The Eurozone’s Financial Disintegration

Tyler Durden

Sat, 08/01/2020 – 08:10

Authored by Alasdair Macleod via GoldMoney.com,

Introduction

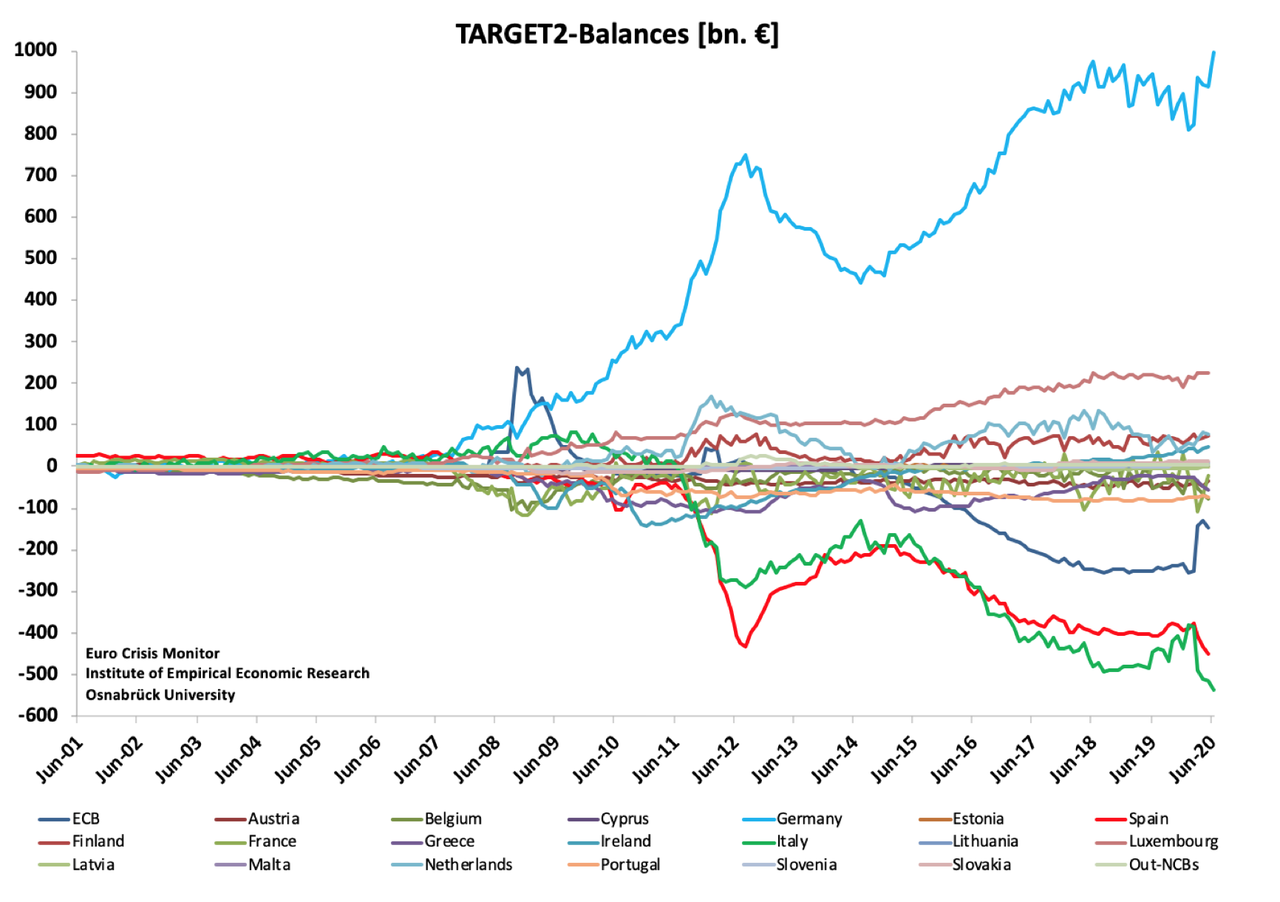

The Euro Crisis Monitor (below) shows the increasing imbalances in the TARGET2 settlement system between all its members: the ECB (itself with a €145bn deficit) and the national central banks in the Eurozone.

