Payrolls Preview: On The Edge Of A Slowdown

Tyler Durden

Thu, 09/03/2020 – 23:04

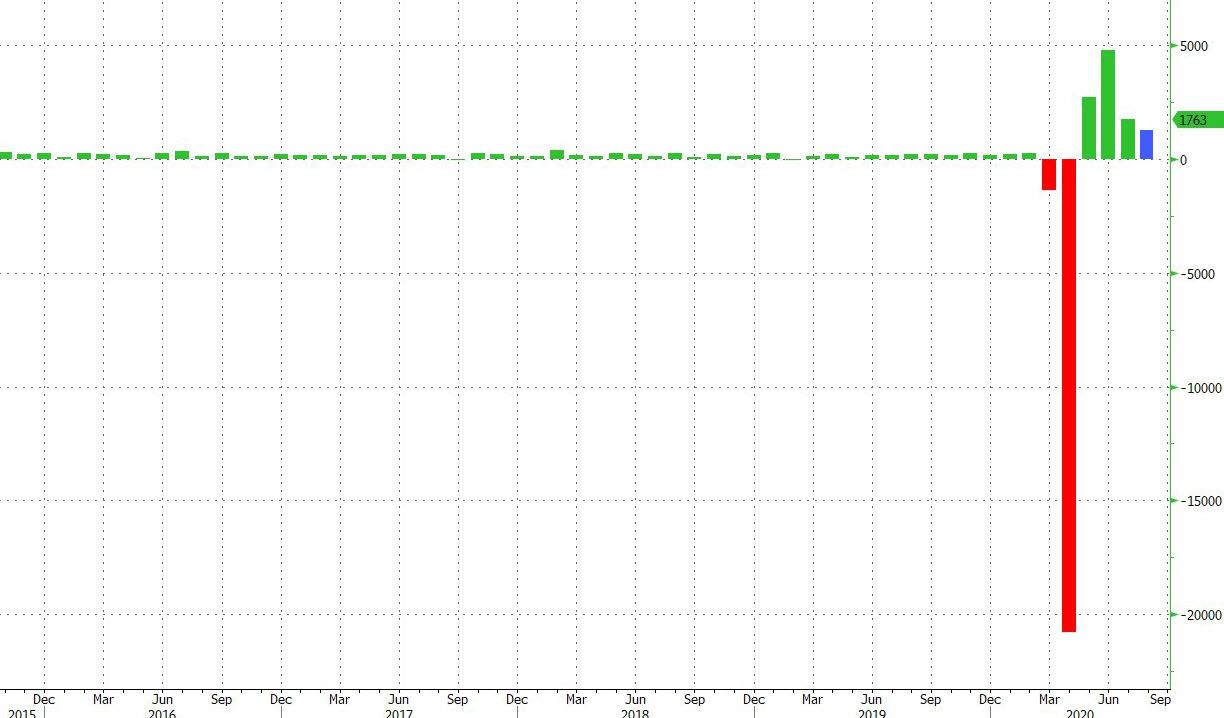

The Street expects 1.4 million nonfarm payrolls to be added to the US economy in August, which would be the weakest pace of payroll additions since the -20.8 million reading in April; according to NewsSquawk, that might signal that labor market progress is stalling.

The government payrolls metric will also matter because as noted previously it will be buoyed by the ramp-up in Census hiring. Both initial jobless claims and continuing claims continue to edge lower, although disappointed expectations in the payroll survey period, albeit the former might be a function of the reinstating of some enhanced jobless benefits, while the latter may have been restricted by the bi-weekly nature of claims being filed in certain states. ADP payrolls gauge also disappointed, and while some point out the weak link between ADP and BLS data, the gap has been narrowing in recent months; the report did show that most of the gains were concentrated in minimum wage sectors, and that might weigh on the AHE metrics in August. Survey data, meanwhile, shows that while the labor market is making progress, it is slow, and not keeping up with the pace of other activity indices.

