Solid Foreign Demand Is Only Redeeming Feature Of Tailing 10Y Auction

Tyler Durden

Wed, 12/09/2020 – 13:15

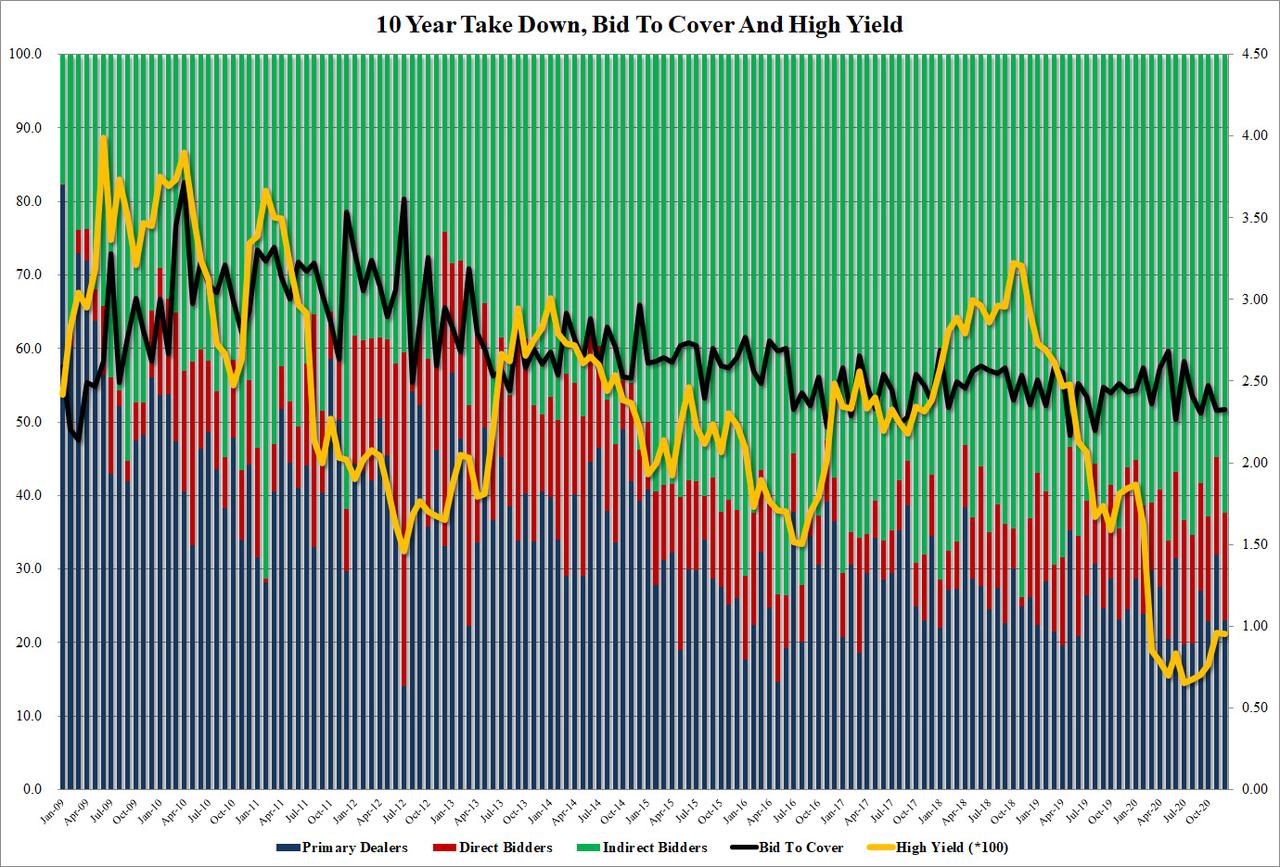

After yesterday’s subpar 3Y auction, moments ago the Treasury sold $38 billion in 10Y notes, which was a modest decline from the record $42 billion offered last month.

Yet despite today’s broad risk off move, the 10Y auction was also disappointing, with the high yield printing at 0.951%, down from November’s 0.96% but 0.4bps higher than the 0.9417% When Issued.

The Bid to Cover was virtually unchanged from last month, at 2.33 vs 2.32, but below the 2.40 six auction average.

The internals were better, with Indirects taking down 62.3%, up from 54.8% last month, and modestly above the 60.3% recent average. And with Directs taking down 14.7%, or in line with recent auction, Dealers were left holding just 23.0% of the auction below last month’s 32.0%, and modestly below the 25.5% recent average.

Overall, another mediocre auction, and what is more concerning is that despite the selloff in stocks, demand was at best lukewarm which one can perhaps attributed to the growing conviction that rates are only going to go up in the coming years.

via ZeroHedge News https://ift.tt/3n2ZsZA Tyler Durden