FOMC Preview: The Fed Must Find Ways To “Out Dove” Market Expectations

Tyler Durden

Tue, 07/28/2020 – 23:18

While nobody expects any fireworks from the Fed tomorrow or any major market-moving announcement, the FOMC meeting will likely involve a debate over the toolkit with a discussion of how to pivot from “stabilization” to “accommodation” policies according to BofA strategists, who notes that while there likely is an agreement that the next steps should accomplish the goal of “enhancing forward guidance,” they do not think Fed officials have settled on the strategy.

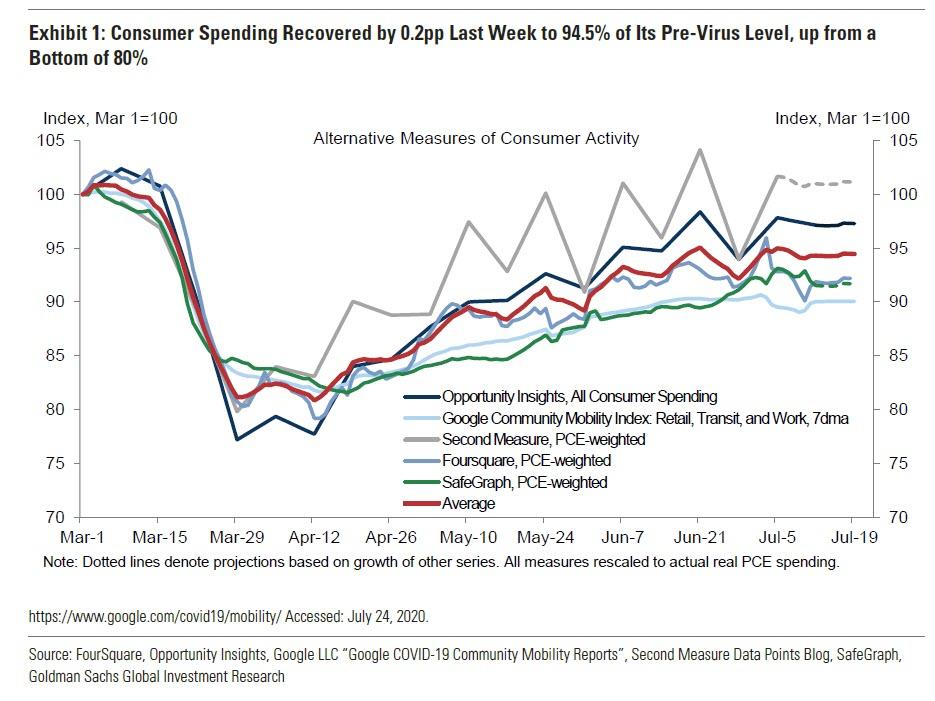

Amid growing fears of covid chaos and renewed economic shutdowns, Powell will likely be grilled on, and will discuss some of the Fed’s options while the minutes released in three weeks will provide more clarity. That said, the statement is likely to provide little new insight, with only a few edits to the current conditions paragraph to highlight improvement thus far, but also express caution over recent signs of slowing in some of the high-frequency indicators.

More importantly, the rates and FX markets expect no new policy action to be taken at the July FOMC meeting, which should lead to a muted reaction across markets (it also sets up markets for a surprise). Instead, according to BofA, market participants will be much more focused on the guidance and “stage setting” that Chair Powell provides on what the next easing steps might look like. On net, a discussion of additional easing measures in the Powell press conference – such as forward guidance, asset purchase duration, and YCC/YCT – risks lower real rates, flatter curve, and weaker USD (and, in the worst case, a very adverse reaction across risk assets).

Economics: a policy discussion

As BofA frames it, there seems to be an agreement among Fed officials on the “what” but not the “how.” The consensus appears to be to send a strong signal that the Fed will be committed to accommodative policy, remaining at the ZLB, well into the recovery and perhaps even until full employment has been reached and inflation is able to run at/above the 2% target. This would be a more dovish strategy than following the 2008-09 recession when the Fed pursued a “normalization” policy, pushing up interest rates prior to achieving trend 2% inflation or closing the output gap. Back then the Fed discussed the balancing act between increasing rates earlier but slower, or waiting and having to hike more quickly. Looking back, it seems many Fed officials believe that waiting longer might have been prudent given that 2% inflation was not achieved and the Fed ended up reversing some of the hikes later in the recovery.

