Crude Crushed, Tech Wrecked, Banks Battered; Bonds & Bullion Bid

Tyler Durden

Tue, 09/08/2020 – 16:01

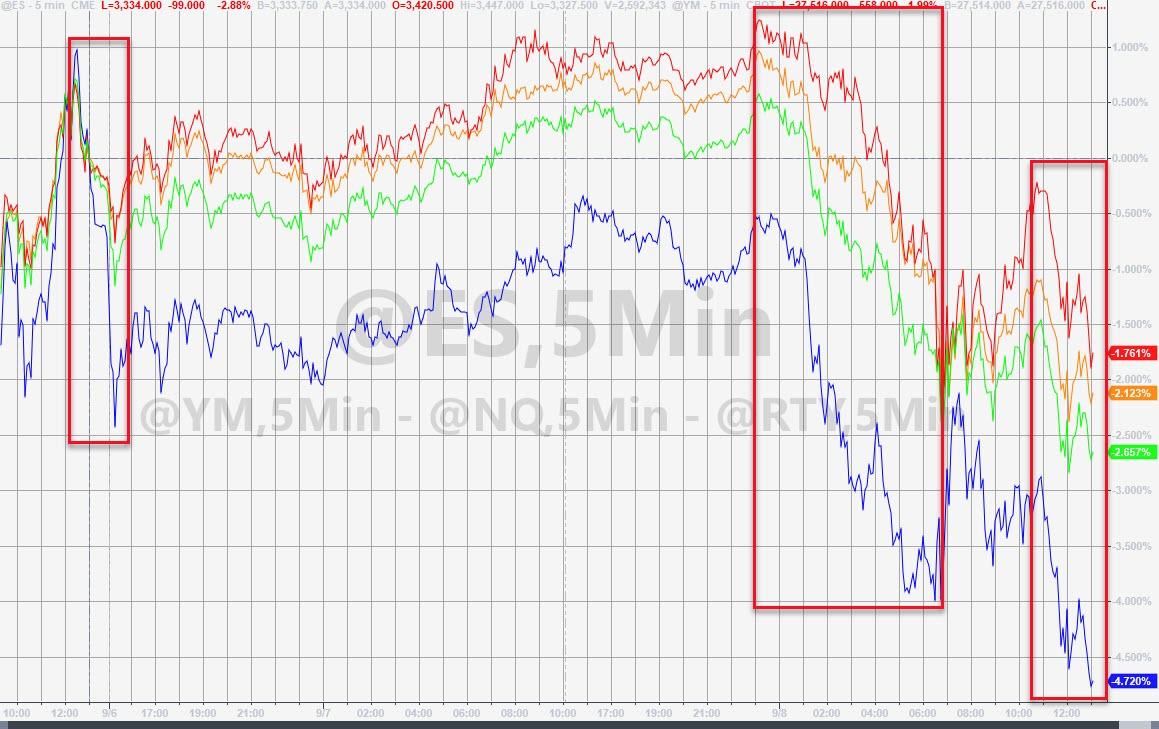

Nasdaq futs are down 11% (correction from their highs last week), and the rest of the majors are down around 5%…

This is Nasdaq’s worst 3-day performance since March (3rd worst 3-day drop since 2001).

Turn the Softbank machines back on!!!!

From Friday’s close, Nasdaq was clubbed like a baby seal and when the 1430ET margin calls hit, stocks legged lower once again…

