Creator Of The Bond VIX: It All Comes Crashing Down After 2025

Tyler Durden

Wed, 12/02/2020 – 18:20

By Harley Bassman, creator of the MOVE index, the “VIX for bonds”

The lack of (CPI) inflation should not distract anyone from recognizing that our financial economy is presently overwhelmed by too much debt, both public and private; and it is beneath the cloak of systemic risk management that the Federal Reserve (FED) flipped on their printing press to support an alphabet soup of asset purchase programs.

And while I do not begrudge most of the FEDs actions to offer relief from both the Great Financial Crisis (GFC) and the COVID pandemic, what we all must recognize is that the financial remediation of these two crises have pulled forward the day of reckoning for how to fund the promise of Social Security and Medicare for the retiring Baby Boomer demographic.

The political game of “kick the can” for managing the two largest strands of our social safety net has reached an end; about a decade sooner than hoped. We are at a crossroads where one path is well trodden by financial history, and the other newly paved by an economic Pied Piper. But her siren song has been too sweet, and we are turning to the perfidy of Modern Monetary Theory (MMT).

Here we consider the reason and consequence of this dangerous road.

Only Congress can legally “spend” money (Fiscal Policy), and since they would not offer sufficient support in response to the GFC, the FED stepped in with (Monetary Policy) Large Scale Asset Purchases (LSAP), also known as Quantitative Easing (QE), as their most potent tool. These assets landed on the FED’s balance sheet.

While indeed much has changed over the past decade, sometimes to the point where facts do not exist, what has remained constant are the rules for double entry bookkeeping, where every asset must be paired with a liability.

Thus, the assets on the FED’s ledger are paid for by the creation of Money; an incongruity since by law the FED cannot “spend” money.

A Zero Interest Rate Policy (ZIRP) and QE were supposed to be interim measures that would be reversed upon an economic recovery; a progression always followed in the past. However, FED attempts at normalization were thwarted by the 2013 bond “taper tantrum” and the late 2018 equity tizzy.

The FED recognized that there are only two ways out of a debt crisis – either default or inflate with the caveat that inflation is simply a slow-motion default.

Since the market would not allow the FED to reduce its balance sheet via asset sales (or even the slow bleed of letting bonds mature), the alternate solution was to create inflation as a way to reduce the value of debt.

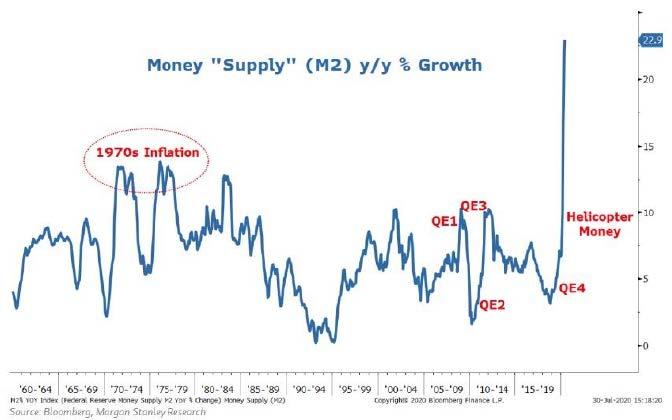

The FEDs dog-eared play book posited that if they increased the supply of Money (M2), and the economy held constant (Quantity), then Prices must rise (inflation) to keep the equation in balance.

GDP = Money * Velocity = Price * Quantity

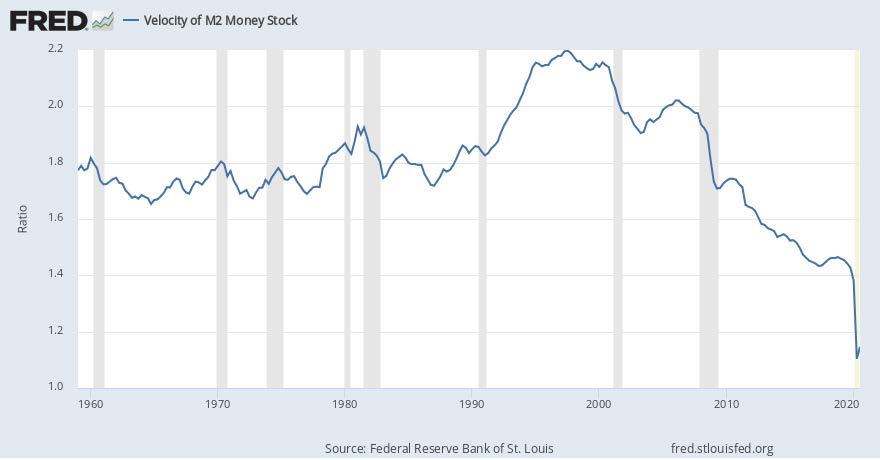

Such a pity that Velocity collapsed, almost fully offsetting the increase (printing) of Money.

