First SPAC ETF Hits The Market

Tyler Durden

Fri, 10/02/2020 – 08:50

By MarketCrumbs

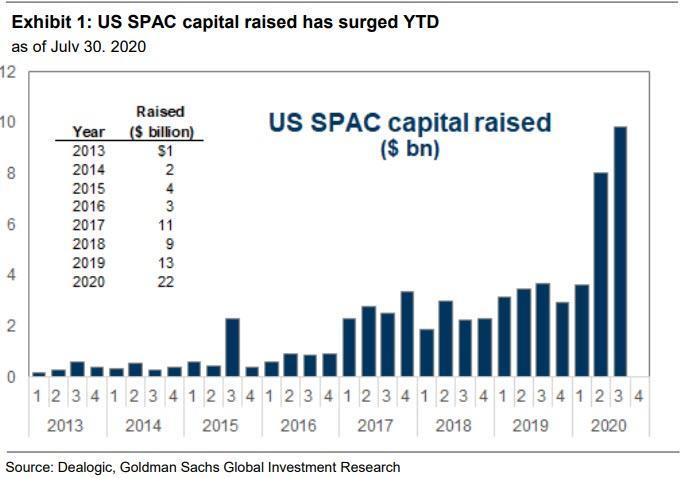

2020 has undoubtedly been the year of the special purpose acquisition company, or SPAC.

According to SPAC Insider, more than 115 initial public offerings for SPACs have brought in almost $44 billion in proceeds, which is more than the last five years combined.

Despite the popularity of SPACs so far this year, there hasn’t been an exchange-traded fund, or ETF, dedicated to SPAC investing. That all changed yesterday when the Defiance NextGen SPAC Derived ETF, which is the first ETF to track blank check companies, made its debut on the New York Stock Exchange yesterday under the ticker SPAK.

“Picking the winners of individual SPACs can be very difficult, however the ETF structure allows investors to access the most liquid SPAC IPOs in a diversified basket,” Defiance ETFs said. “SPAK allows both financial advisors and retail investors to participate in an IPO private equity style of investing, which until now was only available to large financial institutions.”

The ETF has 29 holdings which are rebalanced quarterly and has an expense ratio of 0.45%. An 80% weighting is given to IPO companies derived from SPACs while 20% is allocated to common stock of newly listed SPACs.

The ETF’s largest holding is DraftKings, which accounts for nearly 20% of the fund’s assets. The other stocks rounding out the top five holdings—which account for just over half of the ETF’s assets, are Clarivate Plc, Vertiv Holdings Co., Open Lending Corporation and Broadmark Realty Capital Inc.

Co-founder Joshua Harris of asset manager Apollo Global Management, which itself is looking to raise funds through an initial public offering for a new blank-check company, says SPACs are here to stay.

“The SPAC part of the IPO market is a part of the market that’s here to stay,” Harris said. “There’s a real need for quick, confidential capital and price certainty and for sponsorship in the markets. And most of the SPACs that have been done have been more emerging growth SPACs, less cash flow more growth. And what we see is the opportunity for sponsorship.”

With SPAC deals seemingly taking companies public on a daily basis as of late, time will tell if the launch of a dedicated SPAC ETF marked a sign of a top in the latest craze to hit Wall Street or a generational buying opportunity.

via ZeroHedge News https://ift.tt/3ilv4q5 Tyler Durden