Market Finally Cracks – Is The Bull Market Rally Over?

Tyler Durden

Sun, 09/06/2020 – 10:30

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Finally Cracks

Over the last few weeks, we have discussed that while the markets were continuing their seemingly “unstoppable” advance, there were many “technical extremes” reached.

Here is the problem with watching media headlines rather than paying attention to what is happening in the underlying market.

On Wednesday was this headline:

On Thursday, it was this:

Thursday was not a surprise, As noted in “Winter Is Coming:”

“The market is currently at historic market extremes. I explained this concept in much more detail in today’s #Macroview.

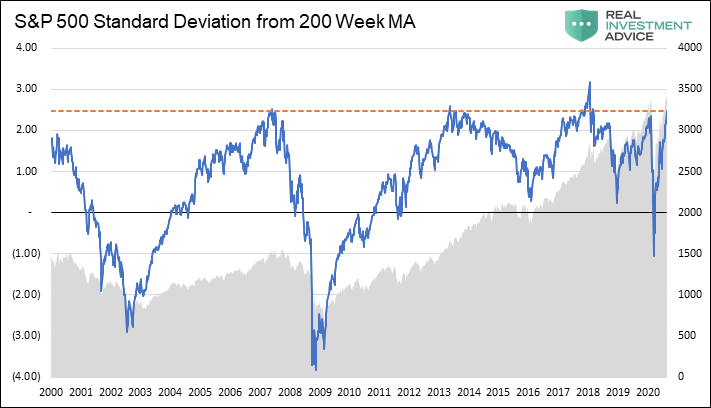

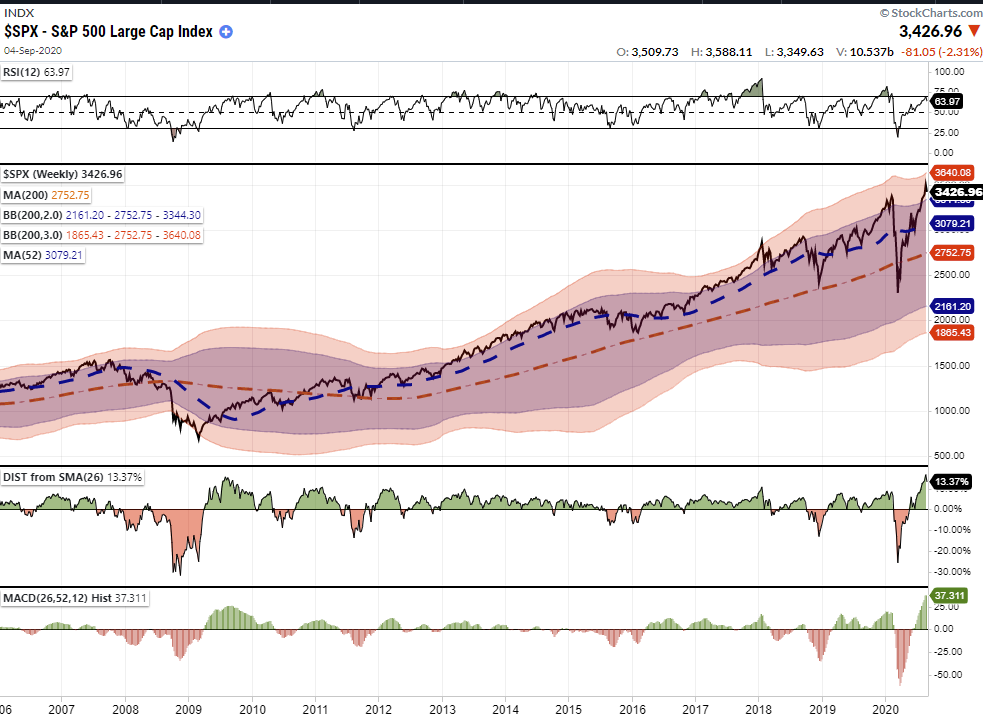

However, the most critical point of that article was the extreme deviation from long-term means. As noted, trend lines and moving averages tend to act as ‘gravity.’ The further away the market moves from the trendline, the greater the pull becomes.

