Goldman Warns “Real Concerns Are Emerging” About The Dollar As Reserve Currency; Goes “All In” Gold

Tyler Durden

Tue, 07/28/2020 – 11:28

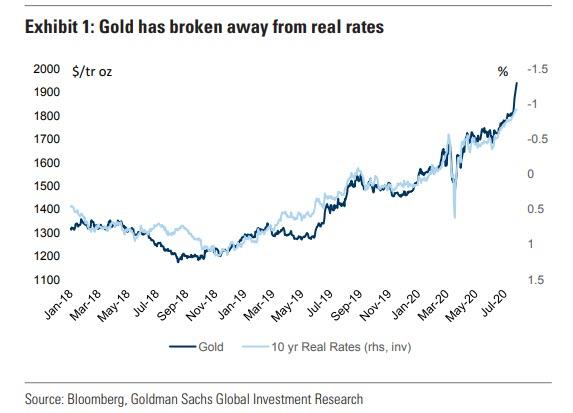

In his morning critique of goldbugs’ resurgent optimism about the future of gold, which has exploded alongside the price of precious metals, which in turn have been tracking the real 10Y rate tick for tick…

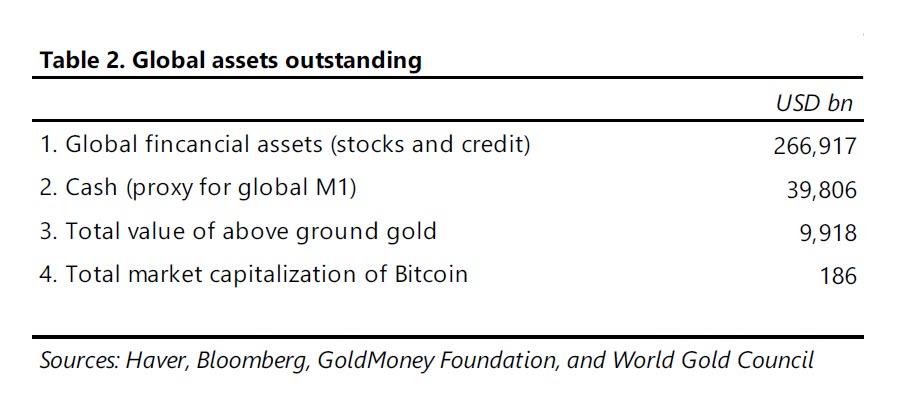

… Rabobank’s Michael Every argued from the familiar position of one who views the modern monetary system as immutable, and bounded by the “Venn Diagram” confines of the dollar as a reserve currency and financial assets as a bedrock of modern household wealth, of which as Paul Tudor Jones recently calculated, there is just over $300 trillion worth, compared to just $10 trillion in total gold value.

Indeed, according to Every, the surge in gold is meaningless because “if you buy gold, technically that is going to make you money. And yet that money is still going to be priced in US DOLLARS – and that gives the whole game away.”

Like fans of the England football team, gold fans can dream of the distant past when gold was the centre of the global monetary system; but they can keep dreaming if they think those days are ever going to return. Gold may be an appreciating asset, but all the evidence suggests that it won’t be one that is of any direct relevance to day-to-day life, finance, and business. Your currency won’t be tied to it. You won’t get paid in it. You won’t spend in it or save in it (other than to the switch back to US Dollars). You won’t be doing deals in it or importing in it.”

Yes but… what if your currency ends up getting tied to it? What if you do get paid in gold? What if you save in gold without any intention of switching back to dollars?

In short, what if the dollar is no longer the world’s reserve currency?

Impossible you say… well, we would disagree. After all, in a world where there is over $100 trillion in dollar-denominated debt which can not be defaulted on and thus must be inflated away, the “exorbitant privilege” of the dollar has become a handicap. But don’t take our word: here is Jared Bernstein, Obama’s former chief economist warning all the way back in 2014 in a NYT op-ed that the US Dollar must lose its reserve status:

There are few truisms about the world economy, but for decades, one has been the role of the United States dollar as the world’s reserve currency. It’s a core principle of American economic policy. After all, who wouldn’t want their currency to be the one that foreign banks and governments want to hold in reserve?

But new research reveals that what was once a privilege is now a burden, undermining job growth, pumping up budget and trade deficits and inflating financial bubbles. To get the American economy on track, the government needs to drop its commitment to maintaining the dollar’s reserve-currency status.

Agree or disagree with Bernstein’s ideology, never has his assessment about the state of the American economy been more accurate than it is now.

