Tytler Cycle & Why More Government Help Leads To Less

Tyler Durden

Wed, 08/19/2020 – 17:25

Authored by Lance Roberts via RealInvestmentAdvice.com,

I recently received a message from a young fan of MMT (Modern Monetary Theory) suggesting it is always the “Government’s” job to ensure the care of citizens. Throughout history, the seven words which have been the hallmark of every socialist and communist system are “I’m the Government, I’m here to help.” A review of the Tytler cycle reveals why more Government help, always leads to less prosperity and freedom.

In the U.S. Constitution, there are specific clauses to providing both the security and infrastructure of the country, and the issuance of currency and debt. Interestingly, there are no clauses that state the Government’s responsibility is the financial support of households and corporations hurt after decades of financial mismanagement.

Defining The Systems

However, these are the basic tenets of both communism and socialism.

-

“Communism” is a political theory advocating class war and leading to a society in which the public owns all property. Each person works, and is paid according to their abilities and needs.

-

“Socialism” suggests a social organization that advocates that the means of production, distribution, and exchange should be owned or regulated by the community.

In both cases, there is a direct relationship between the Government and the care and feeding of the population. However, given the Constitution’s writers had just fled an “Aristocracy,” they wanted to ensure America didn’t follow the same path. The founding documents established the basis from which “capitalism” was allowed to flourish.

-

“Capitalism” is an economic and political system in which a country’s trade and industry are controlled by private owners for profit, rather than by the state.

Do you see the difference?

Since 1775, millions of Americans have given their lives in defense of the American “idea.” The tyranny and oppression which arise from communism, socialism, and dictatorships have been a threat worthy of such sacrifice. I am sure those patriots who died to ensure the “American way of life” would be disheartened by the willingness of the up and coming generations to adopt such ideals.

However, there is little denying the rise of “socialistic” ideas in the U.S. today. You can try and cover the stench by calling it “social democracy,” but in the end, it’s still socialism.

But such shouldn’t be a surprise. It is the cycle of all economic civilizations over time as we “forget our history,” or adopt a “cancel culture” mentality.

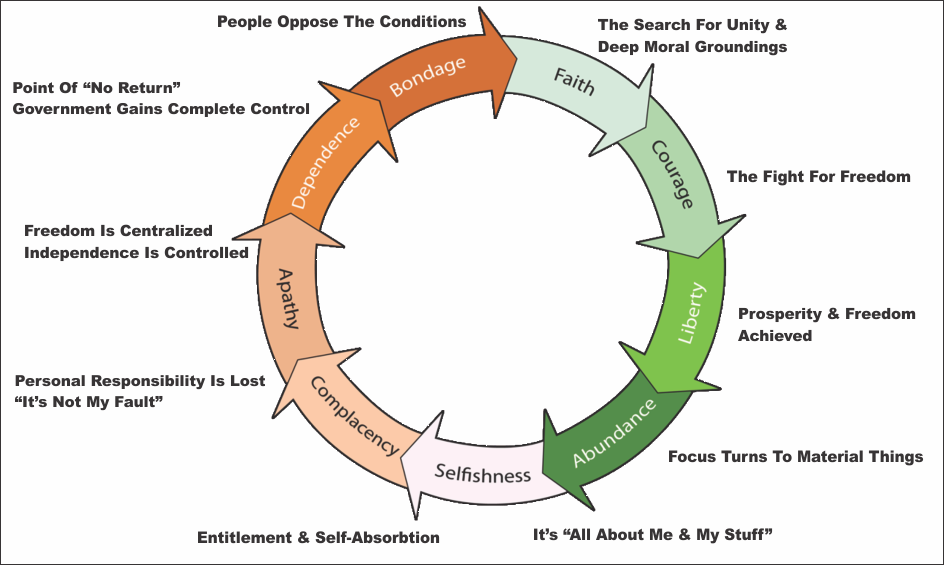

The Tytler Cycle

Scottish economist Alexander Tytler, who, in 1787, was reported to have commented on the then-new American Republic as follows:

“A democracy is always temporary; it simply cannot exist as a permanent form of government. A democracy will continue to exist until the time voters discover they can vote for generous gifts from the public treasury. From that point, the majority always votes for the candidates who promises the most benefits from the public treasury. The result is that every democracy finally collapses due to loose fiscal policy, which is always followed by a dictatorship.