But do not toss out your economic textbooks just yet, as the seeming lack of inflation from the FEDs money-printing is a David Copperfield style illusion.

While CPI inflation barely registers a pulse, asset inflation is rampant. The Case-Shiller Index of residential housing is up 63% from its December 2011 low, and is 23% above its previous peak in June 2006. Gold kissed 2000 in August, an alltime high. And, of course, the S&P 500 is a five-bagger from early 2009.

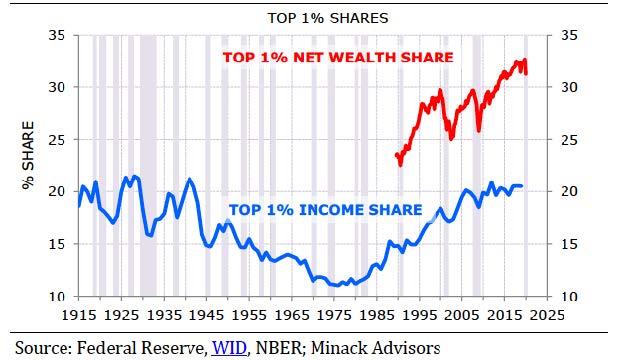

Notice how much of our national wealth is held by the Top 1%. While a 3%-point increase over the previous peaks may seem small, let me assure you that 3% of a huge number is an extremely large number. Strangely, income distribution held steady. If FED policies favored the wealthy, and their share of wealth increased, why did their share of income not rise in a similar fashion ?

Wealth concentration increased despite a static distribution of income because the affluent do not spend additional income. The Velocity of money declined because the dollars the FED created went into asset purchases instead of hourly wages where those funds would be recycled back into the economy.

A recent FED study reported that nearly 40% of US households do not have cash on hand to cover a $400 emergency expense (car repair or broken appliance). Surely funds directed to these households would soon be spent (recycled). Velocity is a measure of recycled spending; financial asset purchases are static.

I am loath to offer the topic of politics on these pages, if only because half my readers would soon use a hardcopy version for lining their bird cage.

But as a public policy comment, middle-class citizens should be mad as hell that Government resources were directed at policies that widened the wealth gap. I will stipulate this was NOT the intention of the FED; and that Fiscal policies by both parties have been grossly insufficient.

Thus, the trumpets have blared for the salve of Modern Monetary Theory.

As a reminder, Modern Monetary Theory (MMT) advocates suggest that Governments that create their own fiat currency can borrow so long as there is spare capacity in the economy. In a nutshell, deficits do not matter until debt capacity is reached, which will be signaled by rising inflation.

Never mind that nary an agency has created a predictive model for inflation; at best one can back test a few variables, but these models collapse in real time. Neither the FED, the CBO, nor the major Wall Street banks have successfully modeled inflation – as such, our policy makers will only dial back a debt binge after inflation occurs. This sort of risk management is akin to racing a car down a foggy lane and not hitting the brakes until after one slams into a tree.