To be sure, since then there have been a handful of other “serious” economists suggesting that the only way the US economy can “reboot” itself and reset its economic engine is for the dollar to lose its currency status, but it is only in the past few days – when the dollar plunged and gold soared to new all time highs – that we have seen a barrage of Wall Street reports contemplating what until recently was viewed as impossible: a world where the dollar is not the reserve currency.

Meanwhile, after its explosive burst higher in March and April, the Bloomberg Dollar Spot Index is on course for its worst July in a decade. The drop comes amid renewed calls for the dollar’s demise following a game-changing rescue package from the European Union deal, which spurred the euro and will lead to jointly-issued debt.

Which brings us to this morning, when none other than the world’s most influential investment bank Goldman Sachs, by way of its chief commodity strategist Jeffrey Currie, wrote that “real concerns around the longevity of the US dollar as a reserve currency have started to emerge.”

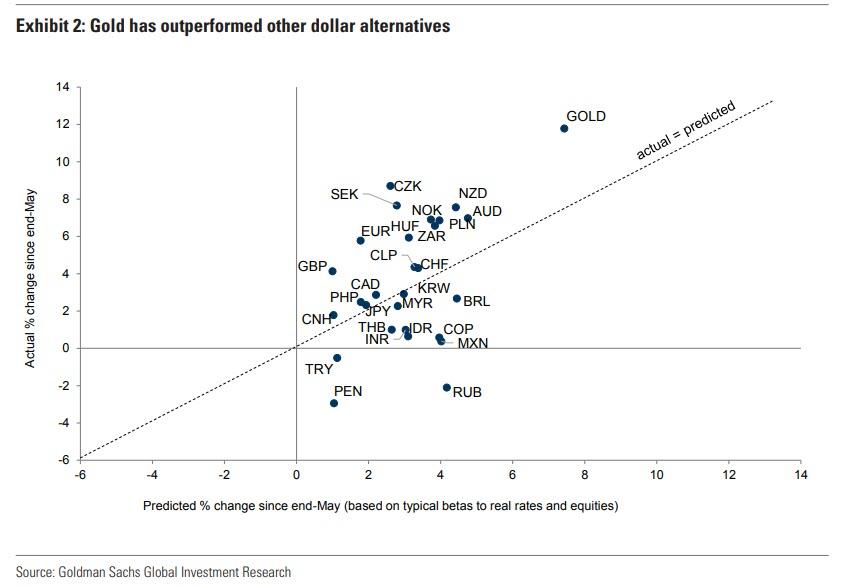

Specifically, Goldman looks at the recent surge in gold prices to new all-time highs which has “substantially outpaced both the rise in real rates…

… and other US dollar alternatives, like the Euro, Yen and Swiss Franc”…

… with Currie writing that he believes this disconnect “is being driven by a potential shift in the US Fed towards an inflationary bias against a backdrop of rising geopolitical tensions, elevated US domestic political and social uncertainty, and a growing second wave of covid-19 related infections.”

This, combined with the record level of debt accumulation by the US government, means that “real concerns around the longevity of the US dollar as a reserve currency have started to emerge.”

Then, Currie reminds his clients that he has “long maintained gold is the currency of last resort, particularly in an environment like the current one where governments are debasing their fiat currencies and pushing real interest rates to all-time lows, with the US 10-year TIPs at -92bp is 5bp below the 2012 lows,” and we indeed noted Currie’s reco to buy gold one day after the Fed went all-in on March 24.

Four months later, the urgency is even greater, and Currie writes that “with more downside expected in US real interest rates we are once again reiterating our long gold recommendation from March and are raising our 12-month gold and silver price forecasts to $2300/toz and $30/toz respectively from $2000/toz and $22/toz.”