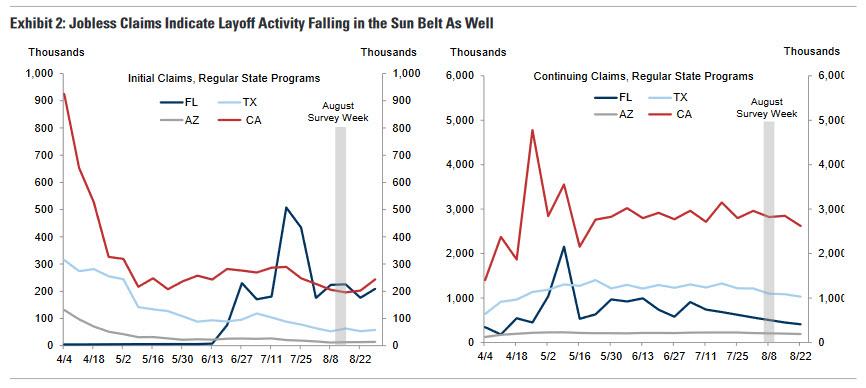

At the same time, Goldman notes that the resurgence of the coronavirus did not produce a meaningful increase in layoffs in the Sun Belt based on jobless claims data, and high-frequency surveys replicating the BLS approach indicate robust August job gains. Additionally, because of measurement issues with the BLS birth-death model, the establishment survey will better capture business reopenings and gross hiring than the mid-summer business closures resulting from the virus.

Finally, yesterday BMO said that it expects “the August data to be more market moving than the last few releases” in keeping with Powell’s comments on ‘the passage of time’ creating more economic clarity. The reason: the US economy is now far enough into the pandemic and expectations for the coming quarters are sufficiently refined that it follows intuitively that the pace of job creation (revival) seeing during Aug-Nov will level-set forecasts going into the final months of the year.

Below is a summary of expectations, courtesy of NewsSqawk:

EXPECTATIONS:

- Nonfarm Payrolls exp. 1.4mln (range -100k to +2.38mln, prev. +1.76mln);

- Private payrolls exp. +1.25mln (prev. 1.46mln);

- Manufacturing payrolls exp. +50k (prev. +26k);

- Government payrolls (prev. +301k);

- U3 Unemployment rate exp. 9.8% (range: 8.5-11.0%, prev. 10.2% (Fed sees the unemployment rate at 9.3% by end-2020); U6 unemployment (prev. 16.5%); Participation (prev. 61.4%);

- Average earnings m/m exp. 0.0% (prev. +0.2%); Average earnings y/y exp. +4.5% (prev. +4.8%);

- Average workweek hours exp. 34.5hrs (prev. 34.5hrs).

WEEKLY CLAIMS: The initial jobless claims data that coincides with the August jobs report disappointed expectations (it printed 1.1mln vs the consensus view for a fall to 925k). Some analysts argued that it may show that the recent fall in claims could have been underpinned by the expiry of enhanced jobless benefits, which rolled off at the end of July, and the tick-up in claims might have therefore been more to do with the partial restoration of those benefits (note: seven states approved additional benefits, retroactive to the 1st August). Continuing claims for the BLS jobs report survey week fell to 14.535mln from 14.758mln, not quite to the 14.45mln level that the Street was modelling. Analysts said the decline was restricted by the nature of bi-weekly filings in some key states (California, Pennsylvania and Texas), with the data coinciding with the ‘off’ week’ some estimates suggest that the rate of continuing claims decay is currently running at around -575k per week, slower than the – 800k approximate weekly pace seen in the early part of July.