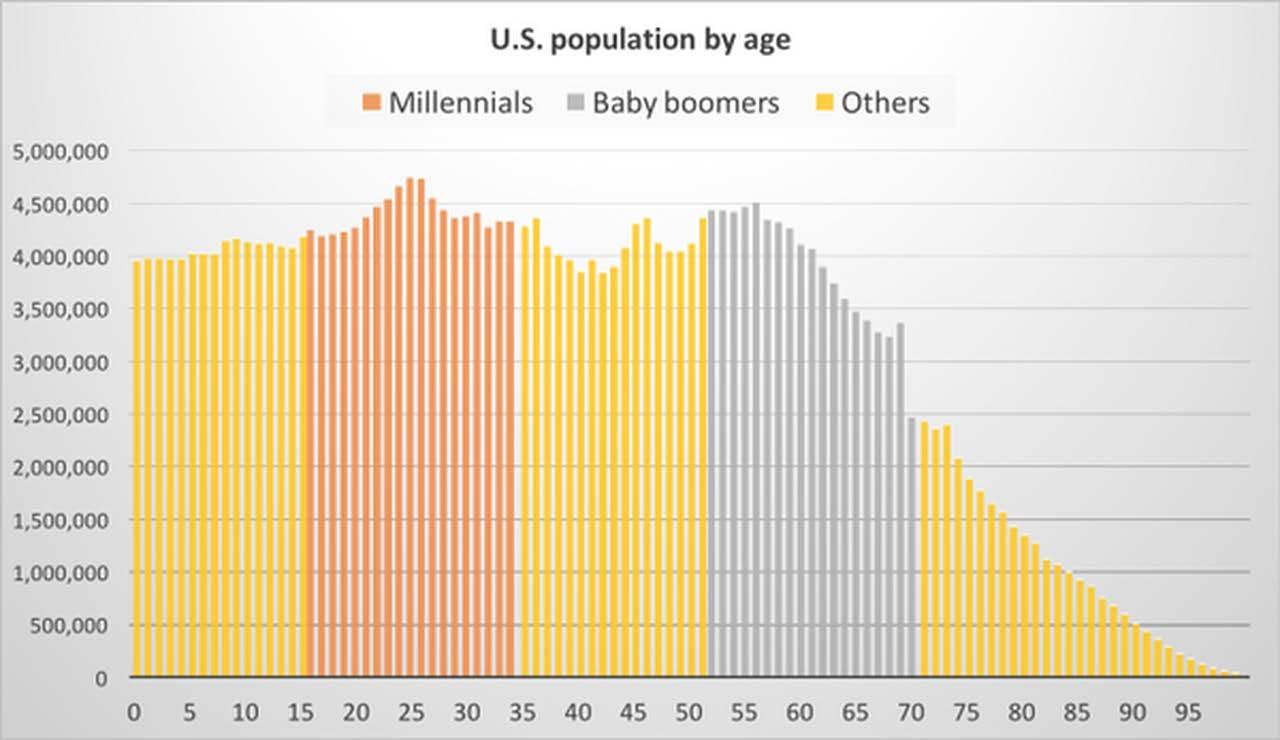

But MMT has arrived as a confluence of events are making economic demands on the Government that cannot be denied by a political class whose priority is reelection. The combination of a COVID support package, perhaps Millennial relief of college debt, and most important, the promise to Baby Boomers to fund Social Security (SS) will draw bipartisan votes in favor of a MMT-fiscal expansion.

Let’s be clear, MMT was coming with or without COVID, no matter who was elected President, but recent events have accelerated the process.

The high-end for a COVID relief package is tagged at $3Tn, and the notion of forgiving all college debt would cost $1.68Tn. But this is my bar bill at the club compared to the funding gap to support Social Security.

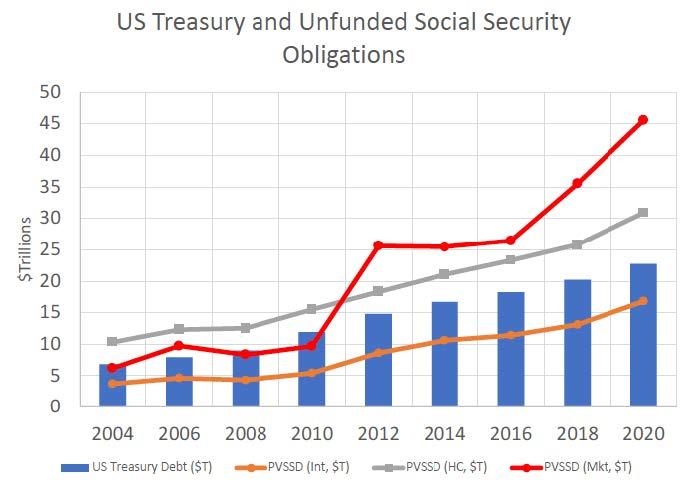

The chart above borrows from a scholarly report by James Moore, PhD. It shows the total US Treasury debt outstanding while the lines are the projected Social Security deficit. From the Social Security Trustees (SST), the orange line is their base-case while the gray line represents the SST’s high-risk scenario. Both were calculated using historical assumptions for interest rates, inflation, and economic growth.

The red line is the result of using current market-based inputs for interest rates and inflation. Notice how this estimate was between the SSTs base-case and high-risk scenarios until 2010, but impact of the Great Financial Crisis (GFC) exploded the future liability.

