Bitcoin Soars Above $15,000 As Markets Price In Much More QE; Gold Surges

Tyler Durden

Thu, 11/05/2020 – 11:05

Earlier today we said that with the collapse of “Blue Wave” hopes, and with them expectations of a massive fiscal stimulus (made even less likely now that Nancy Pelosi is facing a growing rebellion within the Democratic party), the Fed is now the only game in town…

When Powell asks for more fiscal stimulus tomorrow, who will tell him it’s not coming.

— zerohedge (@zerohedge) November 4, 2020

… which naturally means even more QE (assuming the Fed refuses to cut rates to negative), before eventually the Fed launches a digital dollar sparking an inflationary conflagration.

And sure enough, this morning the realization that the end of the “reflation trade” means the start of the QE trade has sparked a massive bid across all risk assets, which has pushed the S&P 2% higher, with the Nasdaq even higher, but it’s the dollar collapse trades that are really exploding.

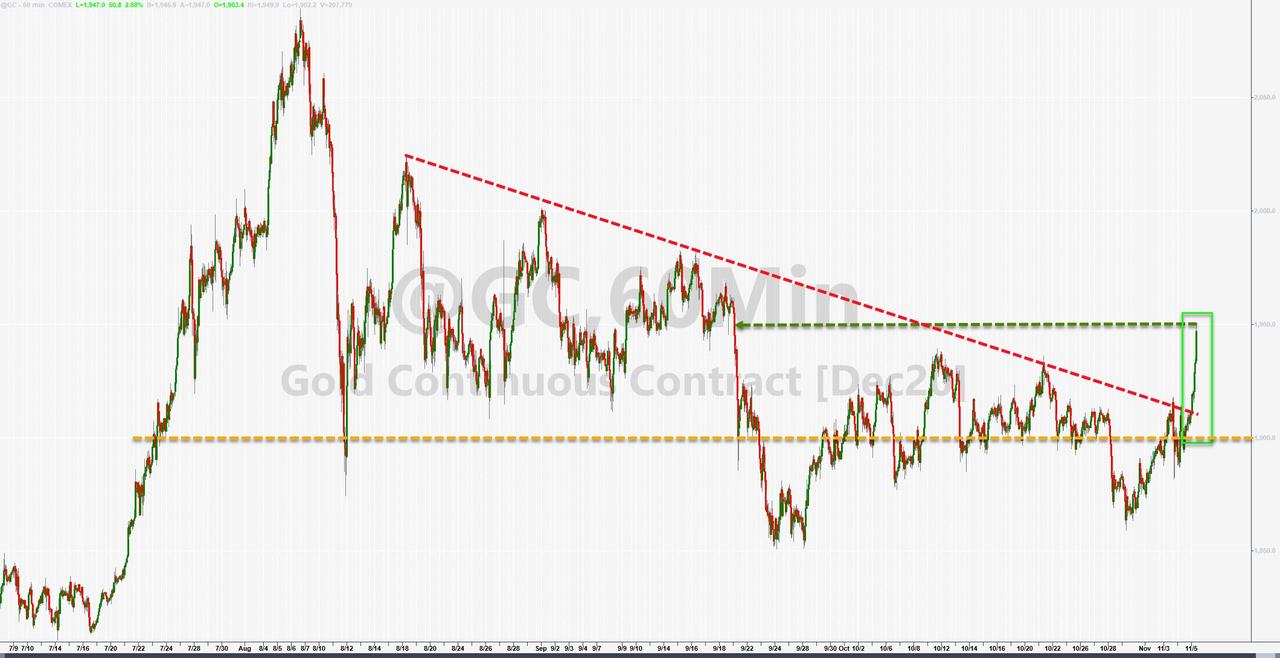

With the dollar plunging as traders start anticipating even more monetary easing, the fiat-alternatives are surging, with gold spiking more than 2%…

… once again tracking the stock of global negative yielding debt tick for tick…

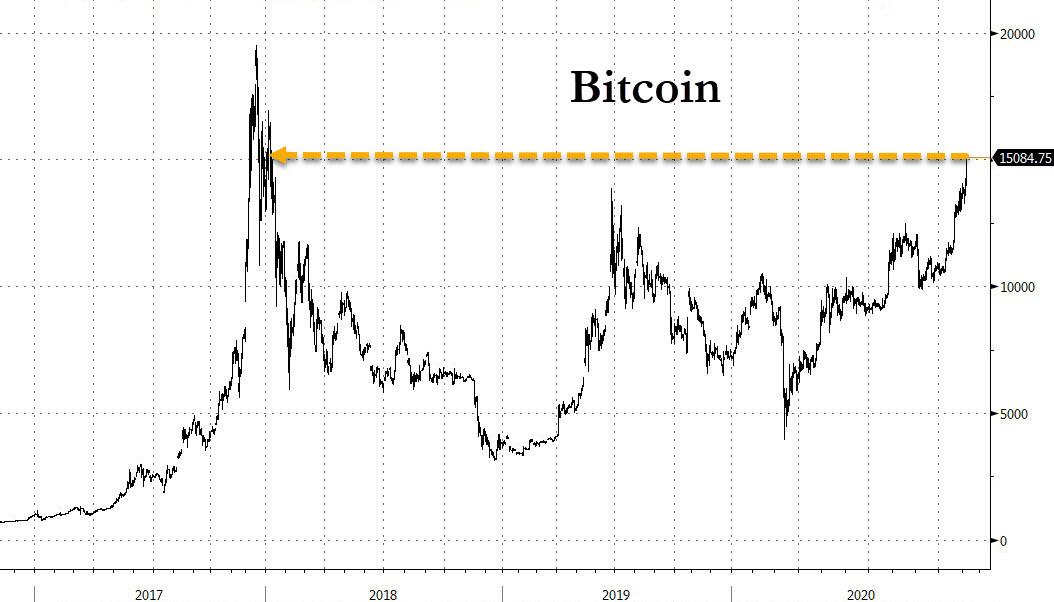

… but it’s really crypto where the action is, with bitcoin soaring…

… and rising above $15,000 for the first time since January 2018…

… and lifting the entire crypto space higher.

via ZeroHedge News https://ift.tt/3jYJjSr Tyler Durden