Why Goldman Just Raised Its S&P Price Target By 20% To 3,600

Tyler Durden

Sat, 08/15/2020 – 14:30

So much can change in less than five months.

Back on March 22, one day before the Fed went all in on central planning by announcing unlimited QE and crossing the rubicon into buying corporate bonds, Goldman nuked its EPS forecast after the US economy basically shutdown to “fight” the covid pandemic, and cut its near-term S&P forecast to 2,000

In the near-term, we expect the S&P 500 will fall towards a low of 2000. The stock market is a leading indicator of business trends, and corporate activity continues to deteriorate with no signs yet of a bottom. The first quarter has not even ended and companies have yet to release 1Q results but equities have already collapsed by 32% in one month. The speed of business erosion is unprecedented.

To be sure, Goldman also hedged its bet laying out what it thought was the absolute upside case: one where in the aftermath of the economic collapse, the market – if not the economy – would recover its losses:

If all goes according to plan, S&P 500 EPS will leap by 55% to $170 in 2021, and the index will end 2020 at 3000 (30% above the current level). Earnings and investor sentiment will be recovering later in 2020. Using the Fed Model, applying a Treasury yield of 1% and a yield gap of 465 bp, suggests a P/E multiple of 18x on 2021 EPS and a year-end 2020 level of 3000

Well, fast forward to today, less than five months later, when the S&P is now more than a 1000 points above its March 23 lows, closing Friday at a whopping 3,372.85 and just shy of its all time high.

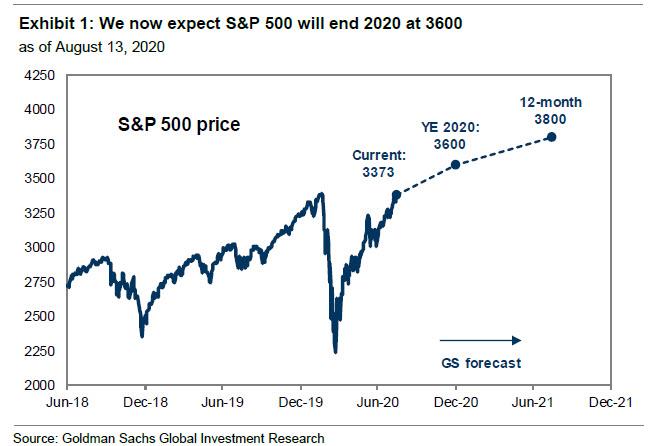

This means that Goldman – which a few months ago quietly capitulated on its bearish case and said its 2020 year-end target was 3,000 – had found itself in the unpleasant spot of chasing the (centrally-planned) market alongside most other sellside banks, and one week after the bank’s chief economist Jan Hatzius hiked his GDP outlook for 2020 and 2021 and chief equity strategist David Kostin hinted that the market was outperforming his cautious take, late on Friday Goldman confirmed that on Wall Street that only thing that matters is price in the rearview mirror, and that so-called “analysts” will goalseek any narrative to justify both the current prices and where momentum impliesit will be in a few months, when Kostin raised his S&P price target from 3,000 to an all time high 3,600.

This is how Kostin began his latest capitulation to the market… and what is likely Goldman’s latest top-tick of stocks now that Goldman has become the new Gartman:

The S&P 500 level has returned to its pre-pandemic high, but the building blocks supporting the price have shifted dramatically. Share prices reflect not just the expected future stream of earnings but also the rate at which the profits are discounted to present value

And here are the details behind Goldman’s latest narrative shift:

Back to the future. Six months ago, on February 19th, the S&P 500 Index reached an all-time high of 3386. The world was in a far distant place compared with today. US GDP was expected to grow by an average of 2.1% in 2020. Both the fed funds rate and the 10-year US Treasury yield equaled 1.6%. Consensus 2020 and 2021 EPS estimates for the S&P 500 were $176 and $196, implying 1-year and 2-year forward P/E multiples of 17.3x and 15.8x, respectively. Our calculation of the market-implied equity risk premium (“ERP”) equaled 5.4%.

Then, the coronavirus hit. The world stopped. Economies froze. The S&P 500 plunged by 34% in 23 trading days. More than 20 million people globally and 5 million individuals in the US contracted COVID-19. Tragically, more than 750,000 people worldwide have died of the virus, including 167,000 in the US. The Fed cut the funds rate to near-zero (0-25 bp). Congress opened the fiscal spigot and implemented a variety of income-replacement policies designed to help individuals and businesses bridge to the other side of the pandemic.

