JPMorgan Doubles Down On Bitcoin: Sees Structural Gold-To-Crypto Flow Over Coming Years

Tyler Durden

Wed, 12/09/2020 – 15:20

Having admitted it was wrong about the end of the Bitcoin Bull run, JPMorgan is doubling down on its bullish crypto bet, warning that the rise of cryptocurrencies in mainstream finance is coming at the expense of gold.

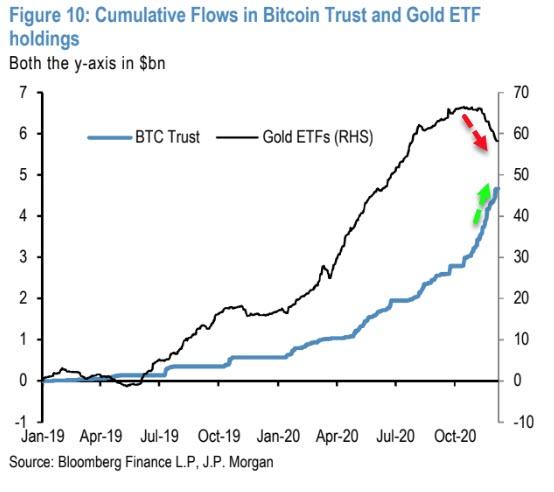

Gold outflows have been steady as crypto inflows and prices have soared…

However, it’s not all unicorns and fairy dust for cryptos as in the short term, there’s a good chance that Bitcoin prices have overshot and gold is due for a recovery, the bank said.

JPMorgan’s quantitative strategists, including Nikolaos Panigirtzoglou, are a little more fearful that recent outlier moves will revert (Bitcoin down and Gold Up):

We continue to believe that the near term outlook for bitcoin is skewed to the downside as momentum signals decay further into January, likely inducing additional risk reduction by momentum traders such as CTAs. As we explained before in our publication, unless the bitcoin price resumes its uptrend quickly rising above $20k, its momentum signal would mechanically decline further over the next couple of months or so, as the comparison with the past becomes less favorable. This is because our short lookback period momentum signal incorporates a moving average period of 5 months, which corresponds to momentum of roughly 2.5 months.

This implies that, at current prices, the momentum signal will keep deteriorating mechanically from here up until the end of January or so in our framework, potentially inducing further position unwinding by momentum traders such as CTAs. The decay of bitcoin’s momentum signals is depicted in Figure 8.

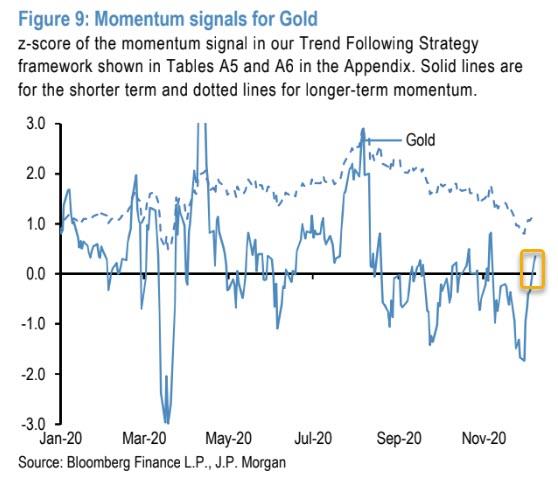

This contrasts with the corresponding picture for gold in Figure 9 which points to an upward rather than downward trajectory for momentum traders’ position in gold.

So over the near term, bitcoin looks rather overbought vs. gold from a momentum traders positioning point of view.

What about the intrinsic value of bitcoin?

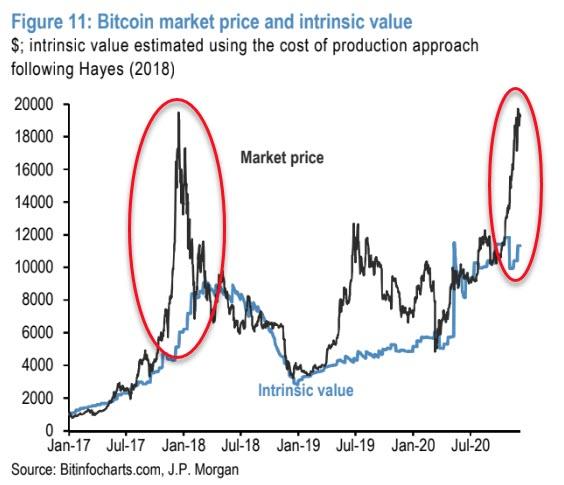

JPMorgan currently estimates an intrinsic value of around $11k-$12k based on our intrinsic value model described in F&L on 4th Aug, 2020.

