Retail On Pace For Most Bankruptcies And Store Closures Ever In One Year: BDO

Tyler Durden

Wed, 09/30/2020 – 12:20

By Daphne Howland of RetailDive

Summary:

-

The pandemic — with its temporary store closures, social distancing requirements, e-commerce boom and supply chain disruption — in the first six months of this year fueled uncertainty for retailers and accelerated existing trends, according to BDO’s biannual bankruptcy update.

-

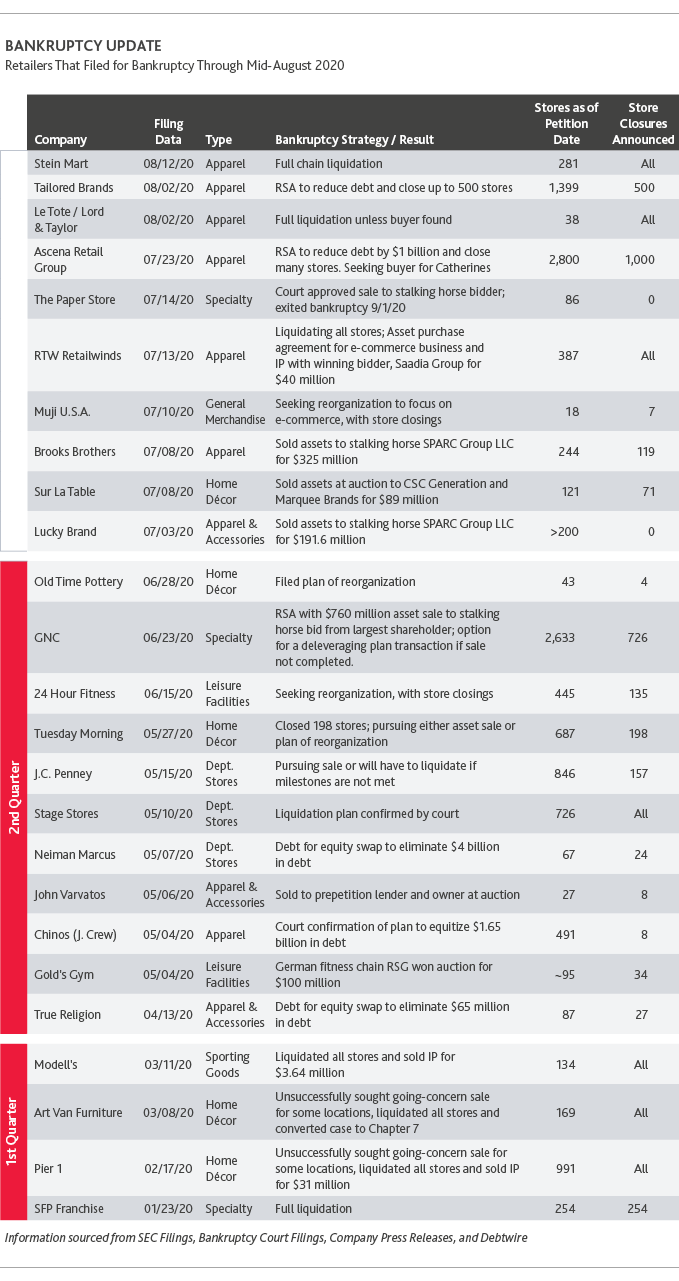

BDO counts 18 retailers that headed to bankruptcy court in the first half of the year and another 11 in July through mid-August. Retail Dive’s bankruptcy tracker similarly lists 27 so far this year, compared to 17 in 2019. (BDO counts some businesses, like Gold’s Gym, as retailers.)

-

The industry’s bankruptcy record so far put it on pace with 2010, following the Great Recession, when there were 48 bankruptcy filings by retailers, according to BDO’s report.

The COVID-19 pandemic has essentially interfered with what is normally a cyclical pattern for retailers and set up the industry for yet more bankruptcies in 2020’s second half, according to BDO researchers.