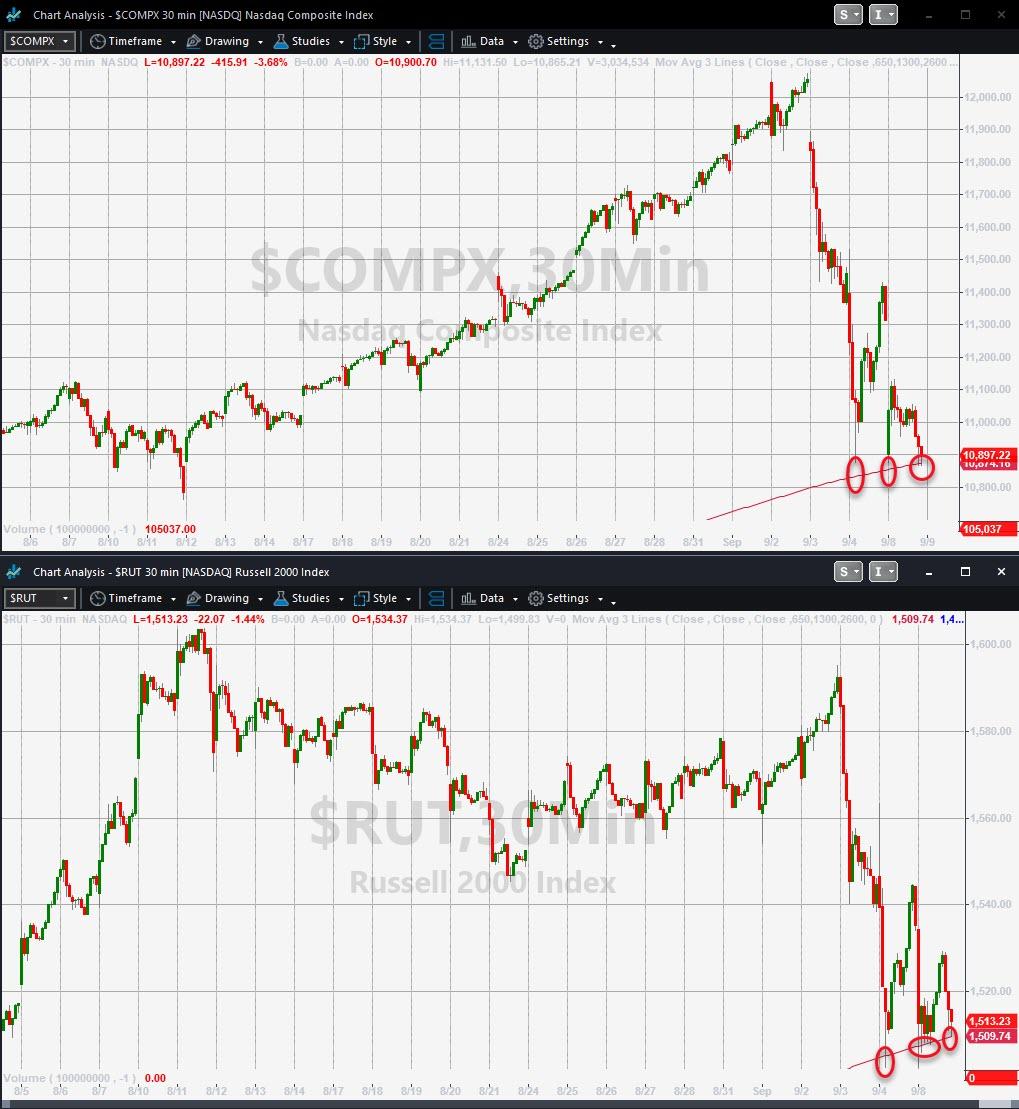

Small Caps and NASDAQ found support at their 50DMA…

Remember when the collapse/divergence of breadth meant nothing at all?

Source: Bloomberg

All the big momentum trades are reversing hard.

Big Tech…

Source: Bloomberg

FANG stocks…

Source: Bloomberg

TSLA (worst day since 2012) lost around $85bn in mkt cap (oe put another TSLA lost a BlackRock, or an Altria, or a Morgan Stanley)…