ADP: The ADP reported 428k nonfarm payrolls were added in August, missing the consensus of +950k; the prior, however, was revised up from 167k to 212k. The accompanying commentary from the ADP was glum, with the payroll processor stating that job gains were minimal, and businesses across all sizes and sectors have yet to come close to their pre-COVID-19 employment levels. From a traders point of view, Pantheon Macroeconomics notes that it was the fourth straight month where the ADP print was very close to the number implied by the Homebase employment data, while the ADP gauge has fallen short of the official BLS nonfarm payrolls number, although the magnitude has narrowed in June and July. Pantheon says that assuming a further narrowing of the gap in August, it looks for the BLS data to show around +750k jobs were added (currently, the consensus looks for +1.4mln). With regards to wage growth, some analysts noted that most of the employment gains in the ADP data were within minimum wage categories – if we see this dynamic in the BLS data, it may result in wage growth falling; recall, the spike in wage growth in the BLS metrics since the pandemic began were more a function of low wage workers losing their jobs, and accordingly, falling out of the wage data sample; were minimum wage jobs to return, some suggest the average wage metrics may also edge lower. Elsewhere, and looking ahead, Pantheon says that the outright decline in small business employment in the Homebase data points to a dip in the September ADP report, and perhaps even the official BLS data too. “Even if the August pace of ADP job growth is sustained, it would take more than two years for the level of ADP employment to return to the pre-COVID peak.”

MANUFACTURING ISM: The manufacturing ISM report was generally quite solid, however, analysts did highlight that the pace of gains in the employment sub-index was lagging versus other activity subindices. The employment index itself rose by 2.1 points to 46.4 in August, the first full month of operations after supply chains restarted and adjustments were made for employees to return to work. Additionally, it remains under 50.0, and accordingly, manufacturing employment saw the thirteenth consecutive month of employment contraction, although it is worth noting that the index has improved for four straight months. Long-term labour market growth remains uncertain, but strong new-order levels and an expanding backlog signify potential strength for the rest of Q3, ISM said; respondent comments indicated that more companies were hiring, or attempting to hire, compared to actively and passively reducing their labour forces.

NON-MANUFACTURING ISM: There was a larger jump in the non-manufacturing ISM’s employment sub-index, which moved from 42.1 to 47.9, though like its manufacturing counterpart, remains under the 50.0 mark. That means the service sector employment has been contracting for six months on the trot. Respondents noted that “attrition has taken employees; hiring is authorized, but slow to materialize” and “the need for employees is greater, but we are having a difficult time filling open positions.”

GOVERNMENT PAYROLLS: Analysts will be keeping an eye on government payrolls, which are expected to pick up due to the hiring of employees to conduct the US Census; Oxford Economics explains that during Census survey years, federal employment has traditionally risen sharply in May, reflecting the hiring of temporary field staff. However, this year, the pandemic has resulted in the suspension of all field operations, but as the economy begins reopening, hiring is ramping up. The Census Bureau has said that 288k workers were paid during the August BLS survey period vs 50k during the July survey period, implying Census related hiring picked up by some 238k in the month. “This should be partly offset by weaker employment at the state and local level as governments budgets remain squeezed,” OxEco writes, “with revenues plummeting and spending increasing to cope with massive rises in unemployment and a public health emergency, state and local governments were likely forced to cut their workforce significantly to balance their budgets.”

JOB CUTS: Data from Challenger showed announced job cuts rose to just under 116k in August (+116% y/y, although -56% m/m), for the highest total August reading since 2002. YTD, employers have announced just under 2mln job cuts (+231% vs the same period in 2019), with around half of those cuts being attributed to COVID. In August, transport sectors saw the biggest job cuts, followed by entertainment/leisure companies. Challenger said that market conditions caused around 45k of the announced cuts in August, around 30k was due to the demand downturn, and around 23k due to costcutting. COVID-19 is the reason cited for 1,083,394 cuts so far this year. Challenger said that the employment landscape was dealing with a host of burdens that reach beyond job cuts; COVID and the recession continue to cause volatile conditions in many industries. It also said that both companies and workers were grappling with increasing uncertainty due to stalled economic relief, the approaching election, and child care and education concerns. “Many employees hesitate to return to the job force out of fear of exposure to COVID,” it wrote. “parents are trying to determine if they can safely send their children back to school or daycare, or if they need to facilitate remote learning. In some cases, working parents do not have a choice.”

