Crude Hits 2-Month Lows As Saudi Price Cuts Signal Demand Woes

Tyler Durden

Mon, 09/07/2020 – 09:52

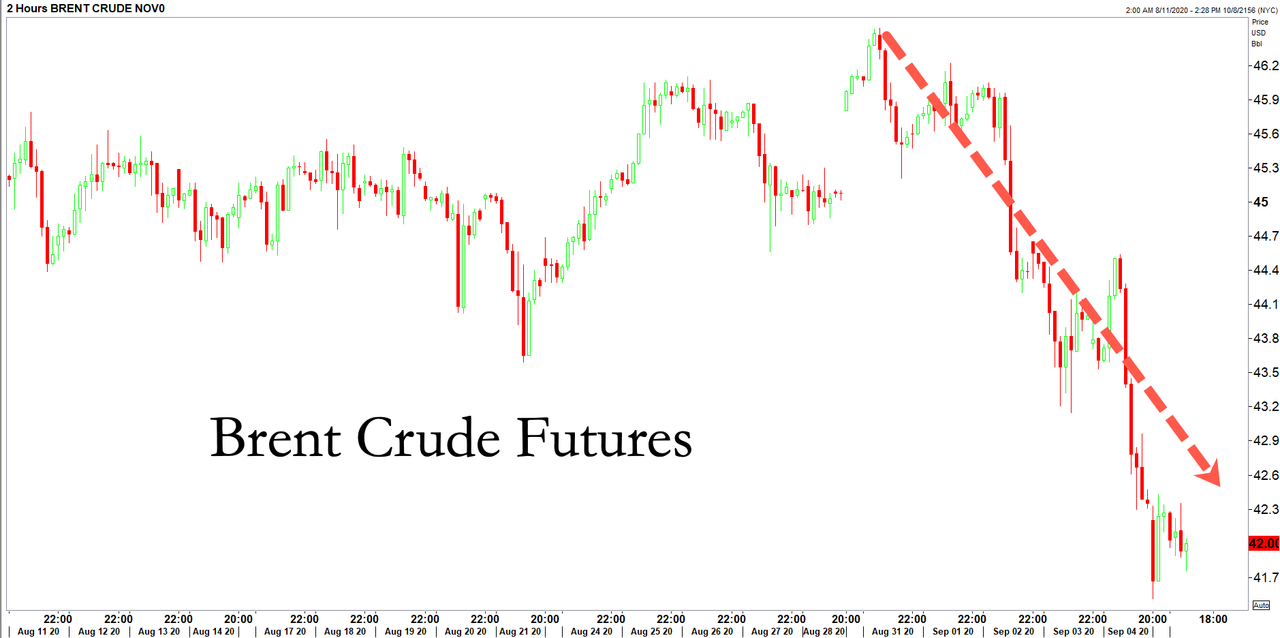

Crude prices slid 1.5% on Monday, declining to levels unseen since late June, after Saudi Arabia announced a round of price cuts as global demand struggles to recover from the virus pandemic.

Brent crude was trading at $42, down 68 cents or, -1.5%, after contracts sank on Sunday evening to $41.51, the lowest levels since July 1.

WTI is more notably back below $40, its weakest since June.

Saudi Arabia slashed Oct. Arab Light crude prices for shipments bound to Asia and the U.S. in the latest sign that global fuel demand is waning in the back half of the year.

“Saudi Aramco reduced its key Arab Light grade by a larger-than-expected amount for shipments to Asia in a sign that fuel demand in the largest oil-importing region is wavering. The company also lowered prices to the U.S. for the first time in six months,” reported Bloomberg.

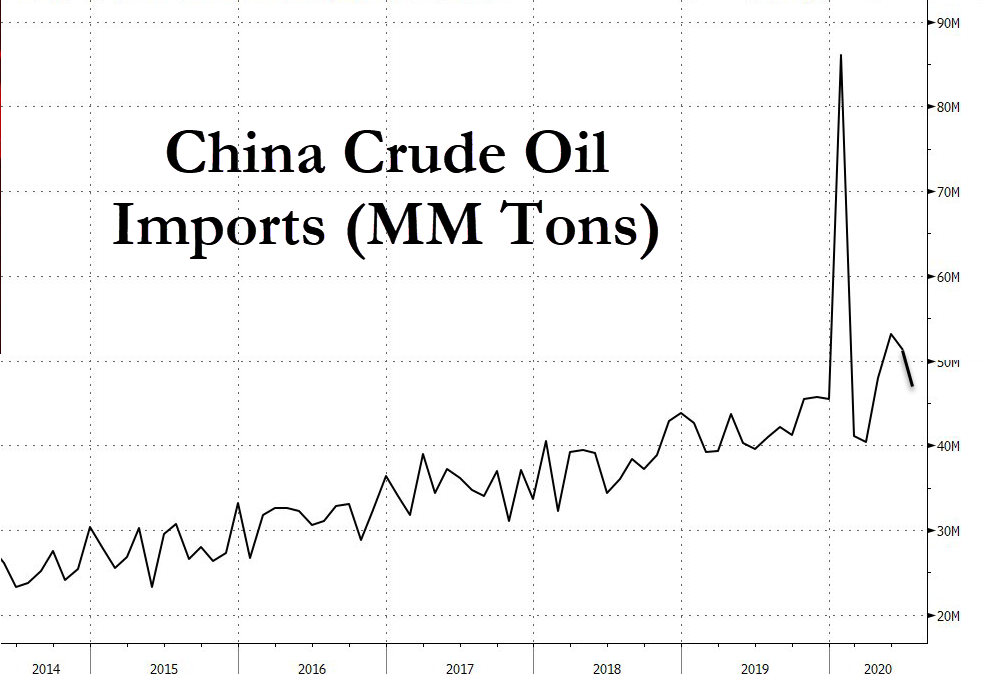

Further compounding demand fears, Chinese crude imports have declined for the second month in August, suggesting the world’s largest importer will purchase less crude in Sept. and Oct. than it did in May and June as refiners run out of quota after a surge in buying earlier in the year.

