Futures Soar In Rollercoaster Session As “Huge Week” Begins

Tyler Durden

Mon, 11/02/2020 – 08:07

In a rollercoaster session which started with futures tumbling at the start of Sunday trading on the heels of a plunge in oil, which sent WTI below $35 on European lockdown fears and up to 1MMb/d in new production out of Libya, risk assets have staged a remarkable comeback with Emini futures rallying around the time of the European open, and surging over 40 points or 1.3%, rising to 3,307 having hit a session high of 3,322 earlier even as oil tumbled and yields were lower on the day.

Apple, Tesla and Twitter were about 1% higher in U.S. pre-market trading. The rebound in Eminis took place after Wall Street recorded its biggest weekly loss since March pushing it a a six-week low as results from technology mega-caps failed to impress and surging coronavirus cases in the United States and Europe as well as fears of a contested U.S. election dampened risk appetite.

Despite the bounce, the VIX remains near 4 month highs, last trading above 37 as investors remain on edge ahead of an event-packed week with the election, a Fed decision, over 100 S&P earnings and October payrolls all due. Traders anticipate short-term trading turmoil and major long-term policy shifts related to taxes, government spending, trade and regulation depending on whether President Donald Trump or his Democratic challenger Joe Biden wins the White House race. Focus this week will also be on the Fed’s two-day policy meeting, the monthly jobs report and earnings from about a quarter of the S&P 500 companies, including Qualcomm, General Motors and AIG.

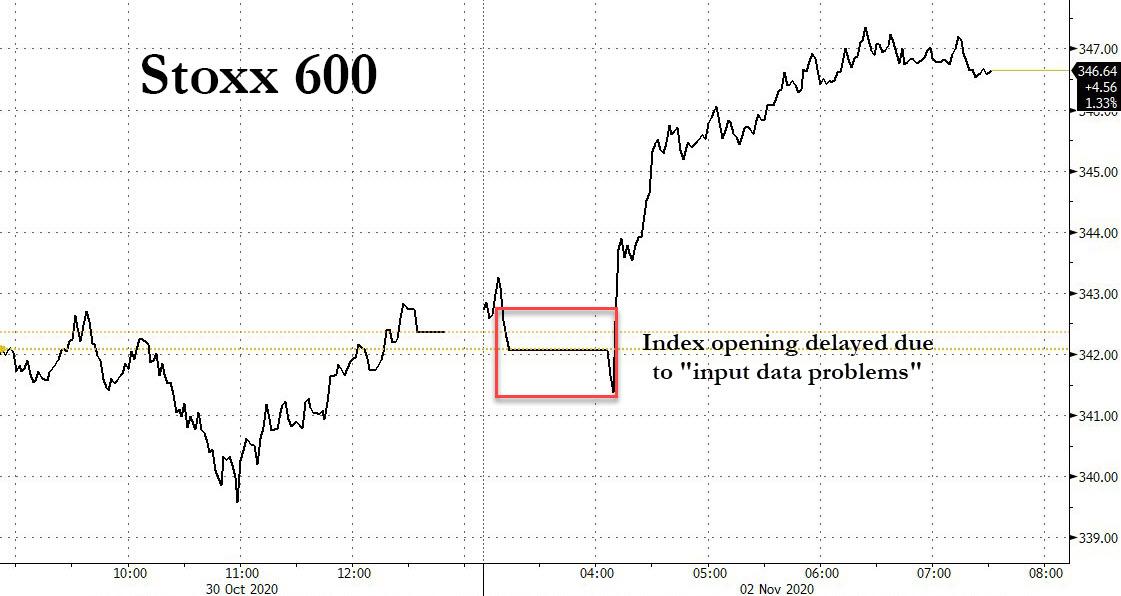

It is a “huge week” for investors with the election, a Fed decision and October payrolls all due, and they are starting it on a positive note. Overnight, the MSCI Asia Pacific Index added 1% while Japan’s Topix index closed 1.9% higher. In Europe, the Stoxx 600 Index had gained 1.2% by 5:50 a.m. Eastern Time after technical difficulties lead to a delayed start in pricing. S&P 500 futures pointed to a rebound at the open, the 10-year Treasury yield was at 0.864% and gold was higher.

“Whichever way you look at it, this coming week will be huge for U.S. and global markets,” said Simon Ballard, chief economist at First Abu Dhabi Bank PJSC. “We see the potential for a sharp rise in volatility around these events — and all in the context of a still deteriorating Covid-19 situation across much of the U.S., Europe and elsewhere.”

