“Buy And Hold” Is Officially Dead

Tyler Durden

Tue, 08/04/2020 – 14:00

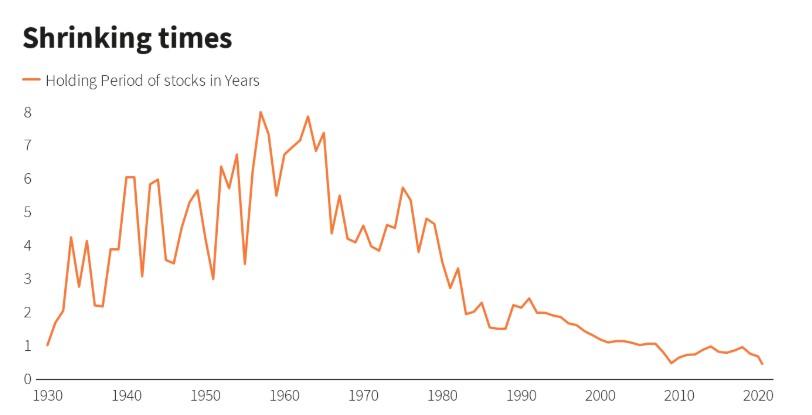

The amount of time an “investor” now holds a stock has accelerated downward, even after falling for the last few decades. In fact, Reuters estimates that the average holding period for U.S. stocks is now just 5.5 months in June, versus 8.5 months at YE 2019.

Of course, we can thank the Federal Reserve for rigging the markets to always go up, giving Robinhood daytraders the impression they are doing something productive when they buy at the open and sell at the close every day, for the strong shift in the data.

The previous low had been 6 months and was hit right after the 2008 crisis. Europe’s data is similar, showing a holding period that has shrunk to just 5 months, down from 7 months last December.

Rob Almeida, a portfolio manager at asset manager MFS, said: “Capital doesn’t have a price thanks to all this stimulus. The COVID-19 crisis has accelerated the trend of short-termism in investing.”

He also attributes the fall to 0% rates, commission-free investing and machine trading.

“So what’s happening is this ability to act or trade or churn, whatever you want to call it, based on information that may not be material,” he continued.

The percentage of portfolio holdings that have turned over in a 12 month period increased to a stunning 92% at the end of June, from 85% just one year ago.

Bank of England chief economist Andrew Haldane calls the trend a “subconscious myopia” resulting from the volatility stocks have seen this year. The action gave “buy and hold” investors the impression that the strategy may no longer work after stocks plunged 40% and then were bid all the way back up after Central Bank interventions.

Kevin Russell, CIO of UBS’ O’Connor hedge fund, said his lowest turnover strategies are performing the worst. BCA Research strategist Dhaval Joshi noted that while short-term returns are attractive, it “doesn’t make sense” to hold assets for longer.

Even with bonds, daily turnover has increased 10% to 20% above historical averages. Asset managers like BlueBay who usually churn positions twice a year are now doing so every 2-3 months, due to the volatility serving up opportunities.

“The same principle also applies to mainstream stock markets which are priced for feeble long-term returns – yet can rally by 20-30% in the space of a few weeks,” Joshi noted.

But the argument for short-term trading has its counterpoints – even despite the massive Central Bank intervention. Fabio Di Giansante, Amundi’s head of large cap equities, concluded: “Because what ultimately drives share price performance is earnings and you need to hold on to good investments for a while to see (companies) execute their business decisions.”

Apparently, he hasn’t gotten the memo that the Central Bank is now the economy, so “executing” no longer matters…

via ZeroHedge News https://ift.tt/3i8X0Oo Tyler Durden