Hundreds Of Companies That Got PPP Loans Have Gone Bankrupt

Tyler Durden

Thu, 11/19/2020 – 08:50

Authored by Mike Shedlock via MishTalk,

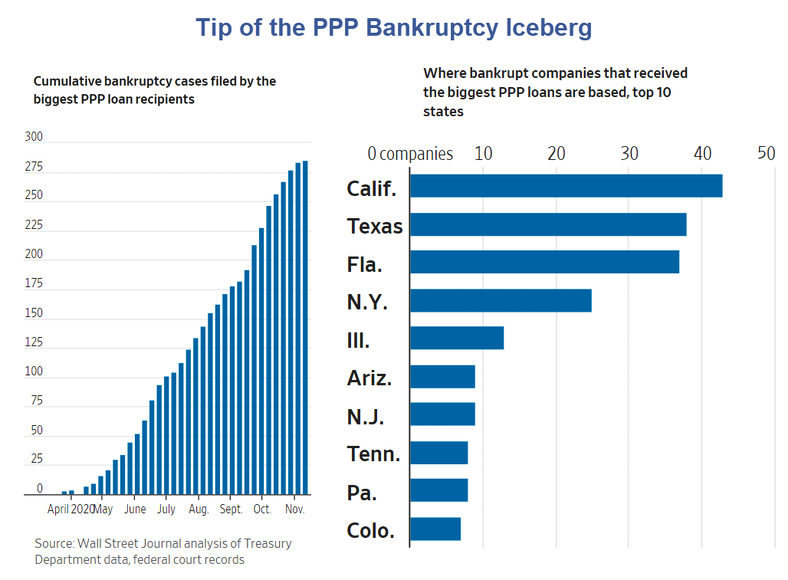

Recipients of PPP loans have filed for bankruptcy after the money ran out.

At least a Half Billion in PPP Loans Won’t Be Repaid

Hundreds of companies employing 23,400 people went Bankrupt after PPP Funds Ran Out.

The total number of companies that failed despite getting PPP loans is likely far higher. The Journal only analyzed the big borrowers from the program, which accounted for about half of the overall loans though only about 13.5% of the total participants. And many small businesses simply liquidate when they run out of cash rather than file for bankruptcy.

The SBA has only released data on the largest borrowers, which the Journal linked to bankruptcy filings.

About $525 billion in loans were distributed to over 5 million companies between April 3 and Aug. 8.

At least 285 medium-sized companies went under. Undoubtedly thousands of smaller companies did as well.

PPP Program Fatally Flawed

I never understood giving money to corporations so they could pay workers.

The workers were covered by state unemployment insurance, plus pandemic assistance.

Many people made more money being unemployed than than they did working thanks to $600 in weekly pandemic assistance checks.

Moreover, the program was fertile grounds for fraud. Many companies opened businesses to take advantage of the guarantees.

Evidence of PPP Fraud Mounts

Please consider Evidence of PPP Fraud Mounts, Officials Say

The Small Business Administration’s inspector general, an arm of the agency that administers the PPP, said last month there were “strong indicators of widespread potential abuse and fraud in the PPP.”

The watchdog counted tens of thousands of companies that received PPP loans for which they appear to have been ineligible, such as corporations created after the pandemic began, businesses that exceeded workforce size limits (generally 500 employees or fewer) or those listed in a federal “Do Not Pay” database because they already owe money to taxpayers.

Several hundred PPP-related investigations have been opened, involving nearly 500 suspects and hundreds of millions of dollars of loans, according to the Federal Bureau of Investigation.

Some Democratic lawmakers and others have voiced concerns that the SBA’s refusal to release the names of all borrowers would make detecting fraud more difficult.

That issue might have been resolved last week, however, when a federal judge sided with news organizations including Dow Jones & Co., publisher of The Wall Street Journal, that argued the SBA was legally required to disclose the borrowers.

More Shutdowns Means More Bankruptcies

Also note 83% of Passengers Will Not Return to Old Travel Habits

States are increasing lockdowns again except this time there is no program in place to deal with the mess.

Bankruptcy counts will soar. What a disaster.

via ZeroHedge News https://ift.tt/2HjAxRW Tyler Durden