The Fed Is Determined To Prove The QTM Right

Tyler Durden

Tue, 08/04/2020 – 15:12

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

Milton Friedman famously said, “Inflation was always and everywhere a monetary phenomenon.” But Friedman didn’t live through the QE years here in the U.S. and blatantly ignored the twenty plus years of Japanese deflation despite QE and insane levels of money printing during the latter years of his life.

Because Friedman, like a lot of modern economists, adhered strictly to the Quantity Theory of Money (QTM).

And as an Austrian economics kinda guy I somewhat agree with the QTM. I agree with Ludwig von Mises on this, as you would expect. So, how do we square the QTM with the evidence that QE in all of its guises has resulted in deflation, as expressed by the general price level, where ever it has been tried?

Martin Armstrong asks this question all the time and is openly hostile to the QTM. And his arguments have some merit, because, as he rightly points out the QTM only looks at the supply side of the money equation.

It cares not about the demand side. He’s right about that. What he’s wrong about is that the Austrians, like von Mises, haven’t considered this either.

Demand for money is just as important as the supply of it. And during a crisis, the demand side of the equation for any particular currency may, in fact, be more important.

This is what the Fed has struggled with for the past twelve years. The demand for the U.S. dollar has far outstripped the increase in supply, causing a far lower aggregate price rise than anticipated by the QTM.

But money, like all commodities, goes to where it is most demanded by thos that obtain it. And Bernanke’s QE post-2008 crisis didn’t go to the people, it went to the banks and the banks and the government who did what they thought was best with it.

In trying to prop up asset values the Fed, however, blew bubbles in not only equities but also home prices, cars, education, health care, government regulation etc.

Offsetting that has been the destruction of price in things like food and energy, which are now far cheaper in real terms (and as a percentage of disposable income) than they’ve been in decades.

And this dynamic couldn’t change in the post-Lehman years under Bernanke if the Fed, like the Bank of Japan before them and the other major central banks today, allowed the money printed to actually circulate.

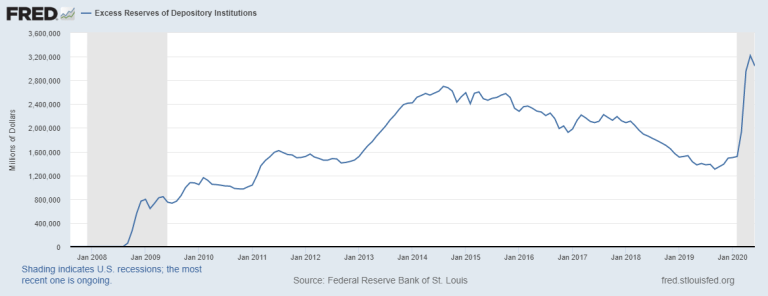

The QTM seems to fail because the money never circulated.

Bernanke ‘sterilized’ the new money, paying banks not to lend but rather hold the money on reserve with the Fed paying a nominal interest rather than engaging in traditional lending.

Because if he had done that the QTM would have risen up to bite him in the ass.

Bernanke understood that he had a demand problem. There was too much demand for dollars to service non-performing debt. But if he had let those trillions circulate it would have touched off an inflationary spiral as most of the money wouldn’t have gone to debt service but to bid up the price of base commodities.

So he chose to slowly bleed out the excesses of the previous credit-induced boom through time and attrition, just like the Bank of Japan, and slowly build the unavoidable inflation through the expansion of the money supply while demand returned to normal.

While the QTM ignores the demand side of the money equation, when the definition of the money supply and, more importantly inflation itself, doesn’t accurately describe reality the QTM becomes a hindrance to understanding what’s going on.

This is summed up in the question, “If Bernanke printed all these trillions, why is there no inflation?” To which Gary North, writing for Lew Rockwell all those years ago answered, “IOER.”

IOER = Interest on Excess Reserves.

To Bernanke he beat the QTM by paying IOER. Previous to Bernanke, excess reserves hovered around zero. The market always paid a better return than the Fed’s 0.25%.