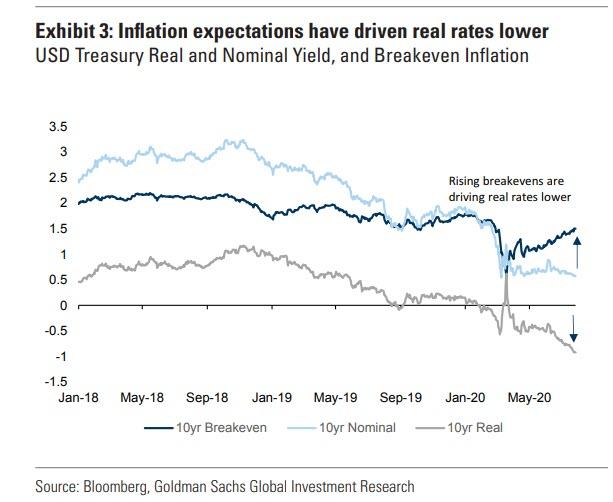

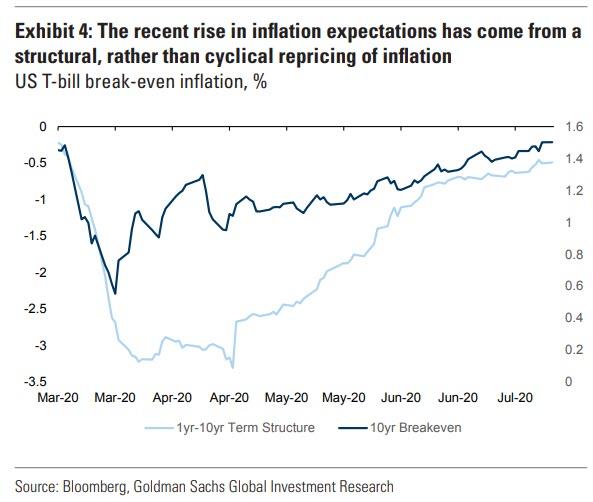

There are other reasons why Goldman believes that Gold’s surge is only just starting: “This relentless decline in real interest rates against nominal rates bounded by the US Fed has caused inflation breakevens to rise (see Exhibit 3) in an environment that would ordinarily be viewed as deflationary, i.e. a weakening US labor market as the country re-enters lockdown.”

This is bad, and is usually described by what may be the most loathed word in the banker lexicon: “stagflation.”

Which also explains the “irony” of the response: the greater the deflationary concerns that policymakers must fight today, the greater the debt build up and the higher the inflationary risks are in the future according to Currie, who expands further on this critical topic:

The deflationary shock caused by the pandemic drives the need to expand balance sheets to support demand today, as seen in the latest US $1.0 trillion Phase 4 stimulus and the €750 billion pan-EU recovery fund. The resulting expanded balance sheets and vast money creation spurs debasement fears which, in turn, create a greater likelihood that at some time in the future, after economic activity has normalized, there will be incentives for central banks and governments to allow inflation to drift higher to reduce the accumulated debt burden.

Indeed, this has already been seen in recent FOMC minutes, as discussions of explicit outcome-based forward guidance raises the prospect for Fed-sanctioned overheating of the economy.

And despite the longer-term nature of these risks, Goldman argues that “asset managers have real concerns today about persistent unanticipated shifts in inflation that can create large discrepancies between current expected real returns and actual realized returns” and this is manifesting itself in the continued faith in the dollar.

What about the gold price? Here is Currie’s explanation why gold will continue to surge:

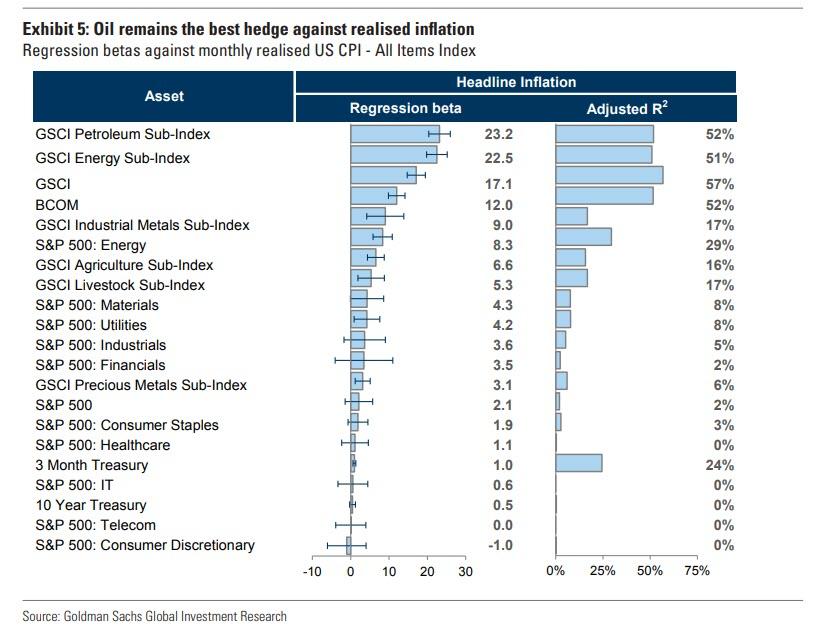

The key point from a hedging perspective is that asset managers care about the level of inflation, not the changes in inflation, and from a level perspective, inflation hedges like commodities and equities are likely far cheaper today than in the future when inflation could arrive. When discussing the drivers of investment demand for gold and commodities, it is important to distinguish between debasement and inflation. The key is that the current debasement and debt accumulation sows the seeds for future inflationary risks despite inflationary risks remaining low today. While debasement in many cases leads to inflation, it is not always the case as witnessed over the past decade. Equally, the best debasement hedge (gold) is not always the best hedge against inflation (oil). Indeed, the word debasement comes from adding base metals like tin or copper to the precious metals that acted as hard currency; therefore, owning the pure precious metal is then the best hedge against debasement.