This was at $140 post split pic.twitter.com/qcD0KalGKX

— zerohedge (@zerohedge) September 8, 2020

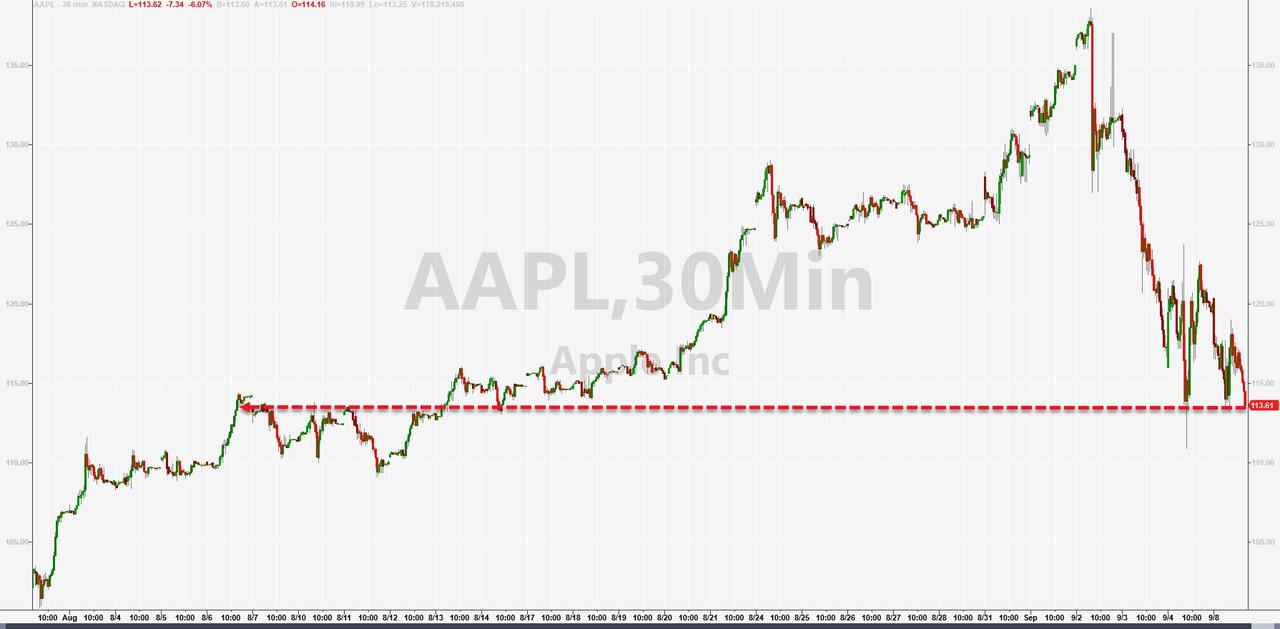

AAPL…

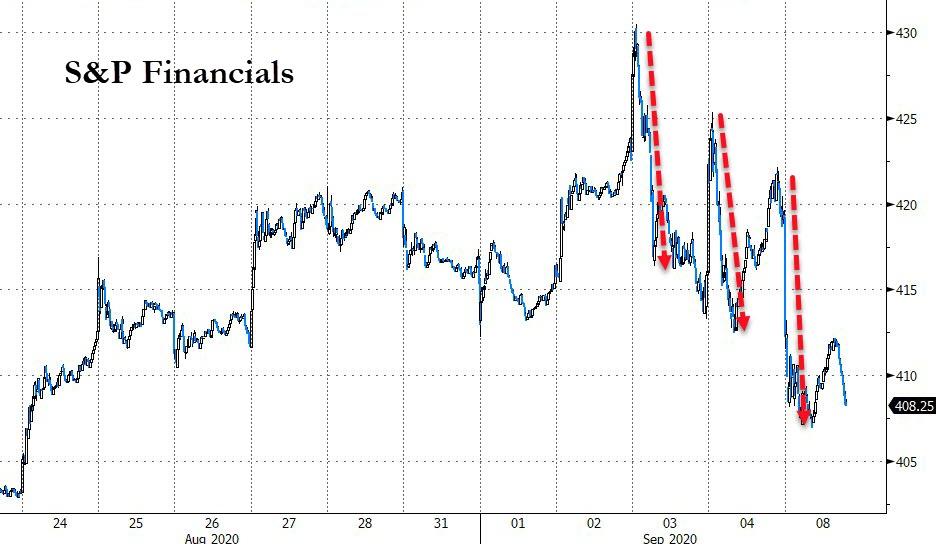

Banks…

Source: Bloomberg

“Work from Home” stocks plunged…

Source: Bloomberg

Semis…

Source: Bloomberg

Energy…

Source: Bloomberg

VIX was up today but trapped in a range…

WTI Crude…

But don’t sweat it – CNBC’s Bob Pisani said “We’ve got a healthy correction going on.”

Still a long way to go for stocks to catch down to bonds…

Source: Bloomberg

Not everything was down. Gold gained after rebounding from early weakness…

Bonds were bid all day with the long-end outperforming…

Source: Bloomberg

With 10Y Yields back below 70bps…

Source: Bloomberg

As Bloomberg noted, freshly-minted bond bears got a harsh lesson in market timing on Tuesday as a precipitous drop in technology shares sent investors in search of havens. Short interest as a percentage of shares outstanding on the $17.2 billion iShares 20+ Year Treasury Bond ETF, ticker TLT, jumped to 9.8% from about 4.4% from the start of last week, according to data from IHS Markit Ltd. That’s the highest level since 2018.

