Americans Pay Down Credit Cards For 5th Consecutive Month As Post-Covid Deleveraging Continues

Tyler Durden

Tue, 09/08/2020 – 15:21

After three months of record declines, total US consumer credit posted its first increase in the month of June since the covid crisis, rising by a modest $8.9 billion, a number which has now been revised to $11.4 billion, and in the latest consumer credit report released by the Fed, in July total consumer credit rose again, increasing by $12.9 billion.

In total, July consumer credit rose at a 3.6% annual rate to $4.13 trillion according to the Fed’s latest G.19 statement.

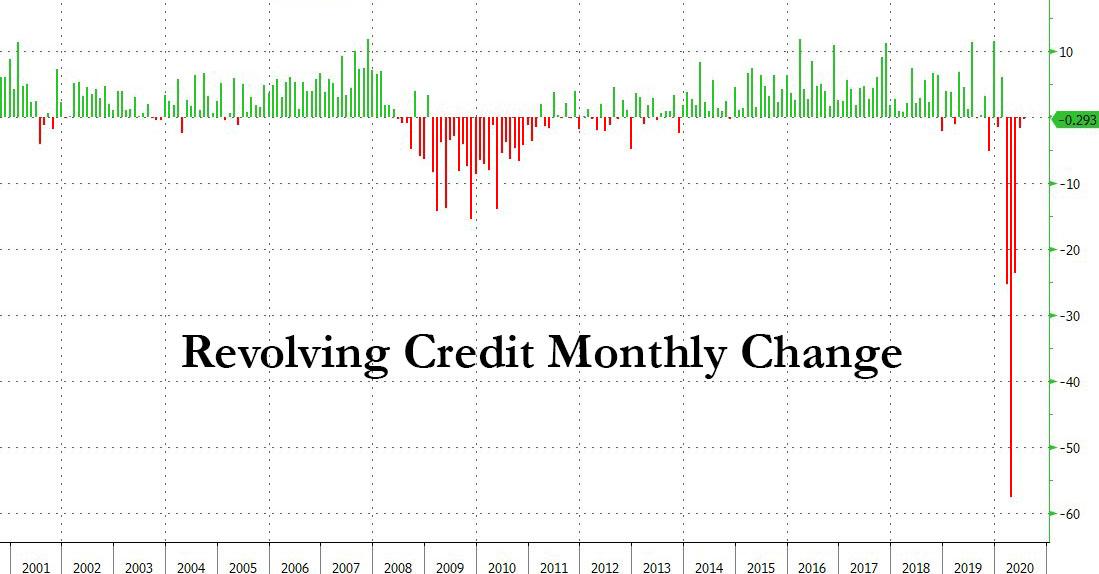

What was more notable, however, is that revolving credit – i.e., credit card debt – shrank once again, the 5th consecutive monthly decline, dropping by $293 million to just below $1 trillion.

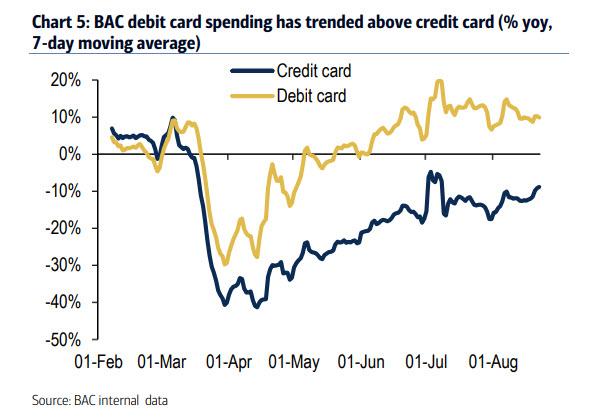

This is the longest stretch of credit card deleveraging since the financial crisis, and confirms that in the post-covid world few are willing to go crazy and charge everything in sight. The date also confirms the latest BofA card data, which showed that while debit card usage is now well above year-ago levels, credit card-funded spending continues to decline.

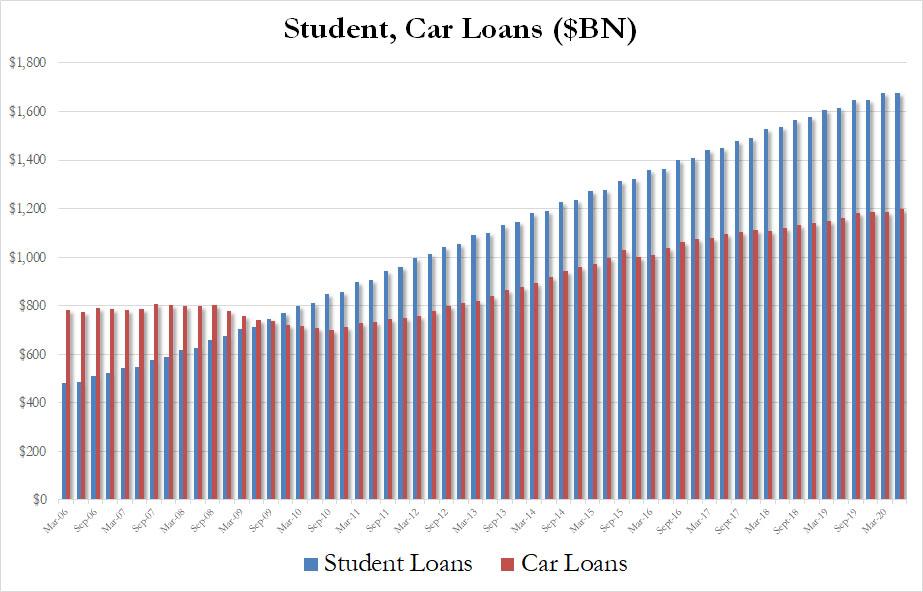

Meanwhile, the trend higher in auto and student loans, i.e., non-revolving credit, continued apace and in July it rose by $12.5 a modest drop from the $13.2 billion increase in June.

Finally, when looking at the biggest component of US household debt after mortgages, namely auto loans and student loans, it’s as if nothing every happened, with both series hitting new all time highs: student loans rose by $2.2 billion to $1.6757 trillion as of the end of Q2, while auto loans increased by $11 billion in the three months ended June 30, reaching a record $1.198 trillion.

With total credit now once again positive, and revolving credit expect to finally turn green in August (unless the fiscal cliff hammers credit card spending) it appears that life in America – where virtually everyone spends well beyond their means – is back to normal…. at least until the next artificial crisis.

via ZeroHedge News https://ift.tt/32bAaQW Tyler Durden