Nuclear Scenario For Markets Emerges In ‘Jaw-Dropping’ SCOTUS/Election Plot-Twist

Tyler Durden

Sat, 09/19/2020 – 18:00

“If the script were being written, this would be the plot-twist that would drop jaws in the theater…”

That is the dramatic (and rightfully so) introduction to a tweet thread by Jake Sherman describing the potential playbook for the next few months as election campaigning and the SCOTUS-nomination-process mutate into what could potentially be a “nuclear option” for markets into year end… and the start of 2021.

Here are the highlights from Sherman’s view on the potentially cataclysmic events over the next few weeks:

45 DAYS before Election Day, the Notorious RBG — the left’s most-beloved and celebrated jurist — dies, and @senatemajldr, the left’s most-hated lawmaker who is also up for re-election, vows a floor vote on President DONALD TRUMP’S nominee to the Sup Court.

THE U.S. CAPITOL will be center stage over the next 15 weeks until the end of 2020, as the Congress considers this open Supreme Court seat.

THIS IS, QUITE LITERALLY, a mesh of MCCONNELL’S most animating interests: power and judicial nominees. The left frequently says that MCCONNELL is obsessed with power — and nothing but power. There is some truth to that — MCCONNELL is acutely aware of what is afforded to him by being the majority leader, and he says it quite frequently: He controls what comes up for a vote, and what doesn’t and when.

HE USES THAT POWER and that leverage with maximum impact. you should expect that here, w a chance to reshape the court for decades to come & a better than even chance of slipping into the minority, @senatemajldr will leverage every ounce of power afforded to him to fill this seat

MCCONNELL has made his promise plain:“President Trump’s nominee will receive a vote on the floor of the United States Senate.”

PAY ATTENTION TO WHAT MCCONNELL DOESN’T SAY: He doesn’t say when. Rushing the nomination could hurt some vulnerable senators. But it could also guarantee Republicans a Supreme Court seat. As WaPo’s put it:“[T]his is a rare moment where a congressional caucus leader’s short-term & long-term interests seriously diverge, his/her immediate interests vs legacy. Fascinating political power play ahead.”

HOW HE’S FRAMING IT TO HIS COLLEAGUES: MCCONNELL wrote GOP senators:“This is not the time to prematurely lock yourselves into a position you may later regret. … I urge you all to be cautious and keep your powder dry until we return to Washington.”

SO, EXPECT a nomination and hearings before the election, but not necessarily a vote.

IS IT POSSIBLE that he tries to squeeze a vote in before Election Day? Yes. Absolutely — especially if TRUMP demands it

IS IT POSSIBLE that he pushes the vote until after the election, both as a practical matter to help his vulnerable colleagues, and a motivating factor for his base? Yep. Absolutely.

IS IT POSSIBLE JOE BIDEN wins the presidency, Republicans lose the Senate and MCCONNELL jams through the nominee in the lame duck? Yes, you bet. Can Democrats do anything besides bellyache? No. They can’t.

Despite what you will hear from the left in the coming days, CHUCK SCHUMER’S power is exceedingly limited. Senate Dems have scheduled a 1 p.m. caucus call (h/t MARIANNE LEVINE) to discuss their options.

REMINDER: If MARK KELLY beats MARTHA MCSALLY in Arizona, he could be sworn in at the end of November, altering the tight majority that MCCONNELL has to work with. It would then be 52-48. This seems like a very live option.

YES, Lindsey Graham has said a number of times that Senate should not consider a nominee in the last year of a president’s term. He said it in 2016 during a Judiciary hearing. He said it to @JeffreyGoldberg in 2018 — if a nominee comes in TRUMP’S last term, he wanted to wait

DOES THAT MEAN, that GRAHAM – in a neck-in-neck race for re-election – will stay true to that? No. Absolutely not. In July, he appeared to walk back his 2018 comments in an interview with CNN’s Manu Raju:

Asked about his past opposition to moving a nominee in a presidential election year after the primary season, Graham said:

“After Kavanaugh, I have a different view of judges,” referencing the brutal 2018 confirmation process of Supreme Court Justice Brett Kavanaugh.

“I’d like to fill a vacancy. But we’d have to see. I don’t know how practical that would be,” Graham told CNN Monday. “Let’s see what the market would bear.”

YOU WILL HEAR A LOT OF REPUBLICANS say it’s dangerous to have a 4-4 court going into an election, but there was a 4-4 court going into the last election… There are a number of Republican senators to watch very closely in the coming days. They will get peppered with several questions: Should the SENATE wait until next year to confirm a nominee? And, would you vote no if MCCONNELL put it on the floor? Is a lame-duck vote appropriate?

While the script above is key, the punchline for markets is the all too real possibility of a deadlocked 4-4 SCOTUS vote deciding what may be the most contested election in US history should Republicans fail to gather the votes to fill the vacant supreme court seat before the election.

And sure enough, Republican Alaska Sen. Lisa Murkowski has already fired the proverbial first shot, confirming she would not vote to replace a Supreme Court justice until after the inauguration.

“When Republicans held off Merrick Garland because nine months prior to the election was too close, we needed to let the people decide,” Murkowski said in August, according to The Hill.

“And I agreed to do that. If we say now that months prior to the election is OK when nine months is not, that is a double standard and I don’t believe we should do it.”

Now where have we seen this before?

Murkowski’s statements echo that of Maine Sen. Susan Collins, a fellow moderate and the only other pro-choice Republican in the Senate.