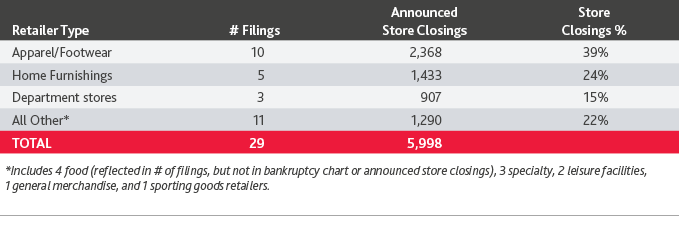

In the first six months of 2020, 18 retailers filed for Chapter 11 bankruptcy, with an additional 11 filing in July through mid-August. These defaults were concentrated in apparel and footwear, home furnishings, food and department stores, with many prominent retailers filing during this time period, including Pier 1, J. Crew, Neiman Marcus, Stage Stores, J.C. Penney, Tuesday Morning, GNC, Lucky Brand, RTW Retailwinds (New York & Co.), Brooks Brothers, Ascena (Ann Taylor, LOFT, Lane Bryant, Justice, Catherines), Le Tote (Lord & Taylor), Tailored Brands (Men’s Wearhouse, Jos. A. Bank, Moores Clothing, K&G) and Stein Mart.

With 29 filings in 2020 to date, this year is on-pace to rival 2010, following the Great Recession, that resulted in 48 total filings.

“In short, 2020 is on track to set the record for the highest number of retail bankruptcies and store closings in a single year,” they wrote. “Based on the trends set through mid-August, our expectation is that more retailers will struggle to navigate the effects of the pandemic — particularly those that are highly levered and mall-based.”

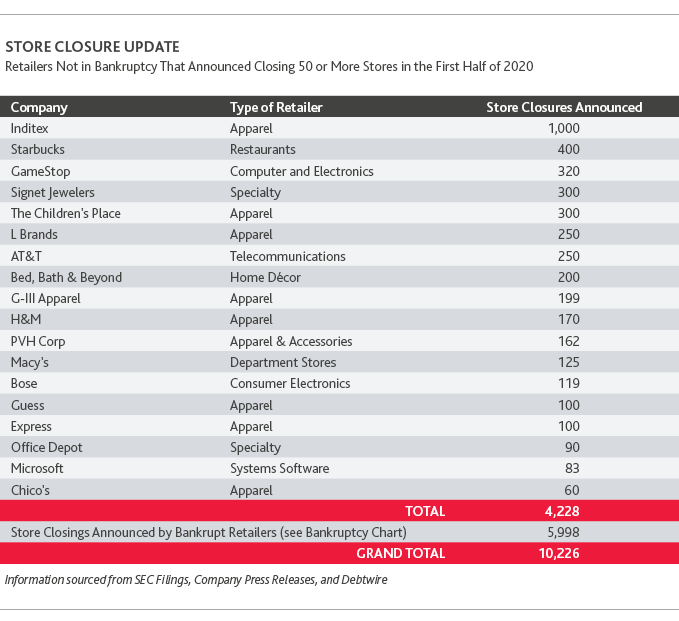

But it’s not just Chapter 11 filings or liquidations. Brick-and-mortar store fleets, which were already being closely scrutinized as more consumers shopped online and avoided malls, are also being slashed by retailers in turnaround, BDO noted.

The firm is just the latest to note how the pandemic has sped up the downward spiral of malls. “[T]he closings of anchor and other stores in shopping malls will likely make visits to them less appealing and depress mall traffic overall, unless landlords are able to quickly fill these vacancies with attractive alternatives,” per the report.

By BDO’s measure, bankrupt retailers alone have announced nearly 6,000 store closings this year, more from January through mid-August “than the record 9,500 stores that closed throughout 2019,” and most of them in malls. But more than 15 retailers (including Macy’s, Bed Bath & Beyond and Gap) outside of bankruptcy court have announced a total of 4,200 closures, researchers said.

The holiday season may be more important than ever for retailers. High hopes for the fourth quarter could prevent more retailers from hurtling toward bankruptcy in the second half of the year, BDO said. Getting assortment and merchandising right and prepping e-commerce and in-store operations in light of COVID are essential, researchers said.

“To stay competitive, brick-and-mortar stores should assume touchless shopping options such as curbside pick-up and self-checkouts are here to stay, and apparel retailers should be reimagining what the fitting room experience will look like post pandemic,” they wrote.

via ZeroHedge News https://ift.tt/3jkQGUM Tyler Durden