Caterpillar North America Machine Sales Crash Most Since The Financial Crisis

Tyler Durden

Fri, 07/31/2020 – 13:20

Earlier today, heavy machinery giant Caterpillar which has been hit hard by the collapse in global industrial activity, reported earnings which came in a bit above sharply reduced expectations, thanks to aggressive cost-cutting efforts (read mass layoffs) which helped the company make up for slowing sales: total operating costs were 25% lower, the company said Friday in an earnings statement released before regular trading hours.

The numbers outside of costs were dismal: sales fell across the company’s segments, with dealers slashing inventories by $1.4 billion signaling a market that remains glutted with equipment. And while Caterpillar declined to provide forward guidance, it sees a similar percentage decrease in end-user demand in the third quarter, and expects dealers to cut stockpiles by more than $2 billion for the full year.

“Unfavorable price realization also contributed to the sales decline due to the geographic mix of sales and competitive market conditions in China,” the company said. “Sales were lower across all regions and in the three primary segments.”

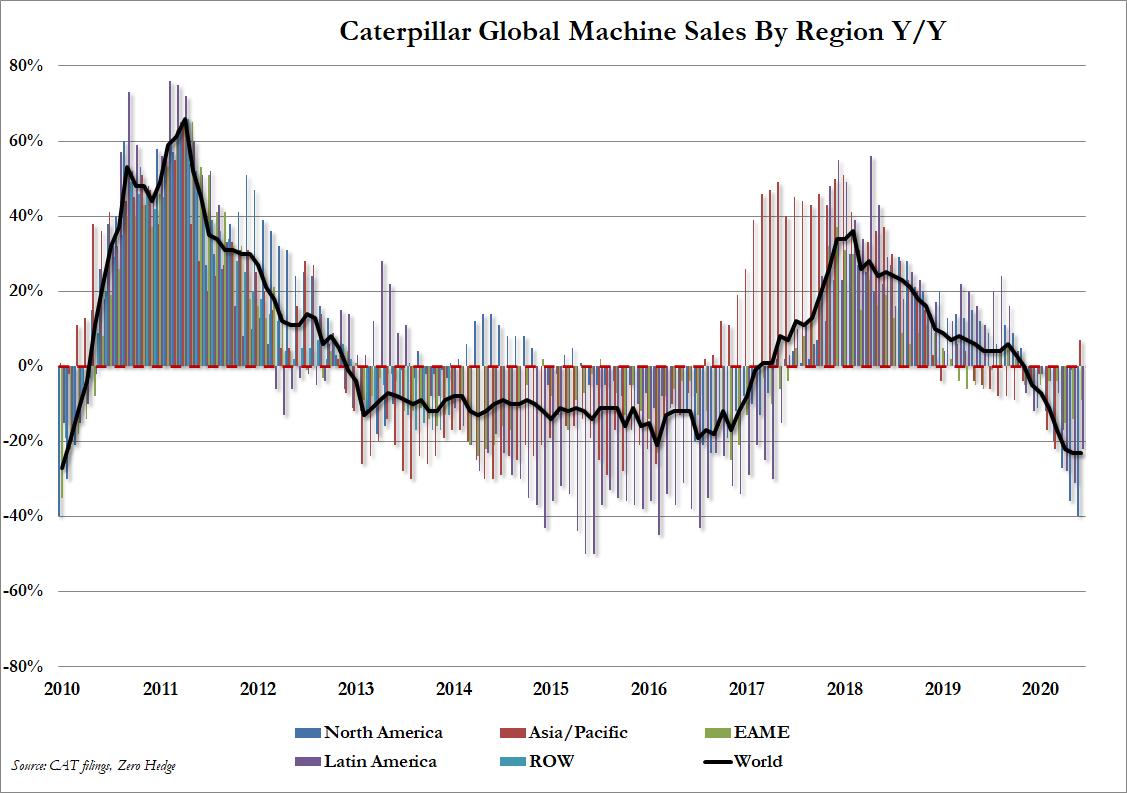

And while the earnings were enough to help push the stock higher premarket, it has since slumped into the red after the company unveiled its latest global retail sales data, which showed that despite a modest, 7% increase in Asia-Pac sales, which rose for the first time since April 2019, it was the continued crash in global sales which tumbled by 23% Y/Y for the second month in a row, the biggest decline since 2010.

