver of the price of gold in terms of fiat money.

Indeed, there is. This demand component is called ‘monetary demand’. Monetary demand and the supply of gold is actually best described as the ‘degree of reluctance of the current owners of gold to part with their gold at current prices’ since, as mentioned above, some 160,000 tons are owned by somebody already.

Monetary Demand is the True Price Driver

Someone must hold every ounce of gold ever mined. Similarly, someone most hold every Bitcoin ever mined.

Diminishing new supply is meaningless in both. Demand for the total supply is what matters.

Gold rises and falls based on monetary demand. If one views Bitcoin as a competing currency, the same claim can be made but speculation clearly plays a larger role for Bitcoin and it has additional problems with potential central bank or government regulation.

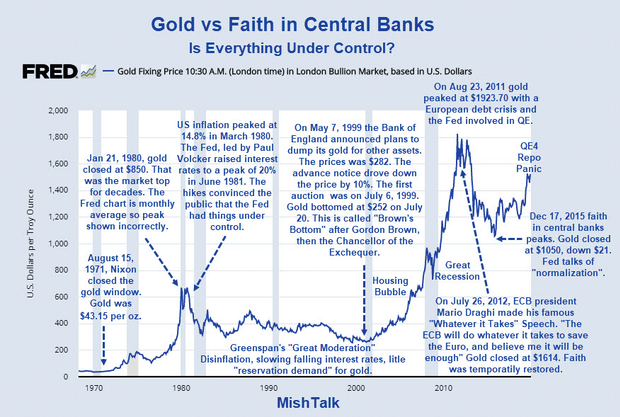

Gold vs Faith in Central Banks

I need to update that chart but it tells the right story.

Gold’s monetary demand is a function of faith in central banks. When ECB president Mario Draghi promised to do “Whatever it Takes” to save the Euro faith in central banks was temporarily restored.

That faith continued until the Fed’s talk of “normalization” dies on the vine. And now?

If you think the Fed has things under control you left your thinking cap on Mars.

via ZeroHedge News https://ift.tt/2X5nQyO Tyler Durden