So the virus will be big news this week but it will be hard to topple tomorrow’s US election off the front pages for the next few days. I say tomorrow but 93.29 million have already voted so far, which is 67.7% of 2016’s total. Incredible numbers. It’s fair to say markets could look very different on Wednesday morning as a “Blue Wave”, if it happens, should get the stimulus junkies hungry to buy and a divided government could remind people of the long winter ahead. So a very big week.

While it is possible that we will not know the winner tomorrow night, due to the high number of mail-in ballots and the various state procedures around them, we will likely have some indication of how the race is leaning. Florida and North Carolina could give a firm signal on the state of the race early on, as both have seen large numbers of early voters and are able to process and count mail-in ballots ahead of tomorrow’s poll closures. Without either of those states, President Trump’s path to re-election narrows. Polling averages continue to show a consistent lead for former Vice President Joe Biden, who is ahead by +8.5pts in the FiveThirtyEight national average, and by +7.2pts in the RealClearPolitics average. However, he leads by a lesser +3.3pt margin in RCP’s average of top battleground states. There will also be a big focus on the Senate races, with the FiveThirtyEight model giving Democrats a 76% chance to win control as we type.

Turning to Asia and over the weekend we saw China’s official October PMIs, which printed a touch better than expectations. The manufacturing PMI came in at 51.4 (vs. 51.3 expected) while non-manufacturing came in at 56.2 (vs. 56.0 expected) bringing the composite reading to 55.3 (vs. 55.1 last month). The Caixin manufacturing PMI this morning printed at 53.6 (vs. 52.8 expected), the highest since Jan 2011. Looking at other Asian manufacturing PMI’s this morning, Japan’s came in 0.7pts above the flash at 48.7 while Australia’s came in in-line with the flash at 54.2 with South Korea’s at 51.2 (vs. 49.8 last month). Vietnam and Taiwan also reported above 50 prints while Indonesia and Malaysia continued to remain in contractionary territory.

Asian markets are largely higher this morning on the better PMIs with the Nikkei (+1.41%), Hang Seng (+1.00%), CSI (+0.35%), Kospi (+1.22%) and Asx (+0.40%) all up. S&P 500 futures are also up +0.20% while yields on 10y USTs are down -1.4bps to 0.861%. In Fx, the US dollar index is up +0.12%, marking the 4th day of continuous gains. Elsewhere, Brent crude oil prices are down -3.16% to $36.74, the lowest since May as an increasing number of countries are going into wider lockdown and at the same time Libya is ramping up production. Libya has already increased its daily output to 800,000 barrels (vs. 100,000 barrels/day in early September).

We’ve also seen some positive Brexit headlines over the weekend with Bloomberg reporting that the UK and EU are seeing a compromise emerging on the contentious issue of fishing rights. Despite this cable is trading down -0.32% to $1.2906 as the lockdown imposed in England over the weekend is acting as an overhang and will likely prompt more monetary stimulus. In other news, Nigel Farage has announced that his party will be rebranded to ‘Reform UK’ in a bid to take on government’s ‘woeful’ Covid-19 response. The party will have an anti-lockdown agenda.

Staying in Asia, DB is hosting a client call tomorrow to discuss decarbonisation in China and the upcoming FYP. They’ll also explore the read-across for Autos/EVs, Mining & Steel. The climate theme continues to be very topical so it should be a good call. Registration details and more info on the topics of the call are here.

Looking forward, attention will also be back on central banks for a second straight week, with both the Federal Reserve and the Bank of England announcing their latest monetary policy decisions on Thursday. Starting with the Fed, the central bank is expected to remain in a holding pattern this meeting but may lay groundwork for action at future ones. We are also likely to hear even more on the need for fiscal stimulus, as the minutes from the last meeting showed that many central bankers had included it in their outlooks. It could also be interesting to hear how the election results, if we have them, alter that outlook. For the Bank of England meeting that’s also on Thursday, our economists expect (link here) a dovish committee, with the November Monetary Policy Report highlighting further downside risks to the UK and the external growth outlook. They also see the majority of the MPC voting for additional stimulus, with £60bn added to the Bank’s Asset Purchase Facility. The latest lockdown could easily see this increased or see the probability of greater action.

On the data front, the final October global manufacturing PMIs continue today in addition to the US ISM reading, before we see services and composite PMIs on Wednesday and Thursday. Also on Wednesday, we will see October inflation data for the Euro area. The week will end with US October payrolls and unemployment data on Friday. Never has payrolls been so far down the pecking order.

