Platts: 5 Commodity Charts To Watch This Week

Tyler Durden

Mon, 09/07/2020 – 14:40

Via S&P Global Platts Insight blog,

California’s power market feels pressure from extreme high temperatures in this week’s selection of energy and commodities trends to watch. Plus, EU gas vs coal power generation, the link between crude oil and US inflation, and more.

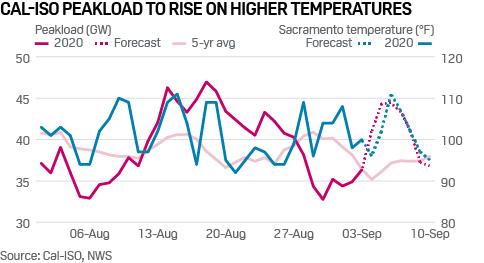

1. Extreme California heat boosting power demand, prices

What’s happening? The California Independent System Operator imposed restrictions on maintenance September 5-6 with demand forecast to top 40 GW and temperatures forecast to reach as high as 118 degrees Fahrenheit even as the region continues to battle numerous wildfires. Spot power prices spiked, with peakload and temperatures forecast to climb. Pricing point SP15 on-peak day-ahead for September 3-4 traded around $75/MWh on the Intercontinental Exchange September 2, a 135% jump day on day compared with its previous settlement.

What’s next? Broadly, these conditions should not change over the short term: an excessive heat watch is in place across most of California and parts of Nevada and Arizona, which could lead to elevated power prices this week. Additionally, wildfires continue to burn across much of the state, which could impact electricity infrastructure. Firefighters are battling more than 20 major fires and lightning complexes in California, with tens of thousands of people currently evacuated.

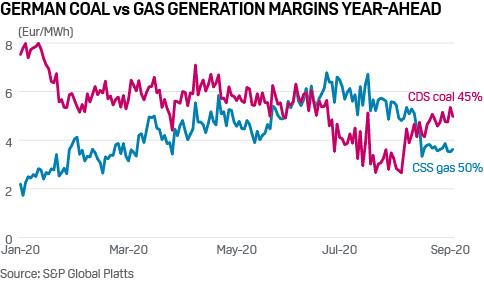

2. German gas-fired generation margins fall as fuel costs rally

What’s happening? German gas-fired generation margins have fallen from record highs in July, moving below comparable coal-fired margins for 2021, S&P Global Platts data show. Behind the latest swing is a sharp rebound in fuel costs: front-month gas on the benchmark Dutch TTF hub has tripled from lows in May. EU CO2 prices dipped in August, but remain high enough to keep less efficient coal units offline for now. Power prices, meanwhile, continue to strengthen amid gradual demand recovery, supported by record-low nuclear generation in Germany and France.

What’s next? Germany’s first coal plant closure compensation auction for 4 GW of hard coal capacity ended September 1. Units awarded compensation are to close by end-2020. Newer, more efficient coal plants with 45% efficiency, however, are likely to return gradually from Q4 as clean dark spreads edge above clean spark spreads. While 2020 coal generation is set for a new record low, German gas-fired output is on track for significant on-year gains with the long-term trend of improved gas margins remaining intact. This has prompted RWE and Uniper to return mothballed gas plants to service from October 1.

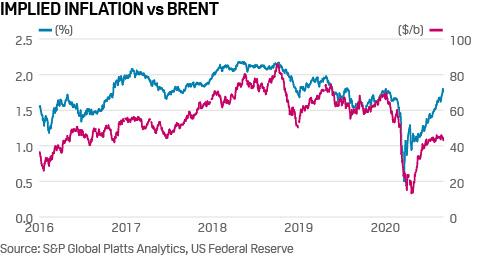

3. US FED boost to inflation supportive to oil but not enough to lift prices higher

What’s happening? Oil prices have partially recovered from April lows, when the expiration of the May WTI contract pushed them into unprecedented negative territory. The oil price recovery has coincided with a rise in implied inflation and a weaker dollar. Implied inflation – the difference between nominal interest rates and inflation protected Treasury rates – received a boost recently, associated with a policy shift by the US Federal Reserve, to likely allow inflation run above its 2% target for a period of time.

What’s next? Oil ultimately trades on its own fundamentals, though implied inflation and the value of the US dollar are recognized by the market at the margin. The recent disconnect between oil and implied inflation is partly related to oil entering a seasonally soft period for crude and product demand, along with weak refining margins and excess inventories. Longer term, oil will only be supported, or strengthen further, if excess inventories are worked off, refining margins improve, and product demand recovers. S&P Global Platts Analytics believes that could occur deeper into Q4, but more likely not until H2 of 2021. For now, the uptick in implied inflation is supportive to oil prices, but is not sufficient, of itself, to pull prices higher. Ultimately that requires stronger fundamentals.

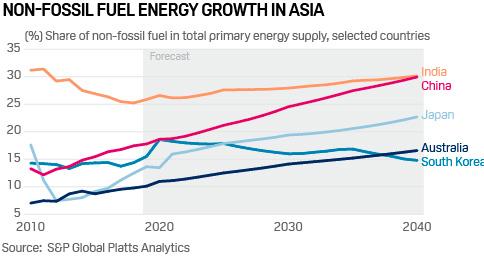

4. Asia’s energy transition ramps up with rising non-fossil fuel contribution

What’s happening? From hydrogen to solar power, Asian countries are stepping up efforts to prepare themselves for energy transition and reduce their dependence on fossil fuel imports.

What Next? The challenge of the energy transition in Asia and other fast-growing economies is to not only satisfy incremental demand growth with low-carbon or carbon-free energy, but also make strides toward decarbonizing existing demand. According to S&P Global Platts Analytics, in order to meet two-degree warming targets, Asia will need to curtail CO2 emissions by nearly 20% of 2019 levels by 2030, while growing total primary energy supply by an average annual rate of 0.7% to meet rising demand.

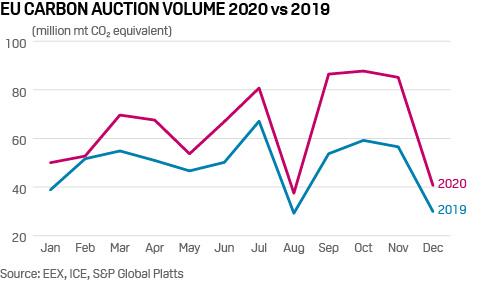

5. EU carbon prices hold above Eur28/mt, but supply hike looms

What’s happening? EU carbon dioxide allowance prices held up at above Eur28.00/mt in early September, amid stronger natural gas prices and as well as longer-term bullish elements linked to tighter carbon allowance supplies in the fourth trading phase which starts in January 2021. Adding to this, the European Commission is expected to announce a revamped EU 2030 emissions reduction target – likely in late September – which is very likely to play into a steeper fall in the annual carbon caps later in the decade to 2030, tightening the supply of allowances.

What’s next? However, recent carbon price strength may be tested as September progresses, with monthly auction volumes set to rebound to over 86 million mt, compared with just 37.5 million mt in August. This will become apparent this week, as auction volumes fully rebound after some holidays in late August and early September which reduced weekly volumes. Auctions volumes are set to jump to 20.8 million mt in the week starting Sept. 7, compared with just 11.8 million mt in the week starting Aug. 31, which may work to counteract some of the recent bullish sentiment.

via ZeroHedge News https://ift.tt/3i8Pbsf Tyler Durden