When markets are pushing extremes, it seems like it is a “no-lose” scenario for investors. It is at those moments when “selling high” becomes opportunistic, but is incredibly hard to do for the “Fear Of Missing Out (FOMO)”

The question now? Was it a one day blip, or the start of a more significant correction process.

Signs, Signs, Everywhere Signs

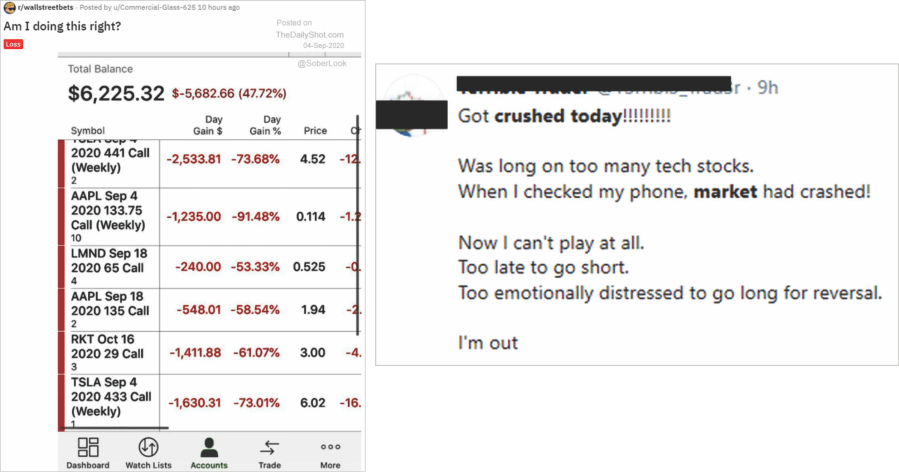

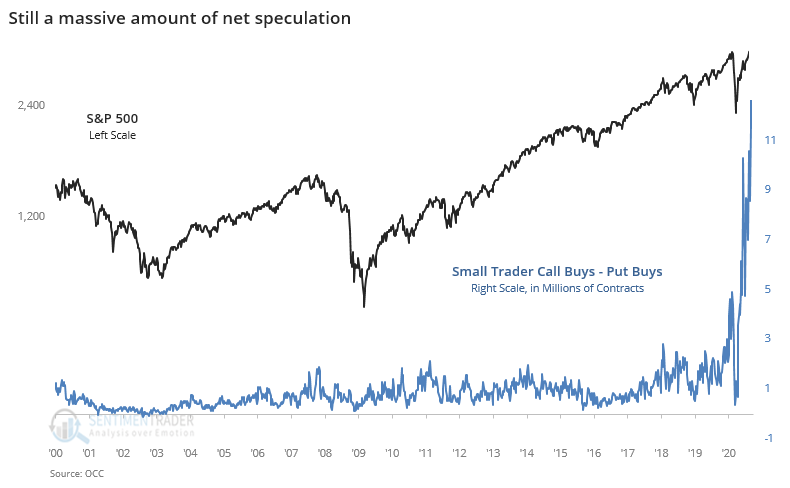

Over the last three weeks, we have been publishing “signs of exuberance,” which have ranged from incredibly high options speculation to investor positioning. Some of these indicators are now at levels only seen in 1999.

If you have 3-minutes, this video covers quite a few of the current indications which suggest risk continues to outweigh the reward.

(We publish “3-Minutes” Monday-Thursday. Click here to subscribe to our YouTube channel for email notification of all of our video postings and live-streams.)

I shot that video Thursday morning before the market opened.

So, did the Thursday/Friday selloff reverse the majority of those excesses back to levels where reward now outweighs the risk?

The short answer is “no.”