Other than minor differences reflecting net cross-border trade not matched by investment flows going the other way, these imbalances should not exist. But following the Lehman crisis and as the Eurozone developed its own series of crises, imbalances arose. Commentators have grown used to them, so have more or less given up pointing them out. But in the last few months, the apparent flight into the Bundesbank (€995,083m surplus) has gathered pace, as have the deficits for Italy (€536,722m) and Spain (€451,798m). It is time to take these rising imbalances seriously again.

Target2 — the ECB’s flexible friend

Target2 is the settlement system for transfers between the national central banks. The way it works, in theory, is as follows. A German manufacturer sells goods to an Italian business. The Italian business pays by bank transfer drawn on its Italian bank via the Italian central bank through the Target2 system, crediting the German manufacturer’s German bank through Germany’s central bank.

But since the Lehman crisis, and more noticeably the last eurozone crisis, capital flows appear to have gravitated from Portugal, Italy, Greece and Spain (the PIGS — remember them?) to principally Germany, Luxembourg, Netherlands and Finland in that order. Before 2008, the balance was maintained by trade deficits in Greece, for example, being offset by capital inflows as residents elsewhere in the eurozone bought Greek bonds, other investments in Greece and the tourist trade collected net cash revenues.

In this sense, it would be wrong to suggest that trade imbalances have led to Target2 imbalances. But part of the problem must be put down to the failure of private sector investment flows to recycle.

Then there is the question of “capital flight”, which is not capital flight as such.

The problem is not that residents in Italy and Spain are opening bank accounts in Germany and transferring their deposits from domestic banks, but more an example of the tragedy of the commons. The origin of this phrase applied to common grazing rights, where everyone in the parish can graze their livestock on common ground, but no one has the incentive to ensure it is properly managed, not overgrazed, and maintained free of gorse and bracken. Consequently, the ground becomes less productive over time. Similarly, the national central banks that are heavily exposed to potentially bad loans know that their losses, if materialised in a general banking crisis, will end up being shared throughout the central bank system, according to their capital keys.

The capital key relates to the national central banks’ equity ownership in the ECB, which for Germany, for example, is 26.4% of the total. If Target2 collapsed for any reason, the Bundesbank, to the extent the bad debts in the Eurosystem are shared, could lose a significant part of the trillion euros owed to it by the other national central banks. But it would be a step too far to say that some national central banks, such as those of Spain and Italy, are gaming the system. It appears to be a problem that simply arises as an unintended consequence of Target2.

If one national central bank runs a Target2 deficit with the other central banks, it is almost certainly because it has loaned money on a net basis to its commercial banks to cover payment transfers, instead of them progressing through the settlement system. Those loans appear as an asset on the national central bank’s balance sheet, which is offset by a liability to the ECB’s Eurosystem through Target2. But under the rules, if something goes wrong either with its own lending or another NCB’s lending, the costs are shared out by the ECB on the pre-set capital key formula. In theory, it is therefore in the interest of a national central bank to run a greater deficit in relation to its capital key by supporting its own banks. It is not necessarily a deliberate act of the Bank d’Italia or the Banco de España to make dodgy loans to their commercial banks; it is just how the system works, and the consequence of national pressures.

To understand how and why the problem arises, we must go back to the earlier crises following Lehman, which have informed national regulatory practices. If the national banking regulator deemed loans to be non-performing, the losses would become a national problem. Alternatively, if the regulator deems them to be performing, they are eligible for the national central bank’s refinancing operations. A commercial bank can then use the questionable loans as collateral, borrowing from the national central bank, which spreads the loan risk with all the other national central banks in accordance with their capital keys. Insolvent loans are thereby removed from the Italian and Spanish banking systems and dumped on the Eurosystem.

In Italy’s case, the very high level of non-performing loans peaked at 17.1% in September 2015 but has now been reduced to 6.9%. As PWC Italia wryly put it,

“Italian banks in response to market and regulatory pressure have halved the total stock of non-performing loans to €135bn in 2019 (vs €341bn in 2015) and at the same time they have set up their NPL platform and organisational controls that will allow to manage non-performing loans more quickly and efficiently and thus to face the incoming economic crisis in a more resilient way.”

