Gamma “Call Wall” Hits Massive $2.5 Billion: Ramp Dead Ahead If VIX Drops Below 20

Tyler Durden

Wed, 12/09/2020 – 09:30

While the futures meltup continued overnight as described earlier, it was a fairly quiet overnight session with spoos holding just north of 3700.

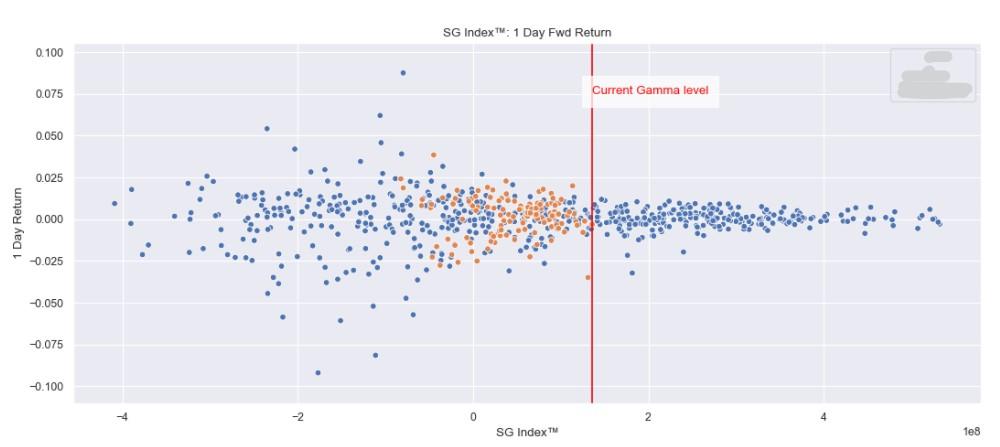

Meanwhile, for those following technicals and “greeks”, our friends at SpotGamma writes that there was “a fairly large jump in positive gamma levels in the SPX, which when combined with the SPY nets around $2.5bn – the largest figure post-Covid”. You can see in this chart that this is a positive gamma “breakout” of sorts vs the last 30 days (orange dots).

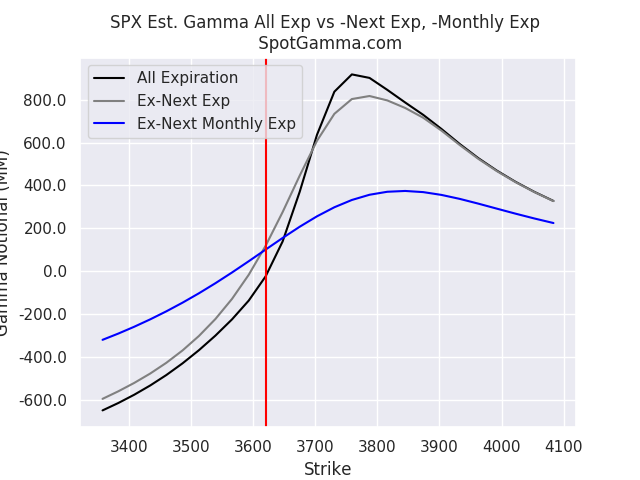

Despite this positive gamma boost, SpotGamma’s Call Wall metric did not shift higher, however both 3725 and 3750 are within striking distance. Ultimately the model holds 3700 as a market top until/unless the Call Wall rolls to a higher strike. The other notable change is the Zero Gamma level which jumped up to 3620. This is a bit more in line with our thoughts that 3650 holds as critical “gamma flip” support.

As SpotGamma summarizes, “this data suggests that markets are now compressing up against the 3700 strike, and we continue to think that the VIX may be the final key needed for a bullish push. The VIX currently holds 20.55 which is essentially the post-Covid low. If it can breach 20 then we may see another move higher in markets.“

Finally, for daytraders, note resistance levels at 3708 and in the 3727 area. 3700 and 3675 is support. Because of the large positive gamma position, SpotGamma is not looking for a large trading range today.

via ZeroHedge News https://ift.tt/2Iu5Rhg Tyler Durden