The average age of the world’s greatest civilizations has been about 200 years. These nations always progressed through this sequence:

From Bondage to Moral Certitude;

Moral Certitude to Great Courage;

Great Courage to Liberty;

Liberty to Abundance;

Abundance to Selfishness;

Selfishness to Complacency;

Complacency to Apathy;

Apathy to Dependency;

Dependency to Bondage.”

Since Tytler’s time, we’ve witnessed many formerly free countries slide inexorably into their final stages of decline. For example, the countries in the EU are further gone than the countries in North America, and Venezuela is, well, just gone.

The cycle is clearly in process in the United States as we have now cleared apathy. Demonstrations, the demand for Government support, and the abolition of “student loan debt” are all signs of the “it’s not my fault” stage.

The Rise Of Socialism (Dependency To Bondage)

How did a country which was once the shining beacon of “capitalism” become a country on the brink of “socialism?”

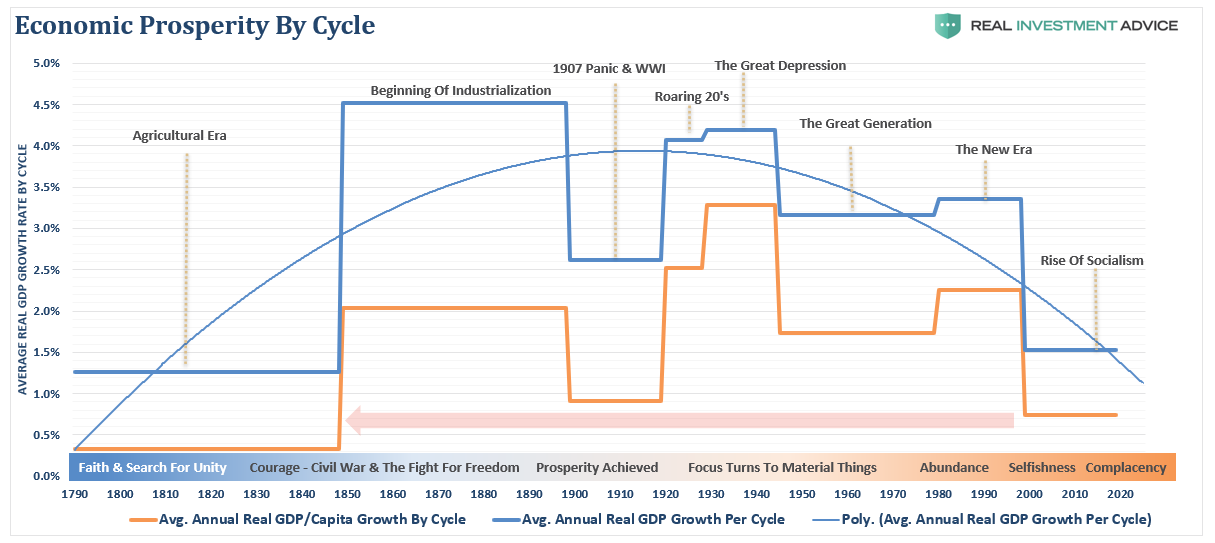

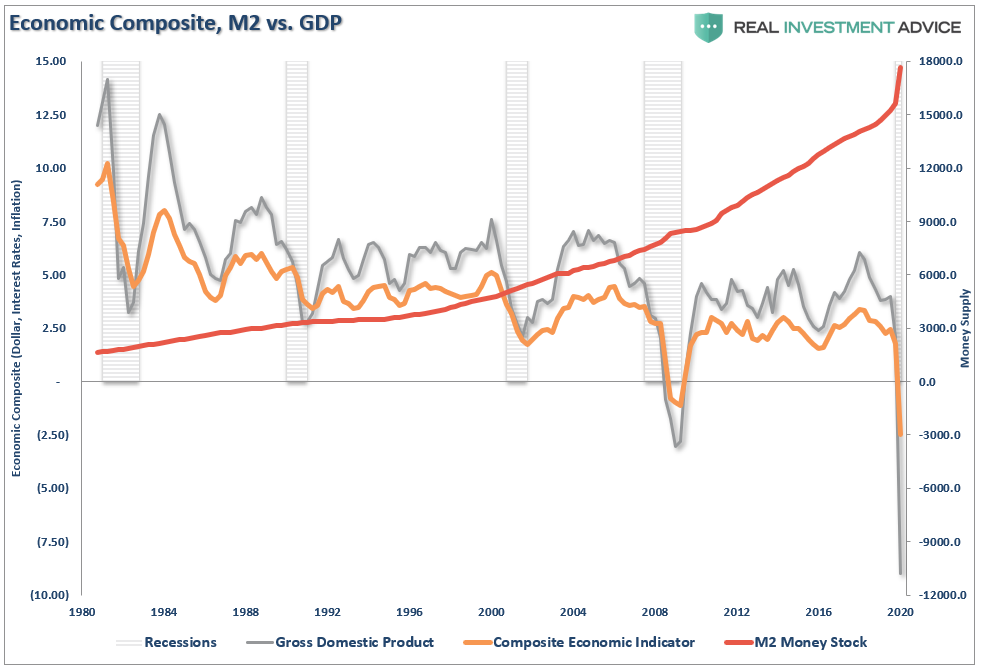

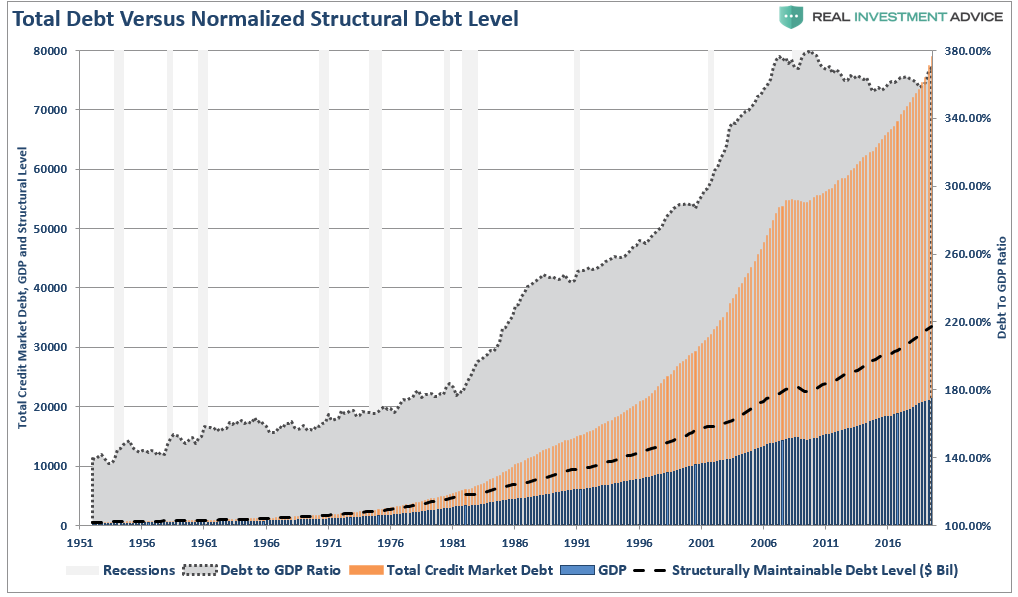

Changes like these don’t happen in a vacuum. It is the result of decades of poor financial choices, both personal and institutional, which led to a burgeoning divide between the wealthy and everyone else. The chart below shows the increase in the “money supply” versus GDP and the “economic composite index.” (The composite index comprises the US Dollar index, 10-year treasury rates, and inflation which all reflect economic activity.)