However, this does not mean gold is the best hedge against inflation — a common misconception of many investors. Gold doesn’t appear significantly in any CPI anywhere in the world. As a result, oil and other commodities that drive the items actually found in different CPIs are the best hedges against inflation. But

Next, Currie goes on to explain why oil may be the best pure play commodity hedge to inflation, “today the risk is from debasement of fiat currencies that sows the risk for inflation and gold is the best hedge against debasement. Further out as inflation risks rise, oil and equities hedge unexpected and expected inflation respectively better than gold (see Exhibit 5), and given the size of the bond portfolios built over the past decade that will need to be hedged against inflation risks, the sheer size of investment demand for commodities is likely to be massive, underscoring the need to act today. “

Hence, gold at $2,000 and soon… $3,000, $5,000 and much more. Indeed, even at $10,000/oz, the total value of gold would be just around $50 trillion, which is still orders of magnitude below the value of global financial assets that need to be hedged (and which according to Paul Tudor Jones is around $270 trillion).

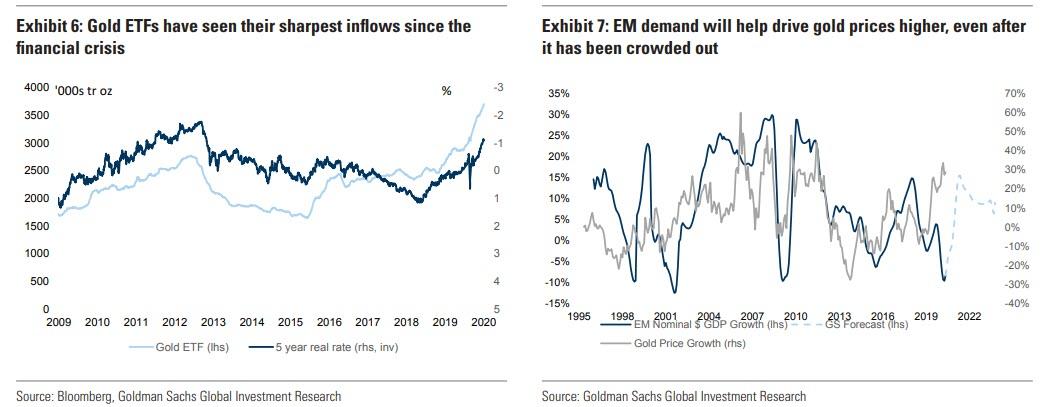

As Currie then notes, the result of this growing debasement risk is that “DM investment demand strength has continued with ETF additions in both Europe and US running high (see Exhibit 6). We see this trend persisting for some time as investment allocations into gold increase inline with allocations to inflation protected assets, similar to what happened after the financial crisis. Following the GFC, inflation fears peaked only at the end of 2011 as the bounce back in inflation ran out of steam, bringing the gold bull market to a halt. Similarly, we see inflationary concerns continuing to rise well into the economic recovery, sustaining hedging inflows into gold ETFs alongside the structural weakening of the dollar, we see gold being used as a dollar hedge by fund managers. Indeed, decomposing our gold forecast, with returns of 18% over the next 12 months, we estimate 9% of the growth is driven by 5yr real rates going to -2% over the next 12 month, (an est. elasticity of 0.1), while the second 9% comes from the 15% increase in the EM dollar GDP (an est. elasticity of 0.5) (see Exhibit 7).”

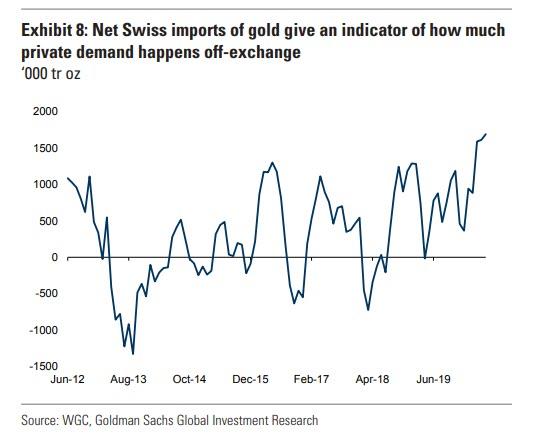

On top of these known flows, a large share of physical investment demand in gold is non-visible according to Goldman, in particular vaulted bar purchases by high net worth individuals. Looking at net Swiss imports one can see that gold stocks in Switzerland, where most of these private vaults are located, have been building at close to a record pace.