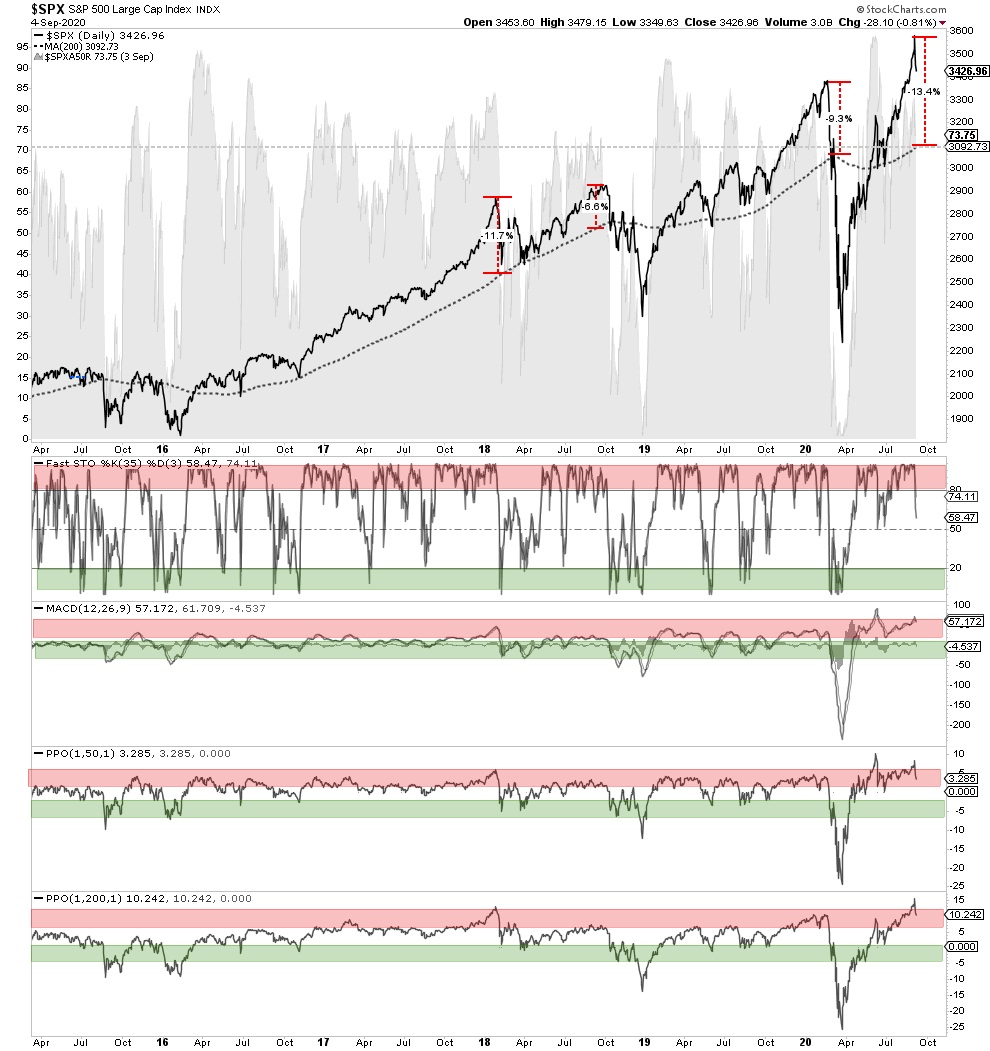

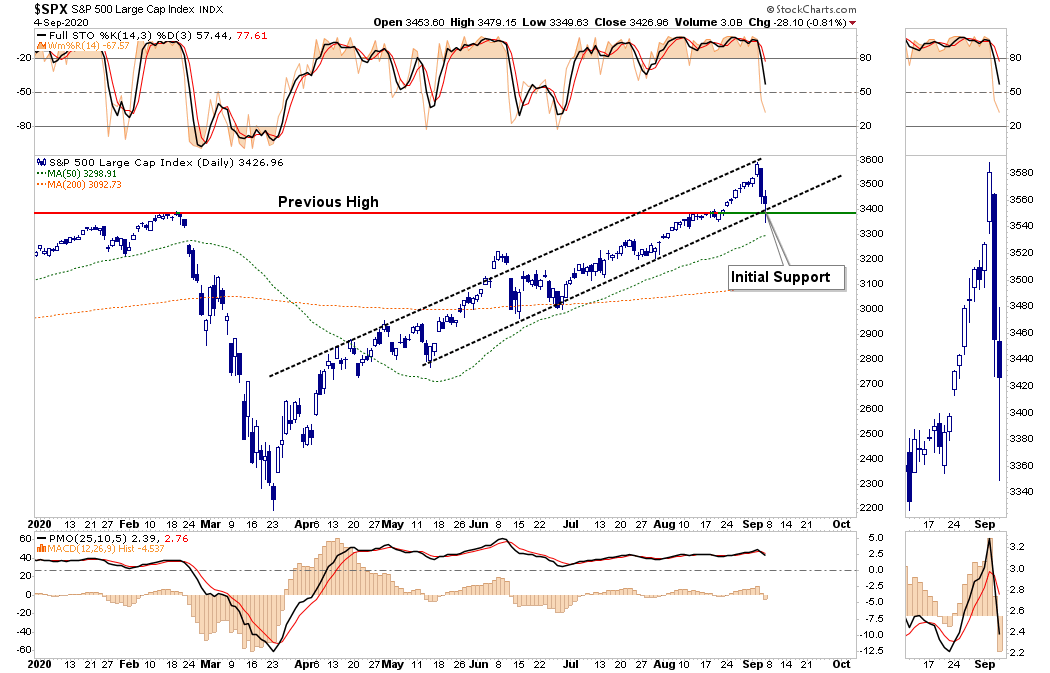

On every level, the market remains overbought and extremely extended from intermediate moving averages. A one or two-day correction will not reverse those levels back to a “buying opportunity.”

However, there is currently a tremendous amount of “bullish sentiment” in the market, which may lead to several attempts at “dip buying” before a correction is complete, which we saw on Friday.

Was that the 5% correction we talked about last week?

“None of this data means the market is about to crash.

What it does mean, as discussed in “Winter Approaches,” is that a correction of 5-10% has become increasingly likely over the next few weeks to two months. While a 5-10% correction may not seem like much, it will feel much worse due to the high level of complacency by investors currently.

All of the data suggests that “Winter Is Coming.” Therefore, this is why we are adding “value” to our portfolios to prepare for colder weather.”

Not surprisingly, the selloff on Thursday and Friday shocked a lot of inexperienced investors that thought it couldn’t happen.

Momentum Is Hard To Kill

There is one crucial aspect of the market, which you should not dismiss – “momentum” is extremely hard to kill.

Many “retail” investors will immediately view the selloff on Thursday and Friday, and the media, as a reason to pick up “stocks on the cheap.” The general bias in the short-term is that you should buy every “dip,” and for a brief period, they may indeed be proved right.