There are several options for the Fed to enhance forward guidance, which are not mutually exclusive:

- the primary focus is on language, potentially using both outcome and calendar-based language. Fed officials seem particularly focused on making sure 2% inflation is reached, which means likely explicitly supporting an overshoot of the inflation target (something which the record surge in gold is clearly sniffing out). This could be done through a commitment to keep rates at zero until 2% is reached on a trend basis but also, perhaps, by reinforcing this language with calendar guidance.

- The secondary focus is on balance-sheet policies such as yield curve caps or targets (YCT) or a change in the composition of the balance sheet (QE). While YCT on the short to medium end of the curve seems like an attractive option, it is still novel and Fed officials appear to want more time to study such a program. Recent language from Fed officials suggests our expectation for YCT to be introduced at the September meeting might end up being too early.

The Fed can choose to employ one or all of these strategies at the same time or phased in, depending on the state of the economy and markets (as a reminder, the worse the economy and the lower the S&P500, the greater the flexibility Powell will have to unleash the next phase, whatever it may be). Certainly, if facing a weaker economy with low realized and expected inflation, the Fed would likely need to be more aggressive. Another scenario would be if the market prematurely prices in hikes thereby tightening financial conditions. The Fed might look to fight this market pricing and push out hike expectations, which could be done through calendar guidance or YCT, most directly (unless of course the Fed wants to push the market lower so it has more degrees of freedom).

Meanwhile, the Fed is also engaging in a prolonged framework review that will likely guide the policy decision. The annual Jackson Hole conference will also take place virtually at the end of August. It has historically been a good forum for central bankers to debate policy and will likely be focused on the best way to achieve enhanced forward guidance.

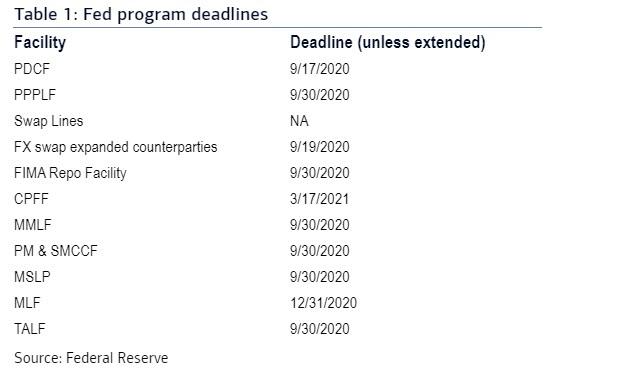

Fed markets programs: extension likely

The July FOMC meeting will likely see some communication around an extension of Fed and Treasury markets programs. Most markets programs are slated to expire in September as shown in the table below.

However, it is virtually assured that these will all be extended as the Fed will want to keep these programs indefinitely in place to guard against the risk of a more material economic slowdown and potential tightening of financial conditions (and also because any of the “temporary” aspects of the covid crisis are really permanent). BofA anticipates that most programs will be extended until March 2021 (in reality they will never expire). This would reduce the risk of a material tightening of financial conditions in 2H and smooth volatility stemming from year-end dealer balance-sheet constrains.

Most of the programs require Treasury approval for extension, and it is safe to assume that both the Fed and Treasury will be supportive of pushing out their deadline.

Rates: September stage setting and twist potential

According to BofA STIR strategists, the US rates market expects no new policy action to be taken at the July FOMC meeting. Instead, market participants will be much more focused on the guidance and “stage setting” that Chair Powell provides on the next steps to ease policy, including enhanced forward guidance, asset purchase adjustments, and yield curve control (YCC)/yield curve targeting (YCT).