In case I was too coy, let’s link these thoughts. The US Government has run a cumulative deficit over the past 100 years of $22.7Tn; in contrast, to fully fund Social Security using current metrics would cost an additional $45.6Tn. Unless eligibility or benefits are significantly altered, some form of debt issuance that rhymes with MMT will be required.

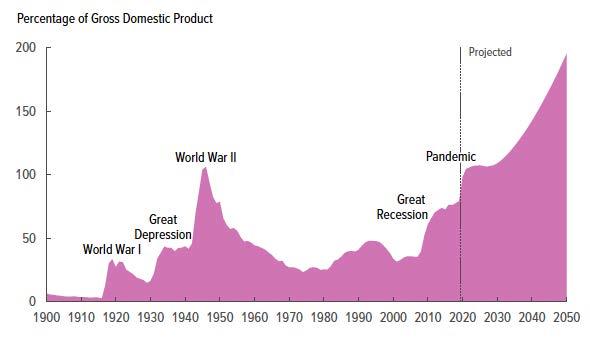

The chart from the CBO offers a similar outlook as a percent of GDP. Notice the steep increase from 2030 to 2050 starts near 100% of GDP instead of closer to 40% of GDP before the GFC and COVID. These two events accelerated an already challenging decision process.

Here is the main point: This past decade’s money printing was used to purchase assets; this next decade’s money printing will be used to fund an expansive Fiscal policy which will funnel money into the hands of people who will spend it. Thus, the Velocity of money will increase and produce inflation.

By 2026 all of the Baby Boomers will qualify for Social Security, and the Millennials will be the largest voting cohort. Both will demand Fiscal support which can only be funded via MMT budgeted borrowing. The most prescient bond bulls (Lacy Hunt, David Rosenberg, Albert Edwards) have noted that the FED’s money creation has been a self-defeating process that may reduce rates further, with the caveat that direct monetization of fiscal spending could lead to inflation. In other words, direct funding the US Treasury.

This is a quibble that deserves a push. In the same way that one “borrows beer” at a party, having the Treasury wash their issuance through Wall Street dealers to the FED’s QE balance sheet is still “money printing”. The key difference is how those funds are used. Presently the FED’s asset purchases have coincided with reduced Velocity which dampened inflation; this will change when Fiscal money is directed toward those who will spend it upon receipt.

Modern Monetary Theory is nonsense; the excessive creation of a fiat currency (eventually) leads to inflation. If it did not, I can assure you there would be a shelf of books detailing such miracles over the past five thousand years of recorded history. “Stop eating when you are fat” is not a healthy diet.

Not to go native on you, but don’t you wonder why the Old Testament called for a trumpet to be sounded on the tenth day of the seventh month every 50 years for a Jubilee where all debts were cancelled ?

While it may take longer than I expect for the final denouement, mark this as the moment our political class shirked their duty to make the hard decisions.

Investment advice:

Don’t panic (yet) as MMT will be terrific for the first number of years. There will be a “sugar high” as expansive Fiscal policy transfuses money to those who will spend it. Similar to how corporate earnings expanded with the 2017 tax cut, so too should earnings enjoy the tailwind from Fiscal support to those who tend to spend.

College debt relief will initially increase retail sales, but will ultimately migrate towards home sales as this is the household formation demographic.

Developed Market (DM) Equities should do well, especially when the dividend yield for most DM Indices exceeds their Central Bank controlled rate.

I love Mortgage REITs despite a nice rally; their dividend yield is still ~9%. This payout should be stable if the FED keeps its promise of ZIRP until 2023.

Other ways of riding the FEDs rate suppression coattails can be sourced via well-managed BDCs and Muni CEFs that employ financial leverage. For CEFs, pay particular attention to the Undistributed Net Investment Income (UNII) as a deficit here usually presages a distribution cut.

I think it’s “safe in the pool” until 2023-25, then it will be adult swim only. This is why I own long-dated options to protect against rising interest rates – a product outlined in “Pigs Can Fly” – January 28, 2020, and I will detail again soon.

“If you tell a lie big enough and keep repeating it, people will eventually come to believe it…the truth is the mortal enemy of the lie.” – Joseph Goebbels

You know my rejoinder: “It’s never different this time.”

via ZeroHedge News https://ift.tt/33z3j8Y Tyler Durden