And in case that wasn’t enough, “the stretched valuations in equities, low real rates and high level of economic and political uncertainty all point toward continued inflows by high net worth individuals,” in Goldman’s view.

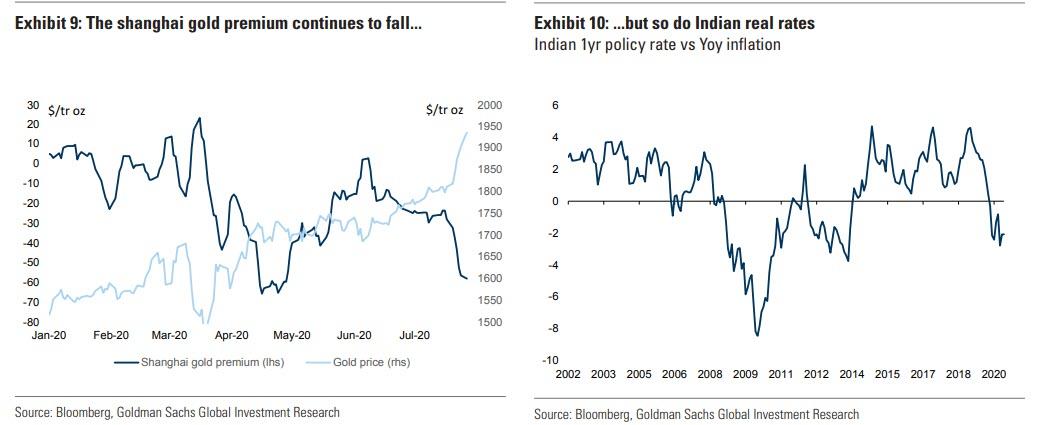

But wait there’s more, with Goldman singling out the potential of a fresh EM demand surge: Indian gold imports are still down 80% yoy in June and the Chinese gold premium is beginning to turn negative again (see Exhibit 9). More recently, however, the weakness in EM demand has been driven more by gold’s high price, as consumers cannot afford to buy gold products at those levels. However, EM currencies are no longer under pressure and India has begun to see the rupee strengthen over the past month. EM growth is also beginning to recover with EM activity entering positive YoY territory in June for the first time since January and our economists seeing the worst of

the EM outlook behind us (see Exhibit 10). EM retail investment demand is also boosted by easier monetary policy together with continued inflation driving EM real rates down. In India, policy rates fell below the YoY inflation rate for the first time since 2013.”

Taken together, and in light of the declining faith in the dollar as a reserve currency, Goldman believes that these factors create a perfect setup for a rebound in EM demand for gold similar to 2010-11:

We will likely see this demand materialize when price stabilizes somewhat and DM investment purchases slow down, creating more room for EM consumers. We feel that for now, investors should not be concerned by weak EM demand prints.

As a final point, Goldman also spared some love for silverbugs, raising its silver forecast to $30/toz on a 3/6/12 month horizon, “pulled upward by higher gold prices and better prospects for silver industrial demand, particularly in solar energy (c.15% of silver demand). Both the European Green Deal and Biden’s war on climate change plans imply a doubling every year of solar panel capacity installations in both the US and Europe. At the same time, silver demand in consumer electronics is benefiting from the transition to working from home as it is heavily used in consumer items such laptops, mobile phones and televisions. Even housing demand, where silver is used in light switches, looks to be better than expected with property sales in both US and China rebounding strongly. Silver has rallied almost 30% over the past few weeks but its ratio with gold is only back to its level at the beginning of this year of 80.”

Currie’s final point on silver:

Historically there has been a tight relationship between silver industrial demand and the gold-silver price ratio. If silver industrial demand next year is 5% higher versus its 2019 level, the gold-to-silver ratio would fall further to 77. Assuming this ratio, our $2300/toz gold target would imply a $30/toz silver price.

That sounds awfully familiar: oh yes, here’s why:

Average historical gold/silver ratio is 60. Means silver has to rise to $31 just to catch up to where it has been in the past. pic.twitter.com/3Lf5EQxFKy

— zerohedge (@zerohedge) July 22, 2020

via ZeroHedge News https://ift.tt/30TKLOB Tyler Durden