The dollar rallied for the 5th day in the last 6…

Source: Bloomberg

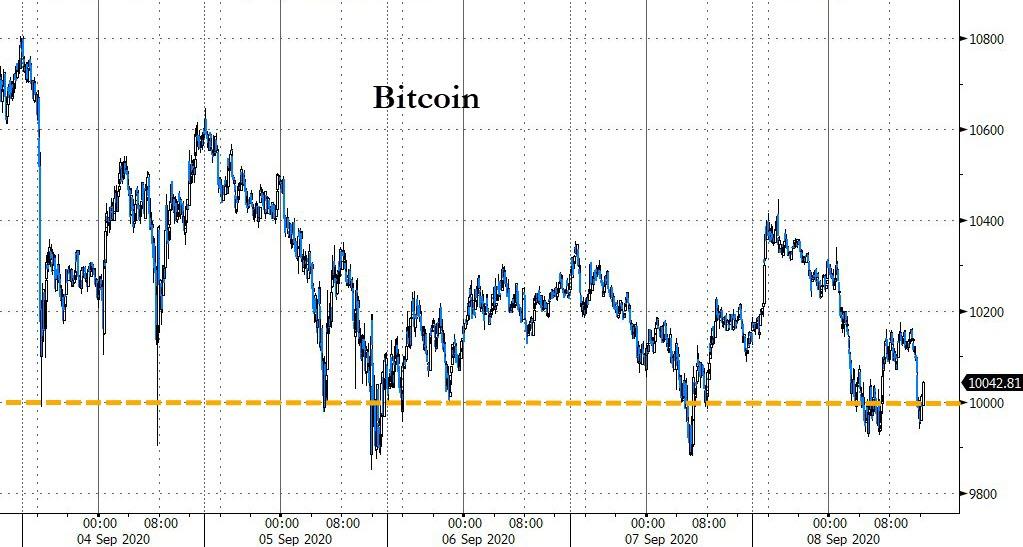

Bitcoin was flatish, hovering around the $10k mark…

Source: Bloomberg

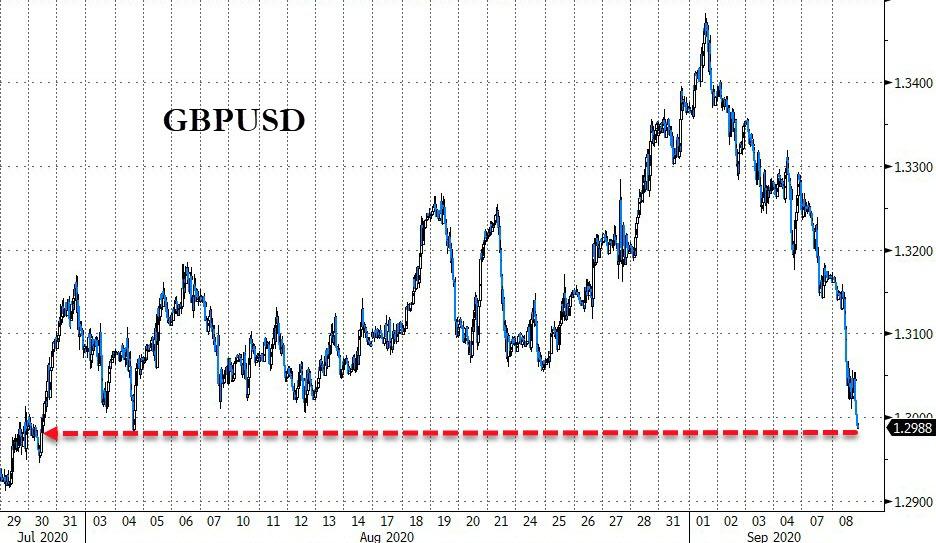

Cable was weak for the 5th day in a row (worst day since March), back below 1.30 amid Brexit uncertainty…

Source: Bloomberg

As downbeat as it is, we give the last word to Liberty Blitzkrieg’s Mike Krieger, who tweeted the following ‘public service announcement’:

“The worst thing you can do right now is assume Washington D.C. is going to help you in any way whatsoever. Not happening. The people there hate you and don’t care what happens to you. Focus on local and get your shit together. Nobody’s coming to save you.”

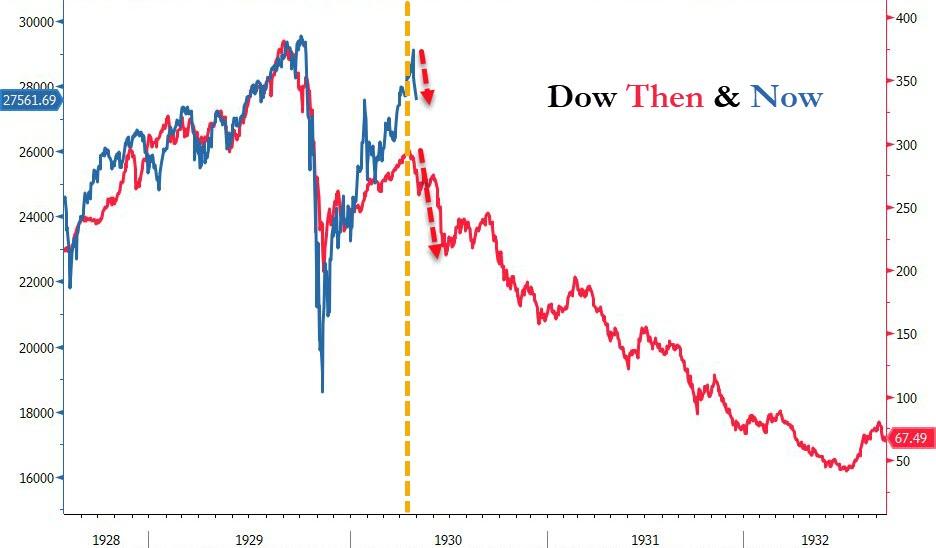

It can’t be that easy can it?

Source: Bloomberg

via ZeroHedge News https://ift.tt/3k4kchP Tyler Durden