Deflationary Acts

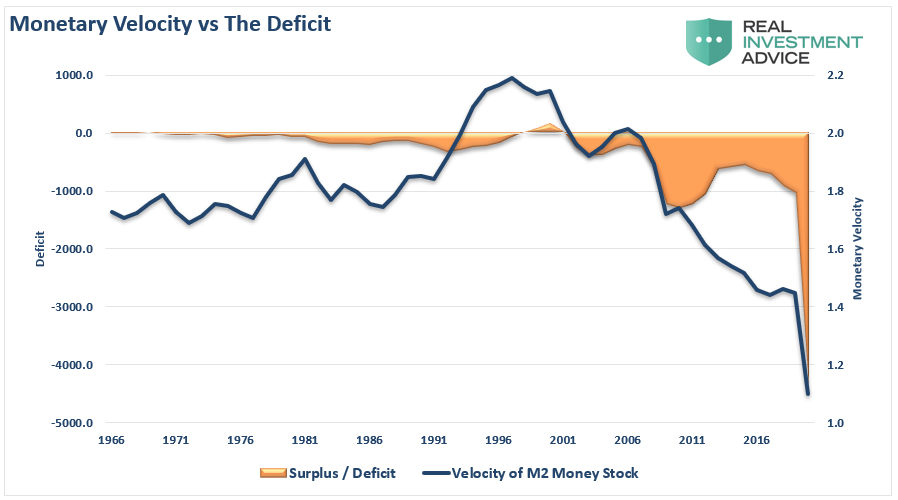

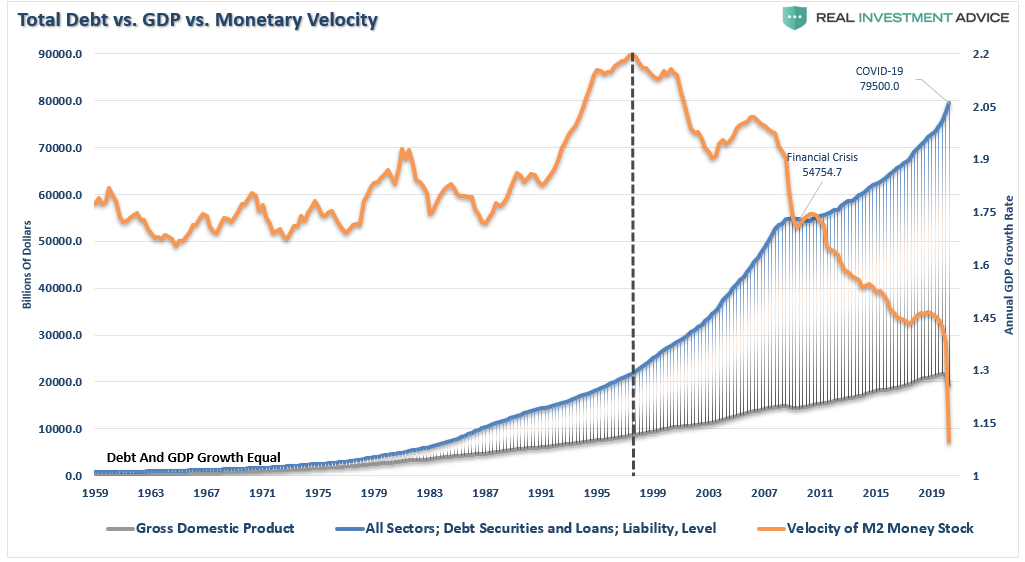

As discussed previously in “The Fed’s Actions Are Deflationary,” the 40-year process of increasing economic leverage has now led to its inevitable conclusion.

“To no surprise, monetary velocity increases when the deficit reverses to a surplus. Such allows revenues to move into productive investments rather than debt service. The problem for the Fed is the misunderstanding of the derivation of organic economic inflation.

“It isn’t just the Federal debt burden that is detracting from economic growth. It is all debt. As stated, the belief that lower interest rates would spur more economic activity was correct, to a point. However, as shown, once the debt burden began to consume more than it produced, the lure of debt turned sour.”

Look closely at the chart above. From 1950-1980 the economy grew at an annualized rate of 7.70%. To accomplish this growth rate, the total credit market debt to GDP ratio was less 150%. The CRITICAL factor to note is that economic growth was trending higher during this span, rising from roughly 5% to nearly 15%.

There were a couple of reasons for this. Lower levels of debt allowed for personal savings to remain robust, which fueled productive investment in the economy. Secondly, the economy was focused primarily on production and manufacturing, which has a high multiplier effect on the economy. This feat of growth also occurred in the face of steadily rising interest rates peaking with the economic expansion in 1980.

The Breaking Point

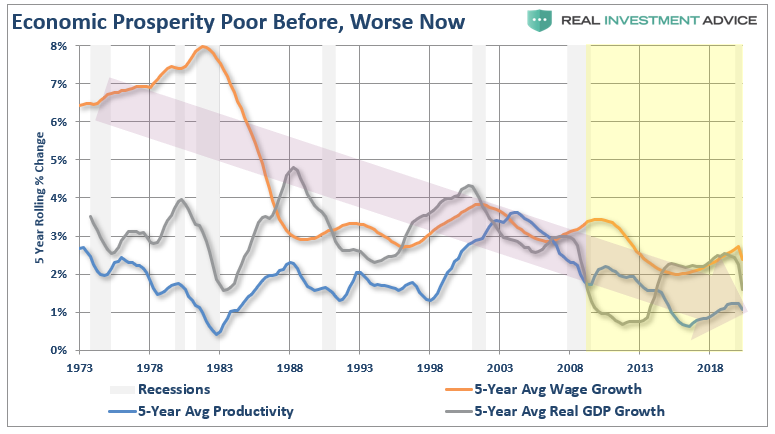

As we have discussed previously in “The Breaking Point,” beginning in 1980, the shift of the economic makeup from a manufacturing and production-based economy to a service and finance economy, where there is a low economic multiplier effect, is partially responsible for this transformation. The decline in economic output was further exacerbated by increased productivity through technological advances, which, while advancing our society, plagued the economy with steadily decreasing wages.