Even with the lowest Saudi crude prices in four months, it wasn’t enough to entice buyers into bolstering demand in the region. Only about 40% of Asian refiners, big buyers of Saudi crude, said they’d purchase more of the Kingdom’s crude.

Readers may recall that an alliance between OPEC and Russia, otherwise known as OPEC+, eased production cuts in Aug. to 7.7 million barrels per day as prices rose following the crude crash in March and April.

“Prices were perhaps overdue a bit of a correction,” said Paul Horsnell, head of commodities research at Standard Chartered, who spoke with Bloomberg.

Horsnell said, “the demand recovery coming in a bit flatter than early expectations has been one of the key themes in fundamental data over the past couple of months.”

Despite OPEC+’s initial supply cuts, which are now being augmented by cuts to prices as well, Saudi hasn’t seen an expected rebound in demand, suggesting that Aramco’s expectations for a “V-shaped” rebound were a little too rosy. Much of the world remains awash in crude and fuel supplies as virus outbreaks have emerged in Europe, parts of Asia, and the U.S. continue to weigh on demand.

Commodities analyst at ANZ said, “with the Labour Day (holiday) in the U.S. officially marking the end of the summer driving season, investors are also facing up to the fact that demand has been lackluster, while inventories remain at elevated levels.”

Russian Deputy Energy Minister Pavel Sorokin was recently quoted by Rossiyskaya Gazeta newspaper as saying global oil demand might not get back to 2019 levels for another ‘two to three years.’

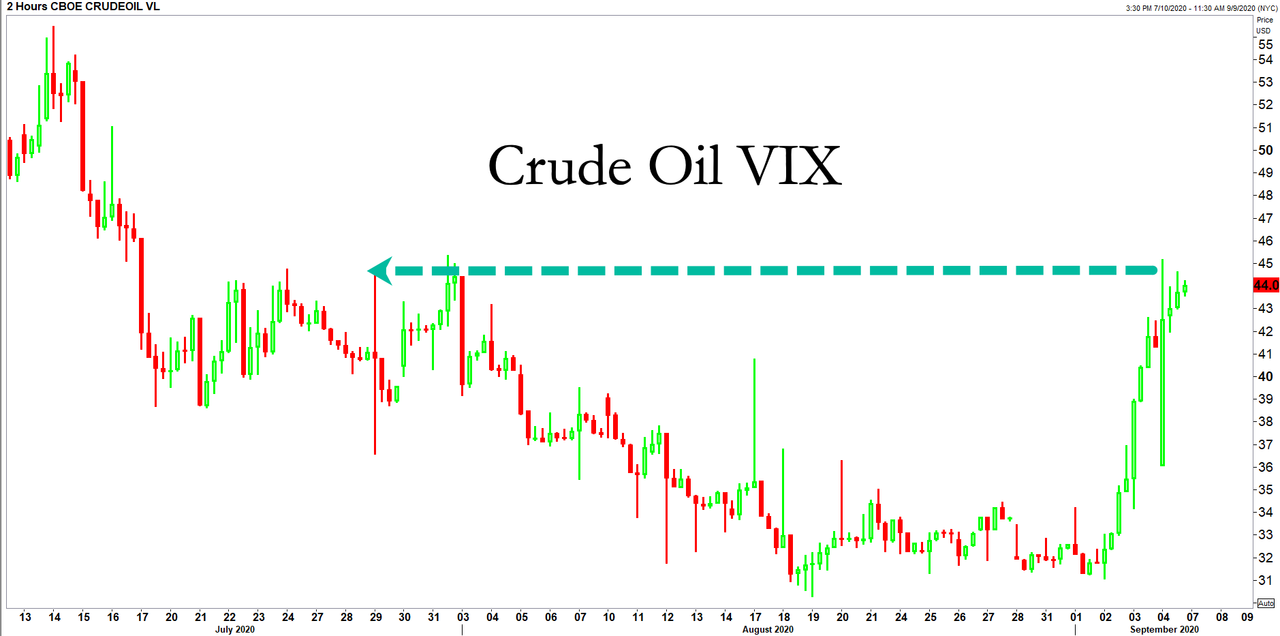

As the recovery narrative is dealt with another blow, oil price volatility has climbed back to late-July levels.

We recently quoted OilPrice.com, which highlighted three reasons (another supply glut, virus uncertainty, renewables boom) on why oil prices may remain depressed. Slumping commodity prices, and the recent plunge in global stocks, is just another sign that the global rebound is faltering.

via ZeroHedge News https://ift.tt/32YOeMI Tyler Durden