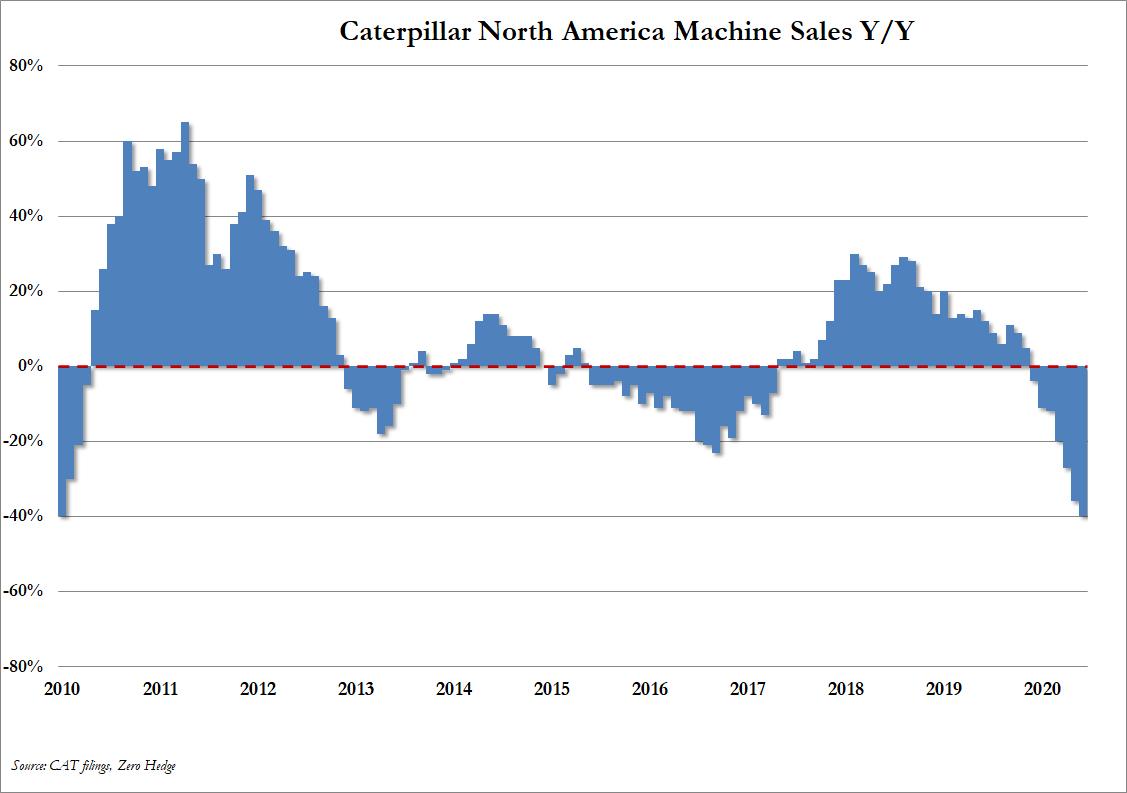

More striking however was the devastation in North American (read US and Mexico) sales, which plunged by a near record 40%, the biggest monthly drop since the financial crisis.

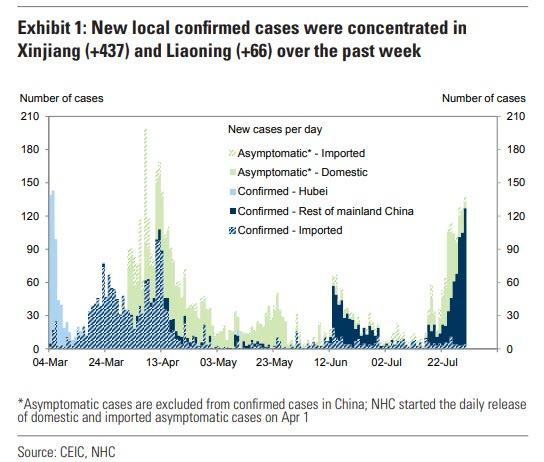

So for all those seeking a V-shaped recovery in the US, you may want to avoid the heavy machinery sector, which just happens to be critical for pretty much every other segment of the economy. As for that rebound in China, considering the latest, third wave in Chinese covid cases…

… that’s too is about to go into freefall mode any second.

via ZeroHedge News https://ift.tt/3jXJy1j Tyler Durden