It’s also another big week on the earnings side too, with a total of 128 companies in the S&P 500 reporting over the week, along with a further 96 from the STOXX 600. In terms of the main highlights, today we’ll hear from Siemens, Clorox, Estee Lauder, PayPal Holdings and SBA Communications. Then on Tuesday, we’ll get releases from BNP Paribas, Bayer, Ferrari, Johnson Controls International, Humana, and Eversource Energy. Wednesday then sees reports from Danske Bank, Consolidated Edison, Vestas Wind Systems, QUALCOMM, MetLife, Allstate Corp and Public Storage. Then on Thursday, releases include Bristol-Myers Squibb Co, Zoetis, Linde, AstraZeneca, Regeneron Pharmaceuticals, Microchip Technology, Electronic Arts, American International Group and T-Mobile US. Lastly, on Friday, there’s Hershey, Allianz SE, CVS Health Corp and Marriott International.

Equity benchmarks across Europe and Asia were also higher, and investors took comfort in data that showed strength in China’s economic expansion, after the latest Caixin manufacturing PMI headline rose further to 53.6 in October, the strongest reading since January 2011. All major sub-indexes suggest stronger growth momentum in the manufacturing sector. The production sub-index rose from 54.2 to 54.5 in October, and the new orders sub-index increased to 57.0 from 55.5. The new export order sub-index moderated from the peak level in September, but still stayed quite strong at 51.0, in comparison with the average level of 45.3 in the first nine months of this year and 49.9 in 2019.

In Europe, the Stoxx 600 Index gained 1.4% after an outage due to “input data problems” led to a delayed start in pricing, incidentally just as US futures reversed their overnight losses and stormed higher. The issue did not affect trading of single stocks, but impacted derivatives or exchange traded funds whose prices are based on the pan-European STOXX 600 levels. “Our input data and index calculation have been affected by input data problems,” said, Qontigo, which is owned by Deutsche Boerse. Qontigo’s spokesman did not give further details on the reason for STOXX’s failure this morning. The STOXX 600 index opened an hour and six minutes late and was trading 0.4% higher at 343.6 points as of 0915 GMT. Online grocery retailer Ocado Group Plc jumped 10% to lead gains in the Europe Stoxx 600 Index.

Earlier in the session, the MSCI Asia Pacific Index added 1% with most markets in the region up. Hong Kong’s Hang Seng Index rose 1.5%, while Indonesia’s Jakarta Composite slid 0.3%. Trading volume for MSCI Asia Pacific Index members was 18% above the monthly average for this time of the day. The Topix added 1.8%, with Toyota and Recruit contributing the most to the move. The Shanghai Composite Index was flat, as Yangtze Power advanced and China Life dropped.

Despite the surge in stocks, not everyone was partying: as noted last night, oil prices slumped to a five-month low after Libya accelerated production and the U.K. joined other European countries in toughening travel restrictions. Oil-exporter currencies were hammered, with the ruble plunging past 80 against the dollar, trading at its weakest level since March.

In pandemic news, deaths from Covid-19 topped 1.2 million after the most fatalities from the virus since April were reported in the last week. As reported over the weekend, England will enter a second lockdown this week after cases spiked there, following similar moves in much of Europe. In an ironic twist, the director of the World Health Organization – which waited over a month to declare a pandemic in March on orders from China – Tedros Adhanom Ghebreyesus said he has gone into self-quarantine.

In rates, Treasuries were steady with yields slightly lower on the day, despite S&P 500 futures exceeding Friday’s highs as crude futures pare early losses. Treasury 10-year yields lower by 1.3bp at around 0.86%, toward top of last week’s 0.744%-0.875% range, while Gilts outperform by 2bp after Citigroup revised its BOE call, predicting an increase in bond buying at Thursday’s policy meeting. Choppy price action during Asia session and European morning reflected markets bracing for risk events; block sale in 10-year futures added some downside pressure.

