McConnell Says He Has Viral Relief Proposal That Trump Supports

Tyler Durden

Tue, 12/01/2020 – 14:40

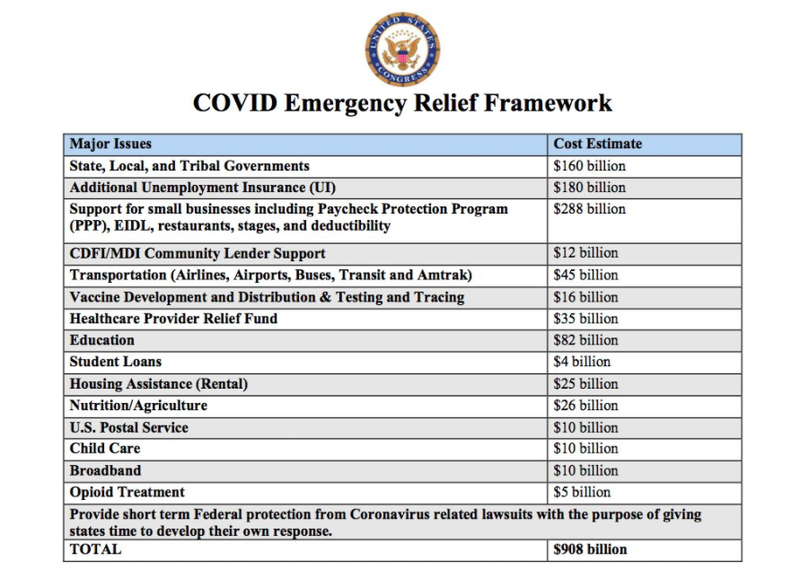

Following reports this morning that a bipartisan group of senators had unveiled a “mini” $908 billion Covid stimulus plan, of which more than half of the funding ($560 billion) would be provided by Mnuchin’s clawback of Fed facilities, and which envisions small businesses getting roughly $300 billion for a version of the Paycheck Protection Program of forgivable loans and other aid, and state and local governments would get about $240 billion, including money for schools…

… there were questions if Trump would support a plan that was backed by some of his biggest Senatorial enemies:

I have a sneaking suspicion that, in the waning days of his presidency, trump won’t support a bill being championed by Susan Collins, Lisa Murkowski, Mitt Romney and Ben Sasse.

I do think there’s a path forward on covid relief. Extension of programs in govt funding.

— Jake Sherman (@JakeSherman) December 1, 2020

Well, it now appears that things are starting to move, because according to the latest batch of news, McConnell said he is now getting Republican feedback on a stimulus proposal that they know President Trump will support.

McConnell said he has been in talks with House Minority Leader Kevin McCarthy, Treasury Sec. Steven Mnuchin and White House Chief of Staff Mark Meadows about virus relief to get a sense of what Trump will sign into law:

- MCCONNELL SAYS HE HAS A VIRUS RELIEF PROPOSAL TRUMP SUPPORTS

- MCCONNELL SAYS HE GOT A RELIEF PROPOSAL FROM PELOSI LAST NIGHT

- MCCONNELL SAYS NEED TO PASS A STIMULUS BILL TRUMP WOULD SIGN

- MCCONNELL SAYS MUST PASS A TARGETED RELIEF BILL THIS YEAR

More importantly, the targeted bill could lay the groundwork for a larger stimulus in 2021:

- MCCONNELL SAYS GOVT SPENDING BILL COULD BE VEHICLE FOR STIMULUS

- SENATE MAJORITY LEADER MCCONNELL SAYS THERE IS AN EXPECTATION FOR AN ADDITIONAL COVID-19 RELIEF PACKAGE EARLY NEXT YEAR

As for the bipartisan proposal, McConnell spoke to reports and said that “we don’t have time to waste time” saying that he would put together a targeted relief bill.

McConnell’s reaction to the bipartisan senate covid bill: “we don’t have time to waste time” … says he’s going to put together a targeted relief bill.

— Jake Sherman (@JakeSherman) December 1, 2020

The movement on the fiscal stimulus front may explain the sharp move higher in yields today, which has seen 20Y and 30Y yields jump more than 10bps, pushing 2s10s and 5s30s spreads to daily wides, while the 10Y is trading as high as 0.94%.

30-year yields reach 1.677%, more than 10bp cheaper on the day and highest since Nov. 16, steepening 5s30s by nearly 5bp to highest since Nov. 17; 10-year yields cheaper by 9bp on the day at 0.93% with 2s10s steeper by 7.2bp

via ZeroHedge News https://ift.tt/2VlGaCs Tyler Durden