“I think that’s too close, I really do,” Collins said when asked whether she would vote to confirm a Supreme Court justice in October. Collins also said that she would oppose seating a justice in the lame duck session of Congress if President Donald Trump loses the election in November.

Collins made her position official in a Saturday tweet saying the Senate should wait until after the election for the vote (although as some have noted, she doesn’t make any promises on how she would vote if/when a vote is called).

My statement on the Supreme Court vacancy: pic.twitter.com/jvYyDN5gG4

— Sen. Susan Collins (@SenatorCollins) September 19, 2020

Add to this the outcome risk from the Mark Kelly vs Martha McSally special election in Arizona (where Kelly has a steady lead), and a 4-4 SCOTUS deciding the next president suddenly looks very real.

Simply put, the political quagmire unleashed by the passing of Ruth Bader Ginsburg leaves the market in an even more precarious position since if a contested election was a source of great uncertainty before, a 4-4 SCOTUS extends that uncertainty even further as we already know there will be no concessions for weeks, and the extensions of mail-in ballots will merely add fuel to the fire of what is shaping up as the most contested election in US history.

In short, this is the “worst case scenario” – that JPMorgan just warned about last week when envisioning a contested election’s impact on markets – on steroids, since The Fed has nothing new to offer and fiscal stimulus will definitely be off the table now until an election decision is made, a decision that may not comes for months without a SCOTUS tiebreaker vote.

Back in July, Goldman’s David Kostin wrote that one of the key concerns expressed by its clients is that a contested election could drag on, resulting in little clarity for weeks if not months, in a rerun of the contested 2000 election between Al Gore and George W. Bush, when it took a Supreme Court challenge and 34 days for the winner to be decided. This is what Goldman said then:

Health concerns and social distancing protocols suggest that more voters than ever will decide not to cast ballots at traditional polling stations on Election Day and instead vote by mail. In the case of a close election, it will take time to count – and invariably re-count – all the absentee and mail-in ballots. The deadline for each state to certify its result and finalize electors is December 8th (35 days after the election) or six days before the Electoral College convenes on December 14th (first Monday after the second Wednesday in December).

Echoing this, Deutsche Bank’s Parag Thatte wrote that the pricing of VIX futures with November and December expiries are likely too sanguine that there will be a quick and clear outcome of the elections.

Then last week, JPM’s chief equity strategist Misla Matejka joined this chorus of warnings about a contested election result, which he sees as the “worst-case scenario” for the market (Matejka also sees a contested election as the top risk for market performance into the year-end), adding that potential legislative paralysis could be “even more damaging” than Bush vs Gore for economy, as key stimulus measures to support economy could be delayed until well after the election:

The 2000 US presidential election between Bush and Gore provides a precedent for this. Equity markets struggled in the period following elections, with S&P500 dropping close to 12%.

Fast forward 20 years, when “in the current scenario,” JPM believes that “the potential legislative paralysis could be even more damaging for the economy, as key stimulus measures to support the economy might be delayed, and the partisanship is very elevated.”

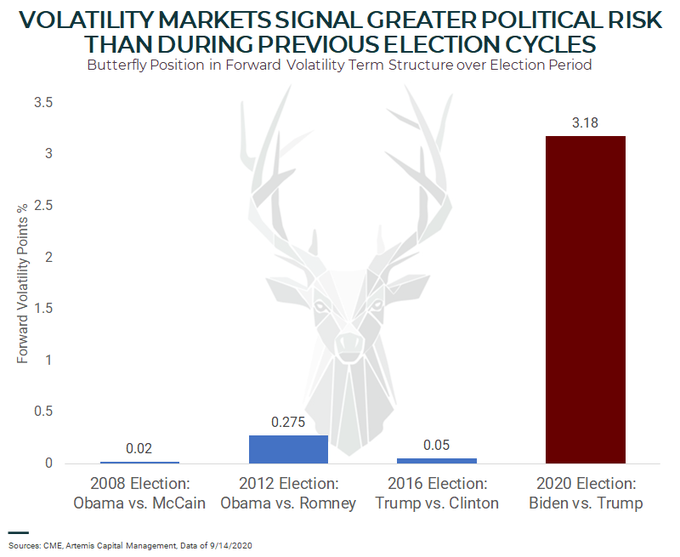

Finally, the same point was underscored by Artemis Capital CIO who earlier today also wrote that “vol markets value the US election as a massive binary risk event that occurs at one point-in-time (like earnings in a stock)” However, “the real risk is a contested election and US constitutional crisis that occurs throughout time. If the latter comes to pass, forward vol is very mispriced.“

Vol markets value the US election as a massive binary risk event that occurs at one point-in-time (like earnings in a stock)

The real risk is a contested election and US constitutional crisis that occurs throughout time

If the latter comes to pass, forward vol is very mispriced

— Christopher Cole (@vol_christopher) September 14, 2020

Putting all this into one chart, this is what the confusion and uncertainty heading into the election looked like before the death of RBG:

And now to all this add the potential “nuclear option” for markets of a contested election AND a deadlocked 4-4 SCOTUS (as Roberts again makes a “surprise” flip) failing to declare a winner, unlike the Bush v Gore 2000 election. What happens then? For the presidency, for the economy, for geopolitics, and for the stock market?

* * *

The script – as bizarre at it appears – has now been written and stocks just have to start “weighing” the risks more efficiently; Sunday night futures open will be fun to watch.

via ZeroHedge News https://ift.tt/35RjErJ Tyler Durden