In FX, the dollar pared an earlier gain as risk sentiment improved though it was still up versus most G-10 peers. The euro was steady, while front-end option bets show investors prefer to short the euro into year-end. The pound led losses and dropped to a one-month low against the dollar, as the prospect of a renewed nationwide lock-down weighed on the currency and offset positive news on Brexit negotiations. Norway’s krone and the Australian dollar erased earlier losses as oil pared its decline; the Aussie was weighed down in Asia hours by expectations of a rate cut this week. RBA will cut the cash rate to 0.10% from 0.25% and set its yield curve control and bank funding facility at the same level, while reinforcing no tightening for three years, economists predicted ahead of Tuesday’s meeting. The yen fell while Japan’s bonds were mixed amid uncertainty over the demand for a 10-year bond that’s set to be auctioned around the time the U.S. election outcome is expected

Elsewhere, spot gold and spot silver were unfazed by the early USD-strength but have seen tailwinds as the Dollar Index wanes off highs heading into this risk-abundant week – with the yellow metal still sub-1900/oz at around USD 1890/oz (vs. low 1873/oz) whilst spot silver test USD 24/oz to the upside (vs. low 23.39/oz). Finally, LME copper opened somewhat lackluster but now ekes mild gains in line with stock market action.

On today’s calendar we get the Canadian manufacturing PMI is at 9:30 a.m., the final reading of the U.S. number at 9:45am, and the US ISM Manufacturing is at 10:00 a.m. Joe Biden holds events in Cleveland and Pennsylvania. Lumber Liquidators Holdings, Mondelez, Skyworks and Clorox are among the many companies reporting results.

Market Snapshot

- S&P 500 futures up 1.2% to 3,304.75

- STOXX Europe 600 up 0.9% to 345.51

- MXAP up 1% to 173.47

- MXAPJ up 0.7% to 574.56

- Nikkei up 1.4% to 23,295.48

- Topix up 1.8% to 1,607.95

- Hang Seng Index up 1.5% to 24,460.01

- Shanghai Composite up 0.02% to 3,225.12

- Sensex up 0.7% to 39,902.90

- Australia S&P/ASX 200 up 0.4% to 5,951.30

- Kospi up 1.5% to 2,300.16

- German 10Y yield rose 1.0 bps to -0.617%

- Euro up 0.01% to $1.1648

- Italian 10Y yield rose 15.9 bps to 0.648%

- Spanish 10Y yield rose 1.8 bps to 0.153%

- Brent futures down 2.1% to $37.15/bbl

- Gold spot up 0.6% to $1,889.18

- U.S. Dollar Index little changed at 94.09

Top Overnight News from Bloomberg

- Following Tuesday’s showdown between President Donald Trump and Democratic nominee Joe Biden means more than identifying the battleground states and remembering how the Electoral College works: your hour-by-hour guide

- Democratic presidential nominee Joe Biden warned Sunday that he wouldn’t let President Donald Trump declare victory in Tuesday’s election before the results are clear

- Democratic nominee Joe Biden leads President Donald Trump in a series of polls released Sunday, remaining ahead nationally and in battleground states, although some state races remain extremely close

- Large swathes of Europe enter lockdown this week, with England joining nations from Austria to Greece in concluding that tougher action is needed to stop the coronavirus spreading out of control

- The Bank of England looks certain to fire another burst of monetary stimulus this week as new coronavirus lockdowns leave the economy facing a third quarter of decline in 2020

- Speculative investors boosted bullish wagers on the U.S. stock market to the highest level in almost two years, a sign that some saw the potential for the S&P 500 index to bounce back from a two-month slump

- The ECB doesn’t need to further fuel booming demand for green bonds, according to Governing Council member Robert Holzmann. Favoring climate- friendly securities risks distortions in financial markets, Holzmann, who also heads the Austrian National Bank, said

- Chinese President Xi Jinping called for setting up independent and controllable supply chains to ensure industrial and national security, just as the U.S. moves to cut China off from key exports

- Last month saw a fourth consecutive increase in euro-area factory output, underpinned by stronger demand from within the region and beyond. Companies remained positive about future production, but still continued to cut staff

A quick look at global markets courtesy of NewsSquawk

Asian equity markets traded with cautious gains and US stock index futures were choppy amid tentativeness moving into a risk-packed week with the US election, major central bank meetings & NFP data all scheduled, while participants also digested new lockdown announcements and stronger than expected Chinese PMI data. ASX 200 (+0.4%) was kept afloat amid expectations of further policy easing by the RBA at tomorrow’s meeting but with gains capped by oil sector losses and indecision in financials, as a continued surge in AMP shares after it confirmed the value of the Ares proposal, was partially counterbalanced by losses in Westpac due to a 62% decline in full-year profit. Nikkei 225 (+1.4%) was underpinned as focus centred on earnings and with the index benefitting from the tailwinds provided by the constructive Chinese data. Elsewhere, Hang Seng (+1.5%) and Shanghai Comp. (U/C) were varied after the recent blue-chip earnings including mostly weaker results from China’s big 4 banks although the PMI data was more encouraging in which the official Manufacturing and Non-Manufacturing PMI data topped estimates, while Chinese Caixin Manufacturing PMI also exceeded expectations to print its highest since January 2011. Finally, 10yr JGBs were steady to provide some reprieve from Friday’s selling pressure and breakdown of the 152.00 support level, although the rebound was limited by the tentative gains in stocks and somewhat inconclusive purchase intentions by the BoJ for November in which it raised the amounts of 1yr-3yr and 3yr-5yr purchases but also reduced the frequency of those purchases to 5 from 6 occasions during the month.