Given the incentives for the regulator to deflect the non-performing loan problem from the domestic economy into the Eurosystem, it would be a miracle if much of the reduction in NPLs is genuine.

In the member states with negative Target2 balances such as Italy there has been a trend to liquidity problems for legacy industries, rendering them insolvent. With the banking regulator incentivised to remove the problem from the domestic economy, loans to these insolvent companies have been continually rolled over and increased. The consequence is that new businesses have been starved of bank credit, because bank credit in the member nation’s banks is increasingly tied up supporting businesses that should have gone to the wall long ago.

Officially, there is no problem, because the ECB and all the national central bank Target2 positions net out to zero, and the mutual sharing of liabilities between the national central banks keeps it that way. To its architects, a systemic failure of Target2 is inconceivable. But, because some national central banks end up using Target2 as a source of funding for their own balance sheets, which in turn funds their own dodgy commercial banks, some national central banks have mounting potential liabilities not of their own making, but rather the making of national bank regulators.

The Eurosystem member with the greatest problem is Germany’s Bundesbank, now owed close to a trillion euros through Target2. And the risk of losses is now accelerating both in their quantity, and given the economic consequences of Covid-19, the quality of the underlying loan-assets is rapidly deteriorating as well. The main culprits, the national central banks of Italy and Spain, at the same time are seeing their deficits increase rapidly. The Bundesbank should be very concerned. Its directors will be aware of the problem, particularly since it is now in the public domain.

One may ask how this “mythical surplus” fits in with the Bundesbank’s own balance sheet. As an asset, the surplus was about half of the Bundesbank’s total assets at 31 December 2019, and it finances, among other things, current accounts and deposit facilities of €560bn for its own risk-averse commercial banks. The Bundesbank’s silence in this matter is increasingly untenable.

Commercial banks are in deep trouble

The position for commercial banks in the eurozone, to say the least, is extremely fragile. For years, they have operated in the strait jacket of negative interest rates imposed by the ECB, which operate as a tax on the commercial banks’ liquidity. They can only offset it by buying government and other bonds with less of a negative yield, or with a positive yield. Alternatively, they can lend revolving capital to business customers and consumers for positive margin. And lastly, they can deploy balance sheets for purely financial purposes, which given underlying fundamentals is becoming a likely source of credit contraction.

One would have thought lending bank credit into the real economy would be the most urgent objective of monetary policy, but as we have seen, the increasing support for zombie corporations to prevent national write-offs precludes other lending for economic benefit. And the ECB’s policy objectives are divorced from this problem, which is the responsibility of the national central banks.

The ECB operates on a higher plain. The real consideration that sets the ECB’s interest rate policy is different: it needs to nurse the finances of insolvent member state governments. It does this through various asset purchase programmes, which allow the ECB to set and supress the cost of funding national deficits. Under its charter the ECB is not allowed to fund member states directly, but it can buy bonds in the secondary market. By buying government bonds, almost entirely from commercial banks, balance sheet space is created for the banks to buy further new issues of government bonds, thus resolving the funding problem.