But North was on it at the end of 2009:

The Federal Reserve can re-ignite monetary inflation at any time by charging banks a fee to keep excess reserves with the FED.

Anyone who predicts an inevitable price deflation does not understand that the present scenario is the product of legitimately terrified bankers and the Federal Reserve’s Board of Governors. At any time, the FED can get all of the banks’ money lent. But the FED knows that this will double the money supply within weeks. This will create mass price inflation.

Bernanke paid the banks not to lend and therefore most of the money printed didn’t circulate. It wasn’t part of the supply and therefore couldn’t cause inflation.

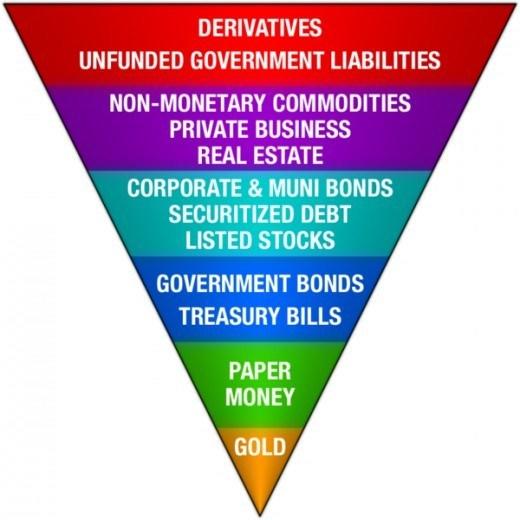

Moreover, credit money was contracting at that time. The top of Exter’s Pyramid was collapsing and Bernanke was trying to widen the base of the Pyramid by printing trillions in base money.

John Exter’s Money Pyramid

Back then it was there was a fight pitting the inflationists led by Peter Schiff versus the deflationists led by Harry S. Dent, and to a lesser extent Martin Armstrong.

Some of that money circulated through the growth in government spending and the returns generated as second-order effects of rising stock prices, the so-called ‘wealth effect.’

In the end we got what the Austrians would expect. Asset bubbles in the things people buy on time at zero-bound rates — cars, houses, medical bills, college degrees, military weapons, war — and deflation in legacy maturing financial assets and high depreciation cost assets like infrastructure through capital starvation, waste and fraud.

The Yellen and Powell years were marked by them hoping to withdraw these ‘temporary’ funds from the banking system by raising rates and doing QT – Quantitative Tightening.

It didn’t work at all, precipitating a credit collapse last year thereby, again, invoking the threat of the QTM. Because now the world was used to these assets at zero-cost of carry, zero-bound rates, which inflated their prices..

And those prices were way too high relative to that old supply of money. Withdraw the funds and watch the money markets seize up.

This is why we Austrian types kept saying the “Fed was trapped!” There was no way to go back to the way things were because while the Fed may have run out the clock on the 2008 toxic asset pile, it created an all-new even bigger pile of toxic-assets-in-waiting by the time we get to 2020…

… exactly as predicted.

Worse than that the Fed internationalized that pile, spreading the cancer out the world over, by turning the dollar into the ultimate carry-trade currency.

The real pandemic we should be scared of in 2020 isn’t COVID-19, it’s the immense pile of un-payable loans of all types, commercial or otherwise. With the rise of MMT now we’re just openly admitting the debts aren’t payable.

And the Fed has done nothing so far to say that it has any cures for this disease other than mo’ money.

It may be the first bit of honesty we’ve ever gotten from them.

So, color me not shocked when I see the latest proposal to come out of the Fed to stave off the deflationary vortex, directly pump money into everyone’s bank account.

The response was striking: they two propose creating a monetary tool that they call recession insurance bonds, which draw on some of the advances in digital payments, which will be wired instantly to Americans.

As Coronado explains the details, Congress would grant the Federal Reserve an additional tool for providing support—say, a percent of GDP [in a lump sum that would be divided equally and distributed] to households in a recession. Recession insurance bonds would be zero-coupon securities, a contingent asset of households that would basically lie in wait. The trigger could be reaching the zero lower bound on interest rates or, as economist Claudia Sahm has proposed, a 0.5 percentage point increase in the unemployment rate. The Fed would then activate the securities and deposit the funds digitally in households’ apps.