Top Asian News

- China Factory Outlook Slips Slightly as Recovery Stays on Track

- Evergrande Raises $2.2 Billion in Asset Sale; Shares Gain

- Ant Group Is Said to Have 50% Premium in Hong Kong Gray Market

- China Gained Ground on India During Bloody Summer in Himalayas

In Europe, cash equities kicked off the week mostly higher and have since extended on opening gains (Euro Stoxx 50 +1.8%) following a similar APAC lead as markets look ahead to a risk-abundant week with the US election (full guide available on the Research Suite) and the FOMC meeting in the forefront ahead of the US labour market report. Back to Europe, upside across cash and futures coincided with the release of above-forecast manufacturing PMI figures suggesting October optimism in the sectors; albeit, as a caveat, the data was collected between October 12th and 23rd and does not take into account the most recently announced lockdown measures in Germany, France, Belgium, UK and Austria. Nonetheless, regional bourses trade with gains across the board, whilst the FTSE 100 (+1.0%) erased earlier lockdown-related losses and conformed to the broader gains across the equity-space. Sectors are now all in positive territory vs. a mixed open which saw energy lagging and IT outpacing following ON Semiconductor’s upbeat sector outlook. However, since then, the oil & gas sector has overtaken regional peers to become the outperformer as the crude complex trims losses. Financials follow as a close second amid tailwinds from higher yields. Unsurprisingly, on the other side of the spectrum resides the Travel & Leisure sector as the reimposition of nationwide lockdowns takes its toll. That being said, most airliners have nursed earlier losses, but easyJet (-1.4%) remains under pressure as the CEO is seeking ways to bolster finances, with state-aid not ruled out, whilst Ryanair (+2.3%) is lifted after a less-dire-than-expected earnings report. Carnival (+6.5%) shares extend gains in early hours as the US CDC’s ban on cruises expired on Saturday without renewal. In terms of other individual movers, Ocado (+9.8%) trades at the top of the Stoxx 600 after a guidance upgrade, with the new UK lockdown also providing some tailwinds for the food delivery space. AstraZeneca (+0.7%) is supported after the Co. said the UK Health regulator had started an accelerated review of its potential coronavirus vaccine. Elsewhere, earnings-related movers include Siemens Healthineers (-0.1%) and Umicore (-6.9%).

Top European News

- Nexi Enters Exclusive Talks With Nets in Payments Shakeup

- Alfa Laval May Drop $2 Billion Takeover After Rival Proposal

- Ryanair Braces for Deeper Loss Amid New Spate of Lockdowns

- Pimco, Davidson Kempner Said to Bid in $13 Billion Alpha Deal

In FX, the Pound unwound all and more of its earlier recovery gains made amidst reports that the UK and EU will resume trade talks this week and could be getting closer to agreeing terms on the issue of fishing that has been so hotly disputed. However, bears pounced on the bounce as the country heads back into lockdown on November 5 when the outcome of the latest BoE policy meeting will be revealed, with Cable around 100 pips down from best levels circa 1.2952 and through the 100 DMA (1.2878) before finding some underlying bids ahead of 1.2850, while Eur/Gbp tested 0.9050 from circa 0.9000 where 1.5 bn option expiries reside. Similarly, Aussie ducked under 0.7000 and is still struggling to retain 1.0600+ status vs its US and Kiwi counterparts respectively even though building approvals blitzed consensus overnight, as expectations are elevated for conventional and non-standard easing from the RBA on Tuesday, while China has upped the import ban ante yet again to offset any positives from above forecast Chinese PMIs.

- USD – An upturn in broad risk sentiment, perhaps more on post-month end positioning rather than any real bullish factor, has dampened some Dollar demand, but the DXY remains firm above the 94.000 handle within a 94.035-285 range ahead of this week’s major events, kicking off with the US Presidential Election tomorrow, then the FOMC on Wednesday and NFP 2 days later. Note, further bear-steepening along the Treasury curve may also be Buck supportive and in recognition of Biden still holding a lead over incumbent Trump.

