Broyhill Warns, The First Half A “W” Looks A Lot Like A “V”…

Tyler Durden

Fri, 08/21/2020 – 15:30

Excerpted from Broyhill Asset Management’s latest letter to investors,

“The fundamental cause of the trouble is that in the modern world the stupid are cocksure while the intelligent are full of doubt.”

– Bertrand Russell

If you had slept through the first six months of the year, only to open your statements in June, it might seem as if you hadn’t missed much. Major market indices ended the first half of the year not far from where they started. But the path to get there was anything but normal. Markets cycled through all five phases of a bubble outlined by Charles Kindleberger’s classic, History of Financial Crises – displacement, boom, euphoria, distress, and panic – in a matter of days rather than years. The S&P lost a third of its value over the course of a few weeks during the first quarter – the quickest such loss since 1933 – only to post its largest quarterly gain since 1998 in the second quarter.

Market Commentary

The first half of a “W” looks an awful lot like a “V” . . .

Markets are at all-time highs. And yet, investors are led to believe that today’s record valuations are accurately discounting the worst economic collapse in a century caused by the worst global pandemic in a century, record levels of unemployment, the prospect of significantly higher tax rates, escalating geopolitical and election risks, growing anti-trust risk for the world’s largest businesses, along with virtually zero earnings visibility. If this doesn’t confuse you, you’re probably not doing it right.

Recoveries from bear market bottoms always begin before the end of a recession. But on any measure, this cycle has been excessive. And yet, the extent of the retracement varies widely. To start, the massive outperformance of the US versus the rest of the world is almost entirely attributable to six stocks. Remove these and the remaining S&P 494 doesn’t have much to show for it.

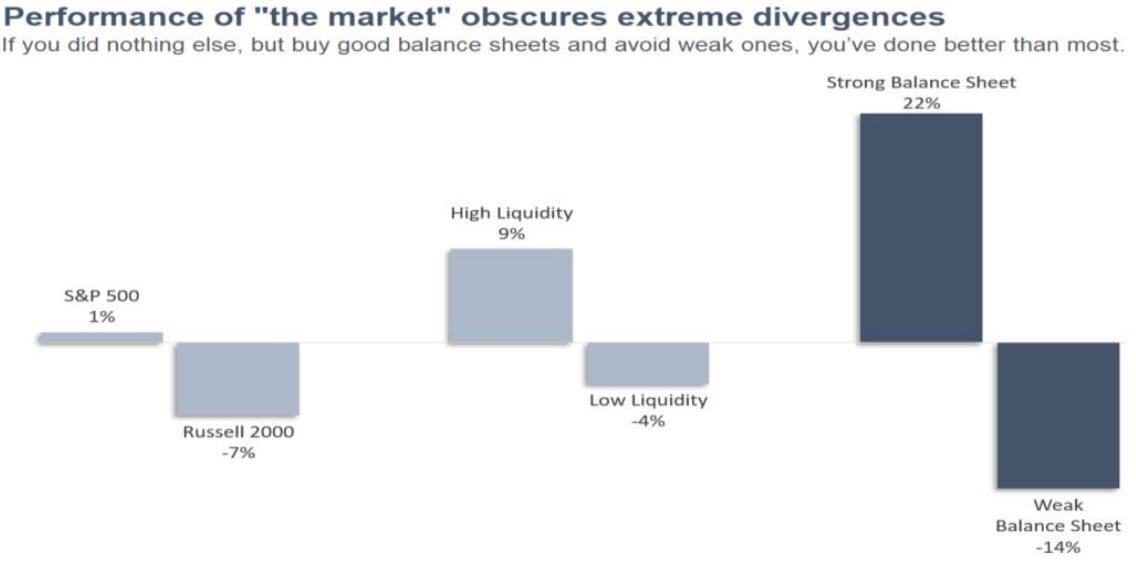

On many levels, recent moves in the technology sector are justifiable – as the pandemic has ravaged industries like travel and leisure, it has accelerated change in others. But today’s tech darlings aren’t the only peculiar divergence this year. Large, liquid businesses with ample access to capital have trounced smaller, less liquid stocks with limited financing flexibility. And perhaps more than any other factor, a firm’s balance sheet has been the single greatest driver of performance this year. If you did nothing else, but buy good balance sheets and avoid weak ones, you’ve done better than most.