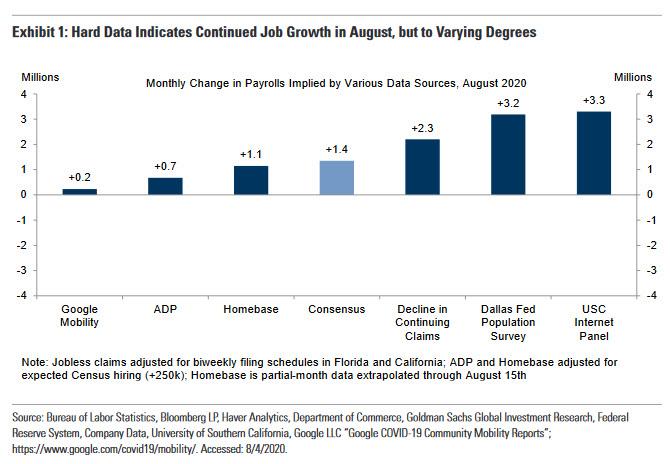

Arguing for a better-than-expected report (via Goldman):

- Big Data. High frequency data on the labor market were mixed in August (seen Exhibit 2), however all six measures we track indicated continued job gains.Furthermore, we note that the weakest two measures (Google, ADP) do not directly track the discrete impact of workers returning to their previous employers (the establishment survey counts an individual as employed provided that they work atleast 1 hour during the reference period).

- Jobless claims. While still elevated, initial jobless claims declined significantly during the August payroll month (averaging 1.2mn per week vs. 1.4mn in July). Additionally, continuing claims declined by 2.3mn from survey week to survey week(after adjusting for biweekly filing schedules in Florida and California). Notably, both measures also declined on net in the Sun Belt states most affected by the second wave of coronavirus infection (see Exhibit 2).

- Census hiring. Census temporary workers are set to boost nonfarm job growth byn255k in August, as additional field staff were hired to conduct interviews.

- Employer surveys. Business activity surveys improved on net in August, as did the employment components of our survey trackers (non-manufacturing +3.0pt to 46.3;manufacturing +2.6pt to 51.4).

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas fell 65% in August to 116k after rising 68% in July and falling 43% in June (mom, sa by GS).They remain 114% above their August 2019 levels.

Arguing for a weaker-than-expected report:

- Second Wave. The US experienced a dramatic resurgence of coronavirus during the second half of June—particularly in the Sun Belt states—and by the July Fourth holiday, nearly two-thirds of the country had paused or reversed their reopening plans. However, job growth remained firm in the July payroll report despite a pause in the Sun Belt leisure and hospitality recovery (+37k in July after +813k in June). Given the further decline in jobless claims in this region (and nationally), and the fact that the establishment survey measures reopenings and expansions more accurately than business closures, we do not expect the second wave to prevent a sizeable gain in August payrolls in tomorrow’s report.

- Seasonality. Payrolls have exhibited a tendency toward weak August first prints, which may reflect a recurring seasonal bias in the first vintages of the data. August job growth has missed consensus in 7 of the last 10 years, and on average the first vintage is 41k below the final. While a negative factor, the unprecedented scale of labor market changes from the coronacrisis renders residual seasonality a relatively marginal factor in tomorrow’s report.

- ADP. Private sector employment in the ADP report rose by 428k in August, well below consensus. We view the ADP miss as incrementally negative information;however, major differences between ADP and BLS nonfarm payrolls in terms of methodology and source data suggest scope for another divergence this month.

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—fell into contractionary territory (-3.7 in August from +2.2 in July and -2.8 in June).

via ZeroHedge News https://ift.tt/31Ug9OC Tyler Durden