- JPY – The Yen has also lost safe-haven status amidst renewed risk appetite, as prior support at 104.50 and a key Fib level becomes resistance and Usd/Jpy eyes 105.00 ahead of rather stale BoJ minutes and the aforementioned US vote.

- NZD/CAD/EUR/CHF – All narrowly mixed against the Greenback, with the Kiwi holding above 0.6600 in advance of NZ jobs data and as PM Adern forms her new cabinet, while the Loonie has rebounded towards 1.3300 alongside crude prices awaiting Canada’s manufacturing PMI. Elsewhere, better than anticipated or flash Eurozone manufacturing PMIs could be keeping the Euro afloat between 1.1623-56 parameters following an extension of the post-ECB decline and the Franc is pivoting 0.9170 after another rise in Swiss sight deposits and a slowdown in the manufacturing PMI, albeit still over 50.0.

- SCANDI/EM – Relatively upbeat manufacturing PMIs appear to be underpinning the Swedish and Norwegian Crowns even though the latter will be wary of ongoing weakness in oil in the run up to Thursday’s Norges Bank policy meeting, but the Turkish Lira has derived little or nothing from cheaper crude, a firmer manufacturing PMI or the CBRT cutting interbank lending limits to zero as Usd/Try sits just shy of yet another ATH (8.4111). Conversely, the SA Rand has gleaned some traction from a strong 60.0+ manufacturing PMI and Brazil’s Real will likely get some respite due to the All Saint’s Day holiday.

In commodities, WTI and Brent front month futures started the trading week on the backfoot amid a continuation of the downside price action seen last week as demand recovery prospects dwindle amid the reimposition of nationwide pandemic-related lockdowns, whilst supply side also sees bearish developments. The crude contracts however are trimming earlier losses in tandem with broader gains across stock market heading into a plethora of risk events later in the week. Back to fundamentals, recently announced restrictions from significant oil consumers UK, Belgium, France and Germany keeps gains in the complex somewhat capped – with ING noting that these four countries contribute to a little over 6% ( or ~6mln BPD) of global consumption. Moving onto the supply side – Hurricane Zeta’s passing sees the resumption of operations in the Gulf of Mexico (GoM), with the latest update from the BSEE suggesting 46% (Prev. 59%) of oil and 20% (Prev. 32%) of natgas production still shut-in, whilst NHC stated that Eta has evolved into a hurricane, but the projected path shows that it will steer clear from the GoM. Sticking with supply, Libya’s oil output has reportedly been ramped up to 800k BPD (vs. 690k BPD on 26th Oct), with the country’s rising output also proving a headache for OPEC+ against the backdrop of the pandemic – suggesting an increasing likelihood that the oil producers will roll over current cuts into next year as opposed to a wind-down. Desks also note of the US election risk, ING suggests that a Biden win could translate into a less hawkish stance on Iran and “raising the possibility that we see oil sanctions against Iran removed.” WTI Dec tested USD 35/bbl to the upside (vs. low 33.64/bbl) whilst Brent Jan regains a footing over USD 37/bbl (vs. low 35.74/bbl). Elsewhere, spot gold and spot silver were unfazed by the early USD-strength but have seen tailwinds as the Dollar Index wanes off highs heading into this risk-abundant week – with the yellow metal still sub-1900/oz at around USD 1890/oz (vs. low 1873/oz) whilst spot silver test USD 24/oz to the upside (vs. low 23.39/oz). Finally, LME copper opened somewhat lacklustre but now ekes mild gains in line with stock market action.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 53.3, prior 53.3

- 10am: ISM Manufacturing, est. 55.8, prior 55.4

- 10am: Construction Spending MoM, est. 0.95%, prior 1.4%

DB’s Jim Reid concludes the overnight wrap

There are many hugely important campaigns and causes around the world and many injustices that make me angry. However I’m embarrassed to say that I signed my first-ever petition over the weekend. Yes to fight for the right for golf courses to stay open during the fresh lockdown that was announced here in England over the weekend. At the moment they are going to be closed again this week just as I was playing some of my best golf of the year with two delayed finals coming up over the next two weekends and chances for silverware. I appreciate my woes are insignificant to the wider problems the world is facing up to but nevertheless if there is a more socially distanced pursuit than golf, then I’d be impressed. Although to be fair perhaps the government discovered I’d been hitting it straighter recently.