While the many oddities within the market are puzzling enough, the most striking aberration is the gap between asset prices and economic fundamentals. To paraphrase Jeremy Grantham, today’s market is valued at levels only seen maybe 10% of the time, while the economy is bouncing around at recessionary levels only seen maybe 10% of the time. And yet, economists attempting to forecast the shape of any economic recovery are even more useless than ever, since the path of the pandemic is the only variable that matters. Unfortunately, it’s a variable that’s proved more difficult to predict than the economy itself.

In The Devil’s Financial Dictionary, Jason Zweig defines certainty as:

“An imaginary state of clarity and predictability in economic and geopolitical affairs that all investors say is indispensable—even though it doesn’t exist, never has, and never will.”

In the real world, uncertainty is everywhere. We don’t know the likelihood or the severity of a second (or third) wave, or when COVID will no longer be a risk factor cited in SEC filings. So we can’t know how the economic recovery will progress. We don’t know how many businesses will cease to reopen their doors1. So we can’t know if those jobs will still exist in the future or how long it will take for the unemployed to get back to work.2 We don’t know if record stimulus will create rampant inflation or if the lagging effects of a financial crisis will unleash lingering deflation. So we can’t know what an “appropriate” discount rate is to value assets.

What we do know is that we have never seen stock prices at such extremes coincide with this degree of uncertainty. We also know that living in an imaginary world of certainty can create big problems managing money in the real world.

We don’t have all the answers. We never do. The best we can do is gather evidence to judge the likelihood of various outcomes and place our bets accordingly. Given the range of outcomes today and the elevated uncertainty around those outcomes, it seems foolish to make big bets here.

Thus far, in the tug of war between “liquidity” and fundamentals, liquidity appears to have won. But best not to celebrate too soon, as risks are building alongside extreme valuations, reflecting a dangerous level of certainty in asset prices today. Reopening before the virus is fully controlled suggests that the initial economic bounce may stall alongside rolling shutdowns. And while fiscal policy has supported the consumer thus far, these measures will soon expire, weighing on growth in 2021.

Even a brief pause in the nonstop wave of liquidity could force a sharp reversal in asset prices which lack any hint of fundamental support. It’s no wonder insiders are dumping stocks at a record pace after buying aggressively in March. Investors would be wise to recall the sage advice of Bernard Baruch- “The main purpose of the stock market is to make fools of as many men as possible.”

Speaking of fools…

“…The stupid are cocksure and the intelligent are full of doubt.”

– Bertrand Russell

““I’m just printing money . . . Losers take profits. Winners push the chips to the middle. … I should be up a billion dollars . . . I’m the new breed. The new generation. Nobody can argue that Buffett is better at the stock market than I am right now. I’m better than he is. That’s a fact.”

– David Portnoy, Founder of Barstool Sports

The more we learn, the more questions we have. But the reverse is also true. The fewer questions we ask, the less we know. This is why poor students often feel more successful than the brightest in the bunch. They lack insight into their own limitations. In other words, without an appreciation for the vast body of knowledge out there, it’s impossible to know how little they know. The first principle is that you must not fool yourself – and you are the easiest person to fool.

