The Election Is Not The Biggest Q4 Risk: According To One Bank, It’s This

Tyler Durden

Fri, 10/02/2020 – 15:20

Two weeks ago, JPMorgan declared that a contested election was the “worst-case scenario” for the market into year-end. Just days later, Ruth Bader Ginsburg died, and suddenly Scotus was set for a major Conservative takeover, although in the process raising the odds of a contested election as Trump would certainly feel empowered to challenge an unfavorable election outcome all the way to SCOTUS.

Of course, since then a lot of things have happened, including the shocking news overnight that Trump now has covid, which has thrown the political and market analysis calculus for a loop. Overnight, Bloomberg’s John Authers had some notable thoughts on what Trump’s covid infection means for markets:

-

This is almost certainly negative news for the economy, because the chances of a significant relaxation in lockdown provisions in the U.S. have just been sharply reduced. It was much easier to argue for reopening the economy when a large part of the population truly believed that the pandemic was a hoax. That will change, and many individuals’ behavior will probably change even without a change in the official rules.

-

The chances for a fiscal stimulus deal may well just have increased. Politicians on both sides will want to be seen to be achieving something in these difficult times, and Covid-19 suddenly looks like much more of an immediate problem than it did a few hours ago. A weak unemployment number might also help this.

-

The chance of some deliberate geopolitical “surprise” to change the subject from Covid-19 may also just have risen. If this news turns out to work against the president, and his polling numbers deteriorate, then the possibility of some escalation in the dispute with China, an issue on which Trump has broad support, becomes that much greater.

-

For stock markets, we can assume that volatility will rise and that defensive stocks (these days meaning the FANGs) will outperform.

-

Perhaps the most interesting market to watch is the dollar. In the past, it has acted as a haven during times of alarm, even if the alarm emanates from the U.S. itself. That happened most famously when investors responded to the Standard & Poor’s downgrade of U.S. Treasuries by buying Treasuries and the dollar. Is it still perceived as that kind of a haven?

And yet despite all the unexpected chaos and confusion, according to BofA’s Chief Investment Strategist Michael Hartnett, the biggest threat to the market in Q4 is neither Trump’s covid infection nor the imminent contested election.

But before we reveal what it is… a quick recap of the latest observations from his latest weekly Flow Show report, in which he notes that the key weekly flows included a reversal of last week’s outflow to the tune of $11Nn into equities, $2.1Nn into bonds, small $0.3Bn into gold and the continued outflows from cash money market funds, in the latest week amounting to $19.5Bn.

Among the notable highlights was the 1st outflow from muni bonds in 5 months; a chunky redemption from HY bonds ($3.4bn…2nd consecutive week); no redemptions from IG bonds ($3.9bn inflow); strong inflows to tech stocks resume ($1.2bn) while EM inflows to stocks & bonds trending higher ($12.9bn inflows past 7 weeks).

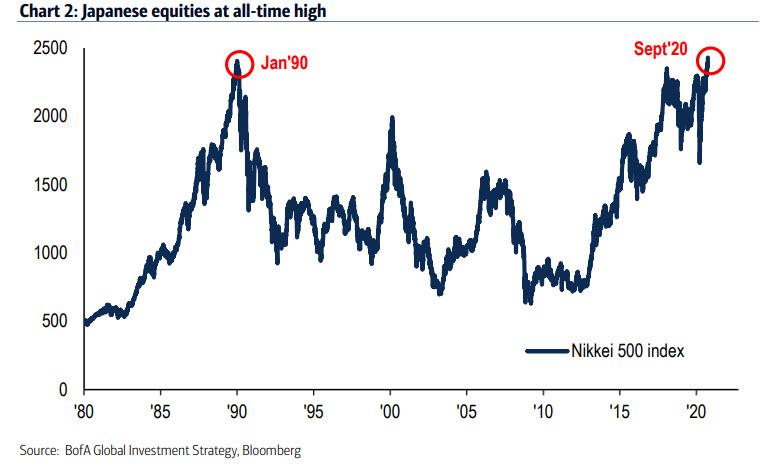

Hartnett then points out two recent records, on one hand the new all-time high in the Nikkei 500, the new economy index, although not to be confused with the legacy Nikkei 225 which is still 40% from Dec ’89…

… at the same time as we get a new all-time low in the Treasury volatility index – the ill-named MOVE – despite the record $4TN in Treasury issuance in 2020, 25% federal deficit/GDP, 100% federal debt/GDP, all of which to Hartnett is “unambiguous Fed success.”

So going back to Q4 which is now 2 trading days in, Hartnett first lays out his views for what happens next all else equal:

-

SPX to retest & fail highs in Q4…high cash, fiscal stimulus, vaccine, lower HY spreads, stronger EPS…final capitulation into risk.

-

“Topping process”…floor in IG spreads, volatility, yields…Wall St credit & equity markets have begun topping process.

