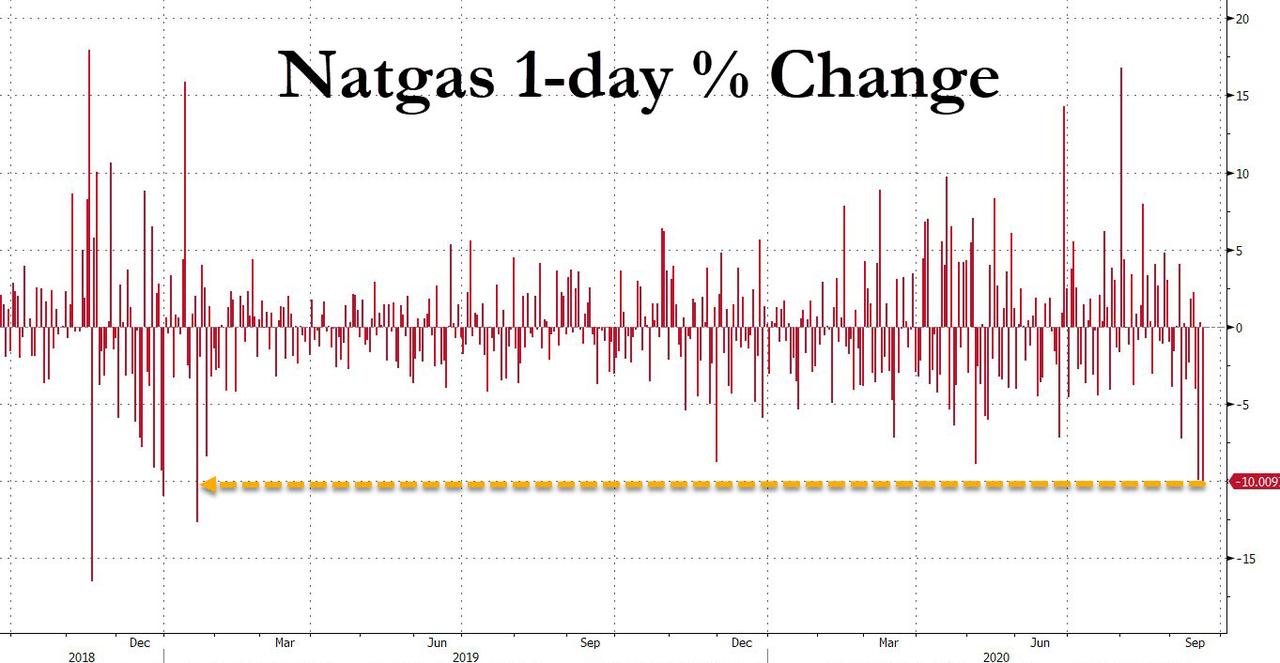

Nat Gas Plummets 10%, Slides Under $2 In Biggest One-Day Drop In 20 Months

Tyler Durden

Mon, 09/21/2020 – 11:22

Natural gas futures tumbled below $2 amid a broad rout in commodity markets and on speculation that Tropical Storm Beta may spur power outages and curtail LNG exports along the Gulf Coast (as Bloomberg notes, Beta is a slow-moving storm that will bring flooding rains in Louisiana as it toward Texas to come ashore near Corpus Christi).

The day’s 10% drop was the biggest since Jan 2019.

“Tropical Storm Beta is definitely a big driver,” says Christin Redmond, an analyst at Schneider Electric. “Although overall it’s a short-term effect, each week that we have this lower demand, we get higher storage injections. And with three storms hitting in less than a month, we’re getting those effects building on each other.”

“Although it’s not hurricane strength anymore, it could cause significant flooding and may cause some LNG export facilities to temporarily shut in” Redmond added noting that these storms have resulted in 12% y/y losses in power demand for gas since start of Sept. At the same time, data provider Refinitiv added that the amount of gas flowing to U.S. LNG export plants was on track to slide to a two-week low of 5.2 bcfd on Monday from a four-month high of 7.9 bcfd last week.

As Bloomberg further observes, citing BNEF data, gas demand from power generators is estimated at just under 30 bcf for Monday, lowest for any Sept. 21 since 2015. Scheduled gas flows to LNG export terminals -33% from Sept. 18 to ~5.6 bcf on Monday.

Meanwhile, as Reuters notes, gas speculators increased their net long positions on the New York Mercantile and Intercontinental Exchanges last week for the seventh time in eight weeks to the highest since May 2017 on expectations energy demand will rise as the economy rebounds once state governments lift more coronavirus-linked lockdowns, so there is also forced liquidations to throw into the mix. Those long positions came despite expectations stockpiles will hit record highs by the end of October, which should remove lingering concerns about price spikes and gas shortages this winter.

via ZeroHedge News https://ift.tt/3mF7KXQ Tyler Durden