Ultra-Rich Investor Group Panic Hoards Cash Ahead Of Potential Growth Scare

Tyler Durden

Mon, 08/31/2020 – 08:50

In an upside-down world of activist central banks jawboning main equity indexes to record highs with terrible market breadth, and the Trump administration finding all sorts of creative headlines (vaccine headlines, trade optimism, stimulus news, etc…) to maintain upside momentum. There’s one group of savvy investors, spooked by the continuing virus-induced downturn, panic hoarding an “unprecedented” amount of cash, reported Bloomberg.

Tiger 21, an investor club of 800 high net worth investors founded in 1999 by Michael Sonnenfeldt, raised cash holdings to 19% of their total assets, which is up from 12% at the start of the pandemic.

The investor group believes market turbulence could persist until June 2021.

“This rise in cash is an extraordinary change — statistically, this is the largest, fastest change in asset allocation Tiger 21 has seen,” Sonnenfeldt said, adding that each member typically has more than $100 million in assets.

Sonnenfeldt said, “in trying to build resources prudently, members have gained liquidity and will not immediately reinvest in those areas in order to keep and build cash to weather this storm.”

The record cash hoarding by this group of centimillionaires comes as market breadth is horrible, and a growth scare could rear its ugly head in the near term and trigger a stock market correction.

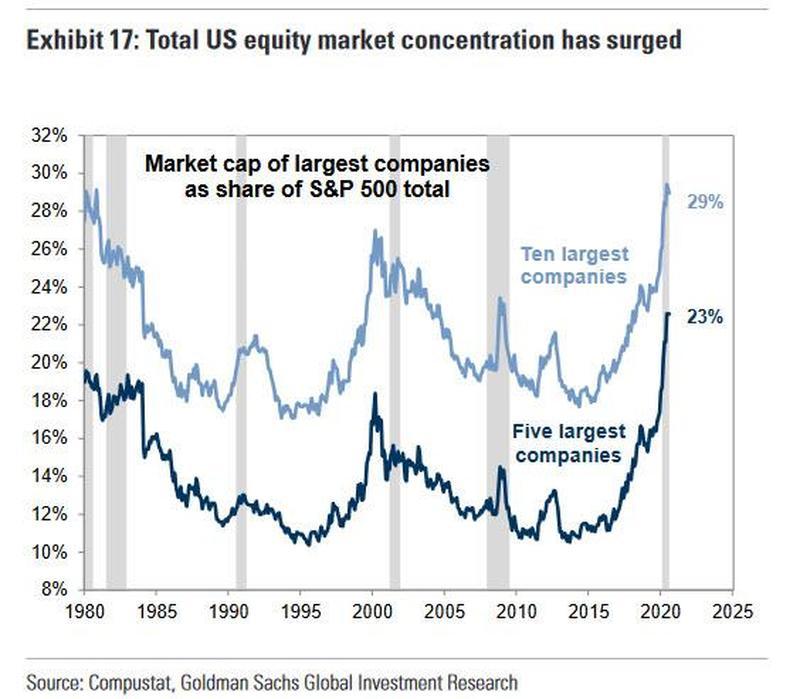

The cause behind dismal breadth, as readers may know, is shown on the following Goldman chart of the market cap of the five largest S&P companies (FAAMG), accounting for about a quarter of the market cap of the S&P500.

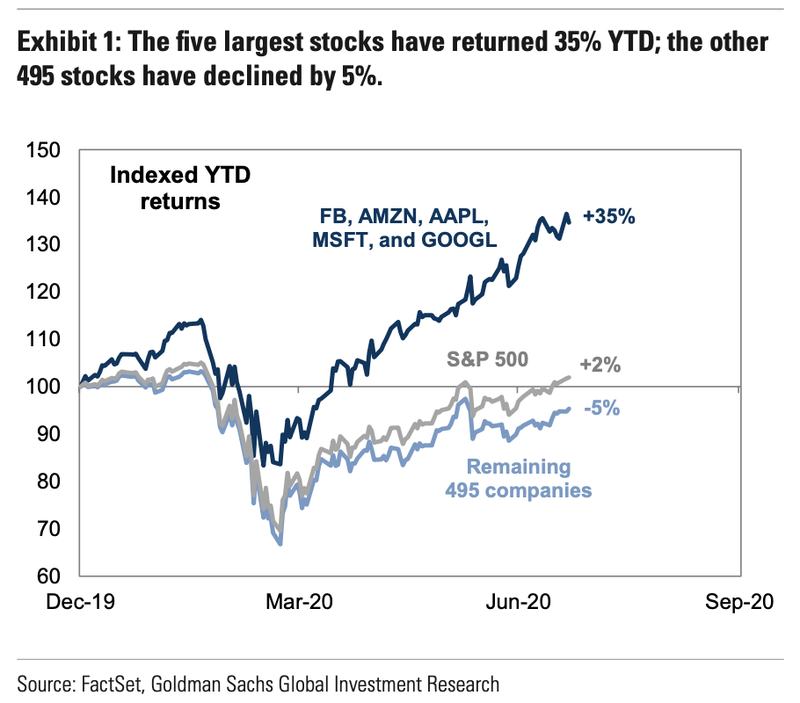

FAAMG stocks are up on the year, accounting for about 35% year-to-date gains for the S&P500; while the 495 other stocks in the main equity index have slumped by 5%.

Rising concentration risks have left the main equity index vulnerable to a market correction if tech stocks are hit with a wave of selling.

UBS Global Wealth Management’s Charles Day told wealthy clients in June to “avoid” chasing parts of the equity market pushed up into a speculative frenzy by day traders.

Readers must ask the question: Why would high net wealth investors build cash, sell stocks, and avoid chasing the blow-off top?

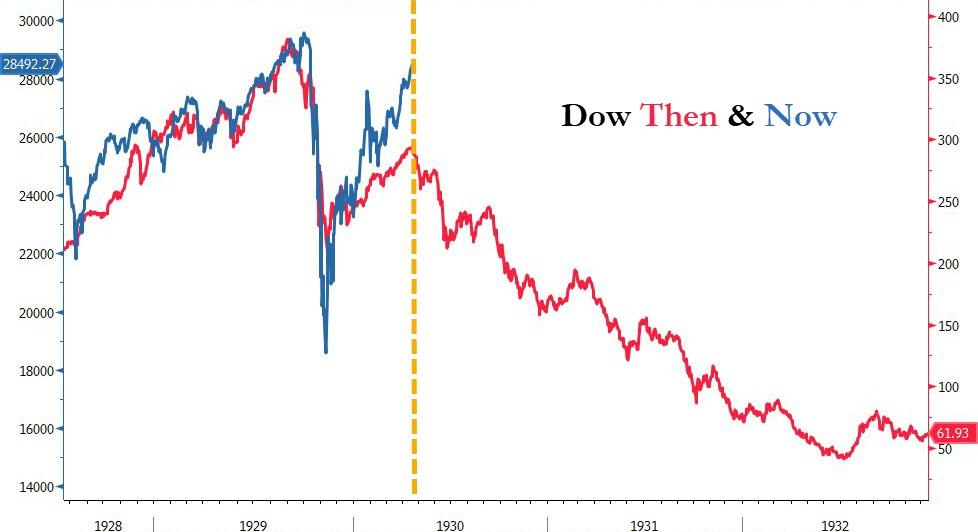

Well, the charts below might offer some clues…

Dow Then & Now

Nasdaq Y2K & Now

Readers all know how the story will end – it’s now just timing…

via ZeroHedge News https://ift.tt/3hKXzxU Tyler Durden