“Something’s Rotten!”

Tyler Durden

Tue, 08/04/2020 – 05:30

Authored by Sven Henrich via NorthmanTrader.com,

As $SPX is entering the February gap zone into 3300 (an area we’ve been mentioning for weeks in Straight Talk) and Nasdaq is again making new all time highs as investors keep relentless chasing into high cap tech, it may be worth pointing out that something’s rotten in the state of markets.

And no it’s not valuations although that’s a discussion on its own. Rather it relates to a specific component of equal weight namely the banks.

The price action is an absolute horror show. Just look at the year today performance versus the Nasdaq:

Which is odd considering all that is supposedly positive. Banks exceeded expectations in recent earnings. The Fed has been supporting the banks intensely including propping up the entire distressed debt sector by buying high yield debt and pushing $JNK prices back to near highs:

Not only that, but the Fed has managed to completely reverse the stress in financial conditions:

And now the Atlanta Fed is talking about nearly 20%+ GDP growth for Q3.

So why is there no sign of life in the banking index?

I’ll tell you why. Because things are much worse than they are advertised to be and investors better pay attention.

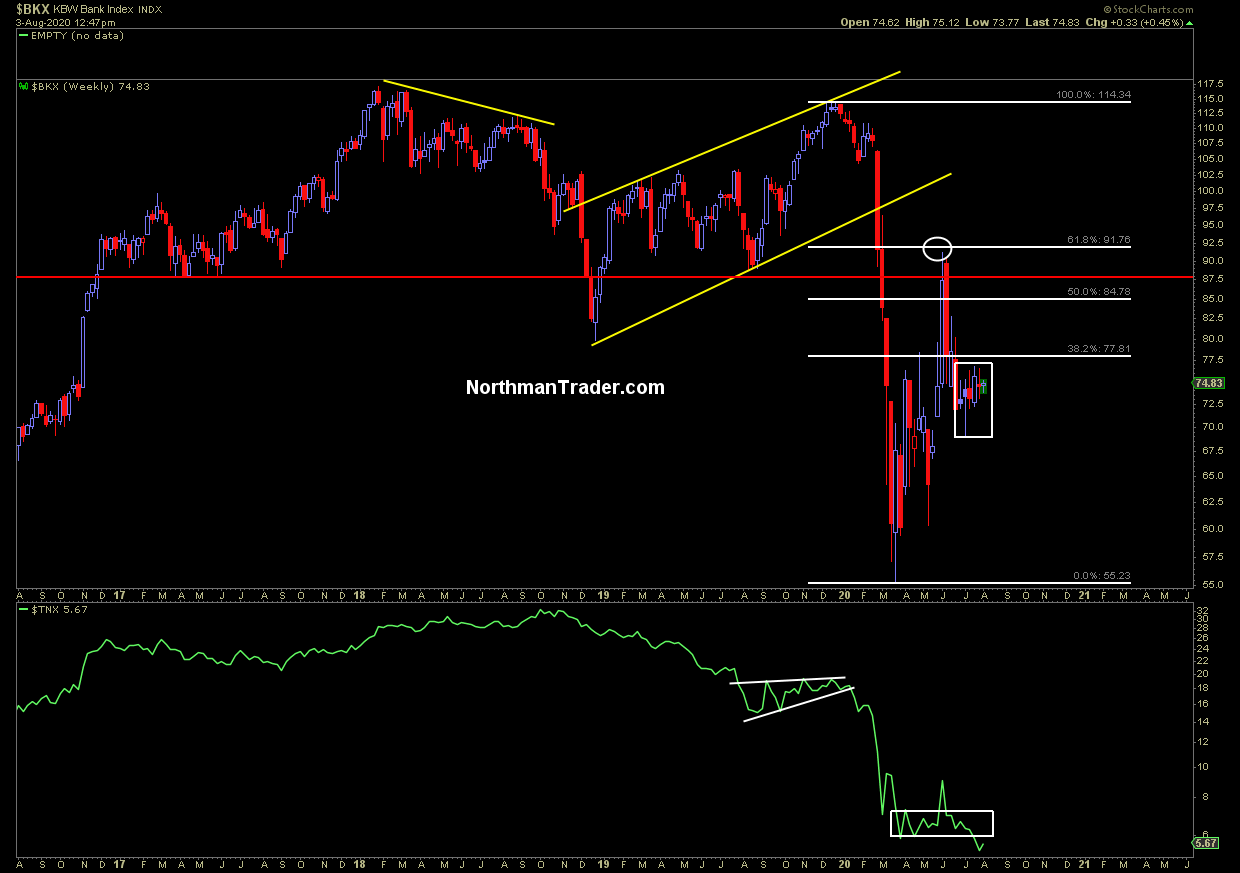

Indeed let me pull up a big picture chart to highlight how completely off this sector’s performance is:

First to note: The yield curve inversion of 2019. It, like many others before, precipitated a recession in the US. As did the weakening in equal weight ($XVG). None of this is unusual and it highlights how the broader business cycle (with Covid the historic trigger exacerbating everything) is actually performing no different than it has before. The only thing that’s different here is the historic asset bubble we have in some key stocks and the records amount of liquidity thrown at these markets.

Now you can argue the banks are hurting because of low yields, but we had low yields in 2016 and banks rallied just fine along with the rest of the market.

What you see in the big chart above though is that the market highs in 1998-2000 an 2006-2007 an even 2014/2015 all had the banking sector participate with either new all time highs or new cycle highs at the time.

Not this time. Not even close. $BKX can’t ever get to the June highs and remains far below all time highs. Rather $BKX is trading at the 2015 levels from 5 years ago. Maybe the price action will change with another stimulus package coming in the next few days.

But as it stands, the weakness in banks signals larger structural issues brewing that the market is currently ignoring. Indeed perhaps the bank stocks are signaling that the Fed’s interventions are not anywhere near as effective as record highs in $NDX and near record highs in $SPX suggest.

The previous, and smaller recessions in comparison, have had price consequences that lasted years. The current main index price action has you believe that price consequences only mattered for 4 weeks.

In my opinion this is a fantasy:

Yes. Except once this falls apart any effects of future stimulus will be greatly diminished as they’ve already already gone all in with little structural effect but zombifying the economy while blowing a historic asset bubble. https://t.co/ztAblTyPJr

— Sven Henrich (@NorthmanTrader) August 3, 2020

We’ll likely find out more following a decision on the next stimulus package. But if markets are supposedly forward looking then perhaps everybody should ask themselves: What are the bank stocks seeing that the rest of the liquidity drenched market is currently ignoring?

Something is rotten.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/3fsWKYy Tyler Durden