Remarkably, the S&P 500 index has fully recovered from its March trough and now trades close to its pre-pandemic peak.The five largest stocks (AAPL, MSFT, AMZN, GOOGL, and FB) accounted for 14% of the market’s 51% rally and now constitute 23% of the index capitalization. Stated differently, the other 495 stocks collectively contributed just 72% of the rebound.

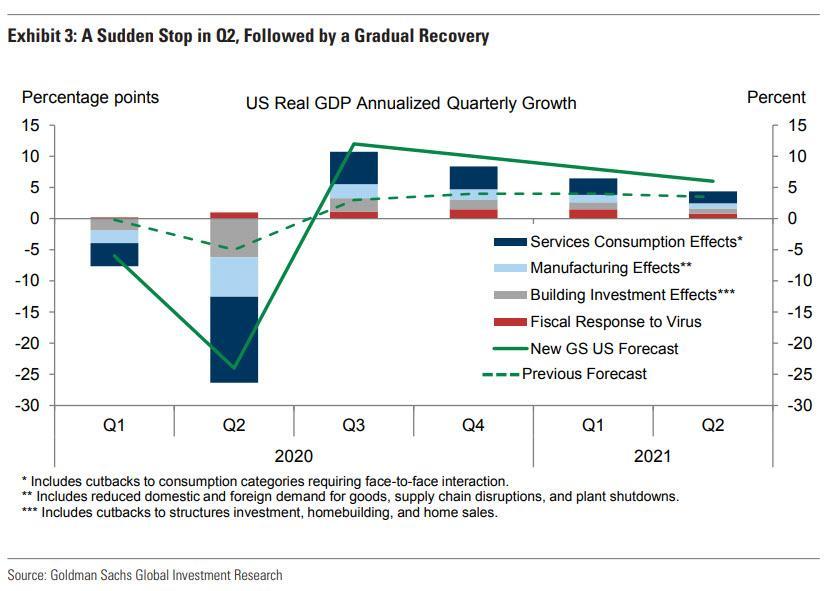

And while the S&P 500 level has returned to its pre-pandemic high, the top Goldman strategist notes that the building blocks of that price have shifted dramatically during the past six months. For one, with stocks back at record highs, the economy is still facing unprecedented devastation, however optimism is returning and as we noted last week, Goldman Sachs economists now forecast US GDP will rebound by +6.4% in 2021.

Following a -5% contraction in 2020, their 2021 growth estimate is well above the Blue Chip consensus estimate of 3.9%.

A key driver of Goldman’s optimistic growth outlook is positive news on the vaccine front; the bank now expect at least one vaccine will be approved by the end of 2020 and will be widely distributed in the US by mid-year 2021. We think this is ludicrous in a country where more than half of the population has said it will refuse to take any hastily prepared vaccine, but hey – Goldman has an optimistic narrative to build just so its prop traders can dump their risk assets to clients.

That’s also why Goldman’s optimism has migrated to the broader market, and the bank’s 2021 EPS estimate of $170 is also above the current consensus of $165:

We expect S&P 500 earnings will contract by 21% this year before rebounding by 30% next year and 11% in 2022 (5% CAGR). Our EPS estimate is driven by higher sales and an expansion in profit margins to 11.4%, back to the level of 2019. However, as we discussed last week, the earnings recovery will be uneven.Information Technology and Health Care will lead the way with CAGR growth through 2022 of +10%. Firms in other sectors such as Energy (-25%) and Financials (-1%) will struggle to return to their prior level of peak earnings

And yet in an economy where there are tens of million unemployed and a record number of companies filing for bankruptcy, the cognitive dissonance between the economic abyss and record stocks is screaming; so much so that even Goldman had to admit that few things make sense. Case in point, Goldman is now justifying its ludicrous – if very much probable – price targets not based on profits or cash flows, but simply on the discount rate used to pull future earnings to the present. And in a world where the discount rate is zero (and in many countries negative) it is an academic embarrassment to say that one’s price target is X just because the future value of earnings can be infinite. And yet, to explain away this centrally planned “market”, this is the kind of bullshit Goldman has to resort to to validate why a record high forward PE multiple…

… should not dissuade Goldman’s clients from buying stocks (that Goldman is selling), to wit:

As the last few months have demonstrated, equity prices depend on not just the expected future stream of earnings but the rate at which those earnings are discounted to present value. A plunging risk-free rate partially explains why equities have performed so well despite downward revisions to expected earnings.

