Payrolls Preview: The Last Report Before The Election

Tyler Durden

Thu, 10/01/2020 – 22:25

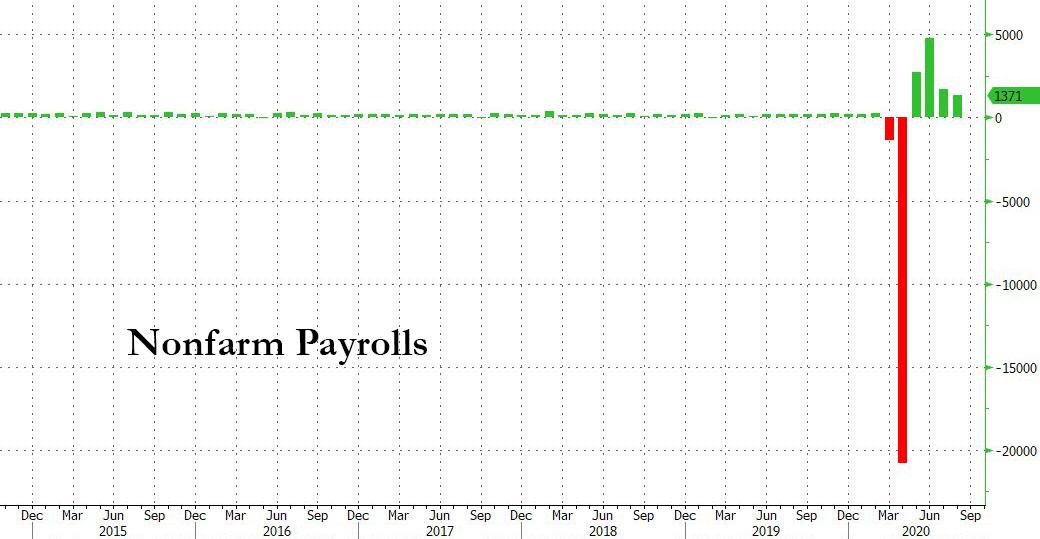

While few expect major surprises from tomorrow’s payrolls report, the fact that it will be the last jobs report before the Nov 3 election makes it especially important if only from a political standpoint: a blowout number will be hyped aggressively by Trump; the opposite will fall right into Biden’s hands as evidence the economy is cooling rapidly.

That said, the odds may be in Trump’s favor because as Goldman writes in its payrolls preview, high-frequency labor market information “indicates strong September job gains, and the second derivative improvement in the public-health situation suggests scope for a pickup in Sun Belt job growth.” On the negative side, there has been a spike in recent mass layoff announcements, while the start of the school year will lower education payrolls by 200-300k, as many janitors and support staff did not return to work. Goldman also expects a roughly 50k drag to government payrolls from the wind-down of the 2020 Census.

That said, here are the consensus expectations ahead of tomorrow’s number which will be released at 830am:

- Nonfarm Payrolls exp. 850k (range -100k to +1.800mln, prev. +1.371mln);

- Unemployment rate exp. 8.2% (range: 7.6-8.6%, prev. 8.4%);

- U6 unemployment (prev. 14.2%);

- Participation (prev. 61.7%);

- Private payrolls exp. 850k (prev. 1.027mln);

- Manufacturing payrolls exp. 35k (prev. 29k);

- Government payrolls (prev. 344k);

- Average earnings m/m exp. +0.2% (prev. +0.4%);

- Average earnings y/y exp. +4.8% (prev. +4.7%);

- Average workweek hours exp. 34.6hrs (prev. 34.6hrs).

Here are some big picture observations ahead of tomorrow’s payrolls courtesy of NewsSquawk:

- The rate of Initial Jobless Claims rose in the September survey week against expectations it would fall, while Continuing Claims fell less than hoped.

- ADP’s payrolls gauge was more encouraging, rising more than expected, although it remains to be seen if it will correlate to the BLS following recent divergences.

- The Manufacturing ISM came in slightly cooler than expected as the pace of the rebound begins to plateau, which was somewhat at odds with the strong regional prints; the employment sub-component rose but it still remains beneath the 50 mark.

- Challenger Job Cuts were little changed from the August print, although have come down considerately since the record print in April.

- There has been a slew of large job cuts announced this week but those will most likely be a matter for October’s report, somewhat balanced out by the pick-up in seasonal hiring.

