One Bank Spots The Demographic Trigger That Launched The Money-Printing Endgame

Tyler Durden

Tue, 09/15/2020 – 14:35

In our lengthy preamble to Jim Reid’s latest long-term asset return study titled appropriately “the Age of Disorder“, we spared no superlatives in our effusive praise of the Deutsche credit banker, who unlike any of his peers has dared to say publicly that he is a “gold bug“, voicing what so many strategists on Wall Street believe but are terrified to say. And with insights such as the one below, it is virtually assured that Reid will continue to be greeted with a warm welcome among the Austrian libertarian community.

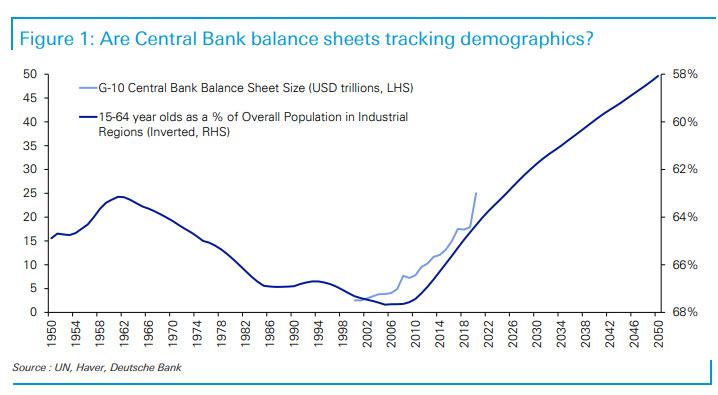

As Reid writes in the context of his Chart of the Day, “regular readers will long be aware that I believe central bank balance sheets are on a seemingly endless march upwards in the years ahead.” We agree with that, and with what he says next, namely that “Covid-19 has just accelerated a trend that was already likely in place.” Still, Covid certainly was a convenient scapegoat for the epic global liquidity eruption which allowed both central banks and politicians to kick the can for a few years with the aid of helicopter money and MMT, both of which are now the norm, flooding the world with so much debt that there is no longer a credible endgame.

Going back to Reid, he next makes an interesting observation, one which fuses debt and demographics trends together into one fatalistic amalgamation that virtually assures the world is doomed:

“one reason is that the developed world has seen a kind of debt pyramid scheme in recent decades that came to an end around the turn of the 2010 decade. Before that there had been a long multi-decade trend of an expanding number of workers in the population in absolute terms and relative to the old. As such accumulated debt was less of an issue as there was always a bigger group in the demographic chain to pay off the debts of the previous and current generation.”

However as he shows in the chart below, since 2010, “this demographic trend reversed and as such the pyramid has a problem.”

This means that unless the authorities are prepared to allow debt to default (they are not as that would mean the entire global equity tranche is also worthless), or make major increases to retirement ages (especially unlikely), then “they need to continue to plug the gap by printing money and allowing debt to look more sustainable than it would in a free market.“

As Reid concludes, in a world where central banks can’t print babies but can certainly, “it’s a case of printing money to keep the ever increasing debt alive rather than making enough babies in the previous generation to pass on the burden.“

To this all we can add is that while the Fed mercifully can’t print babies, it certainly can paradrop money to Americans to motivate them to have babies. In fact, alongside freshly printed monetary reparations to “disadvantaged” minorities in the US, we are confident that this will be one of the Fed’s final “endgame” options before it all comes unglued.

via ZeroHedge News https://ift.tt/3hzxkti Tyler Durden