The Last Time This Happened Was The Day The Dot-Com Bubble Burst

Tyler Durden

Mon, 08/31/2020 – 12:20

The last few weeks have seen something ‘odd’ happening.

VIX has been ‘rising’ as stocks soared to record highs.

Source: Bloomberg

Normally, this is a warning sign since it typically suggests that professionals are buying macro overlays (protection) to lock-in gains or protect against downside for an over-valued stock market.

However, in this case, there’s another reason for the surge (which might be even more concerning) – call-buyers have gone crazy. Not satisfied with simply buying stocks, retail traders are now getting levered long in a hurry and that demand for calls has bid up volatility and lifted VIX…

Source: Bloomberg

Breaking with its typical trading pattern, the last two weeks have seen stocks and VIX rising almost in lockstep as retail specs move the risk dial to ’11’…

Source: Bloomberg

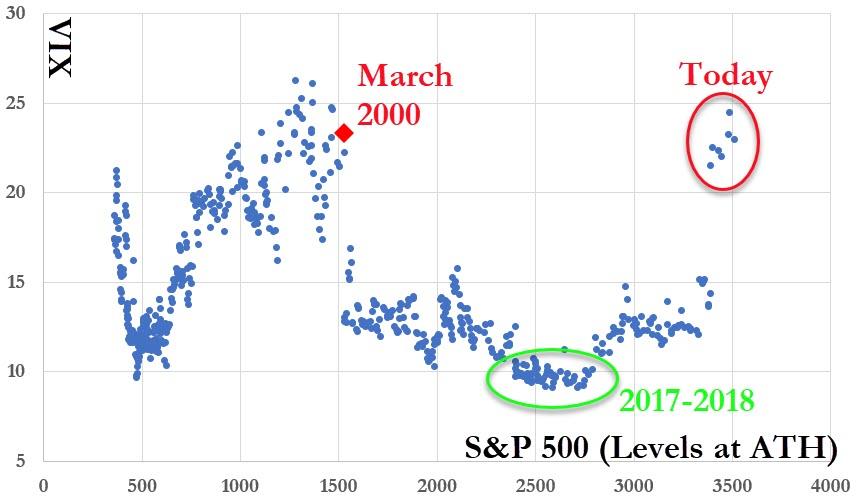

We have seen this pattern before… in March of 2000…

Source: Bloomberg

In fact as the S&P hits all-time-highs, this is a level of VIX that has not been seen since those heady days of extreme speculation and retail day-trading muppetry. This is a very different regime of ‘walls of worry’ that we saw during the 2017/2018 all-time-highs…

Source: Bloomberg

This level of co-movement between VIX and stocks is highly unusual – and has typically not ended well for stocks. Except this time is even more extreme, as the correlation between stocks and vol is at its highest since the collapse of XIV and Volmageddon 2018…

Source: Bloomberg

Oh and one more thing, valuations – no matter how you desperately adjust for hockey-sticks in the future – have never been so high…

Source: Bloomberg

Or against the country’s earnings…

Source: Bloomberg

So, to sum up:

1) Valuations have never been this extreme… ever,

2) VIX Correlation to stocks is at its highest since Volmageddon 2018, and

3) VIX and Stocks are showing similar patterns of extreme speculation as occurred right at the peak of the dotcom bubble.

Trade accordingly.

via ZeroHedge News https://ift.tt/3baZ9Xo Tyler Durden