And some more in-depth observations:

INITIAL JOBLESS CLAIMS: Weekly Initial Jobless Claims rose to 870k from the upwardly revised 866k level in the September employment survey reference week, against expectations for a decline to 850k. Continuing Claims fell to 12.580mln from the pwardly revised 12.747mln. Pantheon Macroeconomics notes that the Initial Claims print has been flat lining now over the past four weeks following a one-time drop of 127k in the final week of August due to a change in the seasonal adjustment methodology, “Using the old seasonals, it looks as though the trend in claims has been unchanged since mid-August.” The consultancy affirms the labour market plateau against the daily small business employment data produced by Homebase, “pointing to flat payrolls in the sector in August and, more recently, a small outright decline.” The consumer-heavy US economy will struggle to continue recovering amid the roll-off of enhanced unemployment benefits, to which Pantheon doesn’t see the implementation of a “meaningful” relief bill until February given the divide in Congress; a pick-up of COVID cases only serves to cut output further. The consultancy warns, “Next week’s September payroll data likely will report a modest seasonally adjusted increase in private jobs, perhaps 500K or so, half the August gain, and October could easily see private payrolls fall.”

ADP: The September ADP report was encouraging as it continued to rise, the headline for private sector employment growth came in at 749k, topping the 650k estimate; the previous was also revised higher to 481k from 428k. The report bodes well for Friday’s BLS report. Although the relationship between the BLS and ADP release has been questionable in recent months, Pantheon highlights that ADP has substantially understated the official figures since the pandemic hit, but the error is much smaller since spring. “We can’t be sure it will narrow again in September, but that seems to be a reasonable assumption”, Pantheon posits. The consultancy looks for 950k in Friday’s September jobs report, adding the homebase employment data points to significantly weaker payrolls in October, and perhaps even the first decline since April.

MANUFACTURING SECTOR: The September ISM fell to 55.4 from 56.0, below the expected rise to 56.4. When comparing to the strong regional Fed surveys, the decline came in as somewhat of a surprise. Weighing the most was the fall in New Orders, which fell from the bumper 67.6 figure to 60.2, still a firm reading. The production component also fell to 61.0 from 63.3. Dampening the fall was the pick-up in the lagging indicators: Delivery Times, Inventories and Employment. The latter rose to 49.6 from 46.4, potentially boding well for the NFP print, although, noticeable, that figure still has not reclaimed the 50 figure. It’s also worth noting that we do not yet have the ISM Services survey to gauge the respective employment component; that is somewhat unhelpful given the US economy is predominantly services-led.

JOB CUTS: Challenger reported 118,804 job cuts in September, which was little changed from August’s 115,762, but was up 185.9% vs September 2019. However, the figure has come down significantly from April’s record 671,129, and note that prior to COVID, the highest reading was 186,350 in February 2009, although this month’s reading still sits heavily above the c. 50k average reading seen in “normal times” during the last decade. Challenger says, “We are setting new records for job cuts even though things have improved since the earliest days of the pandemic.” The report showed the heavily hit sectors such as entertainment and leisure continuing to lead in announced cuts, although there were several sectors outside those industries with large cuts such as Aerospace & Defense, as well as transportation, “We are beginning to see cuts spread to sectors outside Entertainment and Retail. Especially if another relief package fails to pass, employers are going to enter the fourth quarter hesitant to invest or spend.” The silver lining to the release was the pick up in hiring intentions to 929,860, compared to August’s 160,411, however, do note that at least a third of that is related to seasonal hiring and that hiring is heavily skewed to retailers with a strong online presence, with traditional brick and mortar retailers remaining under immense pressure

Finally, some qualitative considerations from Goldman: factors arguing for a better than expected report:

Arguing for a better-than-expected report:

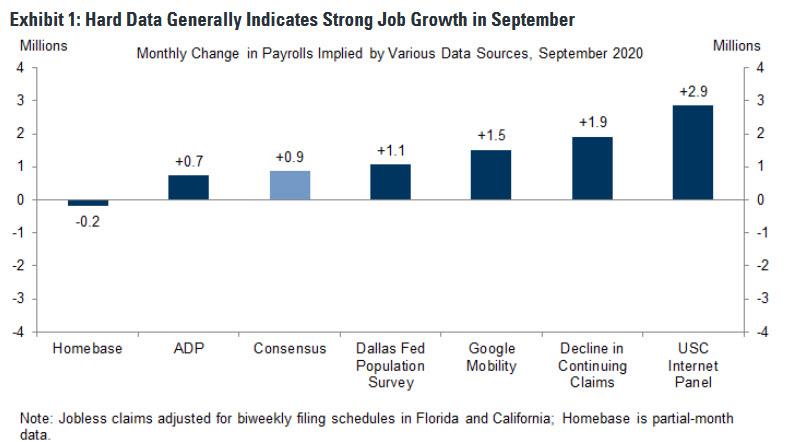

- Big Data. High frequency data on the labor market were generally strong in September (see Exhibit 1), with five of the six measures we track indicating significant job gains and four of the six consistent with a beat tomorrow of 500k or more. Additionally, the restarted Census Household Pulse survey is consistent with a 16mn decline in the level of unemployment from mid-May to mid-September (vs. -7.4mn in the official measure from mid-May to mid-August).