In the field of psychology, this cognitive bias is known as The Dunning–Kruger Effect. It comes from the inability of people to recognize their lack of ability. Without self-awareness, it can be challenging to evaluate competence or the lack thereof. Said differently, the more incompetent you are, the less you’re aware of your own incompetence. Which brings us back to the current speculative and irrational exuberance which, in many ways, dwarfs the heydays of 1999. With the advent of social media, today’s day traders have taken on a whole new form, reaching almost rockstar status. Cooped up at home, armies of “Retail Bros” are pouring money into SPACS and bankrupt stocks, making reckless bets, without any consideration or knowledge of the risks they are taking.

As it turns out, the recipe for unbridled, rampant speculation is simple. Start with one Robinhood account, with zero-commission trades executed from your iPhone. Add one Twitter account, along with all of your unemployed friends and hundreds or thousands of bots created from Mom’s basement. And throw in a gambling itch that desperately needs to be scratched thanks to the lack of sporting events to bet on, and you have today’s full-blown mania.

Needless to say, what we are seeing in the market today is anything but healthy behavior and, consequently, we are more worried than ever about the implications of how this unwinds.

Take a moment to consider the following headlines:

-

Everywhere You Look Under Surging Stocks Is Fervid Retail Buying

-

Dumb Money Is Looking a Lot Smarter in Never-Ending Stock Rally

-

Barstool Sports founder believes he’s a better investor than Warren Buffett

-

Winklevoss Twins Tell Dave Portnoy To Pick Bitcoin Over Gold Due To ‘Space Mining’

Now compare them to those below:

-

Fund that called the last two crashes starts to short global stock markets

-

David Tepper says this is the second-most overvalued stock market he’s ever seen

-

Legendary investor Stanley Druckenmiller says he doesn’t like the way the market is set up

One washed up investor that is apparently no longer relevant once said that, “It’s only when the tide goes out that you learn who’s been swimming naked.” Despite today’s day traders propensity for skinny-dipping, our preference remains in line with other veteran investors and in keeping our pants on.

The “Retail Bros” are enjoying the rush from “easy money” at the moment. But there is nothing easy about this game. And gambling with the house’s money is most dangerous when it looks easiest. Rolling the dice with boundless optimism is not a sustainable investment strategy. Gamblers from shuttered casinos should know better. The house always wins. Thinking otherwise is what prevents the long-term growth of capital – speculative, short-term gains are eventually wiped out by occasional and unpredictable tidal waves. This is why compounding at even low rates of return can turn a small pool of capital into a very large one over the long term. Today’s overconfident amateurs might be well served to hire a couple of experienced analysts – Mr. Dunning and Mr. Kruger.

There is some good news when it comes to bubbles. Every one of them eventually bursts. And when they do, investors with both their capital and courage intact are among the few positioned to scoop up the incredible bargains left behind. Which brings us to our final point.

Credit Where Credit Is Due

In the current race between the collapsing global economy and government attempts to prop up asset prices, governments appear to be winning. In order to keep employees working at those companies with even a slim chance of remaining in business, policymakers unleashed the largest wave of liquidity the world has ever seen, offering free money for anyone and everyone who needs it (and even those that don’t).

As a result, capital markets are no longer properly pricing risk. Nowhere is this more evident than today’s credit markets, where companies are currently issuing debt at record low yields.

Central banks have hoovered up corporate debt under the false pretext of helping the middle class. The result: the Fed is now a top shareholder of LQD, JNK, VCHS, and VCIT, to name just a few. But no amount of Fed buying can fix the bad balance sheets of bad businesses.

Jerome Powell can’t plug these leaks forever. Like the little Dutch boy trying to plug the dike, he’ll eventually run out of fingers.

Making matters worse, businesses aren’t borrowing to fund productive investments. In the years preceding the downturn, managements issued debt to buy back stock and offset dilution from excessive compensation. Today, companies are levering up even more aggressively to plug holes in overburdened balance sheets. These holes are unlikely to get filled in any time soon.