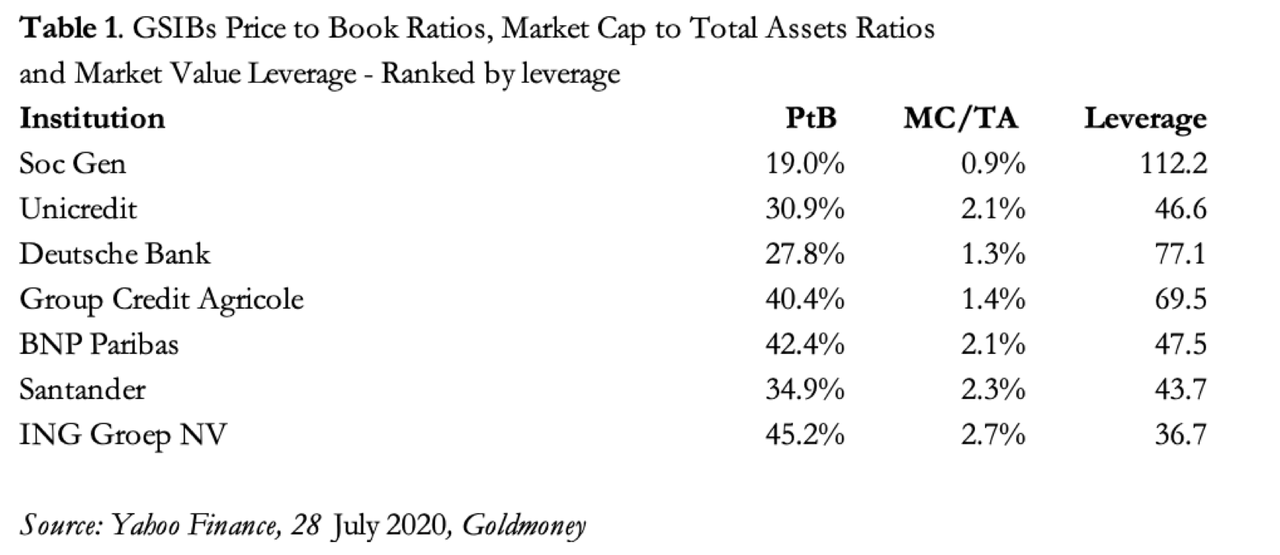

On the face of it, this is a win-win for the governments which are now being paid to borrow, and also for the banks. The yield on national government debt is always set to ensure that a positive return is obtained for the banks by subscribing for new bonds and selling them to the ECB at what amounts to a guaranteed price. But this zero-risk business comes with wafer-thin margins, which encourages excessive balance sheet expansion to compensate. Deutsche Bank, for example, has a ratio of total 2019 assets to equity of 21.4 times, Credit Agricole 28.1 times, BNP Paribas 20.1 times, and Société Generale 21.4 times. These high rates of leverage can only be borne by banks who can demonstrate very low rates of non-performing loans, a situation that will have changed fatally for all Eurozone banks as a consequence of COVID-19 lockdowns.

Other banks, such as UniCredit in Italy, have lower asset to equity ratios (14.4) and Santander in Spain (15.2), reflecting higher lending risks on their balance sheets as well as problems with non-performing loans. But these ratios are still far too high in the context of a contracting European and global economy. Even though the flood of money unleashed by the ECB and other central banks in response to the coronavirus has broadly remained in the financial economy and therefore is puffing up share prices everywhere, the market’s rating of the equity value of eurozone banks is very low. Table 1 shows how this affects balance sheet gearing from a shareholder’s point of view in the global systemically important banks in the eurozone — the GSIBs.

Even though they permit them to be outrageously high, the regulators focus on total asset to equity ratios becomes positively frightening when the true value of balance sheet equity judged by the market is taken into account. For the eurozone’s banking regulators to ignore the market ratings for these banks is a negation of their primary responsibility, to protect the public from bad banking practice.

The whole regulatory thing is a giant banking sham. As far as the ECB is concerned, the role of the commercial banks is to act as agents in its funding of member states’ budget deficits. But that problem has escalated suddenly in recent months putting additional strains on the whole Eurosystem. Yet the ECB continues to drive the commercial banks into the ground by forcing them towards yet higher ratios on the slimmest of margins in its quest to fund member government deficits.

To summarise the problems now faced through the creation of the Eurosystem:

-

The national central banks in the PIIGS are now using the Target2 settlement system as a means of their own balance sheet funding in excess of their capital key, which has the effect of burdening the central banks of Germany, Luxembourg, Finland and the Netherlands with excess liabilities in the event of a partial or complete systemic failure.

-

Instead of non-performing loans being dealt with at a national level, banks are encouraged to continually finance them and carry them on their balance sheet as being solvent. These loans are then used as collateral for funding from the Italian and Spanish central banks as well as those of Portugal and Greece, which are in turn financed through Target2 imbalances.

-

This situation surely should not be tolerated by the Bundesbank in particular, being exposed to close to a trillion euros in a settlement system that is being progressively corrupted by its users.

-

Funding government deficits, being the ECB’s primary and now exclusive objective, has led to extreme levels of operational gearing for the eurozone’s commercial banks, which can only result in an eventual collapse of the whole system. Share prices for the region’s GSIBs are in effect trying to discount this outcome.

-

The Eurosystem is unsuited to deal with a systemic shock on the scale it now faces and, on its realisation, can be expected to collapse.