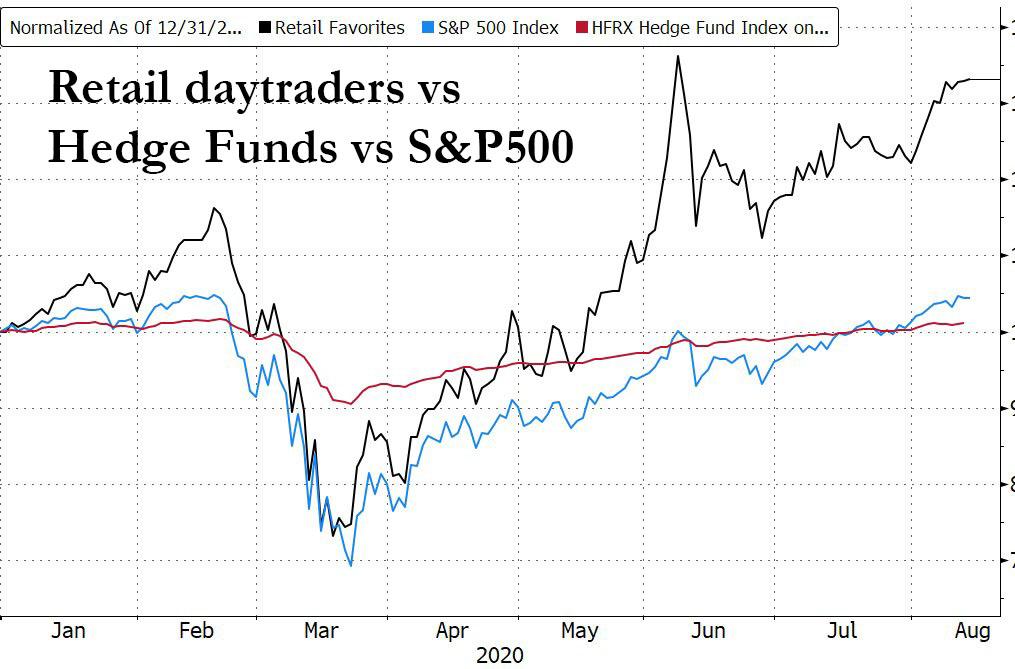

And with every other metric screaming record overvaluation, there is the old faithful “Fed model” explanation, aka the Equity Risk Premium that stocks are in fact cheap, that just because bond yields are at all time lows (which is due to central banks buying all gross issuance), so stocks are expensive if only in comparison to bonds. Once again, a purely academic exercise in goalseeking a selling point, but that’s what Goldman has been reduced to in a “market” where David Portnoy outperforms not just Warren Buffett…

… but the market itself:

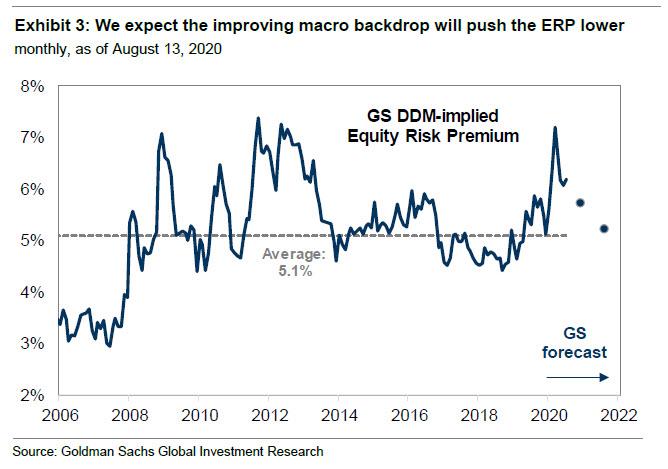

Relative to the peak on February 19th, nominal 10-year yields are 90 bp lower (from 1.6% to 0.7%). With breakeven inflation unchanged (at 1.7%), the key interest rate change has been a fall in real yields from -0.1% to -1.0%. While the Fed balance sheet has exploded by 66%, the policy uncertainty index has surged from 131 to 295 alongside lingering concerns about the virus, the election, and US-China trade. On net, the ERP has increased by nearly a full percentage point, to 6.3% from 5.4%. But falling bond yields means the effective cost of equity is unchanged at 7.0% (Ex. 9).

Thoroughly red-faced by this point, Kostin has no choice but to “explain” some more how stocks are cheap if one only focuses exclusively on the equity risk premium which is meaningless in a world where central banks have nationalized the bond market and rates no longer provide any future discounting signal:

Changes in the ERP are driven by many factors, including the strength of the economy today, the expected state of the economy going forward, and the confidence investors have in that forward path. To model those relationships, we use changes in the bond market’s pricing of future inflation as a proxy for changes in expected growth, and the policy uncertainty index as a representation of confidence. Fed policy also matters for ERP because it has an impact on future growth and investor confidence as well as indirectly increasing equity market liquidity.