But, over the medium-term, JPMorgan says that Bitcoin’s intrinsic value should rise significantly over the coming months as mining activity improves:

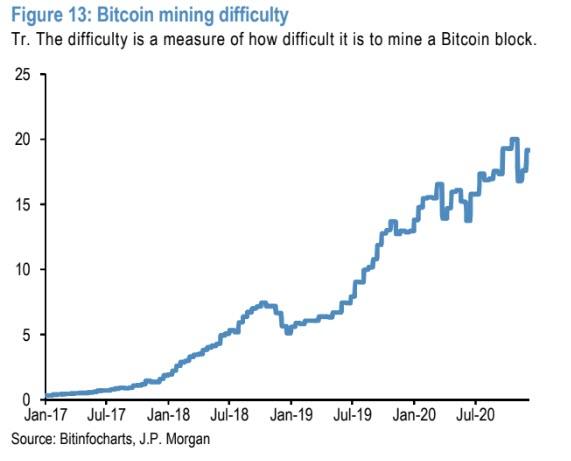

The gap between the intrinsic value and market prices is elevated, and in previous episodes in late 2017 and mid-2019 much of the closing of that gap has taken place via a decline in market value. At face value, this would suggest some headwind for market prices from here, though these gaps can last for some time before closing. However, one key difference between the current conjuncture and the previous two episodes has been a distinct lack of response from miners. In both the late 2017 and mid-2019 episodes, the gap between the cost of production and market prices did incentivize miners to increase mining activity. This increase in hash rates in turn brought about an increase in the difficulty of the algorithm (Figure 13), increasing the energy and hashing power required to mine bitcoins, in turn pushing up the mining cost.

Why has this not occurred this time around? This is at least in part due to disruptions to mining activity from interruptions to power supply due to China related typhoons and heavy rainfall. As conditions normalize, or activity migrates, a pickup in mining activity will likely see an increase in the intrinsic value. We estimate that a 70% increase in difficulty, all else equal, would see the intrinsic value approach current market prices. While this is a large increase, increases of a similar order of magnitude did occur in the late 2017 and mid-2019 episodes. This means we think it is likely that a larger share of the eventual closing of the gap between market prices and cost of production could come from the latter than in the two previous episodes.

Additionally, JPMorgan sees the flow outlook for the medium to longer term supports the opposite of the above near term price backdrop.

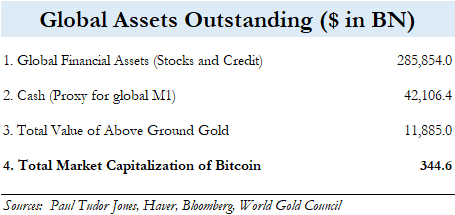

The adoption of bitcoin by institutional investors has only began, while for gold its adoption by institutional investors is very advanced. Most institutional investors have zero exposure to bitcoin and for the ones that have some exposure, mostly HNW/family offices, the exposure is anecdotally small around 1-3% of assets. Family offices in particular control around $6tr of assets globally and the Grayscale Bitcoin Trust has AUM of just above $10bn, so an implicit bitcoin share of only 0.18% of family office assets. This compares to a share of 3.3% share for Gold ETFs.

Which as we have noticed before, on a capital allocation parity basis – about an 18x ratio – works out to around $350,000/bitcoin.

Therefore, for the medium to longer term JPMorgan anticipates that the contrasting institutional flow picture with inflows into the Grayscale Bitcoin Trust and Outflows from Gold ETFs seen over the past two months will likely be sustained rather than reverse. This contrasting flow picture is shown in Figure 10.

Since the beginning of October the Grayscale Bitcoin Trust saw an inflow of almost $2bn while Gold ETFs saw outflows of more than $7bn.

If this medium to longer term thesis proves right, the price of gold would suffer from a structural flow headwind over the coming years.

One simple of way of trading this theme would be to Buy 1 unit of the Grayscale Bitcoin Trust and Sell 3 units of GLD ETF to position for a long term outperformance of bitcoin vs gold on a vol (3:1) adjusted basis.

All of which is a fascinating double-down flip-flop by JPM in just three years:

JPMorgan, Sept 2017: “bitcoin is a fraud that will eventually blow up”

JPMorgan, Dec 2020: “bitcoin’s intrinsic value should rise significantly over the coming months”

— zerohedge (@zerohedge) December 9, 2020

Interestingly, during a “Reddit AMA” last night, billionaire hedge fund manager Ray Dalio softened his stance on Bitcoin, noting that crypoto can offer protection against the “depreciating value of money.”

As CoinTelegraph reports, Dalio, who last month abandoned his skepticism of Bitcoin, said that the cryptocurrency could complement gold as an investment. Dalio: Bitcoin “could be diversifier to gold”

“I think that bitcoin (and some other digital currencies) have over the last ten years established themselves as interesting gold-like asset alternatives, with similarities and differences to gold and other limited-supply, mobile (unlike real estate) storeholds of wealth,” he wrote.

“So it could serve as a diversifier to gold and other such storehold of wealth assets.”

Continuing, he argued that money printing would spur asset inflation, implying that simply holding wealth in cash would lead to losses.

“We are in a flood of money and credit that is lifting most asset prices and distributing wealth in a way that the system that we’ve come to believe is normal is unable to, and that is threatening to the value of our money and credit,” he warned.

“Most likely that flood will not recede, so those assets will not decline when measured in the depreciating value of money. It is important to diversify well in terms of currencies and countries, as well as asset classes.”

His perspective conspicuously mimics that of Bitcoin proponents, notably Michael Saylor, CEO of MicroStrategy, who is guiding the company toward BTC reserves of nearly $1 billion.

via ZeroHedge News https://ift.tt/3m2SB15 Tyler Durden