“We’ve Just Had The Largest Global Upgrade Cycle Since The Dawn Of Personal Computing”

Tyler Durden

Wed, 09/09/2020 – 20:40

Submitted by Nicholas Colas of DataTrek

Even as there are many story lines behind the 3-day, 7% sell-off in the S&P 500, we will focus today on just one: the 11% selloff in the large cap Technology sector.

Three points on this:

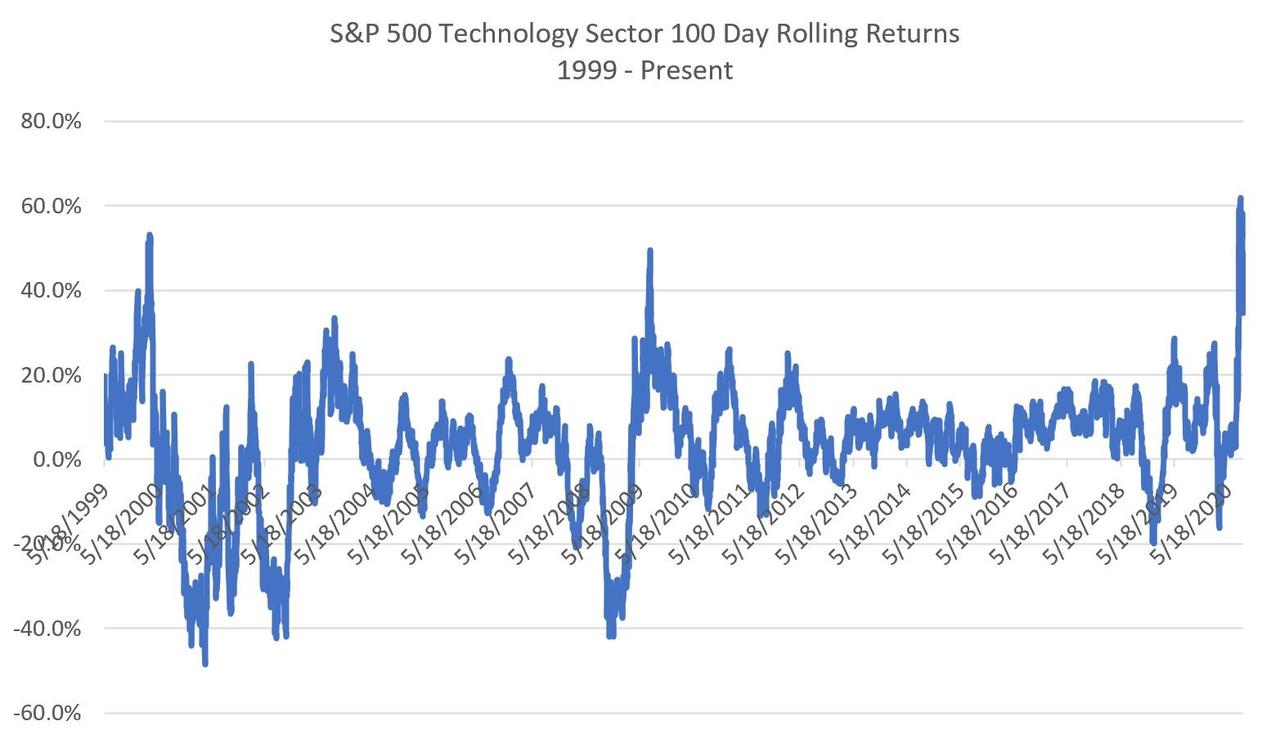

#1: First, let’s look at the sector’s historical 100-trading day returns back to 1999 to get a sense of where the rally from the March 23rd, 2020 lows fits in that context. We chose the 100-day timeframe because it is both a convenient round number and because it is close to the 120 days since those March lows. Here is a chart of rolling returns over that timeframe:

A few things pop out from this data:

-

The S&P Technology sector just posted a record (back to 1999, at least) 100-day return on August 13th with a 62% increase. Note: the group rallied further, but this was the top in terms of momentum.

-

That is more than a 2 standard deviation move (+45.6%), and only 2 other periods have shown similar returns. One ended on March 21, 2000 with a 53% advance, the other on July 30, 2009 with a 50% increase.

-

The first precedent (2000) was the beginning of the bursting of the dot com bubble. Three months later Tech would be 9% lower and a year later it would be 55% lower.

-

The second precedent (2009) was the rally off the March Financial Crisis lows. Three months later Tech would be 4% higher and a year later it would be 11% higher.

-

NB: the large cap Tech sector has had more than its share of redefinitions since 1999, so we won’t overanalyze whether 2020 is actually a record 100-day rally. Given the strong correlations between “Tech” and names like Amazon, Google and Facebook, however, we do think the analysis here is broadly representative of sector returns writ large.