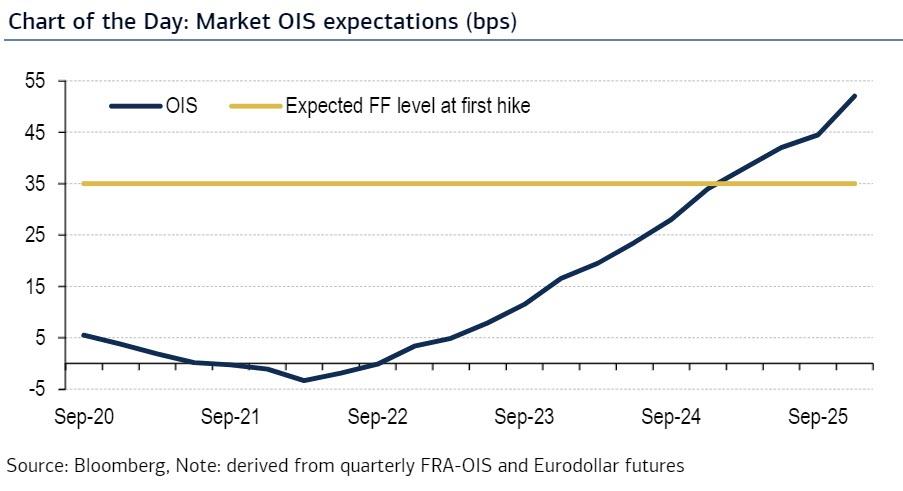

While no change is expected to the Fed’s settings for administered rates (IOER, ON RRP) at this meeting, the rates market is already expecting a very dovish message from the Fed with the timing of the first rate hike not until late 2024 or early 2025 (if ever).

The main challenge for the Fed will be to find ways to “out dove” market expectations in their next easing round likely through:

- the establishment of an inflation framework that ensures a “durable” increase in core PCE at or above 2% for 6 or 12 months before the first rate increase and

- a potential reallocation of Treasury purchases to remove additional duration risk from the market.

BofA discusses the potential for a Fed UST twist and likely market reaction below:

Why twist? Recent media reports have suggested the Fed is considering changing the composition of their UST and MBS toward longer-dated securities to further ease financial conditions. This theme was furthered on last week by headlines from William Dudley, former NY Fed head, who noted that the Fed could extend its purchase duration. Both sets of comments come in the context of a Fed that is seeking to “pivot” from market stabilization to monetary easing via some combination of forward guidance, asset purchases, and potential YCC / YCT.

How to twist? The Fed has clear logic to twist upon implementation of enhanced forward guidance or YCC. The argument to twist would be most impactful if the Fed incorporated any calendar dimension to its guidance. For example, a credible Fed commitment not to raise rates or implement YCC until at least end ’22 / end ’24 would reduce the need to purchase securities at this part of the curve. The slated purchases could then be reallocated to longer-dated maturities to extract more duration risk from the market while keeping total purchase quantity the same or lower.

The Fed is currently purchasing $80bn/month of USTs (in proportion to USTs outstanding). BofA shows hypothetical Fed purchase scenarios below (Table 2) where the Fed could cease buying the 0-2.25Y or 0-4.5Y part of the curve, leave TIPS purchases unchanged, and distribute the remaining purchases in proportion to debt outstanding. The Fed could also remove more 10Y duration equivalent risk from the market while maintaining the current monthly purchase pace or lowering it to $65bn/m.

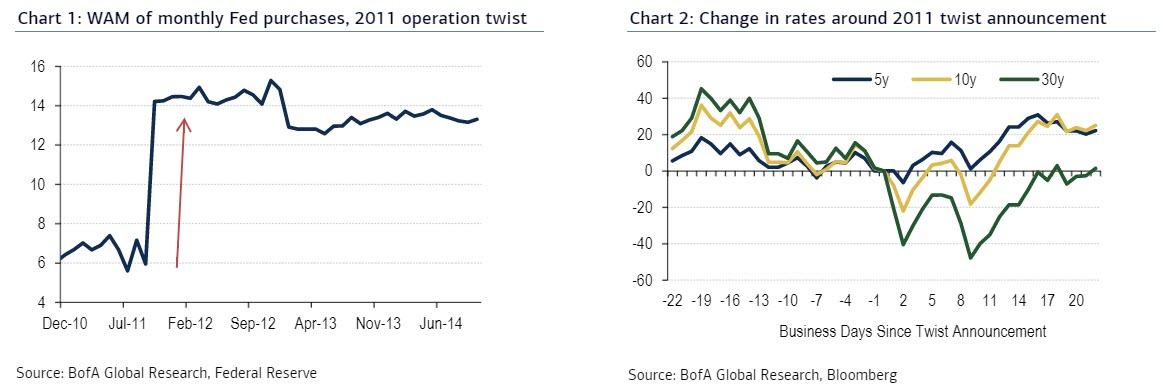

Twist effectiveness? Recall the 2011 twist and relevance of a similar policy today.