So as lockdown “lite” hits yet another country, Europe is facing up to a harsh winter ahead. The question to be asked to all the European countries is can they come out of these measures in some form towards the end of November/early December as is hoped or will they be extended further. The hit to the U.K. economy will be softened by an extension of the furlough scheme but that will only add more to the debt. The hope everywhere is that well before the winter/spring peak virus season is over we’ll have the start of a vaccine program or more realistically in the near term a huge advance in rapid result testing. The latter has to be the greatest hope of restrictions being eased before a vaccine has mass rollout. Meanwhile, overnight Bloomberg reported that Italy might tighten restrictions further today with PM Conte wanting more localised curbs depending on virus transmissions – something some regional authorities are resisting.

So the virus will be big news this week but it will be hard to topple tomorrow’s US election off the front pages for the next few days. I say tomorrow but 93.29 million have already voted so far, which is 67.7% of 2016’s total. Incredible numbers. It’s fair to say markets could look very different on Wednesday morning as a “Blue Wave”, if it happens, should get the stimulus junkies hungry to buy and a divided government could remind people of the long winter ahead. So a very big week.

While it is possible that we will not know the winner tomorrow night, due to the high number of mail-in ballots and the various state procedures around them, we will likely have some indication of how the race is leaning. Florida and North Carolina could give a firm signal on the state of the race early on, as both have seen large numbers of early voters and are able to process and count mail-in ballots ahead of tomorrow’s poll closures. Without either of those states, President Trump’s path to re-election narrows. Polling averages continue to show a consistent lead for former Vice President Joe Biden, who is ahead by +8.5pts in the FiveThirtyEight national average, and by +7.2pts in the RealClearPolitics average. However, he leads by a lesser +3.3pt margin in RCP’s average of top battleground states. There will also be a big focus on the Senate races, with the FiveThirtyEight model giving Democrats a 76% chance to win control as we type.

Turning to Asia and over the weekend we saw China’s official October PMIs, which printed a touch better than expectations. The manufacturing PMI came in at 51.4 (vs. 51.3 expected) while non-manufacturing came in at 56.2 (vs. 56.0 expected) bringing the composite reading to 55.3 (vs. 55.1 last month). The Caixin manufacturing PMI this morning printed at 53.6 (vs. 52.8 expected), the highest since Jan 2011. Looking at other Asian manufacturing PMI’s this morning, Japan’s came in 0.7pts above the flash at 48.7 while Australia’s came in in-line with the flash at 54.2 with South Korea’s at 51.2 (vs. 49.8 last month). Vietnam and Taiwan also reported above 50 prints while Indonesia and Malaysia continued to remain in contractionary territory.

Asian markets are largely higher this morning on the better PMIs with the Nikkei (+1.41%), Hang Seng (+1.00%), CSI (+0.35%), Kospi (+1.22%) and Asx (+0.40%) all up. S&P 500 futures are also up +0.20% while yields on 10y USTs are down -1.4bps to 0.861%. In Fx, the US dollar index is up +0.12%, marking the 4th day of continuous gains. Elsewhere, Brent crude oil prices are down -3.16% to $36.74, the lowest since May as an increasing number of countries are going into wider lockdown and at the same time Libya is ramping up production. Libya has already increased its daily output to 800,000 barrels (vs. 100,000 barrels/day in early September).

We’ve also seen some positive Brexit headlines over the weekend with Bloomberg reporting that the UK and EU are seeing a compromise emerging on the contentious issue of fishing rights. Despite this cable is trading down -0.32% to $1.2906 as the lockdown imposed in England over the weekend is acting as an overhang and will likely prompt more monetary stimulus. In other news, Nigel Farage has announced that his party will be rebranded to ‘Reform UK’ in a bid to take on government’s ‘woeful’ Covid-19 response. The party will have an anti-lockdown agenda.

Staying in Asia, DB is hosting a client call tomorrow to discuss decarbonisation in China and the upcoming FYP. They’ll also explore the read-across for Autos/EVs, Mining & Steel. The climate theme continues to be very topical so it should be a good call. Registration details and more info on the topics of the call are here.