-

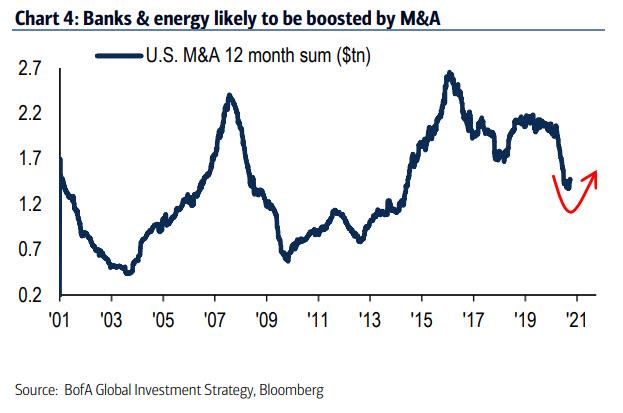

Banks & energy rally…HY spreads down, global EPS up, bond yields drift higher; banks & energy to be boosted by M&A given distressed valuations

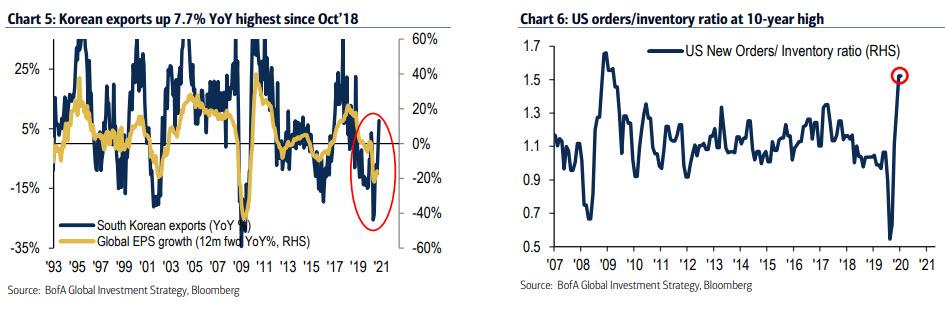

And while BofA does not really stand out in its list of potentially bullish Q4 catalyst, which it views as primarily two, namely Lower HY spreads (look for the recent widening of HY spreads where CDX widened 60bps to 560bps following collapse from 1100bps March spread highs – to reverse in Oct), and Higher global EPS, with China new orders & Korean exports at the highest level since 2018, and US orders/inventory ratio at 10-year high…

… it was BofA’s two bear catalyst for Q4 that we found most interesting.

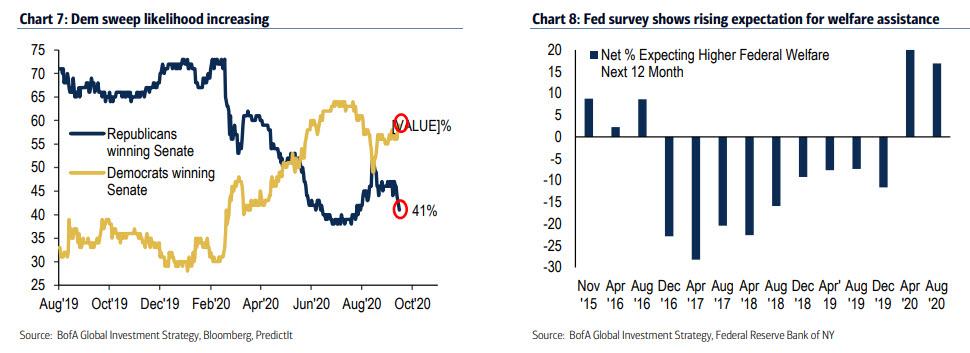

The first – as expected – was the upcoming election, with Hartnett noting that the odds of a Dem sweep are increasing, and social demand for more-and-more government intervention in labor market, guarantees US & global fiscal stimulus here to stay. But as he adds, the now assured contested election that delayed phase IV US fiscal stimulus will pressure state & local government finances (watch MUB) and commercial real estate (watch CMBS); any imminent and aggressive Fed liquidity injections on contested election would favor tech over cyclicals.

But it was the second key Q4 bear catalyst that was most remarkable, i.e., the fact that after $8.3 trillion in monetary injection, 183 rate cuts YTD, the pace of central bank injections via QE fading ($3.8tn in Q2, $2.4tn in Q3, $1.1tn in Q4).

And, in a parallel report, BofA’s Barnaby Martin rhetorically asks “why are markets lacking their usual mojo lately?” and answers:

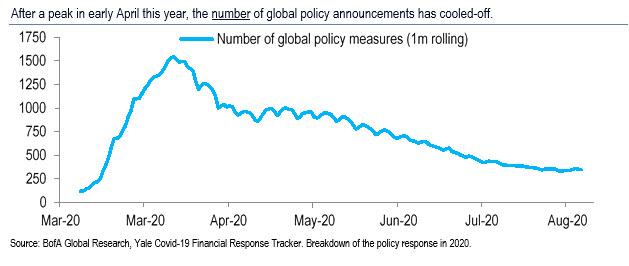

Because it’s been hard for policy makers to keep up with the sheer quantum of support unleashed earlier in the crisis. Between March and June this year, there were 109 (net) rate cuts by central banks…the last 3m have seen just 22. March ’20 saw more than 1200 policy measures announced globally… but August ’20 saw just 273. And while G6 central bank balance sheet growth surged $4.2tr in Q2, the growth rate is forecast to be a “meager” $1.25tr this quarter.

In short, the fact that central banks are slowing down their interventions dramatically means that the only thing that could spark a fresh burst higher in risk assets is, paradoxically, another major crisis which forces the Fed to intervene even more aggressively.

Luckily, if there is one thing the world does not have a shortage of right now, it is potential crisis powder kegs and it’s only a matter of time before one or more explode.

via ZeroHedge News https://ift.tt/3jC9Khm Tyler Durden