We can validate that view by looking at speculative call buyers, who, despite the pullback, increased their leveraged market bets. (Chart via Sentiment Trader) Furthermore, this amount of speculation is historically unprecedented. The eventual outcome when this all unwinds is obvious.

However, in the short-term, the market has pulled back to very short-term support. We suspect the pullback will entice a lot of the momentum buyers, and those who “missed out,” to jump back in. A sellable bounce next week, in lighter post-holiday trading, is very likely.

Furthermore, as we noted previously in a “Tale of Two Bull Markets,” the deviations longer-term are still problematic. The extensions are so large it will require several days to weeks of a correction to work off the extremes. As shown, last week’s decline is barely noticeable and did little to reverse the longer-term overbought conditions.

Currently, we are trapped.

In the longer-term, markets are overbought, overvalued, and extended against a backdrop of weakening economics, a potential political upheaval, and poor earnings outlooks.

On the other hand, we have an exceedingly bullish market, extreme momentum, and a shorter-term defined bullish uptrend.

So what do you do? The same as do you with a “porcupine.”

You deal with it very carefully.

…

If the short-term trend of the market changes from bullish to bearish, we too shall change our positioning accordingly.

The problem for most investors is either a lack of a discipline to manage capital or an unwillingness to acknowledge that what was working no longer is.

We prefer to acknowledge change and have the discipline to deal with it.

via ZeroHedge News https://ift.tt/358Ha2Y Tyler Durden