Credit excesses were extreme before COVID was part of the world’s vocabulary. They are beyond extreme in its aftermath. As central bank intervention re-opened the tap, issuers rushed to raise liquidity to buffer them through the shutdown. Debt issuance is running at the fastest rate on record. In just the last four months, companies raised $3.9 trillion in new corporate debt, the largest amount of capital market activity ever recorded. Businesses that were already running with record leverage heading into the year piled on more leverage in response to the crisis. Eventually, something’s gotta give. When you combine record levels of corporate leverage, with record low credit spreads and the worst economic conditions in a century, you have a recipe for disaster.

There is simply no historical precedent for this behavior. In the past, corporate debt has always receded in recession as businesses cleanse the excesses of the previous cycle. Not this time. Financial imbalances that grew unchecked over the last 12 years are now more extreme than ever. Never before in financial market history have we experienced anything like this.

Over 100 companies have already cited COVID-19 as a reason for bankruptcy filing this year. There are more to come as companies are still doing the opposite of what they should be doing to clean up bad balance sheets. Which is why Edward Altman, creator of the Z-score, predicts a surge in “mega-bankruptcies” this year.7 “When there is an increase in insolvency risk, what you do not need is more debt. You need less debt.” Unprecedented cash burn and lingering unemployment will keep pressure on operating companies for some time and provide a continued supply of distressed opportunities.8 The burst of issuance we’ve seen this year may postpone insolvency for a bit, but at the cost of a much greater problem down the road.

Our view is that the sheer magnitude of this credit expansion combined with the greatest economic uncertainty we’ve ever experienced, will set the stage for the best opportunity for distressed investing that we’ve seen in the last decade. Maybe ever. Record debt issuance on top of record debt outstanding is probably not the best solution to this crisis. But it does provide patient investors with an excellent opportunity to generate equity like returns with significantly more protection from a position higher in the capital structure. Consequently, we’ve spent an increasing proportion of our time over the past few months researching the opportunity set and thinking through exactly how we want to be positioned for the coming wave of opportunity.

We plan to allocate capital across various subsectors of the credit market with investments in both stressed and distressed corporate debt, in addition to various structured credit vehicles. Given our growing excitement for this opportunity, we have decided to put a dedicated vehicle together to provide our partners with access to our best ideas in the space. For current or prospective investors who would like to learn more, please contact Tim LeRoux at tim@broyhillasset.com.

Bottom Line – Unsustainable Stock Prices

If markets are trading at half of today’s levels in a year or two, it will seem obvious to everyone in hindsight, that today’s stock prices and extreme divergences were completely unsustainable. It will have also been a very painful couple years for those that ignored them.

Current investor enthusiasm notwithstanding, risk management has never been more important. Fortunately for us, capital preservation has always been our primary focus since this family office was founded in 1980. While traditional approaches to investment management (either implicitly or explicitly) accept the fact that they will periodically see their net worth cut in half, we just don’t find that acceptable.

Big losses, like those experienced in March, can shake investor confidence even more than their bank accounts. Decision-making under such stress is far from optimal. As a result, aggressive investors that may have enjoyed the fruits of a bull market, often see those fruits spoil. A more disciplined approach, which allows gains to accrue more slowly, often ends up with a much larger basket of fruit to enjoy.

The consensus is eager to look past today’s earnings, through to next year’s v-shaped rebound in profits. But we are a long way from anything that resembles normal, as profit margins are likely to remain depressed by revenue shortfalls and incremental costs for years. As a result, today’s stock prices, still levitating near all-time highs, leaves little margin of safety and even less to get excited about. One might even say that today’s stock market offers a false sense of securities.

In closing, we want to encourage everyone to stay safe during these trying times and to adopt responsible social distancing. In turn, we will do our best to ensure your portfolio practices prudent “market distancing” and remains protected from the virus of “exuberant, irrational valuation.”

Sincerely,

Christopher R. Pavese, CFA

Chief Investment Officer

Broyhill Asset Management

via ZeroHedge News https://ift.tt/2FM3O6F Tyler Durden