Takeaway: Tech only returns +50% over 100 days in 1) a bubble (2000) or 2) a cyclical recovery (2009) and we continue to believe 2020 fits the latter paradigm better than the former. At the end of the day 2020 is an early cycle year (more like 2009) rather than a late cycle one (like 2000).

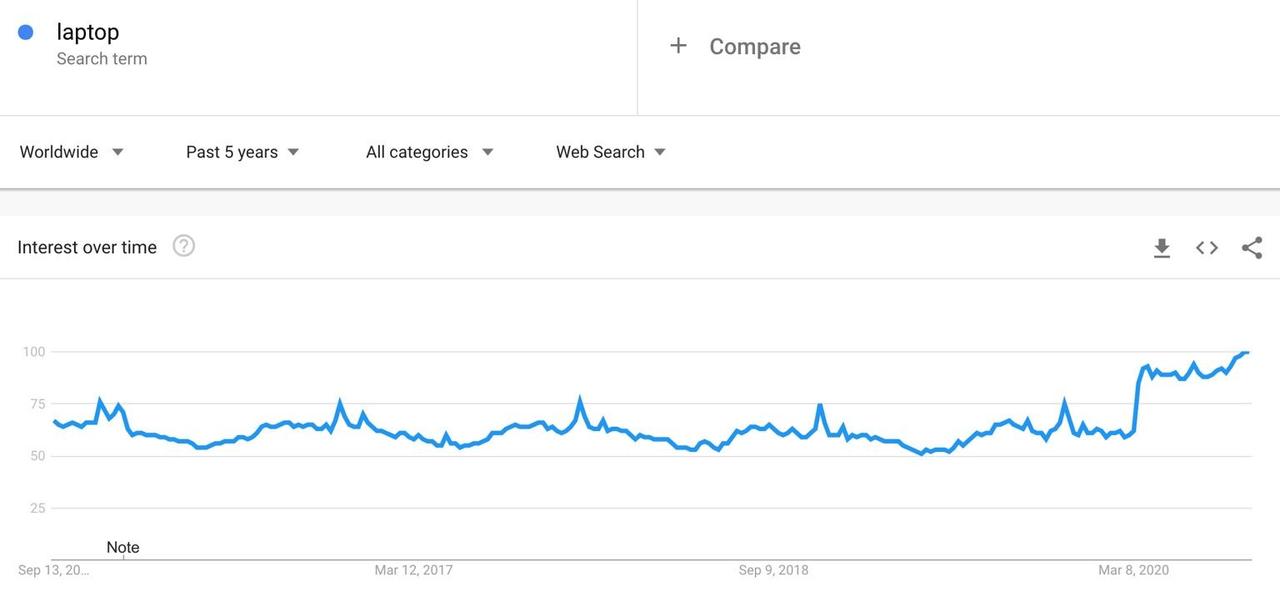

#2: What makes 2020 different from 2009 is that Tech’s fundamentals are ferociously strong just now even though the US/global economy is in a deep recession. As an example, look at the 5-year worldwide Google Trends data (number of searches) for the query “laptop”:

Yes, that chart looks great for current consumer Tech hardware/software demand. It just hit “100” in the last week of August, 33% higher than typical Holiday spending (those prior peaks over the last 5 years). And look at how stable that demand has been since it hit its first new high back in March 2020. We’re at never-before-seen levels of worldwide demand for portable computing.

But… what happens when there is a COVID vaccine and the world begins to return to normal? We’ve just had the largest global upgrade cycle since the dawn of personal computing. And if the typical laptop is good for 3-5 years of productive service, demand could well decline for several years or, best case, stagnate. This idea not only applies to laptops, but all Tech-based goods and services.

Takeaway: markets always look ahead, pricing in future revenue growth and earnings leverage. This year is a banner one for Technology, but that means 2021/2022 face once-in-a-generation difficult comparisons to 2020.

#3: Finally, a few other random thoughts on Tech but with one central theme:

-

The S&P 500 Committee’s decision not to include Tesla in the index just yet is about as brave a move as you’ll ever see from this group. It can only have come from a collective and committed view that TSLA is profoundly overvalued and sits on shakier fundamentals than its mega market cap indicates. We’ve written about this recently but were still surprised when TSLA didn’t make it into the 500.

-

It is important to remember that Technology is a cyclical sector with growth characteristics and 2020 is simply the exception that proves that rule. We have had 5 years of disruption in 5 months… That is true. But the next 5 months are not going to give us another half decade of Tech-led disruption.

-

There are plenty of other cyclical sectors to consider if you (like us) believe the US/global economy will continue to improve. We continue to favor Industrials (plenty of earnings leverage) and US Small Caps (no Big Tech exposure).

Takeaway: there is a lot going on under the surface of the current correction in Tech stocks (we didn’t even get to the Softbank options trade or retail investor buying), but to our thinking the central idea is that this sector is moving from COVID play to what it always is – a cyclical group with upside from human ingenuity.

via ZeroHedge News https://ift.tt/3igRqdg Tyler Durden