Looking forward, attention will also be back on central banks for a second straight week, with both the Federal Reserve and the Bank of England announcing their latest monetary policy decisions on Thursday. Starting with the Fed, the central bank is expected to remain in a holding pattern this meeting but may lay groundwork for action at future ones. We are also likely to hear even more on the need for fiscal stimulus, as the minutes from the last meeting showed that many central bankers had included it in their outlooks. It could also be interesting to hear how the election results, if we have them, alter that outlook. For the Bank of England meeting that’s also on Thursday, our economists expect (link here) a dovish committee, with the November Monetary Policy Report highlighting further downside risks to the UK and the external growth outlook. They also see the majority of the MPC voting for additional stimulus, with £60bn added to the Bank’s Asset Purchase Facility. The latest lockdown could easily see this increased or see the probability of greater action.

On the data front, the final October global manufacturing PMIs continue today in addition to the US ISM reading, before we see services and composite PMIs on Wednesday and Thursday. Also on Wednesday, we will see October inflation data for the Euro area. The week will end with US October payrolls and unemployment data on Friday. Never has payrolls been so far down the pecking order.

Lastly, it’s another big week on the earnings side too, with a total of 128 companies in the S&P 500 reporting over the week, along with a further 96 from the STOXX 600. In terms of the main highlights, today we’ll hear from Siemens, Clorox, Estee Lauder, PayPal Holdings and SBA Communications. Then on Tuesday, we’ll get releases from BNP Paribas, Bayer, Ferrari, Johnson Controls International, Humana, and Eversource Energy. Wednesday then sees reports from Danske Bank, Consolidated Edison, Vestas Wind Systems, QUALCOMM, MetLife, Allstate Corp and Public Storage. Then on Thursday, releases include Bristol-Myers Squibb Co, Zoetis, Linde, AstraZeneca, Regeneron Pharmaceuticals, Microchip Technology, Electronic Arts, American International Group and T-Mobile US. Lastly, on Friday, there’s Hershey, Allianz SE, CVS Health Corp and Marriott International.

Back to last week, and the big story was the reintroduction of lockdowns in Europe’s biggest economies and equities in the US and Europe posting their worst weeks since March. In the US, the S&P 500 fell -5.64% (-1.21% Friday) and was led by losses in megacap technology stocks, many of whom reported earnings in the latter part of the week. The NASDAQ declined -5.51% (-2.45% Friday), the second straight weekly loss. The VIX has now risen 0.4pts to 38.0pts, the highest weekly close since April. Risk sentiment continued to deteriorate in Europe as France and Germany announced national “lite” lockdowns, and various other countries introduced mobility restrictions of their own. The Stoxx 600 ended the week -5.56% lower (+0.18% Friday), at its lowest point since late-May. This was the case in bourses across the continent with the IBEX (-6.40%), FTSE MIB (-6.96%), and DAX (-8.61%) all falling to multi-month lows. The potential demand shock of the shutdowns and rising US dollar saw oil prices fall sharply, with WTI (-10.19%) and Brent (-10.32%) seeing their worst weeks since late April.

With risk sentiment continuing to fall, the dollar rose +1.37% on the week, the second largest weekly rise since the first week of April. Even as equities fell sharply, core sovereign bonds diverged with US 10yr Treasury yields rising +3.1bps on the week, primarily due to the +5.1bps spike on Friday. In Europe, 10yr bunds fell -5.3bps over the week with 10yr gilts dropping -1.8bps as the ECB signalled further easing and markets anticipating possible action from the BoE meeting this week. Elsewhere in fixed income, credit spreads on both sides of the Atlantic widened as equity volatility rose, oil prices plunged and sentiment waned. Both US and European HY cash spreads were +31bps wider, with European IG cash spreads unchanged as US IG widened +4bps.

In terms of data released on Friday, we got a round of Q3 GDP readings from Europe’s largest economies. Euro Area Q3 GDP rose 12.7% (vs 9.6% expected), setting a record that in some ways was overshadowed by the shutdowns announced throughout the week. Italy (+16.1% vs +11.1% expected) and France (+18.2% vs +15.0% expected) rose double digits, while Germany’s economy grew +8.2% (vs +7.3% expected). Headline Euro area CPI fell -0.3% year-on-year in October, in-line with expectations, while core stayed at record lows just above zero. ECB President Lagarde said consumer prices could keep falling into 2021, but did not believe that the economy was seeing deflation. Out of the US, the PCE core deflator rose at 1.4% year-on-year, 0.1pp below expectations, though slightly higher than last month’s revised +1.3% reading. Elsewhere, the MNI Chicago PMI was a strong 61.1 (vs. 58.0 expected) and the University of Michigan consumer sentiment survey came in at 81.8 (vs. 81.2 expected), the highest since March.

via ZeroHedge News https://ift.tt/3oJdgtz Tyler Durden