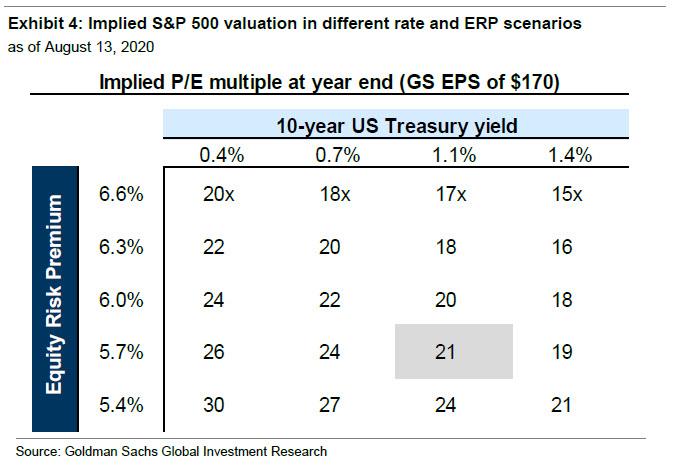

The risk premium for US equities is likely to decline by year-end 2020 (to 5.7%) and during the first half of 2021 (to 5.2%).Under their baseline forecast, our economists expect nominal Treasury yields will rise by 50 bp to 1.1% by year-end and to 1.4% in 12-months, led by higher breakeven inflation and higher real rates [ZH: this will be the 11th year in a row in which Goldman has incorrectly predicted higher rates]. If realized, the rise in rates and inflation through year-end would be a roughly 80th percentile 3-month move relative to the past 15 years and the 12-month move would rank in the 85th percentile. They expect the Fed balance sheet will increase by $800 billion through year-end and by another $1.3 trillion during 2021. We assume the current elevated level of political uncertainty persists into year-end, but declines in early 2021 as investors gain clarity around the administration’s legislative agenda. Our forecast ERP would remain above-average at year-end before declining to the 15-year average in 12 months.

And so the scene is set to “explain” why until just last week Goldman was perfectly happy with a 3,000 S&P price target, and now sees the S&P some 20% higher. Why the Equity Risk Premium of course (the real reason: Goldman is now aggressively selling its risk assets to clients who need to get bulled up and buy from their favorite neighborhood Goldman salesman).

A fall in ERP will be partially offset by a rise in bond yields but the combination will ultimately boost the S&P 500 index to 3600 by year-end (+7%) and to 3800 (+6%) in 12-months’ time.

Our revised year-end 2020 price target represents a significant increase from our previous forecast of 3000, driven by valuation. In February 2020, the S&P 500 traded on a FY2 P/E multiple of 17x consensus 2021 EPS. Today, the market trades at 20x consensus 2021 EPS. Our year-end target of 3600 implies a P/E multiple of 21x our 2021 EPS estimate.

But what if this ridiculous approach to analysis is flawed – as it will be shown to be quite soon? Why Goldman’s chief strategist is smart enough to know he needs an “out” for when he is called out for being massively wrong, and sure enough he embeds just that by noting that the US election, which is now just 80 days away, “represents a significant risk to our year-end forecast.”

As we have highlighted previously, the coronavirus introduces a major complication in the timely tabulation of voting results. Consider the New York 12th Congressional District Democratic primary, where it took six weeks to count all the absentee ballots and determine a winner. And this was just a primary election.

And then there is the (flawed) polling that just like in 2016 sees a Democratic sweep in November. Here’

Prediction markets imply post-election Democratic control of Washington, DC. Equity investors are most focused on the prospect of higher corporate tax rates. We have previously estimated that Vice President Biden’s current plan, if fully enacted, could reduce our baseline 2021 EPS to $150 and our 2022 EPS could be closer to $170. However, the potential for changes in government policies outside of tax policy, such as fiscal spending, trade policy, and regulation, suggest a combination of upside and downside risks to earnings depending on the outcome of November’s elections.

In short, Goldman admits that “election uncertainty suggests near-term risk to our target is tilted to the downside. Of course, the largest risk to our forecast is the timing of a vaccine and path of recovery from the pandemic.”

Stated otherwise, everything can – and will – go wrong, and just because Goldman desperately needs to cash out before it does it has no choice but to boost its S&P price target to get the handful of investors who are still on the fence about stocks to buy whatever Goldman has to sell, before everyone else joins the liquidation puke.

via ZeroHedge News https://ift.tt/30Zaeaz Tyler Durden