Unlike the steadily growing economic environment before 1980; the post-1980 economy has experienced a steady decline. Therefore, a statement that the economy has been growing at 5% since 1980 is grossly misleading. The trend of economic growth, wages, and productivity (5-year averages) show the real problem.

This decline in economic growth has kept the average American struggling to maintain their standard of living. It is from that perspective the rise of socialistic ideas should be of no surprise. As wages declined, families turned to credit to fill the gap in maintaining their current standard of living. This demand for credit became the new breeding ground for the financed based economy. Easier credit terms, lower interest rates, loose lending standards, and less regulation fueled the continued consumption boom.

While America on the surface was the envy of the world for its apparent success and prosperity, the underlying cancer of debt expansion and lower personal savings was eating away at its core.

More Debt Leads To Less Of Everything Else

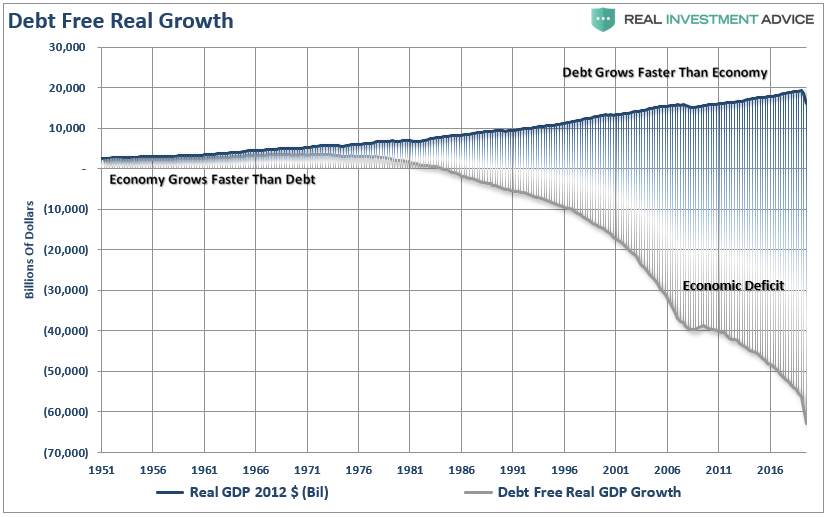

The massive indulgence in debt, what the Austrians refer to as a “credit induced boom,” has now reached its inevitable conclusion. The unsustainable credit-sourced boom, which leads to artificially stimulated borrowing, seeks out diminishing investment opportunities.

Ultimately these diminished investment opportunities lead to widespread malinvestments. Not surprisingly, we saw it play out “real-time” in everything from subprime mortgages to derivative instruments, which was only to milk the system of every potential penny regardless of the apparent underlying risk.

When credit creation can is no longer sustainable, the markets must clear the excesses before the cycle can start again. It is only then, and must be allowed to happen, can resources be reallocated back towards more efficient uses.

Such is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. The ongoing fiscal and monetary policies, from TARP and QE to tax cuts, have only delayed the clearing process allowing it to grow larger. That delay on worsens the current impact and the eventual reversion.

The economy is currently requiring roughly $4 of total credit market debt to create $1 of economic growth. A reversion to a structurally manageable debt level would require a nearly $40 trillion reduction. The last time such a clearing process occurred, it was called the “Great Depression.”

The chart shows why “demands for socialism” is now “a thing.”

Conclusion

The end game of four decades of excess is upon us, and we can’t deny the weight of the debt imbalances that are currently in play. The medicine the current administration is prescribing is a treatment for the common cold; in this case, a normal business cycle recession. The problem is the economy is suffering from a “debt cancer.” Until we prescribe and implement the proper treatment, the patient will continue to suffer.

If I am wrong, then a rising percentage of Americans wouldn’t be demanding more “Government support” in exchange for their economic prosperity and freedoms.

Tytler’s cycle continues to come to fruition.

But we have a choice.

The next time the Government says, “I’m here to help,” we could politely just say “No.”

via ZeroHedge News https://ift.tt/3iXp3k9 Tyler Durden