Beyond The (Benefits) Cliff: The Wile E. Coyote Moment For The US Consumer

Tyler Durden

Thu, 08/13/2020 – 22:42

Just over a month ago, we argued that rapid and record fiscal stimulus had been a critical driver of the initial V-shaped recovery in consumer spending and therefore that several benefits cliffs could endanger this momentum if government support was removed prematurely (see: “Look Out Below”: Why The Economy Is About To Fly Off A Fiscal Cliff”). The first of those cliffs was hit at the end of July, with the failure to pass additional legislation leading to the expiration of the Federal Pandemic Unemployment Compensation (FPUC) benefits, which have provided qualifying unemployed individuals an additional $600 per week.

And although President Trump signed an executive order to renew these benefits at $400 per week – $300 supplied by reallocating unused funds from elsewhere in the CARES Act and $100 from states – legal, administrative and fiscal uncertainty remains about how and when these checks will hit the pockets of the unemployed.

As Deutsche Bank’s Matthew Luzzetti writes this week, the evaporation of these benefits highlights near-term downside risks to consumer spending, particularly for lower income households, which have been a critical engine of the recovery despite being disproportionately more likely to lose a job during the pandemic – a testament to the effectiveness of the income supplement.

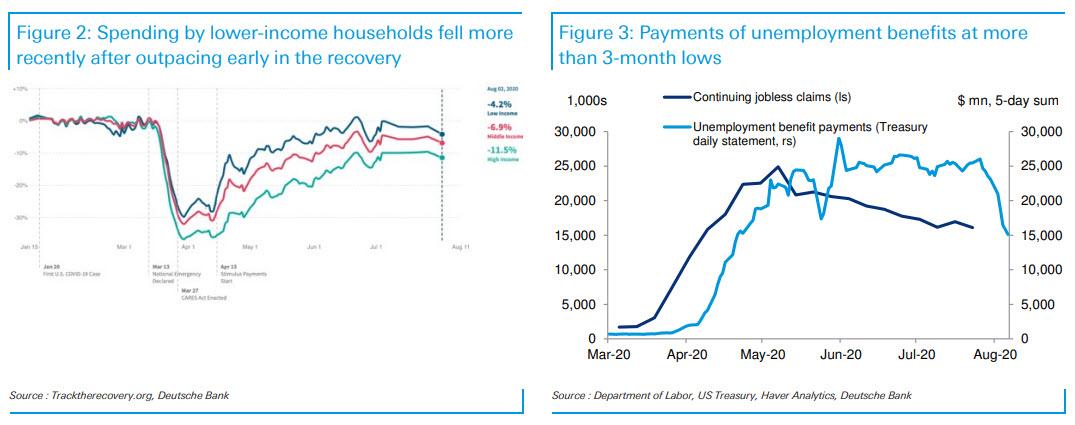

As we noted two months ago, and again as seen in Figure 2, consumer spending by lower-income households has significantly outpaced middle and higher income. In fact, by mid-June spending by lower-income households had already completely normalized. However, around the end of July, consumer spending fell more for lower-income households, no doubt impacted by the sharp decline in unemployment benefits that occurred during this time (Figure 3).

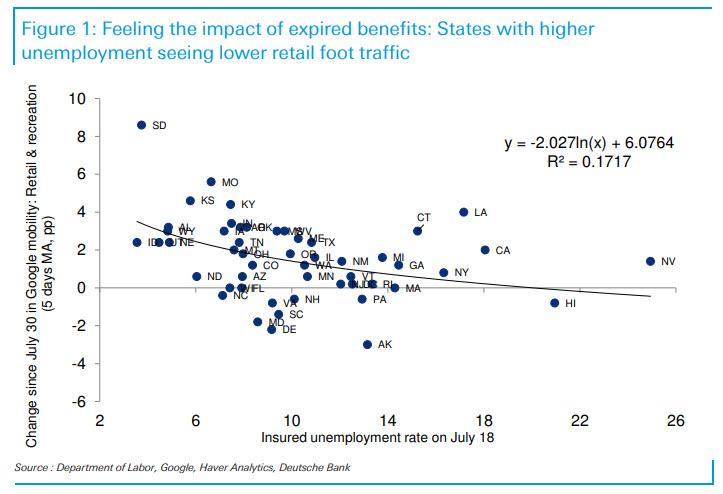

Separately, and consistent with the idea that the expiration of unemployment benefits is likely to impair consumer spending negatively, particularly for lower-income households, Google mobility data also indicates that since the end of July foot traffic around retail has underperformed in states that were more likely to be impacted negatively by the expiration of these benefits. This can be seen in Figure 4, where there is a clearly negative relationship between the insured unemployment rate in a state – with states with a higher insured unemployment rate more sensitive to changes in benefits – and the change in mobility around retail outlets.

As Luzzetti summarizes, while it is too early to reach concrete conclusions about the aggregate implications of the expiration of these benefits, this real-time data reaffirms findings from recent academic research, which found that consumer spending was likely to experience a material hit if expanded unemployment benefits were cut sharply.

via ZeroHedge News https://ift.tt/3iBJ7s8 Tyler Durden