National solvency issues

The underlying problem for the eurozone and the ECB is government spending deficits will continue to grow, and no attempt is being made to address this problem. In the process, events have corrupted the banking and settlement systems, setting national central banks against each other as debtors and creditors, and encouraging commercial banks into unsound practices by not writing off bad debts. We should be in no doubt the financial system of the eurozone is heading towards an eventual crisis which will destroy it.

Before COVID-19, the ECB might have been expected by its critics to continue on its path towards financial oblivion for a few more years yet. After all, top-down control systems can persist for decades despite everything, as long as the control is strong enough. But we should be in no doubt that lockdowns have had an undermining impact that calls the survivability of the Eurosystem into more immediate question.

Table 2, which is of the relevant national statistics for Italy and Spain with the addition of highly indebted France, illustrates the problem emanating from lockdowns.

Forecasts for GDP in 2020 are consensus from Focus Economics. Debt to GDP statistics and their forecasts are from Trading Economics. From these, we can derive the economic effect on national private sectors. It is not widely appreciated that headline GDP numbers are bolstered by extra government spending, which when stripped out leaves the private sector exposed to significant falls in GDP on seemingly Panglossian forecasts. Thus, a 10.5% fall in consensus GDP expectations for Italy this year, after increased public spending in connection with the virus, translates into a fall of 28% in private sector GDP.

The effect on the Italian economy will simply lead to a new round of bankruptcies for all levels of Italian business, accumulating on the balance sheets of Italian banks. Similarly, we see Spain’s private sector contracting by 22.5%, and France’s by 24%. In all three cases, consensus forecasts for 2021 are for significant recoveries, conforming to a V-shape. With a second round of lockdowns increasingly likely, those forecasts are vulnerable to reality.

Forecasters are almost all Keynesian in that they expect government spending to stimulate economic recovery. But in reality, all that extra government spending can be expected to achieve is a statistical appearance of recovery through the creation of more bank credit to bolster government spending. But with the banking system commandeered to provide inflationary finance for governments and already having over-leveraged balance sheets (Table 1), prospects for economic recovery are remote.

As soon as it becomes clear that the recovery is going to take longer than anticipated we can expect the fragile confidence, that the ECB can continue to keep the show on the road, to evaporate. That is if, and not before, one or more of those highly leveraged eurozone banks does not face bankruptcy itself.

The consequences of financial dislocation

The developing situation embodied in the Target2 settlement system has concealed the rotten core of the Eurosystem. The consequences of imbalances, always dismissed by the authorities, are poorly understood and therefore ignored by financial commentators. But as we have seen, the Eurosystem and its Target2 settlement structure have fostered the concealment of bad debts at the national level, transferring them into the national central bank network.

The principal losers are Germany, Luxembourg, the Netherlands and Finland. Excepting Luxembourg, which can be expected to just go with the flow, the others could be determined enough to form the nucleus of a new currency area; but they are unlikely to do so before the Eurosystem implodes. To do so would actively destroy it, and the balance sheets of their own central banks as well.

The collapse of the Eurosystem would bankrupt the PIGS, and possibly other member states, cutting off all monetary financing. One would doubt, that even in such a crisis, there would emerge the political leadership with the strength, skill and determination to take these nations out of the crisis. As a centralising force, Brussels is utterly useless and will have lost all credibility. Furthermore, the collapse of the Eurosystem would mean the end of the euro as circulating money, so currency replacements, presumably on national lines, would have to emerge.

The ending of the euro will not be mourned. Those which it disciplined through its strength regretted the loss of a money they could print for themselves. And those who end up paying for its failure will have sacrificed all their peoples’ hard-won savings.

For the moment, the euro is strong against the world’s reserve currency. This strength comes partly from its moderate international trade surplus compared with the enormous US trade deficit, and the fact that the dollar is over-owned by foreigners while the euro is not. But in terms of purchasing power both currencies are on their different trajectories to purchasing power destruction.

The Fed’s policy of tying in the dollar to the fortunes of financial asset values is one form of currency destruction, but the euro will be destroyed if, and when, the flawed Eurosystem falls apart.

via ZeroHedge News https://ift.tt/3fl3vLY Tyler Durden