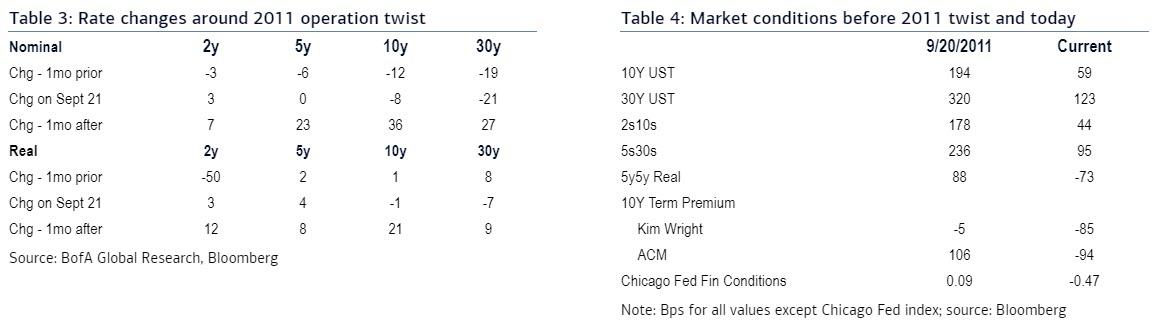

2011 twist: The Fed announced its most recent twist in September 2011 (a combination of short-term UST sales and longer-dated UST purchases) in reaction to the sharp risk off and economic slowdown following the US downgrade. This policy was mentioned in the August meeting minutes and was implemented the following meeting. The weighted average maturity of purchases increased substantially while keeping the total amount of UST holdings the same, on average (Chart 1, Table 2). Long-end rates declined materially the day the twist was announced and the curve aggressively bull flattened (Chart 2, Table 3). The month after the twist, rates sold off but the curve remained flatter.

Effectiveness today: Today is very different from 2011 and the Fed knows it. Comparing today vs September 2011: 10 and 30Y rates are 135-200bp lower, curves are significantly flatter, 10Y term premium measures have fallen 80-200bp, the real neutral rate (real 5y5y) has dropped 160bp, and the Chicago Fed fin conditions index is easier (Table 4).

The June FOMC meeting minutes reflect that the Committee is well aware of these dynamics: “declines in the neutral rate of interest, term premiums, and low levels of longer-term yields would likely act as constraints on the effectiveness of asset purchases in the current environment“. However, Treasury WAM and longer-dated issuance is higher, which a Fed twist would offset.

Twist impact: Fed twist would likely result in (1) 30Y UST rally and curve bull flattening, likely on par with 2011, and (2) spread curve steepening. The spread curve move would be driven by a modest cheapening of short-dated USTs vs OIS (less Fed buying) and a richening of longer-dated USTs vs OIS (more Fed buying). Bank front-end policing would likely limit the potential for a material UST-OIS cheapening.

Bottom line: there is rising likelihood for a “twist” operation, especially since the Fed seemingly wants to ease more. This risks wider 30Y spreads and reinforces even lower longer-dated real rate view (currently 10Y TIPS is at a record low -0.93%). Guidance on the likelihood of a Fed twist from Powell’s press conference or July FOMC minutes release (29 August) will be of keen interest to the rates market and the outlook for the long end of the curve. That said, not even BofA expects the Fed to commit to such a policy at this meeting, but likely start the stage-setting process this week.

* * *

Impact on the dollar

With an uneventful FOMC meeting widely anticipated, there is only moderate risk to FX and USD specifically. Still, potential discussion of the Fed’s toolkit (specifically options to ramp up monetary policy support in the event that downside risks are realized) seems a negative USD risk, in BofA’s view, as it is likely to reinforce the widespread belief among market participants in the Fed “put” that has driven up risk assets and undermined the greenback since end-March. For the same reason, extension of current programs may also weigh on USD. And while perception that a credible and effective set of additional Fed stimulus options exists, it would serve to further undermine USD per above, while as BofA ominously warns, “perception that the Fed is out of ammo could cause a reassessment of the Fed “put” and support USD via lower risk assets.”

Sharp USD weakness over in the second half of July has accelerated into this FOMC meeting. Over the last week, the DXY is about -3% lower, with EUR and SEK leading the pack of outperformers against USD. Much of the recent USD weakness is due to (1) buoyancy in risky “reflation”-sensitive assets, which continue to decouple from challenging economic conditions and recently worsening COVID-19 dynamics; as well as (2) the accelerating EUR rally driven by market participants concerned over missing out on bullish price action post-EU Recovery Fund approval (which however does not equate to broad dollar weakness as discussed previously).

Looking forward, BofA expects a reversal in USD weakness despite persistent over-valuation, and forecasts EUR/USD is 1.08 at end-2020 due to COVID-19-related risks to the global and US economies although it concedes that “persistently frothy risk appetite is a risk to this call.”

via ZeroHedge News https://ift.tt/3gaNwBs Tyler Durden