The Dark Side Of The Cashless Society

Tyler Durden

Sat, 08/01/2020 – 10:30

Authored by Addison Wiggin via The Daily Reckoning,

Real quick, grab a $100 bill from your wallet.

OK, humor me, any bill will do. What do you see?

I’d tell you what I see, but when I grab my Book Book, which serves as both a phone case and a wallet, there’s no cash in it. There rarely ever is. Please, keep that in mind for today’s foray into inductive reasoning.

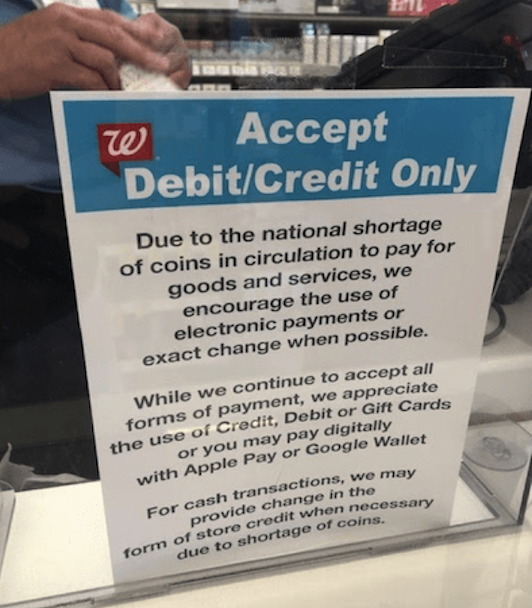

I saw this makeshift sign over the weekend:

Seen at the Walgreens three miles from my house.

“At the airport. Very sparse here, ghost town,” reads an email from a colleague’s mom, “No coins.”

One of Agora Financial’s publishers, Doug Hill, had a similar experience flying to San Francisco last week for a meeting with a private equity fund. He couldn’t get accurate change for a pop rag he wanted to read. No coins.

“With the partial closure of the economy,” Federal Reserve Chairman, Jerome Powell says, “the flow of funds through the economy has stopped.”

Economically-speaking, the national coin shortage is a physical reminder of how slowly the nation’s economy has been; ‘velocity of money’ hit roughly zero.

“We are working with the Mint and the Reserve Banks,” Mr. Powell contends. ”As the economy re-opens, we are starting to see money move around again.”

Fair enough. What else is he going to say?

Back to the Benjamin burning a hole in your wallet. On it, you’ll see digits… a serial number for each bill.

As those bills are returned to the Federal Reserve from their journey around the country, the bills that have gotten too wrinkled, torn or worn thin get their serial numbers retired. The paper gets shredded.

Here’s what I was thinking while watching the film on Netflix the other day:

Wouldn’t it just be easier, and less expensive, if the Fed didn’t have to go through all the trouble of reclaiming and decommissioning the paper? Why not just track the serial numbers electronically?

Anyway, while fact checking the coin shortage story, a USA Today reporter included this little nugget: A Facebook post form including “a sign from a Texas-based grocery store chain H-E-B asking shoppers to use a debit card, credit card or correct change, if possible, due to the shortage.

The posts then warn against the potential of the U.S. becoming a ‘cashless society’.”

The Daily Reckoning has been on this “cashless society” story for some time.

Ideally, a cashless society is no big deal.

As I mentioned, I rarely hold cash if ever. Over the weekend, I got a haircut and didn’t leave a tip because my Book Book was dry.

But it’s not an ideal world.

And the mind does wander to dark places, doesn’t it?

Our own Jim Rickards has argued that elites are pushing for the cashless society so they can “herd” us all into “the digital pens.” Then they can impose negative interest rates on us.

But there’s another angle to the cashless society that hasn’t gotten much attention:

What if the powers that be can “cancel” people with unpopular political opinions?

The Walgreen’s sign says I can pay with credit, debit or gift card. I can use Apple Pay or Google Wallet. But here’s where the story gets spooky…

Ever since Mark Zuckerburg got summoned to appear before a Congressional committee over his backroom dealings with Cambridge Analytica prior to the 2016 election, Facebook is not so friendly to folks who don’t think like they do.

Google followed Facebook’s lead. We have reps at each place. Under their guidance, we try to abide by their rules. But the rules can, and have changed, without warning. It’s their platform, they make the rules. “You don’t like the rules,” their attitude goes, “you don’t have to post with us.”

Then there’s the federal government…

According to the U.S. Treasury site, since the pandemic began the Treasury has issued “more than 140 million Economic Impact Payments worth $239 billion to Americans by direct deposit to accounts at financial institutions, Direct Express card accounts, and by check.”

A prepaid card from the Treasury. Why not?

My kids, who strangely enough qualify, could hypothetically still use the card to procure sundries at the Walgreens down the street.

But what if, hypothetically again, that card doesn’t work because their dad is an ornery son of a b$tch who got in a spat with some readers over the Black Lives Matter movement… and some government bureaucrat didn’t like what I said?

That is, what if suddenly my EIP card doesn’t work at Walgreens anymore?

Or what if Facebook or Google don’t like what I write? What if Apple doesn’t like me either?

Hmm…I use gmail. I use a Mac. I shop at iTunes. I use my credit and debit cards for everything. I never have cash in my Book Book.

Boy, going down this rabbit hole is frightening. Good thing none of it could ever happen… right?

Gold is perhaps the best defense against negative interest rates and the cashless society.

via ZeroHedge News https://ift.tt/3gxcOdv Tyler Durden