- Jobless claims. While still elevated, initial jobless claims declined significantly during the September payroll month (averaging 0.9mn per week vs. 1.2mn in August). Additionally, continuing claims declined by 1.9mn from survey week to survey week (after adjusting for biweekly filing schedules in Florida and California).

- Employer surveys. Business activity surveys improved on net in September, as did the employment components of our survey trackers (non-manufacturing +2.8pt to 49.1; manufacturing +2.4pt to 53.8).

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—rose into expansionary territory (+2.9 in September from -2.2 in August and +2.2 in July).

- ADP. Private sector employment in the ADP report rose by 749k in September, somewhat above consensus. We viewed the ADP report as incrementally positive news but broadly similar to expectations.

- Census hiring. Census temporary workers are set to boost nonfarm job growth by 255k in August, as additional field staff were hired to conduct interviews.

- Employer surveys. Business activity surveys improved on net in August, as did the employment components of our survey trackers (non-manufacturing +3.0pt to 46.3; manufacturing +2.6pt to 51.4).

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas fell 65% in August to 116k after rising 68% in July and falling 43% in June (mom, sa by GS). They remain 114% above their August 2019 levels.

Arguing for a weaker-than-expected report:

- Education seasonality. We expect a seasonal drag in education categories related to the coronacrisis to lower September job growth by roughly 200-300k (public + private). Some of the janitors and other school staff who normally return to work in September did not this year due to virtual reopenings in much of the country. Reflecting this, we expect education payrolls to rise by less than the BLS seasonal factors anticipate, resulting in a sizeable drop in reported job growth in the sector. At the same time, the level of education employment is already considerably below its typical summer bottom (11.9mn vs. roughly 12.5mn in a normal year), which we expect to limit the drag to only a few hundred thousand. The inability to obtain childcare is also likely to weigh on job creation at the margin, though its effect may already be mostly reflected in the August payroll levels (given the cancellation of some in-person summer camps and an earlier reduction in childcare provider availability).

- September seasonality. We also note that payrolls have exhibited a tendency toward weak September first prints, with a miss versus consensus in 8 of the last 10 years. However, the magnitude of the potential bias is small (between -30k and -50k) relative to the underlying inflections in the data this year.

- Census hiring. Census temporary workers are set to lower nonfarm job growth by around 50k in September, as training and field operations began to wind down.

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas rose 5.6% in September to 127k after falling 61% in August and rising 56% in July (mom, sa by GS). They remain 191% above their September 2019 levels.

Neutral/mixed factors:

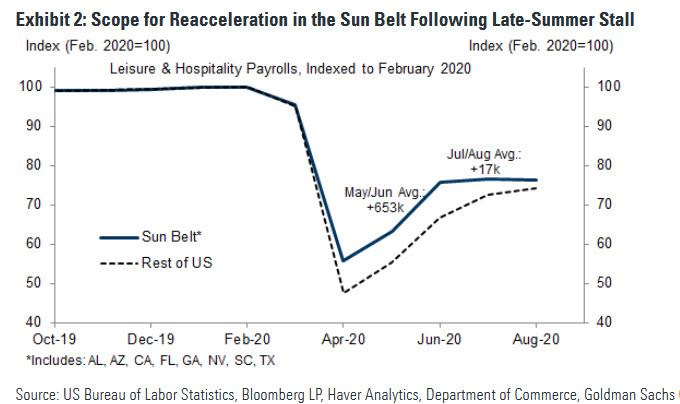

- Second wave. The US experienced a dramatic resurgence of coronavirus during the second half of June—particularly in the Sun Belt states—and by the July Fourth holiday, nearly two-thirds of the country had paused or reversed their reopening plans. However, job growth remained firm in July and August despite a pause in the Sun Belt leisure and hospitality recovery (see Exhibit 2). With restrictions generally stable or easing over the last month, we note scope for a pickup in job growth in some segments. Illustratively, a 50% reversal of the late-summer leisure deceleration in the Sun Belt would boost monthly job growth by 320k. On the other hand, weaker demand for back-to-school apparel may have limited hiring in the retail sector (relative to a normal September).

And speaking of Goldman, this is what the vampire squid expects tomorrow:

- 1.1mn nonfarm payrolls rose, above consensus of +0.875mn; private payrolls up 1.2mn vs consensus is +0.9mn.

- Unemployment rate declined by three tenths to 8.1%, vs 8.2% consensus, a forecast reflecting another strong rise in household employment partially offset by higher labor force participation.

- Average hourly earnings rose 0.1% month-over-month, boosting the year-on-year rate by a tenth to 4.8%

Source: NewsSquawk, Goldman Sachs

via ZeroHedge News https://ift.tt/2GtRBUi Tyler Durden