As Potter then elucidates, “it took Congress too long to get money to people, and it’s too clunky. We need a separate infrastructure. The Fed could buy the bonds quickly without going to the private market. On March 15 they could have said interest rates are now at zero, we’re activating X amount of the bonds, and we’ll be tracking the unemployment rate—if it increases above this level, we’ll buy more. The bonds will be on the asset side of the Fed’s balance sheet; the digital dollars in people’s accounts will be on the liability side.”

Bringing us right back to Milton Friedman and, more importantly, von Mises and the QTM. Because now the Fed is not talking about injecting sterilized reserves into the money supply to create fictions of bank balance sheets.

Because, as Mises pointed out, once there are no more vacancies at the debt hotel now the QTM can be fully expressed. More supply equates to more inflation.

Now Friedman will be proven prophetic.

Because the Fed would be injecting money directly into the economy to stimulate aggregate demand because there are no more places to hide it and get any kind of future return.

Most of the world’s debt trades at a negative yield. IOER is 0.10%. National budgets are running at 20% to GDP deficits. Pension systems are trillions in arrears.

Now we’re at that moment where the old thought exercise of what happens when you inflate the money supply by 10% prices occurs. The answer is prices will go up by 10%.

Critics of the QTM, like Armstrong, argue that the Fed et.al. are obsessed with creating 2% price inflation in a deflationary environment. That’s not completely true. Because if they charge those excess reserves they can create whatever inflation rate they want in a heartbeat.

What they are obsessed with is doing that and bailing out the banks at the same time.

That they can’t do without destroying confidence which is a nice way of saying they are scared of the QTM calling their bluff.

Because no matter how you try to hand wave the arguments away, more money chasing the same number of goods is inflationary. One look at home, car, health care and education costs tells you exactly where all the inflation went.

Bernanke dreaded that scenario just like Dr. North said which is why he paid IOER while destroying the middle class through rising prices for real goods and wage stagnation.

He created trillions in latent inflation based on the U.S.’s capacity as the world’s reserve currency, stuffing the world with reserves it didn’t need to maintain asset prices it couldn’t sustain.

He undermined the validity of every other currency in the process to save the dollar. They’ve had to deal with the QTM biting them, but we only care about ourselves.

In an environment where most people’s time preference is short because they are literally fighting for their economic lives, this new stimulus money will go right into the things people needs right now — food, clothing, shelter.

Things are so bad for so many Americans now that they saved their first stimulus checks and only spent them on the bare necessities, forgoing any thought of paying down debt.

They used what’s left of their credit rating to feed themselves now on someone else’s dime and let the bank choke on their mortgage when the credit card is maxed.

This next round of stimulus money will circulate. The Fed will finally do what Bernanke tried desperately to avoid, print helicopter money.

Zerohedge is right, the Fed finally admitted that QE is deflationary because it signals to the markets that conditions are still too fragile after 12 years to invest in the future because there is no future.

Therefore the money given to the banks is hoarded as excess reserves because the potential return on investment is lower than IOER. Today Jay Powell stopped paying IOER, it’s 0.10% lower than Bernanke’s 0.25% and he still can’t get the money moving.

Excess reserves are rising again. Same playbook, worse results.

That was the first phase of this crisis.

Now that we’re past that part and if the Fed adopts this policy, it will hand us money to keep asset prices from falling by creating fake demand. All that will do is undermine the confidence anyone holding dollars abroad has in the U.S., the dollar and our leadership.

And then the QTM will be our problem, not theirs. Because demand for dollars will collapse and the circulating supply will rise. Gold is sniffing this out now.

Then, and only then, will the Fed achieve its inflation target… and beyond. And Milton Friedman will look down and say, “I was right.”

And Mises will look back at him and say, “Yes, eventually.”

* * *

Join my Patreon if you want help understanding the dynamics of money and credit. Install the Brave Browser if you want to ween the world off of Google.

via ZeroHedge News https://ift.tt/2BWTJ5a Tyler Durden